Previous Trading Day’s Events (13.08.2024)

Australia Wage Growth: Wage Price Index up 4.1% YoY in Q2 2024, unchanged from Q1; public sector wages up to 3.9%, private sector growth slows to 4.1%.

UK Claimant Count: Unemployment claims rose by 135K to 1.801M in July 2024, surpassing the forecast of 14.5K; previous month revised to a 36.2K increase.

US Producer Prices: PPI up 0.1% MoM in July 2024, below the 0.2% forecast; goods prices rise 0.6%, driven by energy; core PPI flat, annual increase slows to 2.4%.

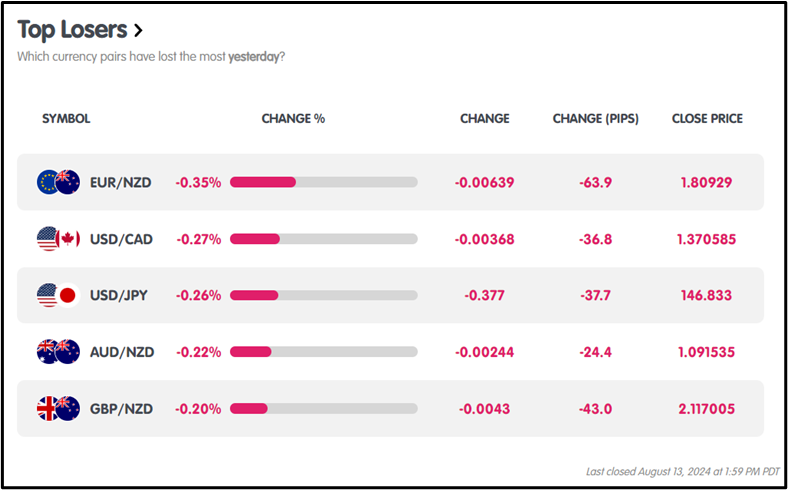

Winners Vs. Losers In the Forex Market

On August 13, 2024, NZDUSD led with a 1.00% gain and 60.3 pips, while EURNZD lagged with a 0.35% drop and a loss of 63.9 pips.

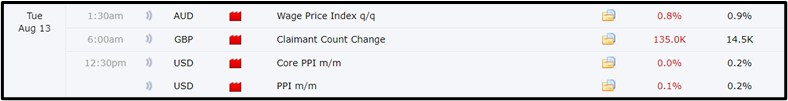

News Reports Monitor – Previous Trading Day (13.08.2024)

Server Time / Timezone EEST (UTC+03:00)

- Tokyo Session: Australia Wage Price Index up 4.1% YoY; bullish impact at 1:30 am GMT.

- London Session: UK Claimant Count up 135K; bullish impact at 6:00 am GMT.

- New York Session: US PPI up 0.1% MoM; bearish impact at 12:30 pm GMT.

General Verdict:

- Mixed impacts with bullish effects in Tokyo and London sessions, bearish in New York.

FOREX MARKETS MONITOR

EURUSD (13.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

EURUSD showed a bullish trend, opening at 1.09250 and closing at 1.09925, peaking at 1.09986 and dipping to a low of 1.09129.

CRYPTO MARKETS MONITOR

BTCUSD (13.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

BTCUSD showed bullish momentum, opening at $58,805.02 and closing at $60,618.33, with a high of $61,619.71 and a low of $58,399.06 for the day.

STOCKS MARKETS MONITOR

UBSG (13.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

UBSG exhibited a bullish trend, opening at $24.9345 and closing at $25.1801, which also marked the day’s high, while the low was $24.7769.

INDICES MARKETS MONITOR

US30 (13.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

US30 showed a bullish trend, opening at $39,404.09 and closing at $39,779.30, with a high of $39,837.03 and a low of $39,247.40 for the day.

COMMODITIES MARKETS MONITOR

USOIL (13.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

USOIL was broadly bearish, opening at $78.113 and closing at $77.128, with a daily high of $78.555 and a low of $76.737.

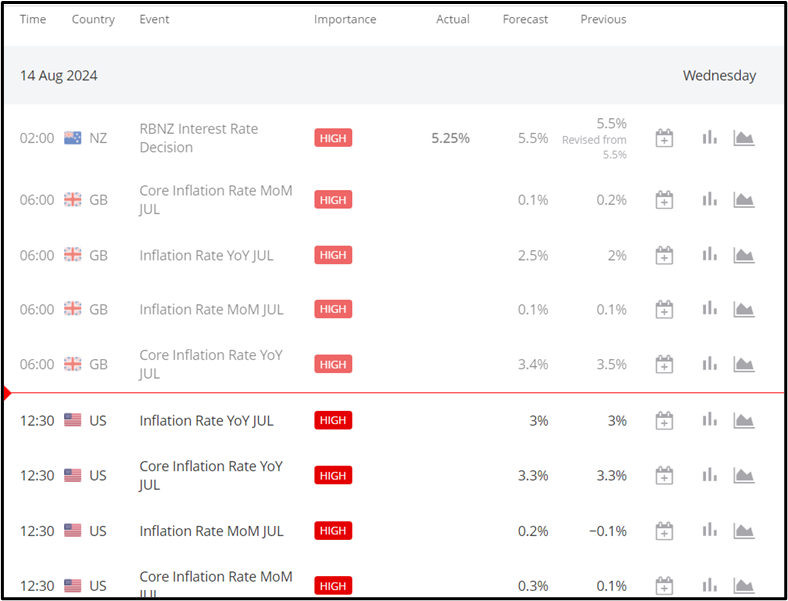

News Reports Monitor – Today Trading Day (14.08.2024)

- Tokyo Session: RBNZ Interest Rate: 5.25% (forecast 5.5%). NZD volatility likely; Bearish impact on NZD currency pairs.

- London Session: UK Inflation YoY: 2.5% (forecast); MoM: 0.1%. UK Core Inflation YoY: 3.4%. GBP may react sharply to deviations.

- New York Session: US Inflation YoY: 3% (forecast); MoM: 0.2%. US Core Inflation YoY: 3.3%. USD is expected to fluctuate based on actual data vs. forecasts.

General Verdict :

- NZD bearish due to the RBNZ rate being below forecast.

- GBP sensitive to inflation data; potential volatility.

- USD volatility is expected based on inflation deviations.

Sources

https://marketmilk.babypips.com/

https://km.bdswiss.com/economic-calendar/

Metatrader 4