PREVIOUS TRADING DAY EVENTS – 12 July 2023

“Interest rates are constraining spending and inflation pressure as anticipated and required,” the RBNZ said in a statement. “The Committee is confident that with interest rates remaining at a restrictive level for some time, consumer price inflation will return to within its target range.”

“We still see the RBNZ as done with tightening, though don’t expect a lower OCR until May next year,” said Nick Tuffley, chief economist at ASB Bank in Auckland. “From here the RBNZ will keep watching the data to confirm whether or not inflation is likely to decline in line with its expectations.”

Inflation “is too high” but is expected to continue to decline back to the target range by the second half of 2024, the RBNZ said today.

“Recent indicators suggest that growth is likely to remain weak in the near term,” the RBNZ said. “Consumer spending growth has eased and residential construction activity has declined.”

Source:

This considerable slowdown in underlying inflation triggered a rally in the stock and bond markets, with investors convinced that the Fed’s tightening cycle has come to a close.

“Inflation isn’t dead, but the extraordinary pandemic push on prices from shortages and shift to stay-at-home purchases is clearly over, and the Fed for the first time has the upper hand in its inflation fight,” said Christopher Rupkey, chief economist at FWDBONDS in New York.

The CPI gained 0.2% last month after edging up 0.1% in May. In the last 12 months through June, the CPI advanced to 3.0%. That was the smallest year-on-year increase since March 2021 and followed a 4.0% rise in May.

Annual inflation is a third of what it was last June. Nevertheless, inflation remains above the Fed’s 2% target, with the labour market still cooling but still at levels that are considered tight enough for the Fed to consider another hike.

Stocks on Wall Street were trading higher after the release. The Dollar fell significantly against a basket of currencies. U.S. Treasury prices rose.

“We have a lot more data between now and September’s meeting,” said Chris Zaccarelli, chief investment officer at Independent Advisor Alliance in Charlotte, North Carolina. “But the evidence is building that the Fed will ‘watch and wait’ after they raise rates this month.”

“For the first time in this rate-hike campaign, the light of price stability is starting to shine more brightly at the end of the tunnel,” said Michael Gregory, deputy chief economist at BMO Capital Markets in Toronto.

This hike was expected by analysts and markets.

The statement mentions that rates were not restrictive enough.

“If new information suggests we need to do more, we are prepared to increase our policy rate further,” BoC Governor Tiff Macklem told reporters after the decision. “But we don’t want to do any more than we have to.”

The members of the governing council “want to take a few rounds of data and they’re leaving the door open for more [hikes]as needed in September,” said Derek Holt, vice president of capital markets economics at Scotiabank. “I think they’re just taking the summer off.”

“The Governing Council remains concerned that progress towards the 2% target could stall, jeopardising the return to price stability,” the BoC said in a statement.

“Inflation is expected to return to 2% in the middle of 2025, although the timing is uncertain given the gradual movement of inflation toward the target,” the BoC said.

______________________________________________________________________

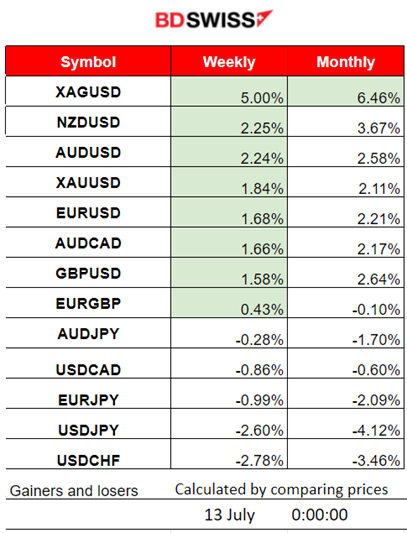

Winners vs Losers

______________________________________________________________________

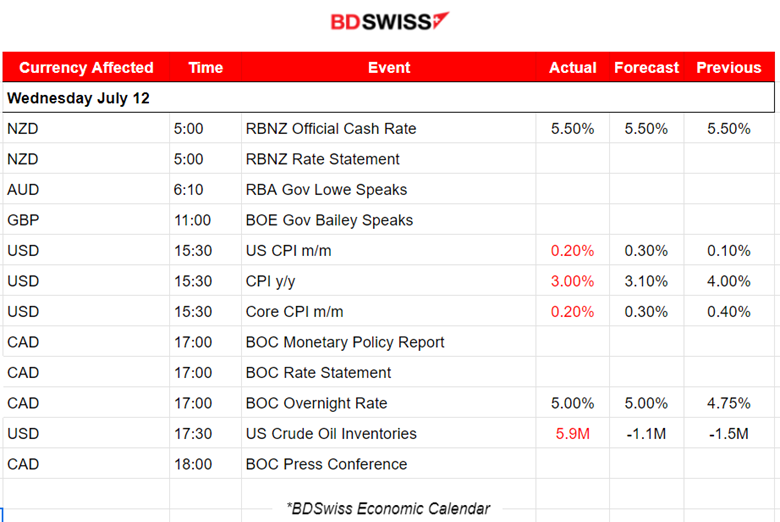

News Reports Monitor – Previous Trading Day (12 July 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

The RBNZ left rates unchanged as expected. An intraday short shock occurred causing the NZD to depreciate for a while, but the effect soon faded.

- Morning – Day Session (European)

At 15:30, the CPI change was reported lower than expected, causing a shock to the USD pairs and high USD weakening. Annual inflation was surprisingly reported 1% lower, a result of continuously rising interest rates, coinciding with the labour market cooling, as indicated by the NFP.

At 17:00, the Bank of Canada decided to proceed with a 25 basis points rate increase. CAD pairs experienced an intraday shock as the CAD appreciated against other currencies greatly. The USDCAD dropped more than 80 pips after the release.

General Verdict:

____________________________________________________________________

FOREX MARKETS MONITOR

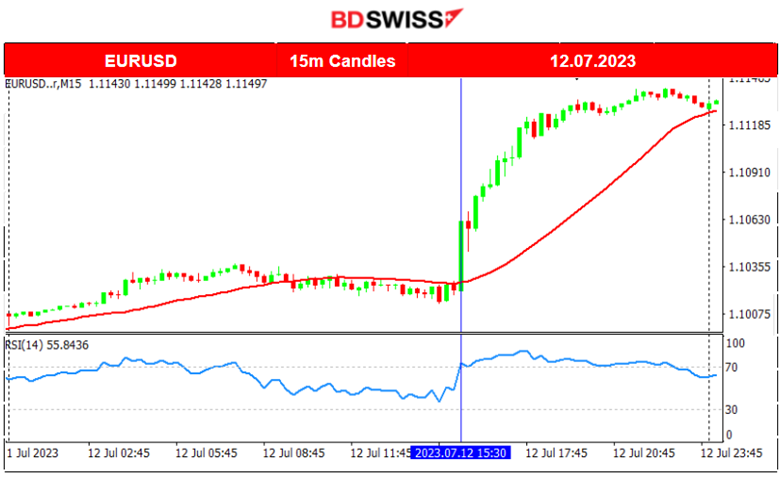

EURUSD (12.07.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair was experiencing low volatility as the market was waiting for the release of the important figures of the day. After the release of the inflation rate figures (CPI Changes), the USD started to weaken heavily, causing the pair to jump and steadily move upwards for the rest of the trading day.

USDCAD (12.07.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair has been experiencing low volatility while moving around the mean and a little bit more to the downside before the major scheduled release of the US CPI figures. The USD has weakened further as a significantly lower-than-expected inflation figure was recorded. The BOC’s decision to increase rates has caused CAD appreciation and the USDCAD dropped further on the same trading day.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The U.S. stock market reversed as all benchmark indices moved rapidly upwards. The recent data regarding the U.S. labour market are in favour of a revision in the decision to hike by the Fed. A policy change is more likely since the NFP showed way lower than expected employment change and the annual inflation dropped by 1%, which is huge. The market participants are not expecting a rise in borrowing costs now, business is expected to grow and investors are shifting investments to more risky assets, such as stocks. Yesterday, the inflation rate release caused the NAS100 to jump and a retracement followed before the index resumed the uptrend.

Related Tradingview Analysis

https://www.tradingview.com/chart/US30/y8EnerBp-US30-Retracement-Intraday-12-07-2023/

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The Oil price is following an upward path formed by the OPEC meetings’ recent statements and other factors. The trend continues and the price moves steadily upwards. On the 12th of July, it reached 75.90 USD/b.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold has been experiencing high volatility, mostly as a result of the USD impact. After the reversal on the 6th of July, it showed more movement to the upside, even though the RSI is showing lower highs. That is because of the Dollar weakening. On the 12th of July, the lower-than-expected inflation figure caused high depreciation of the USD and caused the Gold price to jump.

______________________________________________________________

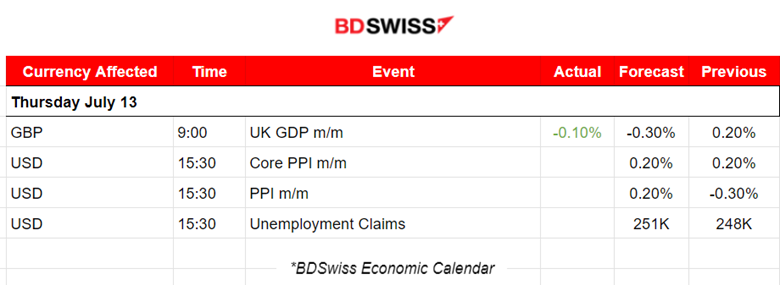

News Reports Monitor – Today Trading Day (13 July 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No major news announcements, no special scheduled releases.

- Morning – Day Session (European)

At 9:00, the monthly change for the U.K. Gross Domestic Product was released, less negative than expected. GDP is estimated to have fallen by 0.1% in May and at the time of the release, some GBP appreciation was observed.

At 15:30, we’re expecting an intraday shock for the USD pairs as the inflation-related data, the PPI figures, are to be released. These monthly figures are expected to be higher, coinciding with the monthly CPI changes reported yesterday.

General Verdict:

______________________________________________________________