PREVIOUS TRADING DAY EVENTS – 01 May 2023

Announcements:

“New order rates remain sluggish as panellists remain concerned about when manufacturing growth will resume,” Timothy Fiore, chair of ISM’s Manufacturing Business Survey Committee, said in a statement. “Panellists’ comments registered a 1-to-1 ratio regarding optimism for future growth and continuing near-term demand declines.”

Contraction in April was led by furniture, wood products and nonmetallic mineral products. Eleven industries contracted while five industries expanded.

______________________________________________________________________

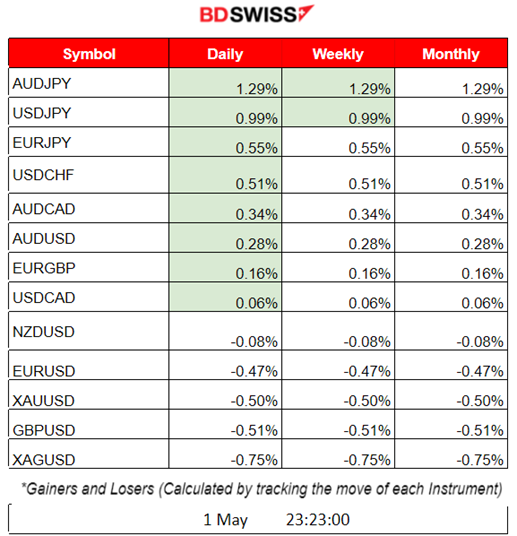

Summary Daily Moves – Winners vs Losers (01 May 2023)

______________________________________________________________________

News Reports Monitor – Previous Trading Day (01 May 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No significant news announcements, nor any important scheduled releases.

- Morning – Day Session (European)

At 17:00, the ISM Manufacturing PMI figure was released, which was more than expected but again lower than 50. It seems that business activity is improving in the manufacturing sector but was still in contraction in April for the sixth consecutive month. USD appreciated after the release intraday as shown below with the DXY chart.

General Verdict:

______________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (01.05.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

EURUSD was moving with low volatility until the European Markets opened. After 11:30, it started to move significantly higher and then, at 17:00, it experienced a rapid drop with the release of the Manufacturing PMI figure. A retracement to the 61.8% level after the drop did not take place. That is not so strange considering that trading activity is lower due to holidays. Perhaps on the next trading day, we will see the correction.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Since the 27th of April, NAS100 started to move higher, showing signals of a new upward trend. However, the fundamentals do not support such a move. Growing business while another rate hike is on its way seems quite odd. In any case, we can see that the price moved sideways on the 1st of May and the RSI shows that the index might soon experience a drop. RSI: Lower Highs, Price: Higher Highs, thus signalling a bearish divergence. The other main U.S. indices have a similar chart with a short-term drop already happening.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude stopped testing the support at 74 USD moving higher. However, that was just the end of a downward trend. Its price seems to settle now around 75.5 USD while it moves sideways with higher volatility than typical.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold continues its volatile and sideways path around the 30-period MA. It is often testing the support level near 1976 USD and the resistance level near 2006 USD. Within a channel, it deviates significantly from the mean but always retraces back and there is no clear trend currently.

______________________________________________________________

News Reports Monitor – Today Trading Day (02 May 2023)

Server Time / Timezone EEST (UTC+03:00)

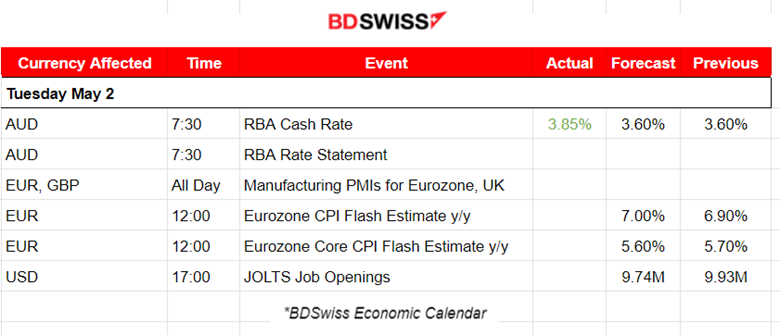

- Midnight – Night Session (Asian)

During the Asian Session at 7:30, the RBA Cash Rate and Rate Statement took place causing intraday shock to the AUD pairs. Policymakers hiked to 3.85% from 3.6%. AUDUSD moved upwards more than 60 pips since the AUD appreciated greatly at that time.

- Morning – Day Session (European)

Today, the PMIs for the Manufacturing sector will be released affecting major pairs, like the EUR and GBP. More volatility than normal is expected. Intraday trends might be created.

At 12:00, the inflation-related data, CPI Flash Estimate and Core CPI Flash Estimate will be released. The EUR is probably going to be affected, causing some intraday shock.

At 17:00, the USD pairs will probably experience an intraday shock since important labour data, i.e. the JOLTS Job Openings figure, will be reported for the U.S.

General Verdict:

______________________________________________________________