PREVIOUS TRADING DAY EVENTS –07 Nov 2023

“Whether further tightening of monetary policy is required to ensure that inflation returns to target in a reasonable timeframe will depend upon the data and the evolving assessment of risks,” RBA Governor Michele Bullock said in a statement.

Economic growth slowed to a two-year low of 2.1% and the RBA sees it approaching 1% in 2024 as the full impact of the higher rate takes full effect.

Consumer price inflation exceeded forecasts in the third quarter to run at 5.4%, well above the RBA’s long-term target range of 2-3%. A rate hike was essentially expected. The hike puts the RBA in the odd position of still following a policy tightening.

______________________________________________________________________

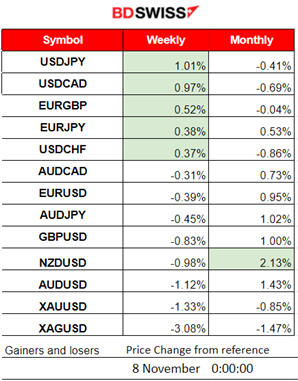

Winners and Losers

NZDUSD was removed from the top of the week but still remains the top gainer for the month with 2.13% gains.

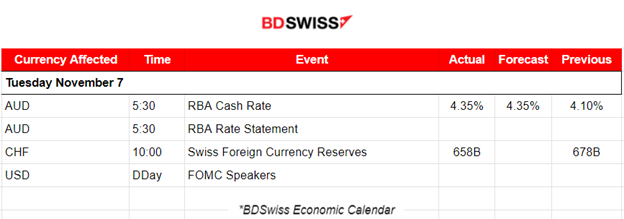

News Reports Monitor – Previous Trading Day (07 Nov 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

The Reserve Bank of Australia (RBA) has hiked its cash rate from 4.10% to 4.35%, as expected. Inflation expectations are still running higher than 5%, probably closer to 6%. The new higher 4.35% rate will be at a level that is far lower than most similar central banks have. The market reacted with AUD depreciation causing a near 30 pips drop in AUDUSD at the time of the release.

- Morning–Day Session (European and N. American Session)

No major releases, no major news announcements.

General Verdict:

FOREX MARKETS MONITOR

AUDUSD (07.11.2023) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair experienced a shock at 5:30 when the RBA decided to hike rates in line with expectations. The market reacted with AUD depreciation at that time causing the pair to drop sharply at the time of the release and continue further during the trading day until it found support at near 0.64060. It eventually retraced back to the 61.8% Fibo level late at some point.

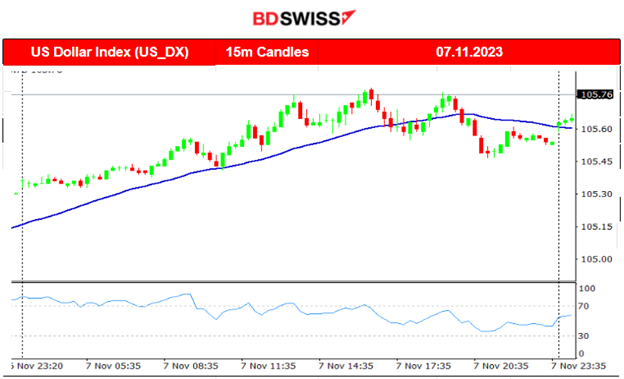

EURUSD (07.11.2023) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair moved lower after the start of the European session as the USD experienced early appreciation. EURUSD dropped until the support was near 1.06665 before reversing to the mean. After the turning point to the upside, it moved higher crossing the 30-period MA reaching an intraday resistance near 1.07060 and moved a bit lower soon after to close the trading day. From the dollar index chart, it is obvious that most of the path is attributed to USD since this is the main driver.

___________________________________________________________________

___________________________________________________________________

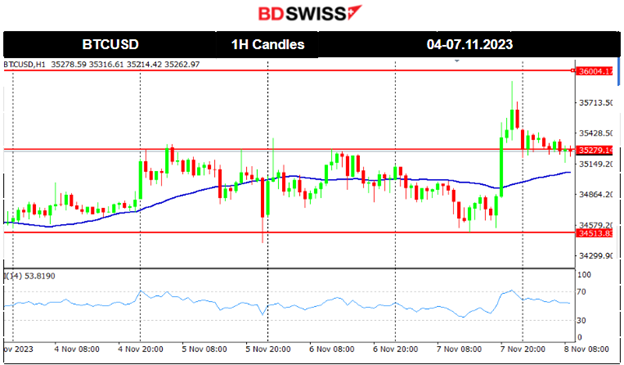

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

As mentioned in the previous report, the 35400 resistance was critical for bitcoin. It eventually broke that resistance and almost touched the 36000 level on its way up yesterday after it saw a jump. The price soon retraced back to the 61.8% Fibo level and settled near the support levels that were previously acting as resistance levels near 35300.

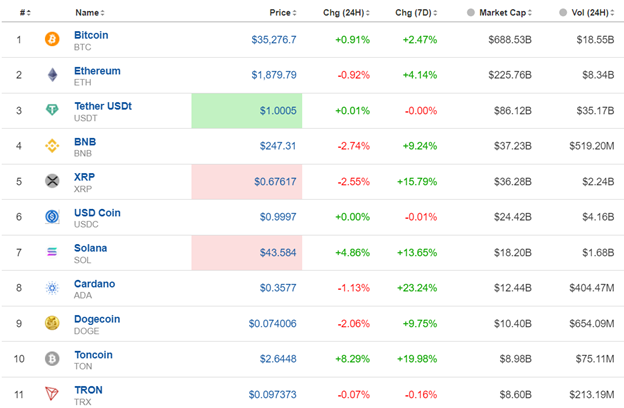

Crypto sorted by Highest Market Cap:

Cryptos are moving steadily to the upside but not significantly. Mean reversals, like the case of Bitcoin above, keep prices low. Solana and Toncoin are leading the last 24 hours with 4.86% and 8.29% gains respectively while Cardano remains on the top of the gainer’s list for the last 7 days with 23.4% gains so far.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

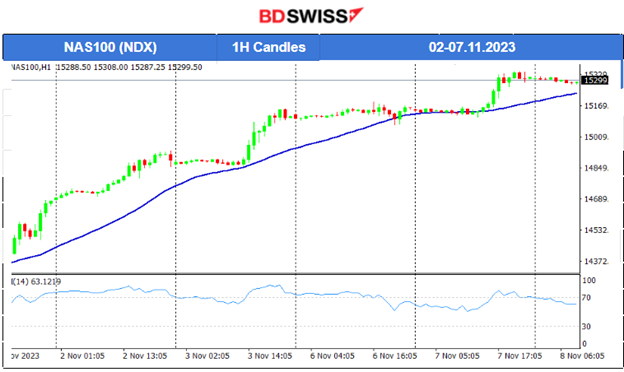

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Despite the slowdown that the U.S. Stock market has been experiencing lately after a strong uptrend, stocks moved again higher yesterday indicating that the uptrend is still on. All benchmark U.S. indices have been experiencing the same path upwards. The RSI still shows lower highs, it is a matter of time before the market eventually retraces back. We will wait until we have more evidence that there is an end to this uptrend and support breakouts indicating a reversal and a long retracement for the price correction to the downside.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The price has experienced a sharp fall recently and strong support is currently preventing the price from falling further. Technically and considering the volatility of Crude oil’s price, a retracement should take place. The potential retracement opportunity for Crude oil requires that the resistance at 77.5 has been broken indicating a signal to the upside.

Alternative scenario: The 100 Fibo level acts as a support that if a breakout occurs to the downside, the price could drop further rapidly until the next support at 75.5.

TradingView Analysis

https://www.tradingview.com/chart/USOIL/uA8kUaQm-USOIL-Retracement-08-11-2023/

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Gold jumped during the NFP report and immediately reversed to the downside with mean reversal. During the jump it reached the resistance at near 2004 UD/oz, however, it reversed lower and remained on the downside. On the 6th Nov, it actually moved steadily further to the downside as the USD started to gain strength again. It eventually moved lower on the 7th Nov breaking the important support near 1970 USD/oz and towards the 1960 USD/oz support level. The same day it retraced back to the 30-period MA and the 61.8% Fibo level.

______________________________________________________________

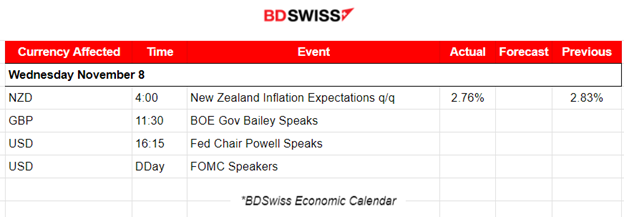

News Reports Monitor – Today Trading Day (08 Nov 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

Respondents’ expectations for one-year ahead and two-year-ahead annual inflation have declined. Inflation expectations for the quarter were reported with a 2.76% figure versus the previous higher 2.83%. Annual CPI inflation for the September 2023 quarter was measured at 5.6%, a decline from last quarter’s 6.0% annual inflation. The five-year-ahead and ten-year-ahead annual inflation expectations increased from last quarter’s mean estimates and remained within the 1-3% inflation target. No major impact was recorded affecting the NZD pairs at the time of the report release.

- Morning–Day Session (European and N. American Session)

No major releases, no major news announcements. Several speeches take place from central bank representatives throughout the day.

General Verdict:

______________________________________________________________