PREVIOUS TRADING DAY EVENTS – 06 June 2023

Announcements:

The Reserve Bank of Australia raised interest rates, on June 6th, to an 11-year high, and stated that further tightening is possible. RBA hiked the cash rate to 4.1% versus the expected 3.85%. The AUD surged.

In the policy statement, RBA Governor Lowe said the latest rate increase will “provide greater confidence that inflation will return to target within a reasonable timeframe.”

“We think the Bank is no longer as confident as it was before on the trajectory of medium-term inflation expectations given that it dropped the sentence,” said TD Securities’ Asia-Pacific rates strategist Prashant Newnaha.

“The omission of this sentence reads hawkish in our view and may spell further rate hikes ahead from the RBA.”

“The Bank could well move ahead of that… Risks are likely skewed toward the RBA needing to move more than just once more,” said Boyton.

“The Board remains alert to the risk that expectations of ongoing high inflation contribute to larger increases in both prices and wages, especially given the limited spare capacity in the economy and the still very low rate of unemployment.”

“As the RBA takes rates higher, the risk of a greater slowing in the economy is rising,” said Tapas Strickland, head of market economics at NAB.

Source:

______________________________________________________________________

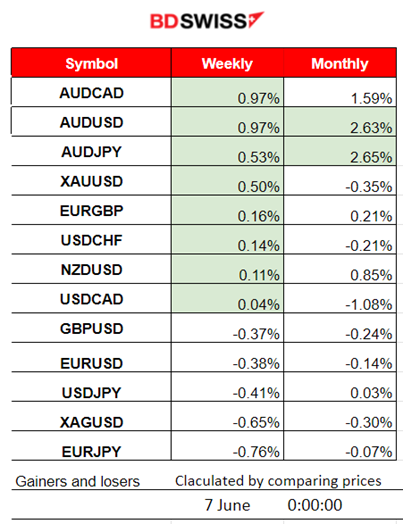

Summary Daily Moves – Winners vs Losers (06 June 2023)

- AUD pairs take the lead this week as the RBA continues to increase rates. AUDCAD and AUDUSD reach the top having both 0.97% gains.

- This month, AUDUSD and AUDJPY are leading with near 2.65%

______________________________________________________________________

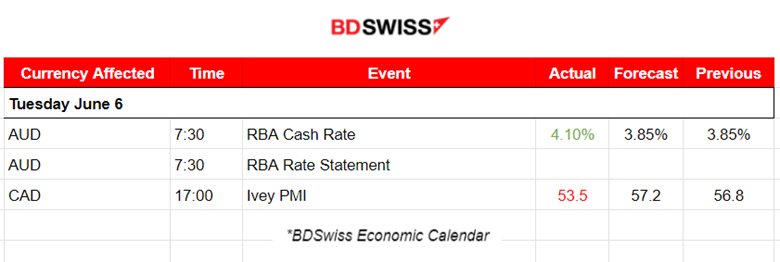

News Reports Monitor – Previous Trading Day (06 June 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, nor any significant scheduled releases.

- Morning – Day Session (European)

A surprise rate increase of the RBA was announced at 7:30. The Cash Rate was set to 4.10%, more than the expected 3.85%, causing AUD to appreciate greatly with this shock. AUDUSD jumped more than 50 pips at that time.

Canada’s Ivey PMI fell to a three-month low in May. The seasonally adjusted index fell to 53.5 in May from 56.8 in April, posting its lowest level since February. No major impact on the CAD pairs.

General Verdict:

______________________________________________________________________

FOREX MARKETS MONITOR

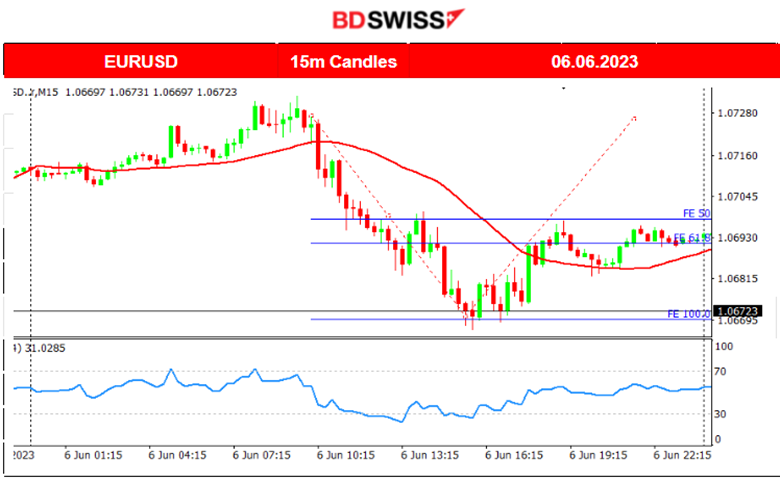

EURUSD (05.06.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

EURUSD moved rapidly downwards after the European Markets opening crossing the 30-period MA and showing more volatility. After finding support first at near 1.06820, it retraced and then continued with the rapid downward movement again towards the next support near 1.06685. When the move for the day stopped at that level, it retraced back to the mean.

Trading Opportunities

The pair showed a rapid downward movement when there were no significant news releases. Retracement was almost impossible not to happen. By using the Fibonacci retracement level, after the end of the movement to the downside, we can identify the 61.8 or even 50 levels that the price might retrace to, as depicted on the chart.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

NAS100 has been moving upwards but the price path was quite volatile. A bearish divergence was formed indicating that the upward trend stopped. Yesterday it moved sideways with low volatility testing the support near 14495. No clear direction yet as the market probably is waiting for the Fed’s decision on rates. The NFP data recently showed a strong Labour Market with a high degree of resilience to rate hikes.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude has been experiencing an upward short-term trend starting from the 1st of June. It moved above the 30-period MA and remained on an upward path. On the 4th of June, the OPEC-JMMC meetings took place, with OPEC+ announcing that it will limit combined oil production greatly in 2024, more than was expected. On the 5th of June, the market opened higher as depicted on the chart but the price reversed crossing the MA, moving under it, testing the 70 USD/b price level. It settled near 71.70 USD/b.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

After the NFP report on the 2nd of June, due to high USD appreciation, Gold’s price fell rapidly reversing and crossing the 30-period MA, finding support at near 1938 USD/oz. On Monday, the 5th of June, the U.S. ISM Services PMI figure was released causing the USD to depreciate greatly, thus the Gold price to jump. With that boost, it crossed the MA and moved further upwards. Yesterday the markets experienced low volatility and Gold moved on a sideways path settling at nearly 1960 USD/oz.

______________________________________________________________

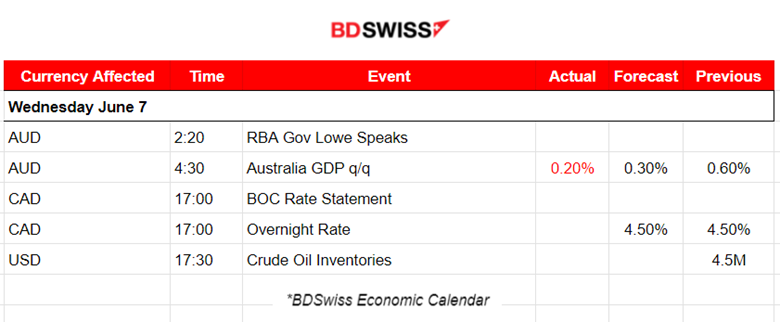

News Reports Monitor – Today Trading Day (06 June 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

Australia’s first-quarter Gross Domestic Product (GDP) expanded by 2.3% year-on-year. On a quarter-on-quarter basis, GDP grew by 0.2%, compared to the 0.3% expected. A very low-level intraday shock on AUD pairs followed after the report.

- Morning – Day Session (European)

At 17:00 the Bank of Canada (BOC) is going to decide on the overnight rate. The consensus is that rates will remain unchanged. This week, the RBA has surprised the markets with an increase. Should we not expect anything less from the BOC? It has been on pause since March and, like the RBA, a hike might be on the table as well.

General Verdict:

______________________________________________________________