PREVIOUS TRADING DAY EVENTS – 04 April 2023

Announcements:

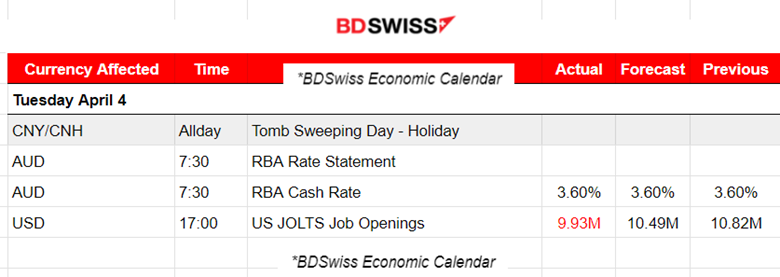

- According to the U.S. Bureau of Labor Statistics, the number of job openings decreased to 9.9 million on the last business day of February. That’s lower than the revised 10.56 million reported for January, based on the latest Job Openings and Labor Turnover Survey.

Economists were expecting 10.4 million available positions, according to Refinitiv. The February JOLTS report showed that the number of new hires decreased to 6.1 million from 6.3 million, layoffs fell to 1.5 million from 1.7 million, and resignations grew to 4 million from 3.9 million.

The industries with the largest declines in job openings were professional and business services, health care and social assistance, and transportation, warehousing and utilities.

At the time of the release of this report, the USD had depreciated greatly.

Source: https://www.bls.gov/news.release/archives/jolts_04042023.htm

- Australia’s central bank paused rate increases. The cash rate figure was released on the 4th of April remaining at 3.6%, the same as the previous figure. That was in line with a majority of economists and market expectations.

Among reasons to pause, Governor Philip Lowe highlighted the string of rate increases and high inflation that are “leading to a substantial slowing in household spending.” He added that some households are “experiencing a painful squeeze on their finances.”

The RBA’s decision to pause rate hikes in April increases the chance that they are over now. However, “the fact that the central bank paused today, underscores their concerns over the growth outlook, and the lagged effects of the monetary tightening,” said Oliver Levingston, a rates strategist at Bank of America in Sydney. “This points to a high bar for the RBA to resume hikes.”

Source: https://www.bloomberg.com/news/articles/2023-04-04/australia-pauses-tightening-cycle-amid-economic-uncertainty?srnd=economics-v2#xj4y7vzkg

______________________________________________________________________

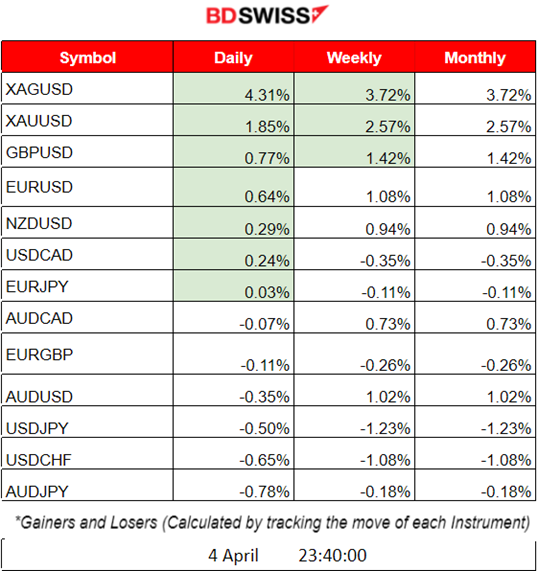

Summary Daily Moves – Winners vs Losers (04 April 2023)

- Silver and Gold take the lead with positive changes in the price of 31% and 1.85% respectively for the day.

- This week metals are having the biggest positive changes over 2.5%, followed by the GBPUSD which has a 1.42% change in price until today.

______________________________________________________________________

News Reports Monitor – Previous Trading Day (04 April 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

At 7:30, the Reserve Bank of Australia (RBA) released the Cash Rate figure to 3.60% as anticipated after the revised expectation of 3.85%. The figure is the same as the previous rate signalling that RBA has paused rate hikes.

The announcement caused an intraday shock for the AUD pairs as it affected the AUD with the currency depreciating. AUDUSD dropped nearly 25 pips after the release.

- Morning – Day Session (European)

The Bureau of Labor Statistics released its report for JOLTS Job Openings. The figure was lower than expected at 9.93M and lower than the previously reported openings, 10.56M. It was the first time vacancies fell below 10 million since May 2021. The USD depreciated greatly causing an intraday shock affecting the USD pairs and creating retracement opportunities. The EURUSD jumped near 64 pips after the release.

General Verdict:

- Most pairs experience volatility and large deviations from their 30-period MA (H1 charts) after important figure releases.

- It seems that Australia Central Bank follows Canada Central Bank and sets a “pause” on rate hikes as well.

______________________________________________________________________

FOREX MARKETS MONITOR

EURUSD 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

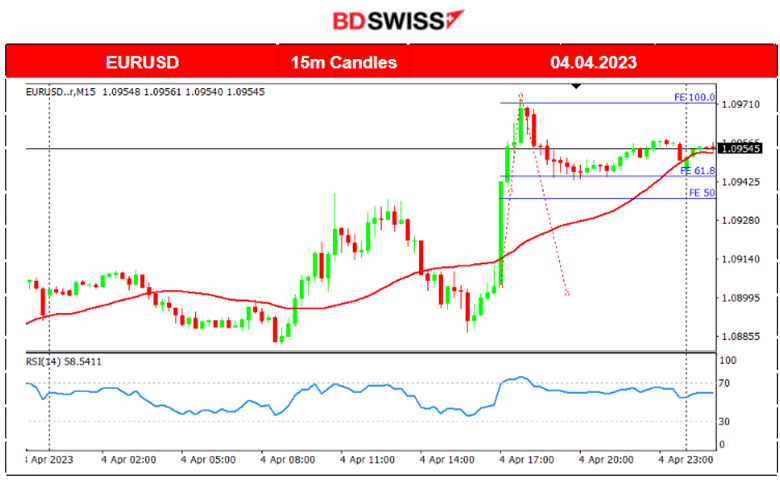

EURUSD was moving sideways the last few days mainly driven by the USD. High volatile though, with deviations from the 30-period MA of the size 60-80 pips. JOLTS Job Openings figure caused the price to pass the 1.094 level as the USD depreciated.

EURUSD (04.04.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair experienced high volatility the whole day, especially during the European and American sessions. The release of less significant figures such as the Spanish Unemployment Change at 10:00, which was in favour of the EUR, caused an appreciation of the currency and more volatility. As time passed, the pair was approaching the more important figure, the JOLTS Job Openings which was released later at 17:00. This figure caused a jump in EURUSD, an intraday shock followed by a retracement.

Trading Opportunities

It is clear that after the jump the price found good resistance and eventually retraced back to the Fibo 61.8%. Catching the retracement was possible considering the volatility that the pair was experiencing yesterday.

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NASDAQ – NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The index saw an upward movement the last few days above the 30-period MA while experiencing high volatility as well. The movement was upward with a diminishing rate and now the market has stabilised. The last NYSE market openings were not in favour of an uptrend. The index experienced large moves upwards and downwards with no clear upward path.

Trading Opportunities

RSI: Lower Highs, Price: Higher Highs. A bearish divergence occurred. This is an indication of price reversal and so it could be estimated that the future movement could be downwards.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

Gold (XAUUSD) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

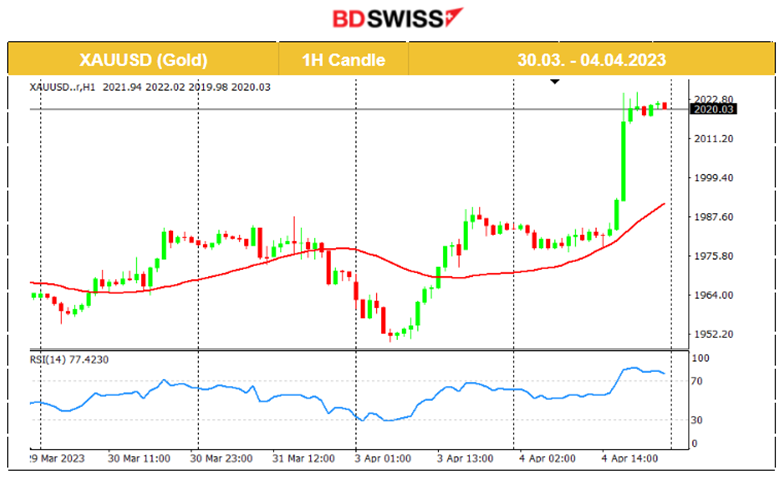

The price of Gold was moving sideways the last few days mainly driven by the USD. High volatile though with deviations from the 30-period MA of the size 15-20 USD. JOLTS Job Openings figure caused the price to pass the 2000 USD level as the USD depreciated.

Gold (XAUUSD) (04.04.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold was moving slowly sideways experiencing low volatility, around the mean level of 1982 USD. At 17:00 it jumped heavily over 30 USD upwards since the lower-than-expected JOLTS Job Openings figure caused heavy USD depreciation.

Trading Opportunities

A retracement is possible after the price breaks support 2015 USD. 2010 USD is the Fibo level 61.8% to which the price will retrace at least. The price is still high and that is why further downward movement is required to confirm the retracement.

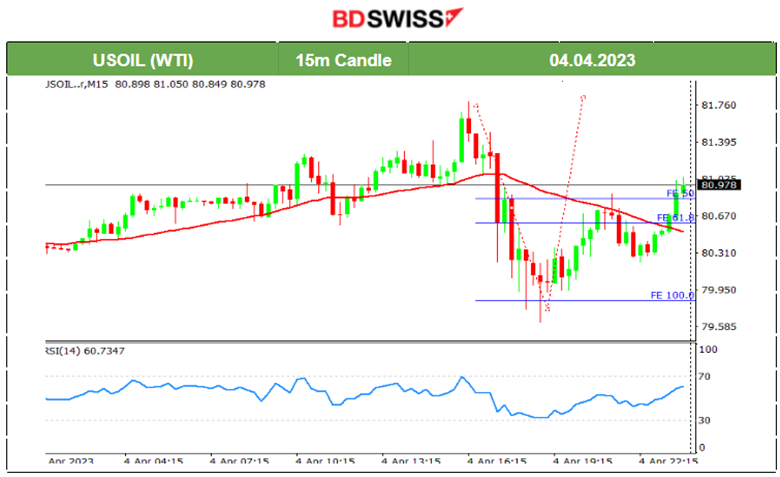

USOIL (WTI) (04.04.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The price of US Crude Oil calmed after the big jump caused by the OPEC+ announcement to cut production. After reaching the 81.5 USD level, it retraced back to 79.8 USD and settled. Yesterday, it moved upwards steadily during the Asian session reaching a high near 81.8 USD where it found resistance. At 16:30, the price reversed moving downwards and back again until the end of the day indicating high volatile sideways movement for now.

Trading Opportunities

Usually, after price reversals, retracement follows. The key is to find the end of the movement. In the above case, the reversal happened downwards when the price crossed the 30-period MA and retracement followed.

______________________________________________________________

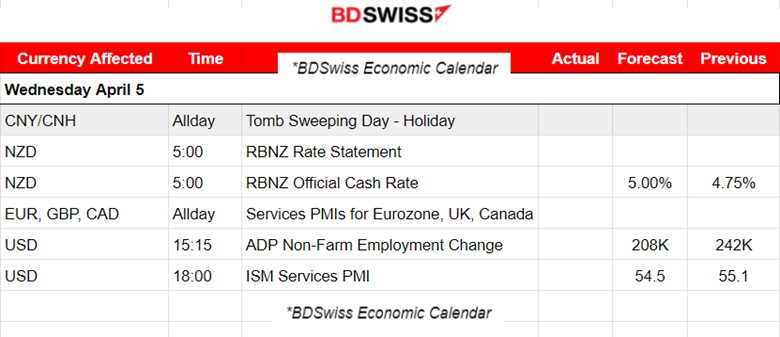

News Reports Monitor – Today Trading Day (05 April 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

At 5:00, the Reserve Bank of New Zealand (RBNZ) is going to release the Official Cash Rate figure. It is expected that RBNZ will increase the cash rate by 25bps in April to 5.00%. The announcement will probably cause an intraday shock for the NZD pairs during that time and if the actual figure is a surprise, the deviation will be high or low.

- Morning – Day Session (European)

During the day we have the Services sector PMI releases for the Eurozone, Canada and the UK. The US ISM Services PMI will be released late at 18:00 and it will probably cause an intraday shock as it will affect the USD since it is a broadly anticipated important figure.

The ADP Non-Farm Employment Change, the estimated change in the number of employed people during the previous month, excluding the farming industry and government was released at 15:15. It is expected to be lower than the previous figure and this also will greatly impact USD. If the number is lower than the previous change, this would cause the USD to depreciate.

General Verdict:

- Services PMIs are released throughout the day and this will cause high volatility as investors are going to form a whole picture of the economy’s condition, especially the U.S. economy.

- Intraday shocks are expected with the RBNZ rate release and the ADP Non-Farm Employment change figure. However, their impact will be intraday and not high enough to create long trends as the markets are waiting for NFP on Friday.

______________________________________________________________