PREVIOUS TRADING DAY EVENTS – 03 Oct 2023

The Fed holds rates steady currently but signalled a hike by the end of this year.

Job openings were reported at 9.610M versus the previous 8.92M on the last day of August. That was the most in just over two years. Expectations changed regarding the U.S. central bank decision on rates. Now it looks unlikely it will keep rates unchanged at its Oct. 31-Nov. 1 policy meeting, according to CME Group’s FedWatch tool.

“Friday’s payroll data should help clarify if the labour market is as strong as the JOLTS report implies because at this stage of the Fed’s ‘last mile’ to untangle the remaining ‘sticky’ inflation, a stronger than expected report will be the last thing the Fed wants to see, not to mention financial markets,” said Quincy Krosby, chief global strategist at LPL Financial in Charlotte, North Carolina.

Source:

https://www.reuters.com/world/us/us-job-openings-unexpectedly-rise-august-2023-10-03/

______________________________________________________________________

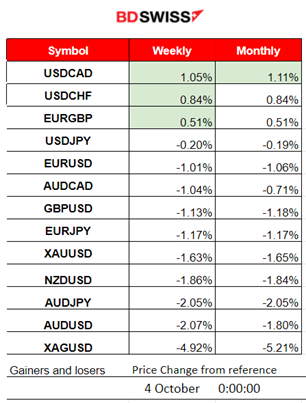

Winners and Losers

News Reports Monitor – Previous Trading Day (03 Oct 2023)

Server Time / Timezone EEST (UTC+03:00)

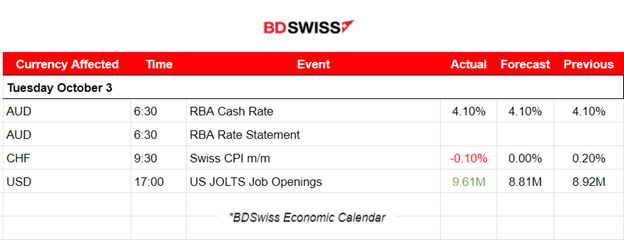

- Midnight – Night Session (Asian)

The RBA decided to keep rates unchanged. There was no significant shock observed at that time. The market did move, but with less volatility than expected. The AUDUSD is currently moving to the downside.

- Morning–Day Session (European and N. American Session)

According to the Swiss CPI monthly figure, consumer prices decreased by 0.1% in September. A result due to several factors, including lower prices for hotels and supplementary accommodation. The market did not react significantly to the release.

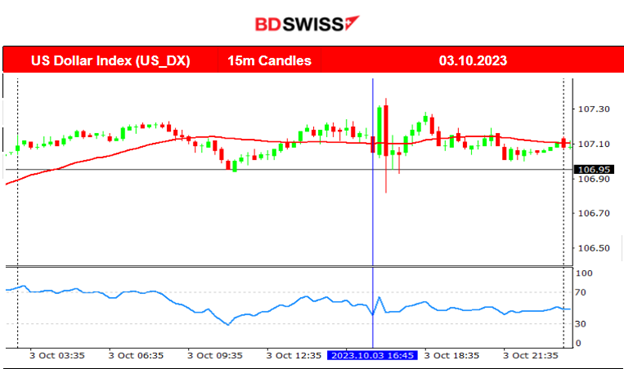

The JOLTS Job Openings figure for the U.S. surprisingly was reported way higher, at 9.61M vs the previous 8.92. A shock occurred, causing high volatility, but the market did not move in one direction. The USD initially experienced appreciation, but later the effect faded and reversed, following the DXY’s sideways path.

General Verdict:

____________________________________________________________________

FOREX MARKETS MONITOR

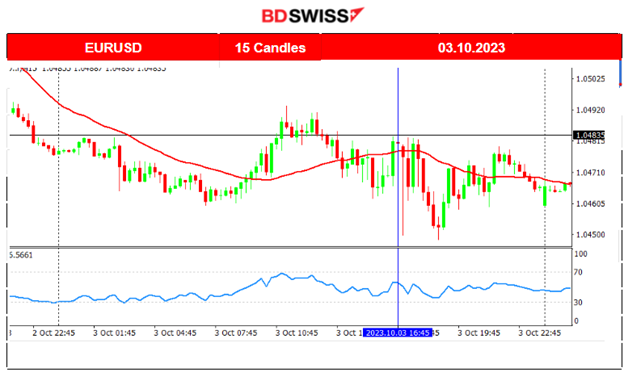

EURUSD (03.10.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The EURUSD closed nearly flat overall. The path was volatile but sideways due to the absence of critical special releases, except the JOLTS job openings report, which affected the USD greatly. It was reported higher, and the initial shock caused the USD to appreciate and, thus, a sharp drop for EURUSD. It, however, remained in range after testing the support at 1.045, and so continued to move around the 30-period MA.

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

A sudden jump on the 2nd of October caused bitcoin to move upwards more than 900 USD after breaking the resistance at 27300. The market calmed down after that, moving to lower levels. No other important movement was recorded recently, and the path keeps the sideways direction.

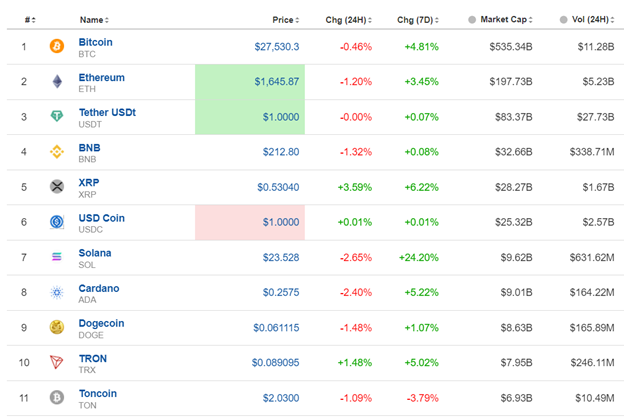

Crypto sorted by Highest Market Cap:

The 7 Days Change is still green and with roughly the same figures apparently meaning that indeed the crypto market has not experienced significant movements in general.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 3rd of October the index eventually broke the triangle formation that was formed and mentioned in our previous report. After that breakout the index dived, reaching the support at near 14450 before starting to retrace. There is still room for more as it seems since the 30-period MA is not reached yet.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude’s price continued on the 29th Sept. to move with high volatility, breaking the support at near 90.5 USD/b and moving further to the downside. 89.70 USD/b was broken as well causing Crude to dive. Now it found support at 86.70 USD/b and remained near that level. No good signals for a reversal currently. OPEC+ so far did not show any signs of cooling the rally that brought prices near $100 a barrel. Crude has soared more than 20% in three months as alliance leaders Saudi Arabia and Russia squeeze supplies while world fuel demand hits records. OPEC+ meetings are taking place today.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold keeps breaking important support levels while moving on a clear downtrend. Even though the RSI is slowing down, staying close to the 30 level, there is no significant data to suggest that there will be a reversal or even a halt. However, that support level 1815 looks significant. It might be the result of lower volatility ahead of the NFP. The USD is the primary driver now and currently, and DXY is currently on the sideways path. The RSI shows a bullish divergence formation with its higher highs. However, the news is probably going to distort this.

______________________________________________________________

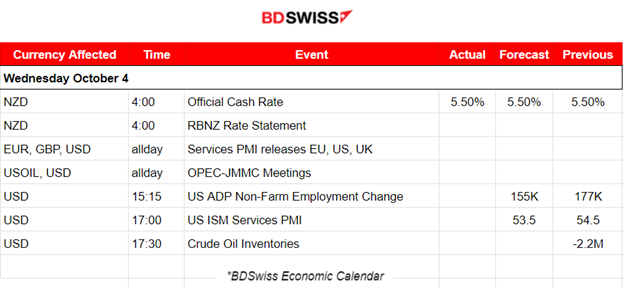

News Reports Monitor – Today Trading Day (04 Oct 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

The RBNZ decided to keep the Official Cash Rate (OCR) at 5.50%. Current rates are constraining economic activity and reducing inflationary pressure. Demand growth in the economy continues to ease. However the near term risk is that inflation is not slowing down as anticipated. The NZD suffered depreciation against other currencies. NZDUSD dropped sharply, nearly 50 pips at the time of the release and retracing soon after.

- Morning–Day Session (European and N. American Session)

Services PMIs are having an effect. Figures in the expansion area especially for the eurozone, cause some effect on the EUR while the USD experiences clear heavy depreciation causing the USD pairs to move to the upside. The GBP is appreciating against the EUR heavily.

The ADP report for the U.S. regarding changes in private employment will shade some light to the labour market situation. We already see reports giving strong indications of future high numbers in employment, however the expected ADP figure is lower. A surprise will probably cause a big shock for the USD pairs at the time of the release and thus opportunities.

The ISM Services PMI was reported at 54 previously in the expansion area. The U.S. is indeed doing well in that sector compared with the other economic regions. The release could create more volatility than usual for the USD pairs but no major shock is expected since the NFP is just down the road.

General Verdict:

______________________________________________________________