This article reviews Bitcoin’s performance in Q2 2024 (April – June) and provides a technical outlook for Q3 2024. While Q1 experienced a bullish trend driven by ETF approvals, regulations, and adoption by renowned financial institutions, Q2 saw a reversal of this trend. This article explores the reasons behind the failure of the bullish trend to continue in Q2.

April Review

On April 19, 2024, at 8:09 p.m. ET, Bitcoin’s fourth halving event reduced the block reward for miners from 6.25 BTC to 3.125 BTC per block, impacting miners’ profitability and potentially altering the cryptocurrency mining landscape. This deflationary mechanism was expected to exert long-term upward pressure on Bitcoin’s price, though the link between halving events and price appreciation remained complex. About a week before the halving, BTC’s price dipped from over $67,000 to $62,000. Additionally, higher-than-expected April CPI data from the US, showing 3.8% inflation, dampened expectations for early rate cuts in 2024, negatively impacting investor sentiment and turning crypto markets bearish.

May Review

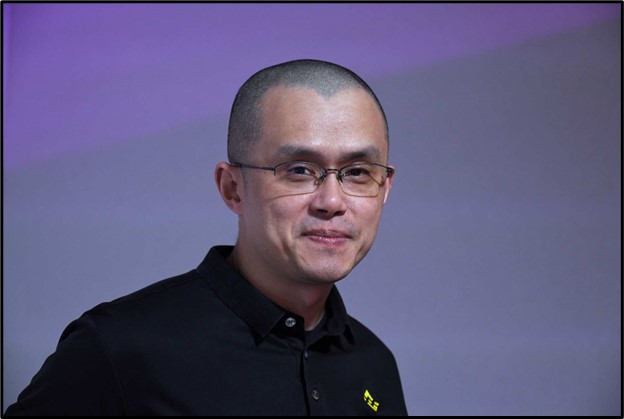

In May, BTC dropped 5% to $56,526, its lowest level since February 27, according to CoinMetrics, and settled down about 4% at $56,954.13. Investors focused on the Federal Reserve’s latest interest rate decision, which left the benchmark short-term borrowing rate unchanged within the 5.25% to 5.50% range. Zach Pandl of Grayscale Investments noted that higher real interest rates likely supported the dollar and pressured Bitcoin over the past month. The FOMC’s concerns about inflation, without ruling out future rate cuts, added to the tight trading range of Bitcoin. Furthermore, five days of outflows from U.S. Bitcoin ETFs, a poor reaction to Hong Kong’s spot Bitcoin ETFs, and the sentencing of Binance’s former CEO to prison for money laundering charges contributed to the decline.

June Review

On June 12, 2024, leading cryptocurrencies dipped further ahead of a key U.S. inflation report and Federal Reserve interest rate decision. Bitcoin fell 0.5% to $67,337, while Ethereum dropped 0.9% to $3,519, contributing to a 0.65% decline in the global cryptocurrency market cap. An anticipated Fed rate cut, following encouraging inflation data, could potentially lead to an upward trend in the crypto market.

Q2 Technical Analysis Review

In Q2 2024, overall Bitcoin exhibited a bearish trend following the initial price opening at $71,448.52 on April 1st, 2024. By April 2nd, 2024, the price had dropped to $64,457.01, marking the beginning of a ranging market phase. The peak of the quarter occurred on April 8th, 2024, when the price surged to $72,765.10. However, the market later saw a decline, reaching a low of $56,532.52 on May 24th, 2024, the lowest point of the quarter. A recovery ensued, with prices nearing monthly highs on June 7th, 2024, reaching $72,401.90 before turning bearish for the remainder of June, closing the month at $60,779.66.

Q3 Technical Analysis Forecast

-BTCUSD observed rejection at uptrend line resistance at $59,239.70.

– If rejection holds:

Potential upside target: $68,281.77.

Further potential upside upon breaking $68,281.77: $79,783.80.

– Alternatively, if rejection fails:

Potential downside target: $52,125.73.

Further potential downside upon breaking $52,125.73: $46,540.92.

Sources:

https://www.cnbc.com/2024/04/15/hong-kong-regulators-approve-spot-bitcoin-and-ether-etfs-.html

https://www.reuters.com/markets/currencies/crypto-fans-count-down-bitcoins-halving-2024-04-19/

https://www.binance.com/en/square/post/8884651632594

https://www.forexfactory.com/calendar?day=jul5.2024&event=135992#detail-all=136102

https://images.app.goo.gl/ieupoCy3xcHYYPET7

https://images.app.goo.gl/SveWKcaV6BHeTpaR7