Previous Trading Day’s Events (14.03.2024)

The Fed is expected to leave rates unchanged at its policy meeting next week.

“If we take inflation as a whole, we’ve had relatively hot inflation readings the last two months now, yet the market has kind of powered higher,” said Tony Welch, chief investment officer of SignatureFD.

Nvidia shares fell 3.2%, while an index of semiconductors was down 1.8%.

“There’s nervousness about the market being very extended with a relatively narrow breadth. You can see the anxiety from the hotter PPI expressed in the Russell index of small and midcap names,” said Michael James, managing director of equity trading at Wedbush Securities in Los Angeles.

______________________________________________________________________

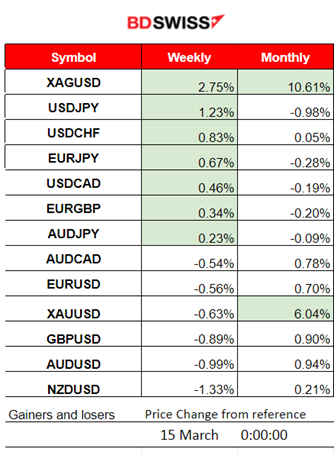

Winners vs Losers

Silver (XAGUSD) takes the lead as it moved greatly to the upside yesterday marking a 2.75% gain for the week and a 10.6% gain this month. Gold remains stable and the dollar has strengthened with higher-than-expected PPI data.

______________________________________________________________________

______________________________________________________________________

News Reports Monitor – Previous Trading Day (14 Mar 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

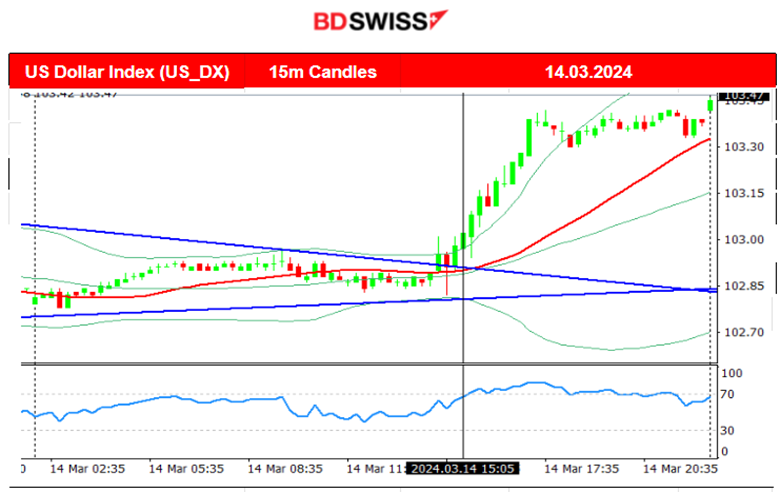

U.S. PPI figures were reported higher than expected and that caused a market reaction to the dollar strengthening. With more reports showing sticky prices, the probability of rate cuts in June lowered significantly, currently around 57%.

U.S. Retail sales figures turned to growth but were reported lower than the expected figures. U.S. Unemployment claims saw a decrease adding to labour market data that support strength, thus making it difficult for the Fed to consider interest rate cuts soon.

General Verdict:

__________________________________________________________________

__________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (14.03.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair experienced very low volatility with the absence of scheduled releases and significant news before 14:30. The market reacted greatly after the news for the U.S. with dollar appreciation, thus causing the pair to move downwards rapidly. No significant retracement took place until the end of the trading day.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

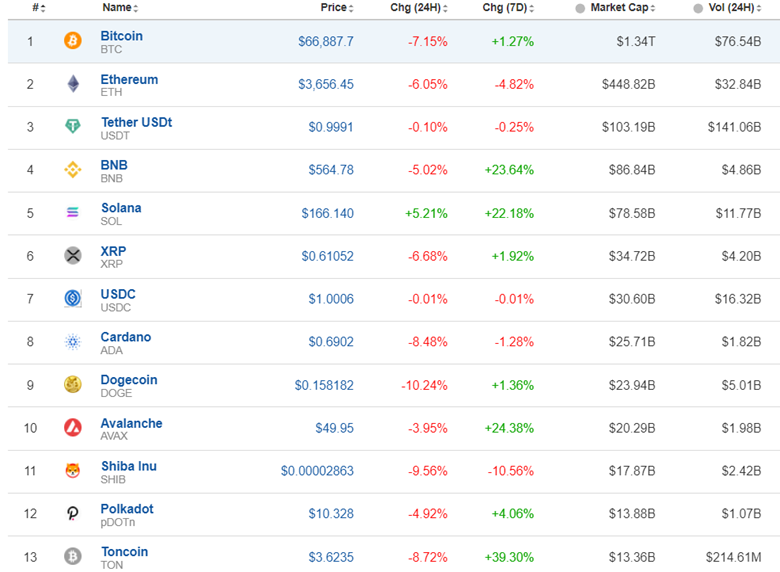

Bitcoin started to retreat significantly yesterday 14th March, especially after the news release for the U.S.

It reached near 74,000 USD this week but dropped heavily, currently reaching 66,700 USD and moving below the 30-period MA. Is this volatile downward movement a sign that the uptrend is over currently? Probably for some time.

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

Finally we see a reversal in markets and it’s quite a big one. Dogecoin suffered a 10.2% loss in 24 hours. A week’s gains are wiped out for most.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 11th of March, the USD actually showed strength and indices fell further downwards with NAS100 reaching the support at 17,890 USD before retracing to the 30-period MA and back to the 18,000 USD level. On the 12th of March, the inflation report release figures had actually caused the U.S. Indices to climb. An upward wedge is visible with a clear resistance level at nearly 18,265 USD. On the 13th of March, the upward wedge was broken to the downside and the index dropped until the support at near 18,040 USD, moving below the 30-period MA on its way down. With the dollar appreciating further the drop continued on the 14th of March reaching the support near 17,950 USD before retracing to MA again.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Crude oil retraced on the 11th of March and continued trading in range during the inflation report on the 12th of March. A breakout of the resistance on the 13th of March caused its price to move away from the 78 USD/b level and reach higher at 79.5 USD/b. On the 13th of March, it started to see a rise in price that was kept steady for two consecutive days causing the price to reach a peak near 81 USD /b. Retracement followed, back to near 80 SUD/b.

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Gold will be pushed to the downside only if the Fed hints that there will be delays in cuts, following the hooter than expected inflation. GOLD remained high as it moved to the upside on the 13th of March. The U.S. dollar (USD) weakened and Gold moved to the upside crossing the 30-period MA on its way up. The RSI does not show any divergence and moves along with the price making the future path uncertain. A triangle formation is visible currently as volatility is lowering for Gold. On the 14th of March, Gold lowered due to the USD appreciation yesterday and reversed today. Waiting for a triangle breakout. Significant support remains at 2,150 USD.

______________________________________________________________

______________________________________________________________

News Reports Monitor – Today Trading Day (15 Mar 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

The preliminary consumer sentiment report on the 15th will show if Americans changed their expectations about future business or if the short-run inflation expectations remained within the 2.3-3.0% range. The Preliminary release is the earlier and thus tends to have the most impact affecting mostly the USD.

General Verdict:

______________________________________________________________