PREVIOUS WEEK’S EVENTS (19.08.2024 – 23.08.2024)

Japan Economy:

Aug 23, 12:33 am: BOJ Gov Ueda Speaks

Aug 23, 4:00 am: BOJ Gov Ueda Speaks Again

European Economy:

Aug 22, 7:15 am: French Manufacturing PMI (Actual: 42.1, Forecast: 44.4)

Aug 22, 7:15 am: French Services PMI (Actual: 55.0, Forecast: 50.2)

Aug 22, 7:30 am: German Manufacturing PMI (Actual: 42.1, Forecast: 43.4)

Aug 22, 7:30 am: German Services PMI (Actual: 51.4, Forecast: 52.3)

UK Economy:

Aug 22, 8:30 am: Manufacturing PMI (Actual: 52.5, Forecast: 52.1)

Aug 22, 8:30 am: Services PMI (Actual: 53.3, Forecast: 52.8)

Aug 23, 3:00 pm: BOE Gov Bailey Speaks

Canada Economy:

Aug 20, 12:30 pm: CPI m/m (Actual: 0.4%, Forecast: 0.4%)

Aug 20, 12:30 pm: Median CPI y/y (Actual: 2.4%, Forecast: 2.5%)

Aug 20, 12:30 pm: Trimmed CPI y/y (Actual: 2.7%, Forecast: 2.8%)

Aug 23, 12:30 pm: Core Retail Sales m/m (Actual: 0.3%, Forecast: -0.2%)

Aug 23, 12:30 pm: Retail Sales m/m (Actual: -0.3%, Forecast: -0.3%)

US Economy:

Aug 21, 6:00 pm: FOMC Meeting Minutes

Aug 22, 12:30 pm: Unemployment Claims (Actual: 232K, Forecast: 232K)

Aug 22, 1:45 pm: Flash Manufacturing PMI (Actual: 48.0, Forecast: 49.5)

Aug 22, 1:45 pm: Flash Services PMI (Actual: 55.2, Forecast: 54.0)

Aug 23, 2:05 pm: Fed Chair Powell Speaks

Currency Markets Impact – Past Releases (19.08.2024 – 23.08.2024)

Japan Economy:

Aug 23, 12:33 am: Bullish JPY. BOJ Gov Ueda Speaks

Aug 23, 4:00 am: Bearish JPY. BOJ Gov Ueda Speaks Again

European Economy:

Aug 22, 7:15 am: Bearish Euro. French Manufacturing PMI (Actual: 42.1, Forecast: 44.4)

Aug 22, 7:15 am: Bearish Euro. French Services PMI (Actual: 55.0, Forecast: 50.2)

Aug 22, 7:30 am: Bearish Euro. German Manufacturing PMI (Actual: 42.1, Forecast: 43.4)

Aug 22, 7:30 am: Bearish Euro. German Services PMI (Actual: 51.4, Forecast: 52.3)

UK Economy:

Aug 22, 8:30 am: Bullish GBP. Manufacturing PMI (Actual: 52.5, Forecast: 52.1)

Aug 22, 8:30 am: Bullish GBP. Services PMI (Actual: 53.3, Forecast: 52.8)

Aug 23, 3:00 pm: Bullish GBP. BOE Gov Bailey Speaks

Canada Economy:

Aug 20, 12:30 pm: Bearish CAD. CPI m/m (Actual: 0.4%, Forecast: 0.4%)

Aug 20, 12:30 pm: Bearish CAD. Median CPI y/y (Actual: 2.4%, Forecast: 2.5%)

Aug 20, 12:30 pm: Bearish CAD. Trimmed CPI y/y (Actual: 2.7%, Forecast: 2.8%)

Aug 23, 12:30 pm: Bullish CAD. Core Retail Sales m/m (Actual: 0.3%, Forecast: -0.2%)

Aug 23, 12:30 pm: Bullish CAD. Retail Sales m/m (Actual: -0.3%, Forecast: -0.3%)

US Economy:

Aug 21, 6:00 pm: Bearish USD. FOMC Meeting Minutes

Aug 22, 12:30 pm: Bearish USD. Unemployment Claims (Actual: 232K, Forecast: 232K)

Aug 22, 1:45 pm: Bullish USD. Flash Manufacturing PMI (Actual: 48.0, Forecast: 49.5)

Aug 22, 1:45 pm: Bullish USD. Flash Services PMI (Actual: 55.2, Forecast: 54.0)

Aug 23, 2:05 pm: Bearish USD. Fed Chair Powell Speaks

FOREX MARKETS MONITOR

EURUSD (19.08.2024 – 23.08.2024) 1HR Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

Last Week Recap: EURUSD was bullish, opening at 1.10221 and closing at 1.11899. The week’s high was 1.12042, and the low was 1.10221.

Coming Week Outlook: If resistance at 1.12007 breaks, EURUSD may rise to 1.12497 and 1.13120. If the breakout fails, it could fall to 1.11622 and 1.11320. CRYPTO MARKETS MONITOR

CRYPTO MARKETS MONITOR

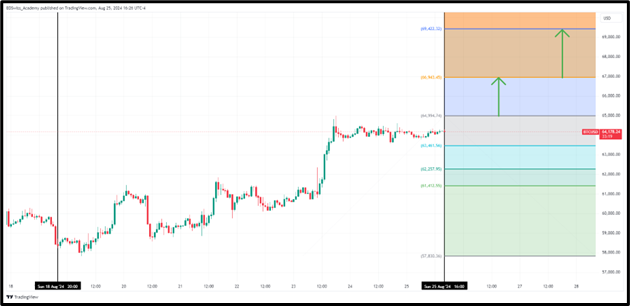

BTCUSD (19.08.2024 – 23.08.2024) 1HR Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

Last Week Recap: BTCUSD was bullish, opening at $58,401.27 and closing at $64,159.14. The weekly high was $65,041.60, and the low was $57,800.49.

Coming Week Outlook: BTCUSD shows potential for a resistance breakout at $64,994.74. If it holds, prices may rise to $66,943.45 and $69,422.32. If it fails, a drop to $63,461.56 and $62,257.95 is likely.

STOCKS MARKETS MONITOR

STOCKS MARKETS MONITOR

NVIDIA (19.08.2024 – 23.08.2024) 1HR Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

Last Week Recap: Nvidia had a bullish week, opening at $124.19 and closing at $129.37. The weekly high was $130.78, and the low was $123.17.

Coming Week Outlook: Nvidia is testing resistance at $130.82. A successful breakout could push prices to $132.92 and $135.59, while a failed breakout might see a decline to $129.17 and $127.87.

INDICES MARKETS MONITOR

INDICES MARKETS MONITOR

S&P 500 (19.08.2024 – 23.08.2024) 1HR Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

Last Week Recap: The S&P 500 was bullish, opening at 5556.29 and closing at 5634.60 points. The week’s high was 5644.00, while the low was 5556.15 points.

Coming Week Outlook: The S&P 500 is currently testing a resistance breakout at 5642.94. If the breakout holds, the index may rise to 5667.25 or 5698.17 points. If it fails, it could drop to 5624.05 or 5608.80 points.

COMMODITIES MARKETS MONITOR

COMMODITIES MARKETS MONITOR

XAUUSD (19.08.2024 – 23.08.2024) 1HR Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

Last Week Recap: XAUUSD was bullish, opening at $2507.09 and closing at $2512.01. The week’s high was $2531.68, and the low was $2470.96.

Coming Week Outlook: A potential breakout above $2517.08 could push prices to $2529.75 and $2545.89. If the breakout fails, prices may drop to $2507.08 and $2499.25.

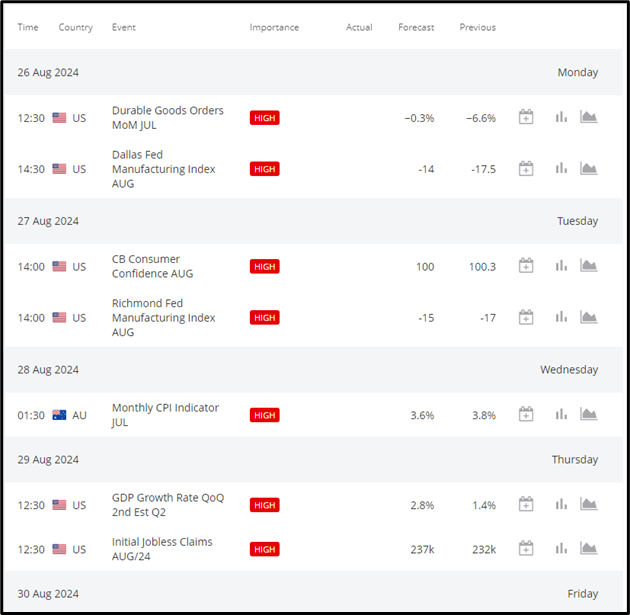

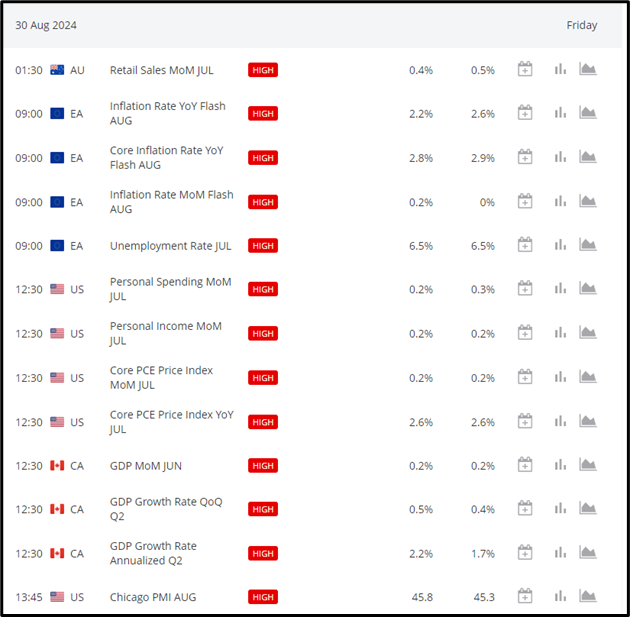

THIS WEEK’S EVENTS

(26.08.2024 – 30.08.2024)

Coming up:

Canada Economy:

Aug 30, 12:30 PM: GDP m/m (Forecast: 0.1%). Above forecast strengthens CAD, below weakens.

US Economy:

Aug 27, 2:00 PM: CB Consumer Confidence (Forecast: 100.2). Higher than forecast supports USD, lower weakens.

Aug 29, 12:30 PM: Preliminary GDP q/q (Forecast: 2.8%). Above forecast supports USD, below weakens.

Aug 29, 12:30 PM: Unemployment Claims (Forecast: 234K). Higher than forecast weakens USD, lower supports.

Aug 30, 12:30 PM: Core PCE Price Index m/m (Forecast: 0.2%). Above forecast supports USD, below weakens.

European Economy:

Aug 29, All Day: German Preliminary CPI m/m (Forecast: 0.0%). Above forecast strengthens Euro, below weakens.

Aug 30, 9:00 AM: CPI Flash Estimate y/y (Forecast: 2.2%). Above forecast supports Euro, below weakens.

Australia Economy:

Aug 28, 1:30 AM: CPI y/y (Forecast: 3.4%). Higher than forecast supports AUD, lower weakens.

Sources :

https://www.conference-board.org/