PREVIOUS TRADING DAY EVENTS – 21 June 2023

A huge surprise for policymakers who, despite the continuous interest rate increases, inflation remains stubborn. A warning for all economies. This release now puts more pressure on the Bank of England. Today it is expected to raise interest rates for the 13th time in a row.

Sources say that there is a 40% chance of the BOE to raise interest rates from 4.5% to 5% and a nearly 100% chance rates will reach 6% by December, even as the economy skirts recession. This would mean a surprise today and GBP to strengthen significantly.

Finance minister Jeremy Hunt said the government would “stick to its guns” on cutting inflation.

“Inflation has moderated somewhat since the middle of last year,” with the Fed’s preferred measure of inflation falling substantially from a peak of around 7% last year to 4.4% as of April.

“Inflation pressures continue to run high, and the process of getting inflation back down to 2% has a long way to go,” Powell said, noting that even as the Fed held off raising interest rates at the Federal Open Market Committee meeting last week “nearly all” participants expect further rate increases will be appropriate by the end of the year.

Market participants expect hikes to resume at the Fed’s July meeting. Data regarding inflation expectations show expected inflation lower and suggest that more hikes after July might not take place.

“My colleagues and I understand the hardship that high inflation is causing, and we remain strongly committed to bringing inflation back down to our 2% goal,” Powell was set to tell the House committee, where Republicans hold the majority.

“We have been seeing the effects of our policy tightening on demand in the most interest-rate–sensitive sectors of the economy” such as housing, Powell said.

“It will take time, however, for the full effects of monetary restraint to be realized, especially on inflation,” Powell said.

______________________________________________________________________

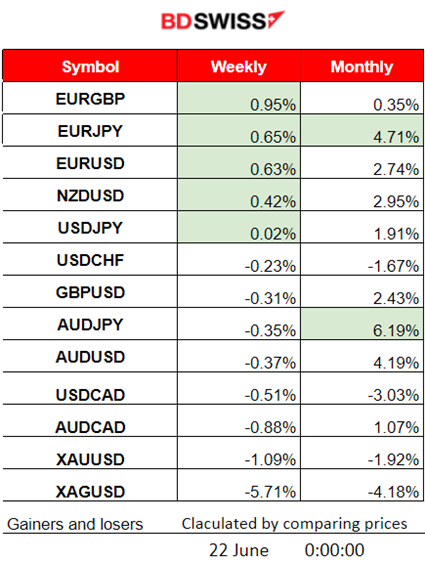

Summary Daily Moves – Winners vs Losers (21 June 2023)

- The EURGBP has reached the top of the Winner’s list this week with 0.95% price change so far.

- The month so far finds AUDJPY and EURJPY on the top still with 6.19% and 4.71% price changes respectively.

______________________________________________________________________

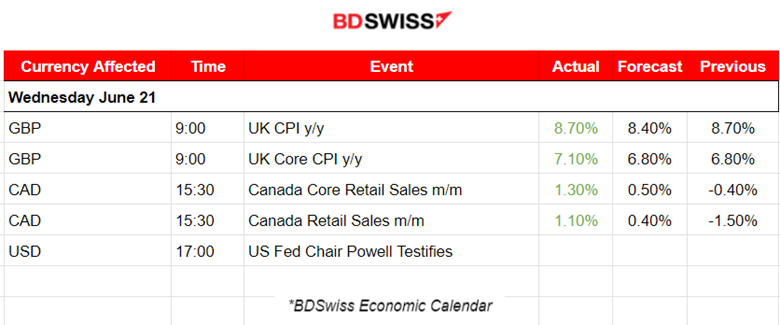

News Reports Monitor – Previous Trading Day (21 June 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No significant news announcements, no special scheduled releases.

- Morning – Day Session (European)

Annual Inflation was reported higher than expected for the U.K. causing a surprise. It remains at 8.7%, the same as the previous figure. The GBP appreciated greatly and then reversed during the release. GBP pairs with GBP as base currency settled eventually downwards. EURGBP jumped.

At 15:30 significant releases for Canada, Retail Sales figures were reported more than expected. Despite high prices, Canadian shopping activity remains steady. The CAD pairs were affected by CAD appreciation. USDCAD moved downwards steadily after the release as this was mainly due to the USD weakening after Powell’s speech at 17:00.

General Verdict:

______________________________________________________________________

FOREX MARKETS MONITOR

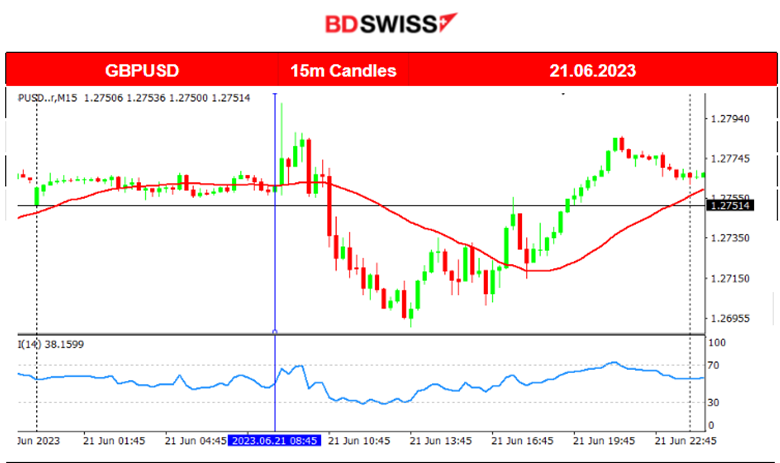

GBPUSD (21.06.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair experienced a shock at 9:00 during the U.K. annual CPI change release. The figure was higher than expected and inflation remained unchanged giving a surprise to the BOE and everyone else. Inflation was supposed to drop to lower levels due to the continuous policymakers’ efforts, but the data eventually coincide with the recent strong labour market data for the U.K. Today, BOE will decide on rates and probably it will be a hike considering all these figures. The question is, will there be a hike of more than 25 basis points? The market reacted strangely after the release with GBP depreciation and then retracted back to the mean moving further upwards above the 30-period MA as the USD was losing ground after 17:00.

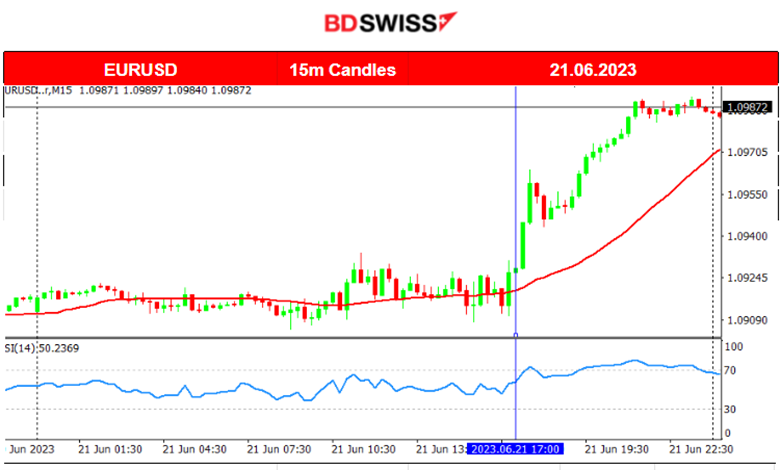

EURUSD (21.06.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair was moving sideways around the 30-period MA with low volatility until the time of the speech of the Fed Chairman. Powell expects more Fed rate hikes because the fight against inflation is not over yet. However, the comments seem to defend the pause and the market reacted with USD depreciation causing the EURUSD to move steadily upwards until the end of the trading day.

USDCAD (21.06.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair showed more volatility than the others above early since the beginning of the Asia Session. During the European session, it moved around the mean until Powell’s speech which eventually brought the pair downwards since USD started to depreciate during the speech.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

It is quite clear that the market conditions have changed. The U.S. Stocks are no longer following an upward trend and it might be the case that a sideways movement has also ended. The beginning of a retracement is at hand since the index shows that it has been below the MA for days. Yesterday, after the NYSE opening the index fell near 175 USD. A new downward trend can be visible also on the other benchmark indices charts, S&P500 and US30.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

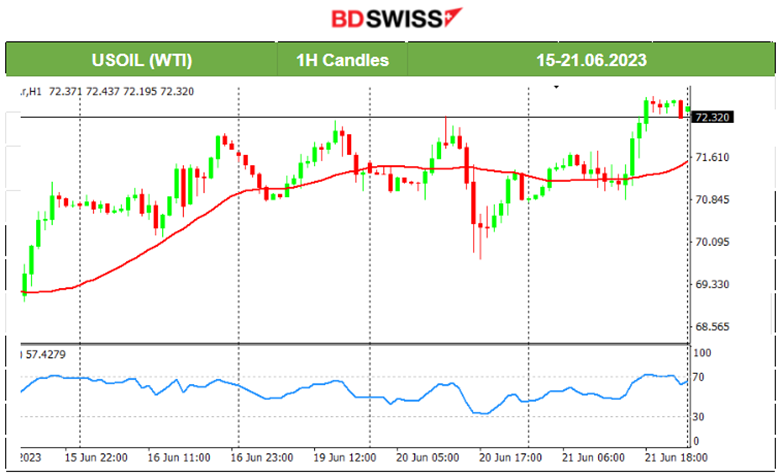

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude was moving sideways around the mean but with high volatility. A channel was formed with a resistance level at near 72.20 that was eventually broken causing it to move higher near 72.70. Overall we see that energy costs are getting higher and higher lately, causing inflation to remain sticky. Central banks have work and lots of thinking to do.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold moves lower and lower. A downward trend has been formed. 1945 USD/oz was a significant support level that was broken on the 20th of June and pushed Gold downwards to the next support at 1930 USD/oz. Yesterday, that level was also broken pushing it even further downwards near 1919 before it retraced back to the mean as USD started to lose ground on the 21st of June after Powell’s speech.

______________________________________________________________

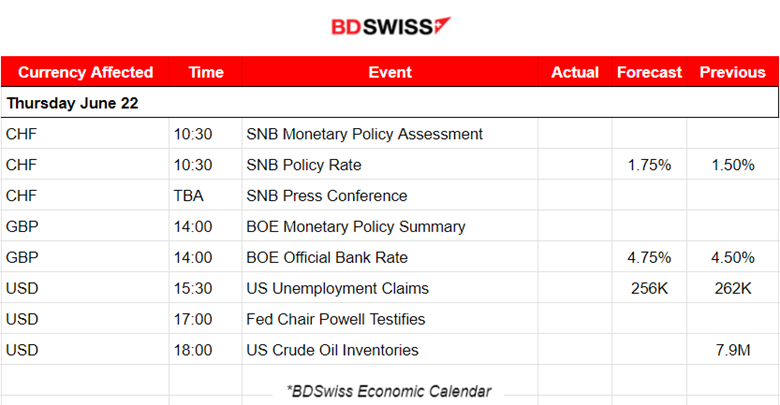

News Reports Monitor – Today Trading Day (22 June 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No significant news announcements, no special scheduled releases.

- Morning – Day Session (European)

The Swiss National Bank (SNB) decided to increase the SNB policy rate to 1.75% matching expectations and tightening monetary policy further. At the time of the release at 10:30, the market experienced a shock, affecting CHF pairs. No clear direction yet.

The Bank of England (BEO) is going to decide on rates at 14:00. It is expected that rates will increase by 25 basis points, bringing the OBR to 4.75%. This takes place after a disappointing inflation data release that showed no signs of an inflation slowdown. A surprise is not impossible. A shock will probably take place affecting the GBP pairs greatly.

U.S. Unemployment claims figure is one of the Fed’s important indicators of Labor market resilience and policymakers are waiting for a reduction in those numbers. It is going to be released at 15:30 and the expected figure is not so low though. A surprise increase will probably cause a moderate shock for the USD pairs.

A high U.S. oil inventories figure was reported last time, 7.9M. Price was indeed some time ago but last week it started climbing to higher and higher levels. The expected figure today is lower by nearly 7M barrels in inventories.

General Verdict:

______________________________________________________________