FX:

Commitments of Traders (CoT) report

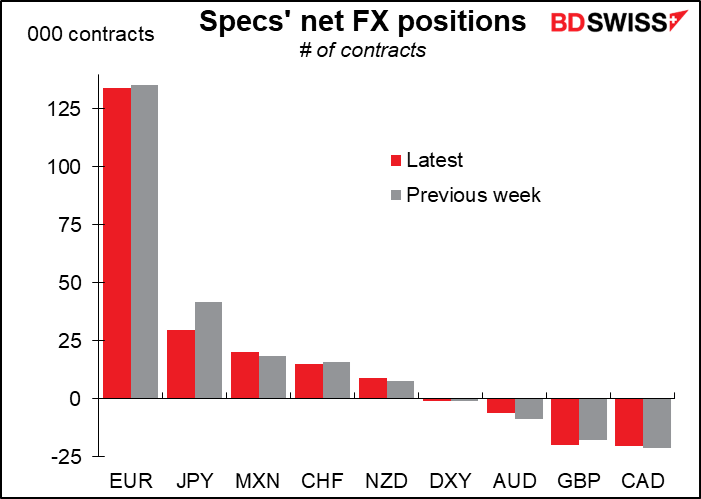

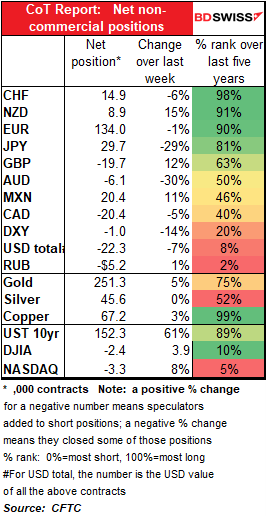

Again, the general trend was cutting positions, both long and short.

Speculators cut their long JPY positions over the week and took some profits as USD/JPY fell from 105.30 to 104.19. They continued to trim long EUR positions, but that’s a habit nowadays.

The exceptions were GBP, where they increased their short GBP positions, and MXN & NZD, where they increased their longs.

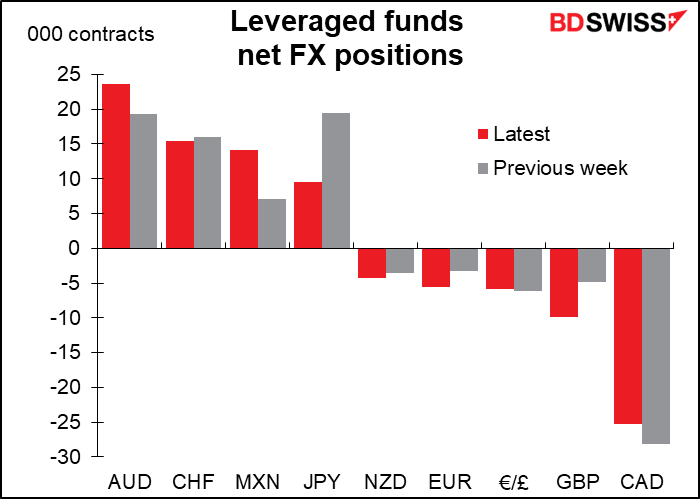

Leveraged funds

Hedge funds also cut their long JPY positions substantially. But they didn’t dial back risk that much. They also increased their long MXN substantially and their long AUD, as well as increasing short positions in NZD, EUR and GBP.

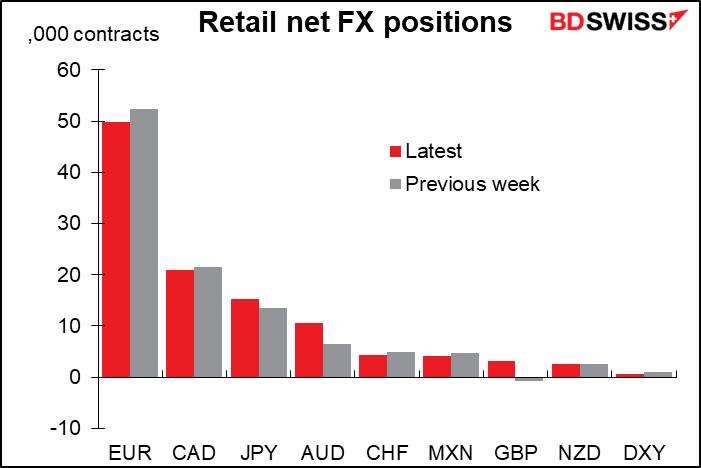

Retail investors

Retail investors also increased their long JPY positions, plus their long AUDs. They flipped from short GBP to long.

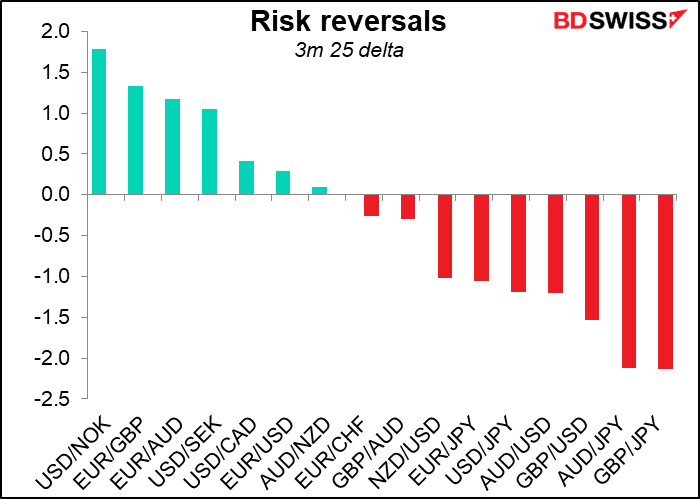

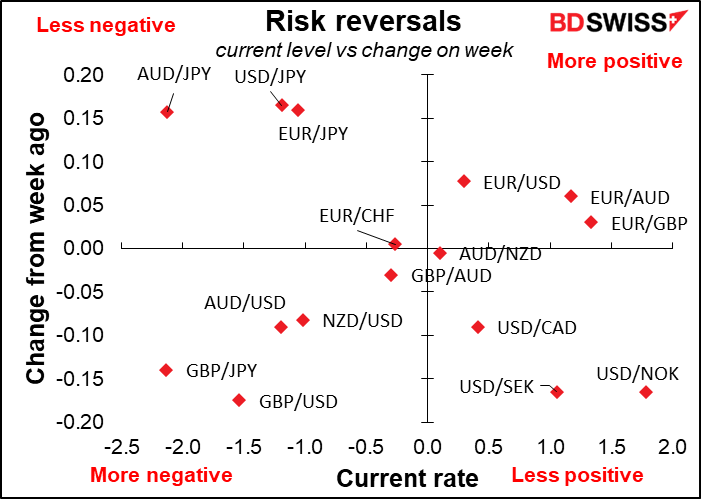

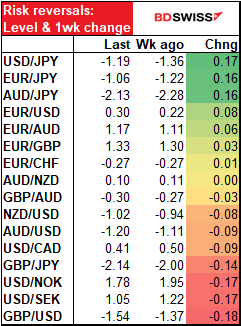

Risk reversals

AUD/JPY and USD/JPY RRs saw relatively large increases, as did GBP/JPY and GBP/USD.

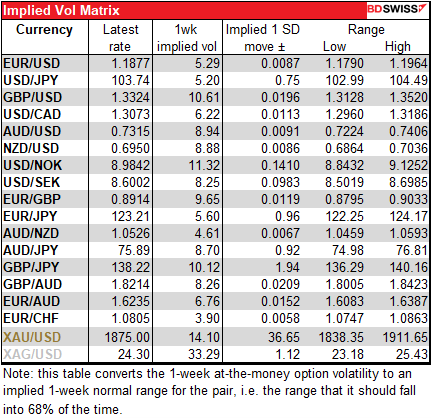

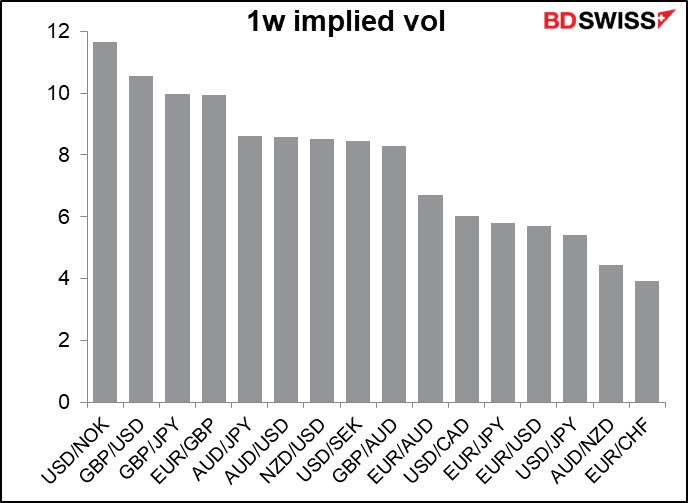

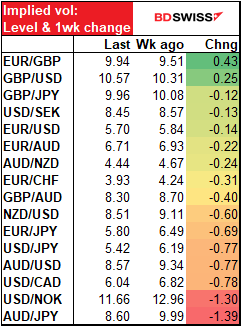

Implied Volatility: mostly lower, except GBP

With the US elections over and a vaccine on the horizon, implied volatility fell over the week for virtually all pairs that I track. The only exceptions were the two main GBP pairs, EUR/GBP and GBP/USD.

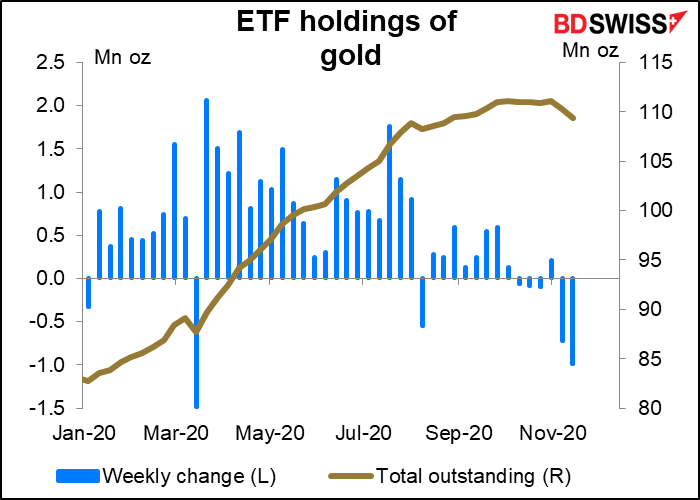

Gold & Silver

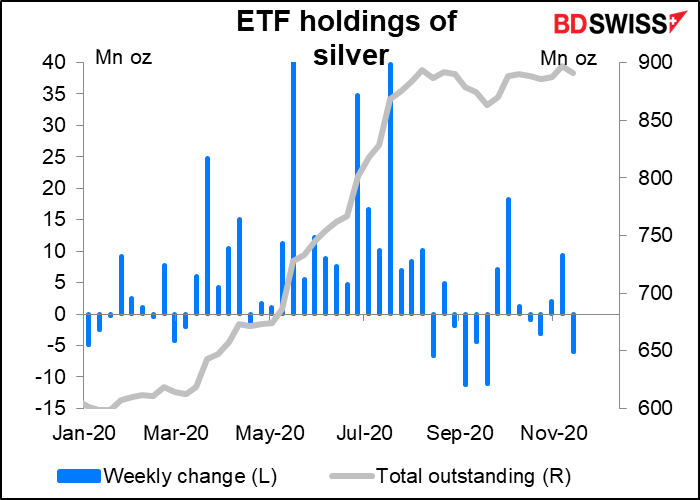

Exchange-traded funds (ETFs)

ETF holdings of gold at an accelerated pace over the last week.Silver holdings fell too, although within the usual range of fluctuations.

Specs’ positioning in futures

In the futures market however speculators increased their long position in gold futures. They didn’t change their silver position.

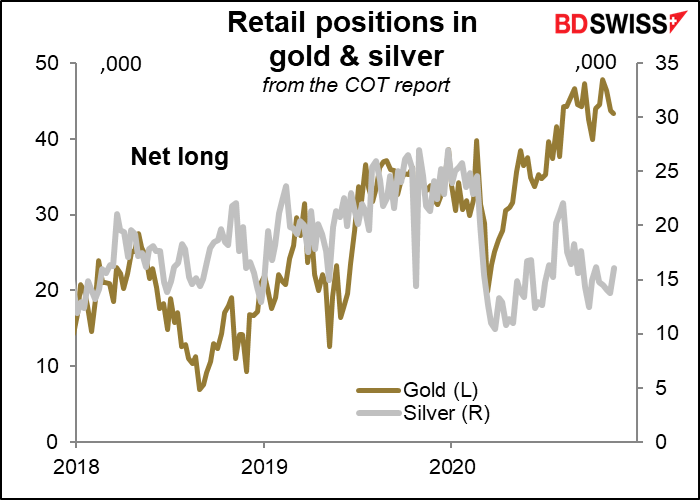

Retail positioning

Retail investors also cut their long gold positions but increased their long silver position.

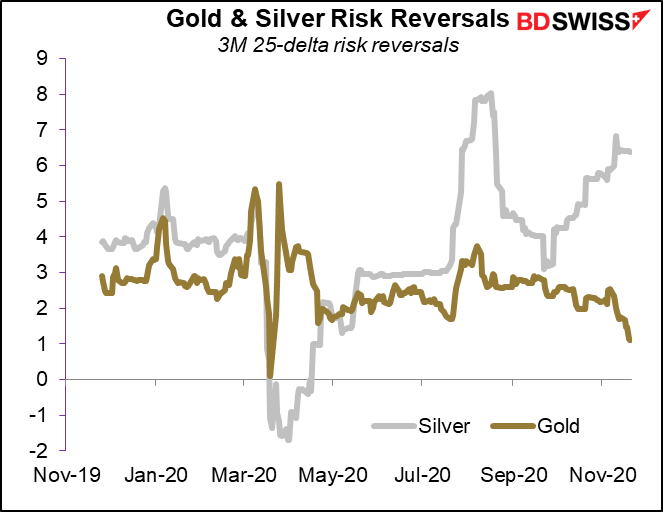

Gold & silver risk reversal

The gold risk reversal continued to fall, indicating less and less expectation of a rise. Silver was also down, but just slightly.