Previous Trading Day’s Events (24 Jan 2024)

Annual inflation in December accelerated to 3.4%, still higher than the central bank’s 2% target but below a June 2022 peak of 8.1%.

“The Governing Council’s discussion of monetary policy is shifting from whether our policy rate is restrictive enough to restore price stability, to how long it needs to stay at the current level,” Governor Tiff Macklem said in remarks. Later, Macklem told reporters: “It is premature to discuss reducing our policy rate.”

______________________________________________________________________

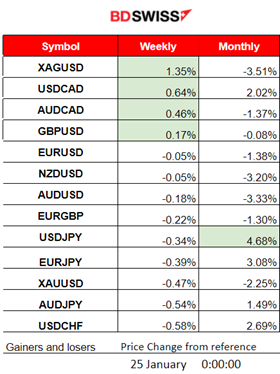

Winners vs Losers

Silver surges while Gold plunges. Silver (XAGUSD) managed to record 1.35% gains for the week reaching the top. USDJPY remains the top winner for the month with 4.68% gains.

______________________________________________________________________

______________________________________________________________________

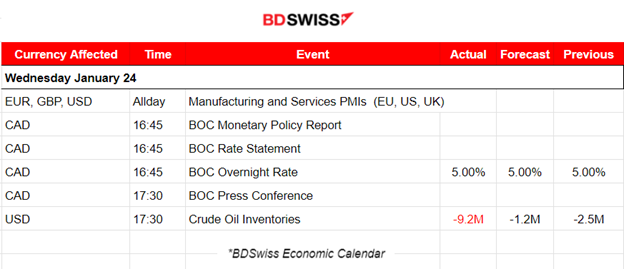

News Reports Monitor – Previous Trading Day (24 Jan 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no major scheduled figure releases.

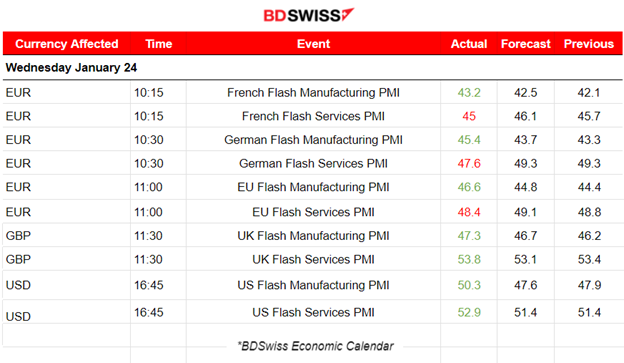

- Morning–Day Session (European and N. American Session)

PMI releases for both the manufacturing and the services sector.

Eurozone PMIs

The French economy continues to show grim PMIs for both sectors with the manufacturing sector showing the worst figure of 43.2. Overall the economy ended the year 2023 in deep contraction and began the new year with more deterioration in January, with faster falls in output at both service providers and manufacturers leading to the steepest overall rate of decline since last September.

Germany continued the downturn in the private sector while stepping into the new year as business activity fell for a seventh straight month in January. The manufacturing PMI, despite improvement to a 45.4 figure, remains in contraction while the services PMI actually moved away from the 50 threshold, to a worse 47.6 points figure.

The Eurozone downturn moderates somehow at the start of 2024. The PMI figures are still reported in contraction however reports show that business activity fell at the slowest rate for six months in January. Downturns persist significantly in both manufacturing and service sectors, however, the market runs with a sense of optimism about future business conditions.

The U.K.’s PMIs are obviously showing a better picture, especially for the services sector. The Manufacturing sector saw an improvement but is still in contraction while the services sector continues with a stable expansion with the last PMI figure for services to be recorded 53.8 points, in the expansion area. The rise in service sector activity was the fastest since last May, whereas manufacturing production decreased to the greatest extent for three months.

The U.S. PMI for the manufacturing sector, surprisingly, was recorded in expansion while the services PMI improved. Business activity expanded at the fastest pace in seven months boosting confidence with stronger orders growth and expectations for lower inflation in 2024.

At 15:30, BOC maintained the overnight rate to 5%, continuing with quantitative tightening as largely expected. No rate cuts are on the table yet, although inflation has come down significantly since its peak of 8.1% in June 2022, sitting at 3.4% last month. There is no consistent month-after-month downward trend and that keeps rates elevated for longer periods. The market reacted with strong CAD depreciation after the news and press conference.

General Verdict:

____________________________________________________________________

____________________________________________________________________

FOREX MARKETS MONITOR

USDCAD (24.01.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Quite volatile moves yesterday for USDCAD as the BOC news took place within the trading day. The pair moved early to the downside with a steady pace finding support at near 1.34290. At the time of the rate decision release, at 16:45, an intraday shock took place with the CAD experiencing strong depreciation as time passed. Even after the press conference at 17:30, it continued with the upward movement finding resistance as depicted in the chart and retracing to the 61.8 Fibo level. Then more depreciation against other currencies, and the USD, led USDCAD to climb further to the 161.8 Fibo level without experiencing any further retracement.

___________________________________________________________________

___________________________________________________________________

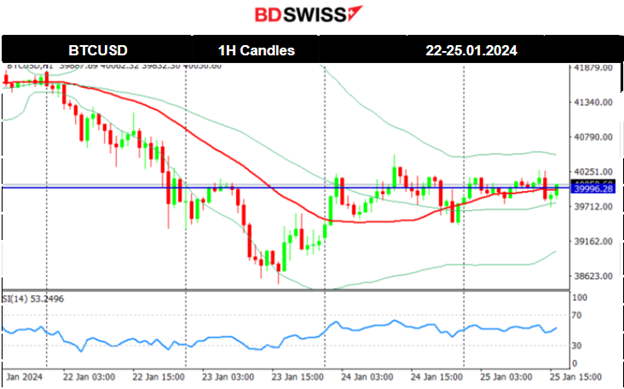

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H Timeframe

Server Time / Timezone EEST (UTC+02:00)

Price Movement

After the Spot Bitcoin ETF approval from the SEC, Bitcoin saw an unusual fall in value. On the 18th Jan, it dropped heavily until the support near 40600 USD. Retracement followed but on the 19th it saw another drop to 40200 USD. On the same day, it recovered fully and on its way up it crossed the 30-period MA showing strength, settling at near 41600 USD. On the 22nd Jan, the price dropped heavily again reaching and testing the 40600 USD support once more, breaking that support and eventually falling further to 39400 USD. Bitcoin eventually reached near 38500 USD on the 23rd Jan before bouncing back. From the 22nd Jan, the drop was relatively rapid leaving room for retracement. This happened already since the price returned to the 30-period MA and further back to the 61.8 Fibo level. The market is in consolidation currently and the price remains near the 40000 USD level.

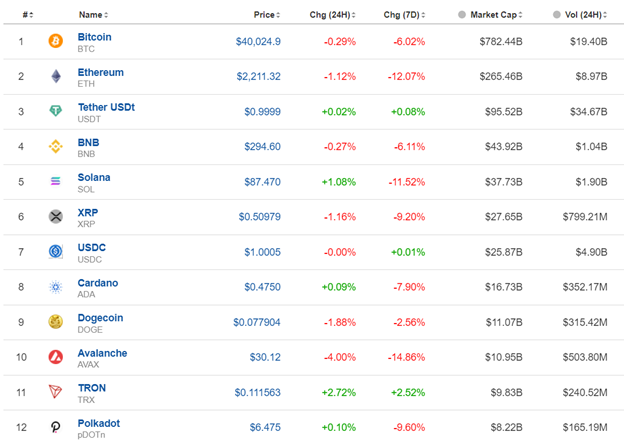

Crypto sorted by Highest Market Cap:

The whole market is obviously suffering. Values remained at lower levels.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

All benchmark U.S. indices moved to the upside quite rapidly during the past few days, particularly since the 17th Jan. The uptrend is clear with some retracements taking place every day, however not being complete as the path is quite strong to the upside. On the 22nd the index found resistance that caused it to retrace significantly back to the 61.8 Fibo level. However, this long uptrend continued when, on the 23rd Jan, the index tested the resistance again with a successful breakout to the upside. On the 24th it moved to the upside early again but after the NYSE opening, it experienced a huge drop returning back to the MA. Currently, it seems that testing the highs again is a possibility.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

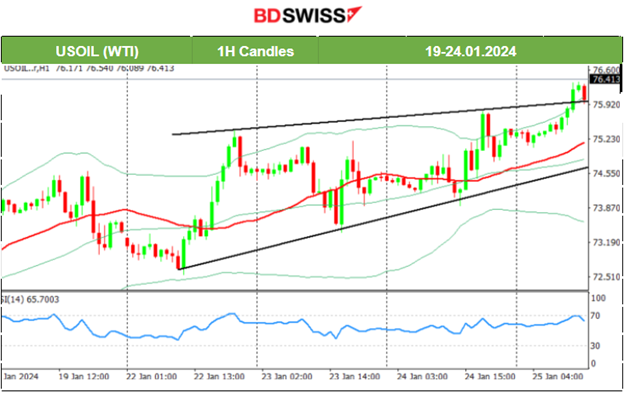

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Crude oil seems to give signals for moving higher in the future as it breaks the upward wedge on the upside. Looking at things from afar, using a daily chart we see that the support at 70 USD/b is quite strong and served as a turning point to the upside. Next resistance is possible to take place near 78 USD/b.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Gold found support on the 22nd Jan and on the 23rd it jumped higher finding resistance at near 2035 USD/oz. It seems that the recent path for Gold was sideways with significantly higher volatility levels. A triangle formation was apparent and on the 24th Jan, the price dropped heavily breaking the triangle formation and moving to the 2010 USD/oz support level. Retracement followed back to 2020 USD/oz and the 61.8 Fibo level.

______________________________________________________________

______________________________________________________________

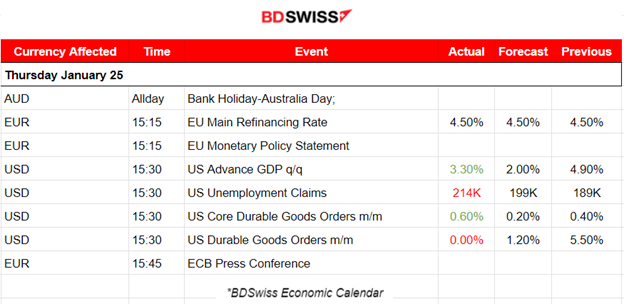

News Reports Monitor – Today Trading Day (25 Jan 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no major scheduled figure releases.

- Morning–Day Session (European and N. American Session)

The European Central Bank (ECB) decided to keep the three key ECB interest rates unchanged. The declining trend in underlying inflation has continued with the current interest rate policy in place. Policymakers further stated that tight financing conditions are dampening demand, and this is helping to push down inflation more. They are determined to ensure that inflation returns to its 2% medium-term target. The market reacted with a low-level intraday shock at that time and the EUR started to depreciate more and more against the dollar as time passed and after the press conference took place.

The pace of U.S. economic growth slowed in the last three months of 2023 but far less than had been expected. The U.S. gross domestic product (GDP) grew at an annualised rate of 3.3% in the final quarter of the year, down from 4.9%. However, it is still higher than the estimated 2% for the quarter. Unemployment claims were reported higher than expected showing a still-tight labour market when entering the new year. There was a slight reaction in the market with USD experiencing strength but the effect soon faded.

General Verdict:

______________________________________________________________