PREVIOUS TRADING DAY EVENTS – 22 Sep 2023

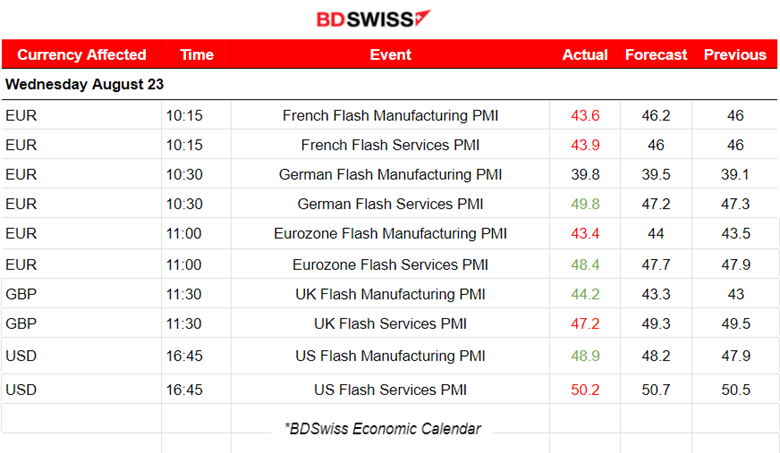

“The numbers for PMI services in the eurozone paint a grim picture,” said Cyrus de la Rubia, chief economist at Hamburg Commercial Bank, adding he thought the economy would 0.4% contract this quarter. “The main drag continues to come from manufacturing where the order situation deteriorated further.”

The services PMI rose to 48.4 from 47.9, again in contraction. The manufacturing PMI has been sub-50 since mid-2022 and the latest headline index dipped to 43.4 from 43.5.

Other reports showed that retail sales rose in August, partially recovering from a rain-induced plunge in July, and a measure of consumer confidence climbed to its highest since January 2022.

“The disappointing PMI survey results for September mean a recession is looking increasingly likely in the UK,” said Chris Williamson, chief business economist at S&P Global.

Source: https://www.reuters.com/world/uk/uk-recession-risk-deepens-companies-falter-pmi-2023-09-22/

S&P Global said its flash U.S. Composite PMI index, which tracks the manufacturing and service sectors, dipped to a reading of 50.1 in September from a final August reading of 50.2. No other PMIs remain slightly over 50 and so in the expansion area.

The survey’s composite new orders index suggests a second month of declining new business. Input cost pressures ticked higher for a second month as well.

In general, the U.S. Economy has avoided a recession that could occur from the aggressive interest rate hikes. Job growth and consumer spending have all held up, and the pace of inflation has significantly slowed.

“PMI data for September added to concerns regarding the trajectory of demand conditions in the U.S. economy following interest rate hikes and elevated inflation,” Siân Jones, Principal Economist at S&P Global Market Intelligence, said in a statement.

Overall employment growth was the strongest in four months, led by the services sector.

“Subdued demand did not translate into overall job losses in September as a greater ability to find and retain employees led to a quicker rise in employment growth,” Jones said. “That said, the boost to hiring from rising candidate availability may not be sustained amid evidence of burgeoning spare capacity and dwindling backlogs which have previously supported workloads.”

______________________________________________________________________

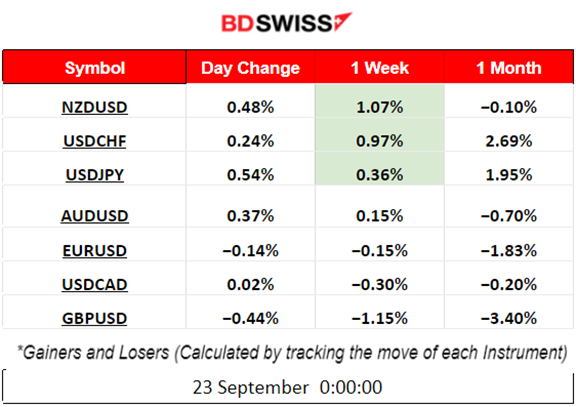

Winners vs Losers

______________________________________________________________________

News Reports Monitor – Previous Trading Day (22 Sep 2023)

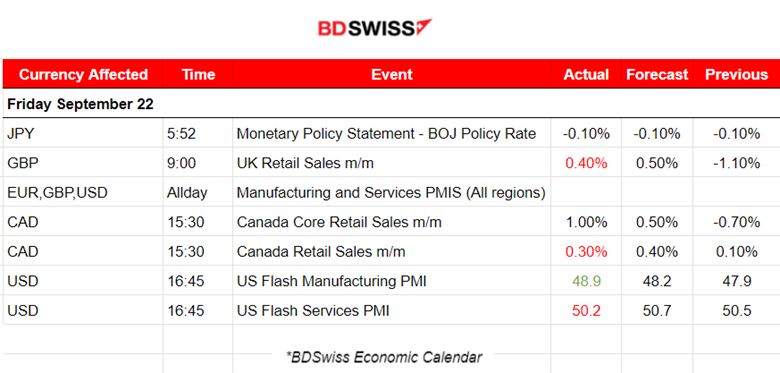

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

The Policy Board of the Bank of Japan leaves rates unchanged, maintaining ultra-loose monetary policy as per the report at 5:52. It maintains the short-term interest rates at -0.1%, and caps the 10-year Japanese government bond yield around zero. The impact on the market was not a shock but rather a slow depreciation of the JPY currency at the time. USDJPY is currently moving to the upside.

https://www.boj.or.jp/en/mopo/mpmdeci/mpr_2023/k230922a.pdf

- Morning–Day Session (European and N. American Session)

According to the report at 9:00, the U.K. retail sales volumes are estimated to have risen by 0.4% in August 2023, partially recovering from a fall of 1.1% in July 2023 (revised from a fall of 1.2%). The market responded with some increased volatility but not a significant shock. Since the European market opening the GBP has depreciated though steadily and is further affected similarly by the PMI releases. The same happens to the EUR.

Retail Sales for Canada were reported higher with a monthly increase of 0.30% and for Core a 1%. The CAD suffered depreciation against other currencies. The USDCAD moved to the upside steadily after the release near 60 pips.

Manufacturing and Services PMI releases:

Eurozone PMIs:

In France, private sector business activity levels fell at the strongest pace since November 2020. Declines in both manufacturing and services accelerated much since August. The PMI data reflect that the French economy contracted at the strongest rate for almost three years in September. For both sectors, they fell just more than 2 points since the previous report and remained in the contraction area.

According to the latest reports, business activity and the demand for goods and services fell sharply in Germany. The Manufacturing PMI did not show a significant change while the services sector showed an increase to 49.8 from 47.3 ending the 3rd quarter in a contraction area.

Eurozone business conditions suffered since companies saw the sharpest drop in new orders for almost three years. The private sector remained in contraction as weak demand led to a further decline in activity. The manufacturing sector contributed most to the drop in output, with the latest PMI remaining close to 43.5 points, but the service sector also saw activity decrease for the second month, with PMI being close to 48 during that period, in contraction.

At the time of the releases after the start of the European session, volatility started to pick up and the markets experienced intraday shocks for EUR, GBP and USD upon release time.

UK PMIs:

According to the reports, U.K. private sector companies cut staff at the fastest pace since the pandemic, adding to the risk of a recession. The PMIs signalled a second straight month below the 50 threshold and pointed to a downturn in GDP. Further weakness in services, the UK’s largest sector, dragged on activity. The manufacturing PMI was reported higher by nearly 1 point and the services PMI was lower by almost 2.

US PMIs:

U.S. manufacturers and service providers saw a fall in demand. September data indicated the worst performance across the private sector since February, as the service economy lost further momentum. New orders fell at the strongest pace this year so far. Manufacturers also saw a drop in new sales. The services PMI remains just above the 50 threshold while the manufacturing PMI improved by 1 point, however remaining still in the contraction area. This release had no major impact on the USD pairs at that time.

General Verdict:

____________________________________________________________________

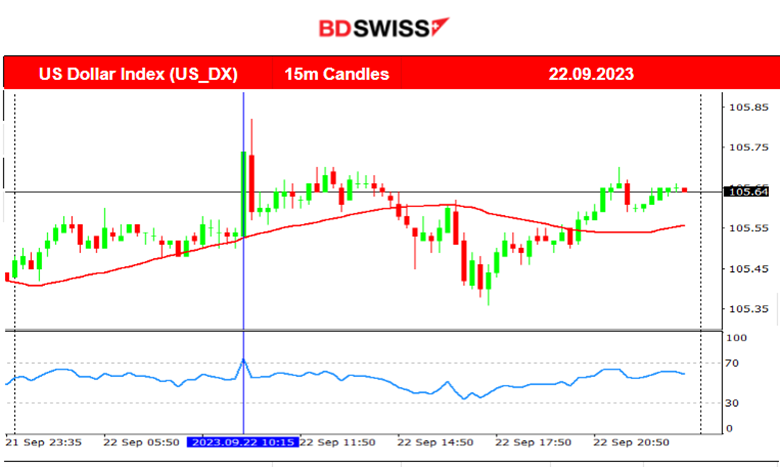

FOREX MARKETS MONITOR

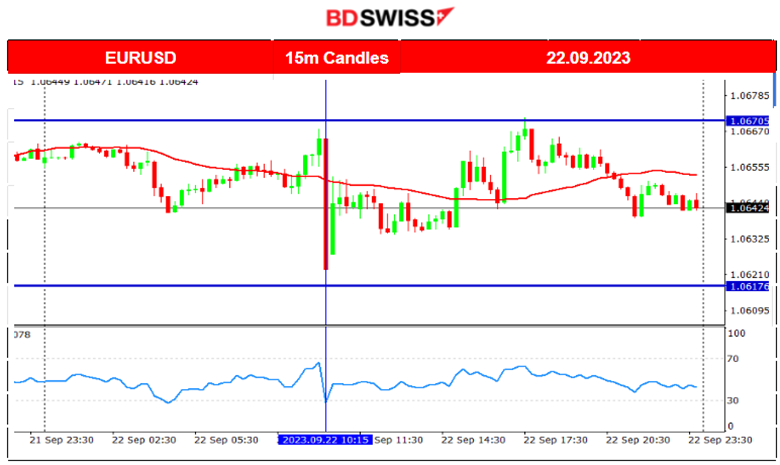

EURUSD (22.09.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair experienced a shock at 10:15 with the start of the release of the Eurozone PMIs. The EUR took a hit with depreciation against the USD causing the pair to drop heavily and around 40 pips before retracing quickly back to the mean.

GBPUSD (22.09.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The PMIs had their role to play again affecting the GBP negatively, with depreciation against the USD. The U.S. PMIs were showing a better picture, compared with the U.K. and at the start of the European session when the PMIs started to be released the pair experienced more volatility moving to the downside as the USD appreciated. Following GBP depreciation caused by the grim picture described by the PMI reports, the pair followed an intraday but rather volatile downward path.

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Bitcoin broke the triangle formation that was mentioned in our previous report and moved to the downside rapidly on the 21st Sept. It was breaking important support levels continuously and reached even the support near 26360 before eventually retracing back to 26640. Despite the PMI releases yesterday and their impact on the USD, BTCUSD had not experienced significant volatility and rather remained on the sideways path.

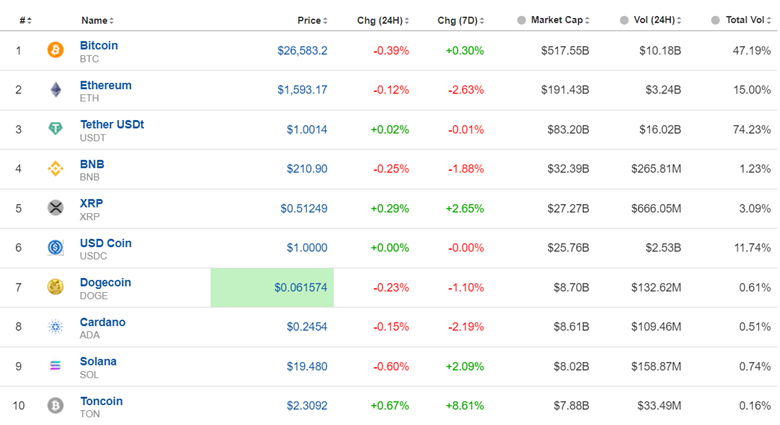

Crypto sorted by Highest Market Cap:

Bitcoin remains under 26600 and is close to the next significant support at 26400. Toncoin holds the first place in the winner’s list with 8.6% gains in the last 7 days while Ethereum holds the last place with -2.6% price change.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The USD experienced strong appreciation while the U.S. stocks lost significant value in general as per the chart. On the 21st of September, the index moved lower rapidly. This downward movement confirmed the downtrend. The index eventually retraced back to the 61.8 Fibo retracement level after it found strong support at near 14670. Other benchmark indices are following a downtrend as well with a similar price path.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude price is moving with high volatility sideways. However, it tested the resistance 90.70 twice and eventually broke that level on the 22nd of September, moving higher to the next resistance at 91 USD/oz. Retracement followed back to the mean where it eventually settled near 90 USD/oz.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 20th of September, Gold moved to the upside because the market caused USD depreciation before the Fed reports. However, later when the release of the Fed Rate took place, the USD weakened heavily and the Gold price dropped moving downwards towards the support near 1923 USD/oz. Later it further dropped to the support near 1914 USD/oz and retraced back to the 61.8 Fibo level where it settled. For the 22nd of September, Friday, Gold price moved sideways overall with no significant volatility closing at near 1925 USD/oz.

______________________________________________________________

News Reports Monitor – Today Trading Day (25 Sep 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important announcements, no significant scheduled figure releases.

- Morning–Day Session (European and N. American Session)

The result of the German ifo Business Climate Survey will be reported at 11:00.

It tends to create a hefty market impact upon release so we could experience high volatility, especially for the EUR pairs.

General Verdict:

______________________________________________________________