Previous Trading Day’s Events (02 Jan 2024)

Winners vs Losers

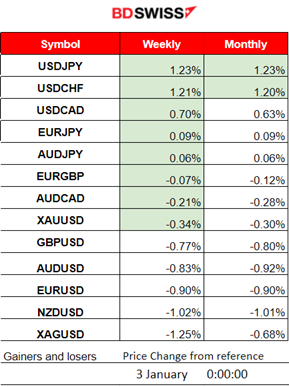

The Dollar has been rallying over the last couple of days. USDJPY now hits the top of the week’s gainers list with 1.23% gains so far followed by the USDCHF with 1.20% gains.

______________________________________________________________________

______________________________________________________________________

News Reports Monitor – Previous Trading Day (02 Jan 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

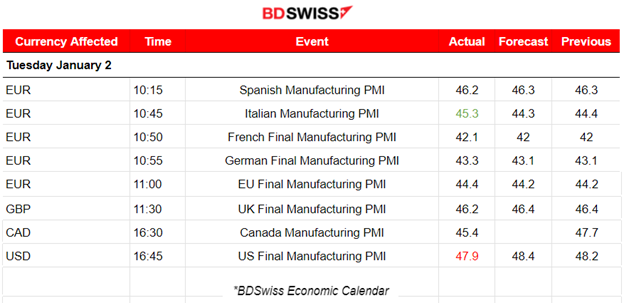

PMI Releases

Eurozone: The Spanish manufacturing sector remains in contraction territory with falling output and new orders for December. Deterioration for manufacturing in Italy as well with sustained, but softer contractions in output and new orders. The French manufacturing sector ends in 2023 with the strongest deterioration in operating conditions since May 2020. Declines in production, new orders and purchasing activity worsened with a job loss for a seventh straight month. Germany’s manufacturing sector ended in 2023 still firmly in contraction territory. Solid and slightly accelerated decreases in both output and employment.

The Eurozone manufacturing sector remained stuck in contraction at the end of 2023, with output continuing to fall and factory job losses extending into a seventh successive month. The EUR suffered some depreciation but the effect was moderate. The dollar however gained ground.

U.K.: The downturn in UK manufacturing production deepened as the downturn in production volumes accelerated. Both domestic and export work opportunities from clients declined significantly.

Canada: The downturn in Canada’s manufacturing sector intensified during December, with accelerated declines in both output and new orders signalled.

U.S.: The worse than the previous figure, now 47.9, suggests serious deterioration of the sector. The U.S. manufacturing performance declines at a sharper pace. Demand conditions weakened and output returned to decline. The sector remains however the strongest relative to other regions.

General Verdict:

____________________________________________________________________

____________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (02.01.2024) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

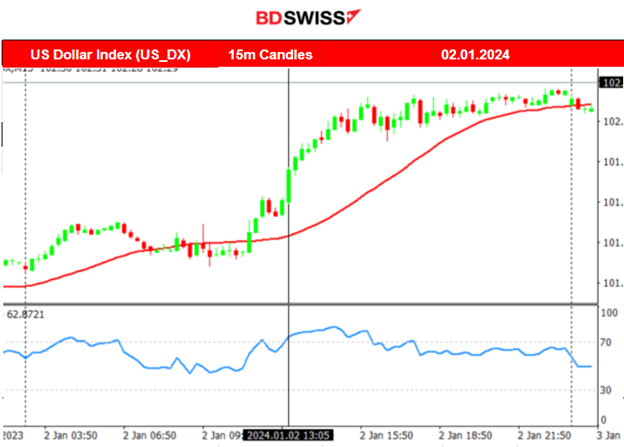

The pair experienced a fall after the PMI releases that affected the EUR negatively. The effect on the EUR was not so great though. It is the USD that caused the pair to drop as it started to gain significant strength after 11:00. The fall was steady and that is why no significant retracement took place.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

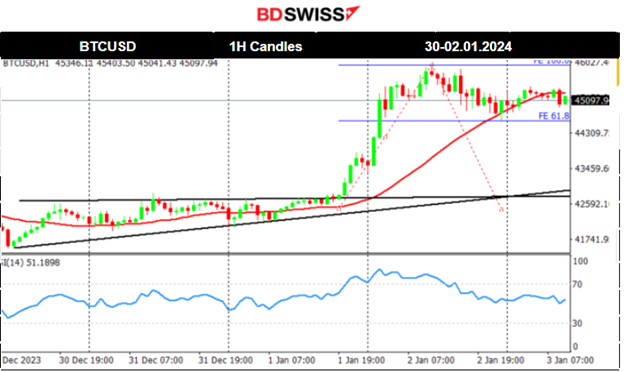

Bitcoin jumped recently on the 1st Jan, with the new year around 21:00 server time. This jump broke the upward wedge that was formed recently and the price moved rapidly reaching the resistance at 46000 USD, before experiencing the retracement to the mean. As per the Fibo expansion tool, the price reached already the 61.8 Fibo level and settled around the mean.

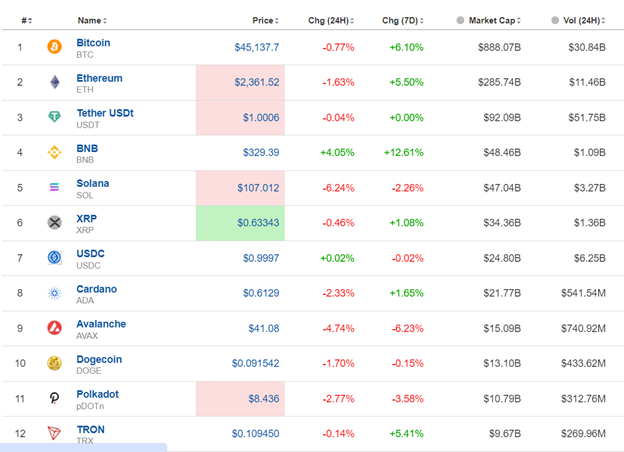

Crypto sorted by Highest Market Cap:

Volatility remains low after a sudden jump in prices since the 1st Jan 2024. The 7-day performance is mixed but stays high for most crypto.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4Hour Timeframe Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Benchmark indices were experiencing an amazing performance this year. Recently there was an uptrend since the 21st that lasted until the 29th when the index faced a drop again. With the New Year, the stock market experienced a shock bringing the NAS100 further to the downside. That is clear on the 2nd Jan 2024, when the index fell more than 380 dollars before retracing slightly. I would expect the index to retrace more and touch the 30-period MA but currently, it is moving to the downside. That will only happen if the support near 16470 is strong enough to keep the index high.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Crude oil is moving steadily to the downside with high volatility. The moving average faces a downtrend at the moment and the price is moving around it experiencing high deviations. The Crude’s price drop could continue further if more support levels break. Currently, it tests 70 USD/b and could drop to the next support at near 69 USD/b. The other scenario is that, since it deviated a lot from the MA and moved within a channel, retracement back to 71 USD/b is a possibility. The 70 USD/b levels seem to hold the support pretty well.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Gold is volatile and has moved to the downside recently but on a very volatile downward trend. This is clear when observing the downward moving average and the price moving around it. It looks like a downward wedge is formed but it’s not clear yet. Gold is breaking important support levels as the dollar gains ground, however, we need to see further wedge breakout to support a further rapid downward movement for Gold.

______________________________________________________________

______________________________________________________________

News Reports Monitor – Today Trading Day (03 Jan 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

The ISM Manufacturing PMI report and JOLTS Job openings reports are potentially going to affect the dollar greatly at 17:00. The timing might be not so optimal for big deviations however we should expect a moderate shock at least as this related labour and business activity data are important for the Fed in taking decisions. This is amid the NFP report on Friday.

General Verdict:

______________________________________________________________