Previous Trading Day’s Events (01 Feb 2024)

The central bank Governor Andrew Bailey said inflation was “moving in the right direction”: “Things are moving in the right direction. Today, the MPC has held bank rates at 5.25%. So, yes, we have had good news, but we have to be more confident that inflation will fall all the way back to the 2% target and stay there. And we’re not yet to the point where we can lower interest rates.”

Bailey further said the central bank was still cautious and inflation falling to its 2% target would not be “job done.”

“We believe tech has the best growth of any sector in the global markets this year. Sixteen, seventeen percent – primarily backed by the beneficiaries of AI. Specifically within tech, we like software and semis [semiconductor chips]. [FLASH] I wouldn’t make the year after one day’s volatility after an earnings announcement. What we’ve seen so far out of tech is beats on revenue and earnings. And if stocks rallied into those numbers, it’s often normal to see stocks sell off after they report [earnings].”T

Data this week showed further evidence of a softening labour market, which is expected to be confirmed by the closely-watched non-farm payrolls report today.

______________________________________________________________________

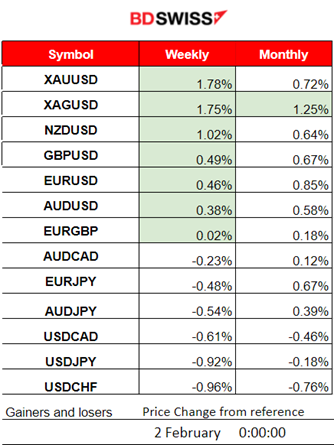

Winners vs Losers

Metals remain on the lead for this week with Gold having 1.78% and Silver 1.75% gains so far. Silver is the top performer for the month of February with 1.25% gains

______________________________________________________________________

______________________________________________________________________

News Reports Monitor – Previous Trading Day (01 Feb 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

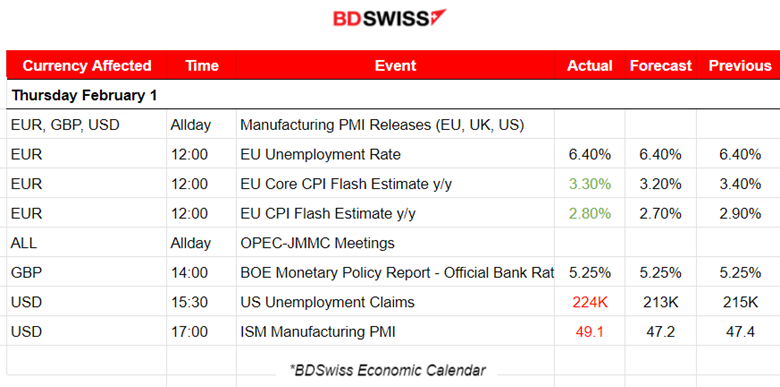

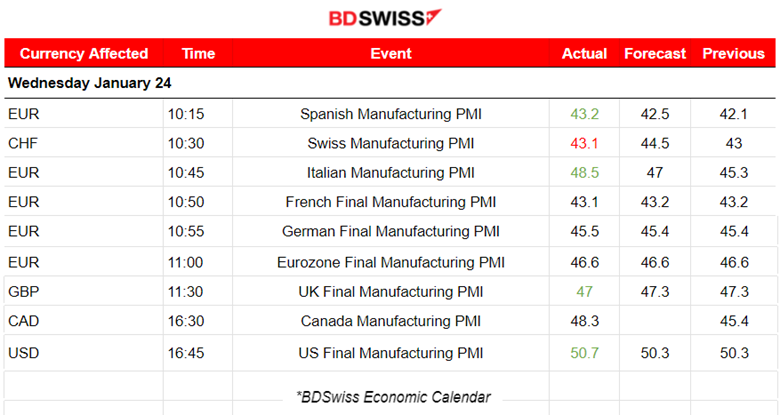

Manufacturing PMI releases:

Eurozone PMIs:

In Spain, the manufacturing sector continues to contract despite an improved figure. It is still significantly lower than 50, at 43.2 points in contraction territory during January with falls in output, new orders, employment, and stocks.

Italian business conditions deteriorated at a softer rate in January as the figure suggests, which is reported higher than expected, at 48.5 versus 47 points. Declines in production and factory orders slowed favourably. Firms continued to reduce input buying levels and deplete stocks in January.

France’s manufacturing sector is showing that it remains under a lot of pressure as incoming data for January suggest. The PMI figure is reported to be 43.1 points reflecting strong contraction in output, new orders and employment.

Germany also faces a downturn in the manufacturing sector and the PMI is not improving, however, the sector showed further signs of easing in January, with output, new orders and purchasing activity all falling at the slowest rates.

In the Eurozone the PMI is still reported in contraction, 46.6 points, however, reports show that the slump in the Eurozone’s manufacturing sector eased in January. Factory output and new orders continued to decline, however at the softest rates. Cutbacks to purchasing activity, stocks of inputs and employment cooled. Business confidence rose to a nine-month high. Decreases in both input costs and output prices gathered momentum.

United Kingdom PMIs:

U.K. manufacturing sector contracts as January saw output and new orders decline further, leading to additional job losses and cutbacks in purchasing and stock holdings. Furthermore, the Red Sea crisis hits supply chains and contributes to rising costs. The Red Sea has experienced a surge in regional tensions recently, leading to attacks on commercial vessels, causing significant rerouting of maritime traffic. The PMI was reported at 47 points, confirming that there is no improvement in the sector at all.

United States PMI:

The U.S. continues to lead with the best conditions in the manufacturing business. It has faced the strongest improvement in manufacturing performance since September 2022. The PMI figure was reported in the expansion area which is above 50, at 50.7 points and more than the expected 50.3 figure.

At 12:00 the CPI flash estimates showed more than expected figures. No major shock was recorded, however, the EUR faced a positive impact and the EURUSD continued steadily upwards after the release. Overall it seems that the Euro-area inflation slowed down in January, less than expected, however towards the target.

At 14:00 the Bank of England (BoE) announced the decision to keep the Bank rate at 5.25%. The central bank revised higher its expectations for inflation in the coming two years and two policymakers voted for a rate hike. The market responded with GBP appreciation at the time of the release and a jump was recorded for GBPUSD near 60 pips before a retracement took place. Speaking to CNBC, Bailey said he was “not going to commit” to a specific timeline for rate cuts, but added that he did not object to the market consensus.

The U.S. Unemployment Claims report, released at 15:30, confirmed that in January the labour market was negatively affected negatively. In the week ending January 27, the advance figure for seasonally adjusted initial claims was 224K, more than the expected figure, showing an increase of 9K from the previous week’s revised level.

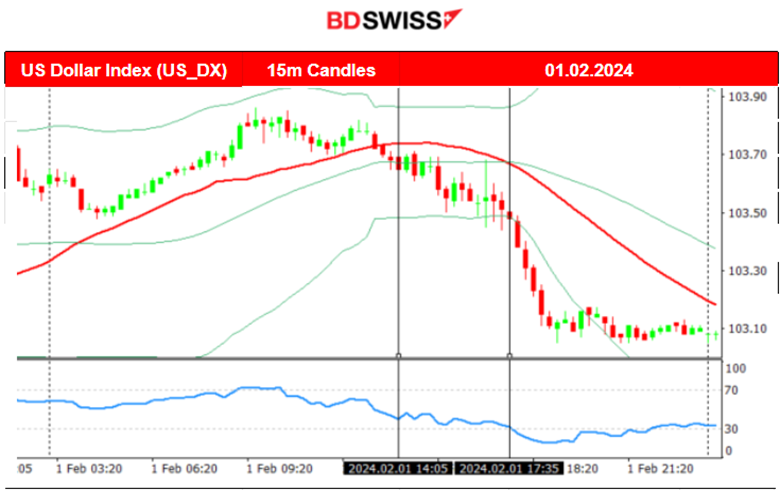

The ISM Manufacturing PMI report at 17:00 is showing a different picture. This measure of U.S. factory activity climbed to a 15-month high at the start of the year, suggesting manufacturing is starting to stabilise. Mixed data for the U.S. However, the market responded with steady and long USD depreciation, with USD pairs moving rapidly in one direction and not experiencing significant retracement during the trading day.

General Verdict:

____________________________________________________________________

____________________________________________________________________

FOREX MARKETS MONITOR

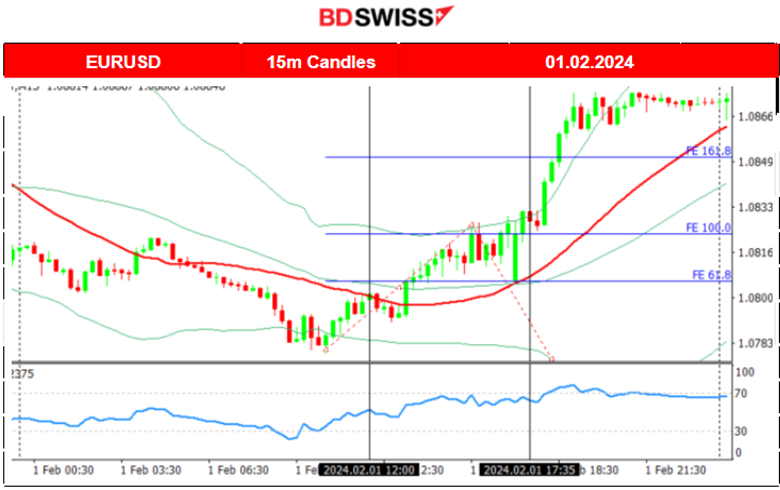

EURUSD (01.02.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

EURUSD saw higher volatility levels after the start of the European session. The PMIs were reported grim again and in contraction, however, the pair started to climb as the USD was experiencing strong depreciation. U.S. data were reported mixed, with unemployment claims to rise while the manufacturing sector saw improvement. Though the market decided to act in the way that the dollar has weakened significantly and caused the jump in the EURUSD pair.

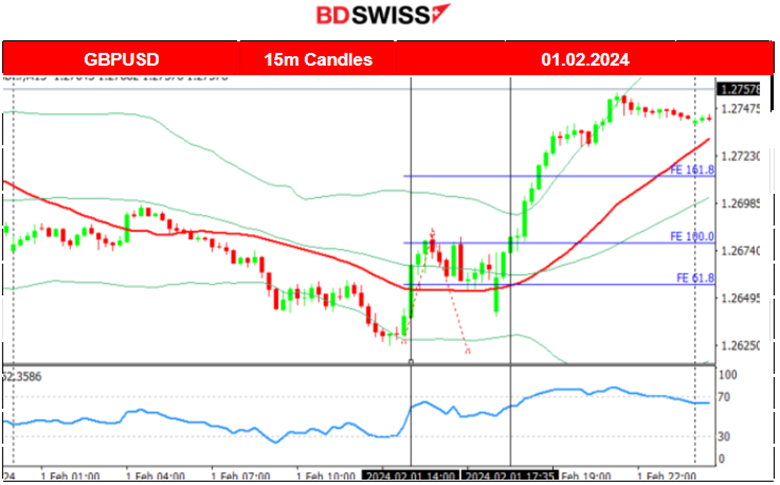

GBPUSD (01.02.2024) 15m Chart Summary

GBPUSD (01.02.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

A similar path for the GBPUSD as the USD began with moderate appreciation during the start of the trading day and after the start of the European session, it began its downturn. During the release of the BOE decision to keep the Bank rate steady, the GBP appreciated against the USD significantly causing a jump of the GBPUSD to near 60 pips before retracement took place. After the U.S. news, the dollar depreciated significantly for a long period of time, causing the pair to climb higher and higher until the end of the trading day.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

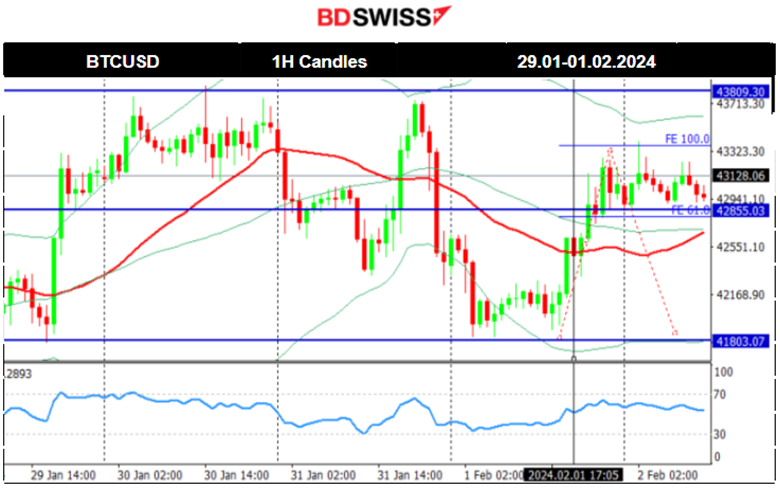

BTCUSD (Bitcoin) Chart Summary 1H Timeframe

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Bitcoin seems to stabilise and refuses to drop below the support of 41800 USD. On the 1st of Feb, its price tested that support twice before eventually reversal to the upside took place. The price reached the next resistance at near 43400 USD rapidly and retracement followed to the 61.8 Fibo level. Bitcoin settled near 43000 USD after this significant upward movement yesterday and the strong USD weakness is definitely a contributing factor to this increase.

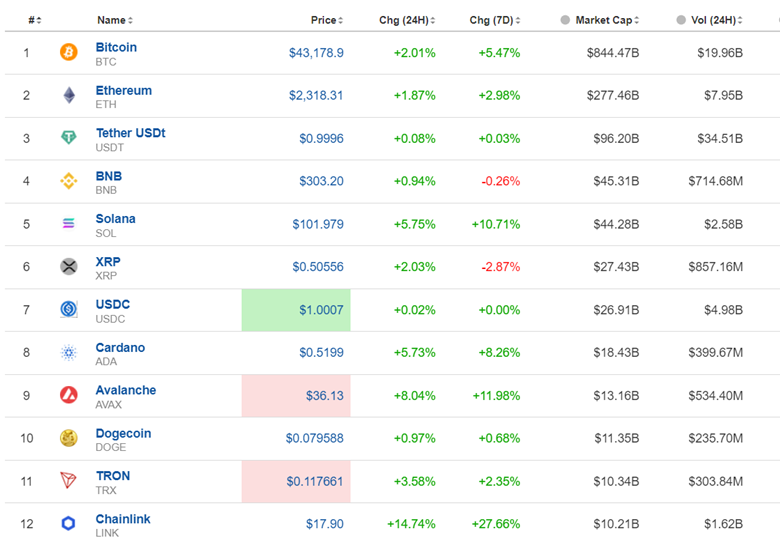

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

Most of the week’s gains were wiped out after Crypto experienced a downturn. The market however sees strong resilience and refuses to drop. It currently stabilises to lower levels since when the U.S. regulator decided to proceed to spot Bitcoin ETF approval.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

U.S. indices surged to higher levels yesterday. U.S. stocks rebounded on Thursday as investors looked to favourable earnings releases and acted amid the key jobs reports to be released today. Good to mention that the USD depreciated significantly yesterday during the time the stocks were climbing rapidly. No retracement was recorded yesterday after this sharp upward movement.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

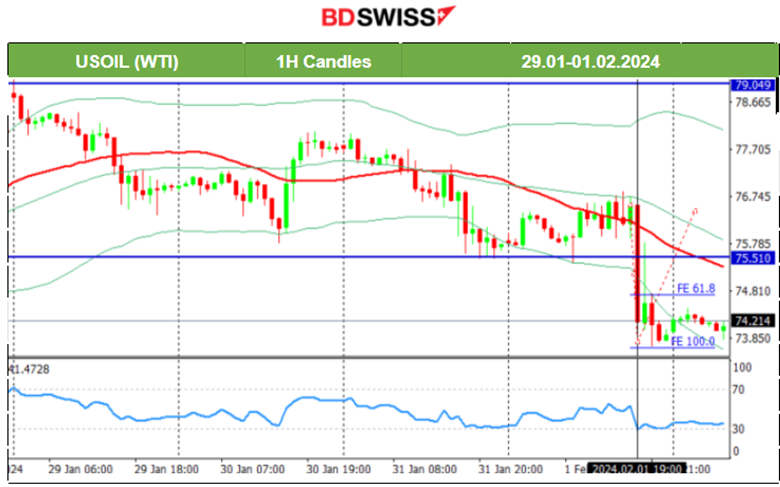

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Crude oil found strong support this week around 76 USD/b on the 30th Jan. It reversed upwards, crossing the 30-period MA on its way up, finding support at near 78 USD/b. Retracement followed with Crude settling near 77 USD/b. As previously stated in our previous analysis, the price signalled a downward movement and on the 31st it dropped until the support of 75.5 USD/b, before retracing back to the mean. On the 1st of February it tested that support and successfully broke it, coming down to near 73.6 USD before retracing. That was a 3 dollars sharp drop after 17:00.

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Gold on the 31st broke the resistance, reaching 2055 USD/oz prior to the FOMC news. The heavy reversal followed and increased volatility after the USD was affected positively by the Fed’s statements. On the 1st of February Gold tested the support near 2031 USD/oz unsuccessfully and reversed with a jump upwards reaching the resistance near 2065 USD/oz before retracing. Obvious higher levels of volatility yesterday, with notable USD weakening after 17:00.

______________________________________________________________

______________________________________________________________

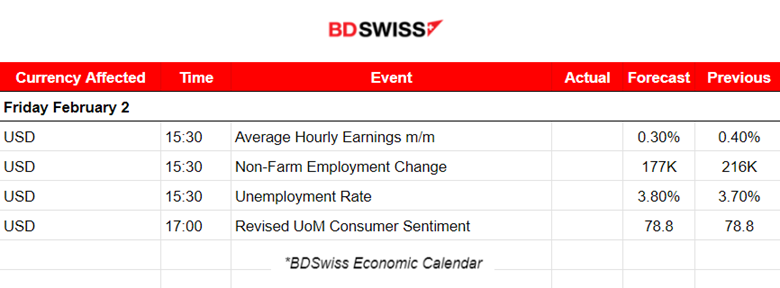

News Reports Monitor – Today Trading Day (02 Feb 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

Payrolls Friday for the U.S. today. The Average Hourly Earnings, Non-Farm Employment Change, and Unemployment Rate will be reported. It is the most important news of the month and refers to January. The employment change figure for December was high enough to suggest that for the specific month, the labour market was hotter than expected with the unemployment rate unchanged. In addition, inflation was actually higher than anticipated. In January, the market expects labour market cooling, as we move away from the holiday season and interest rates remain elevated. Higher Jobless rate to 3.8% and lower employment change. Nevertheless, during this major news, the USD pairs will probably see major intraday shock at the time of the release.

General Verdict:

______________________________________________________________