Previous Trading Day’s Events (02.04.2024)

The JOLTS report showed there were 1.36 vacancies for every unemployed person in February, down from 1.43 in January. The decline in the vacancy-to-unemployment ratio reflected a spike in unemployment at the start of the year. Economists, however, argued that the drop in the ratio in February did not mark a material shift in the labour market.

“There is nothing here to worry Fed policymakers, who want a strong labour market, but the very slow progress in reducing the apparent excess demand for labour is not likely to encourage the Fed to cut interest rates in the immediate future,” said Conrad DeQuadros, senior economic advisor at Brean Capital in New York.

“We view the openings data as indicative of the demand for labour still being strong relative to supply but with there being less imbalance recently than there was a couple of years ago,” said Daniel Silver, an economist at JPMorgan in New York.

Source: https://www.reuters.com/markets/us/us-job-openings-little-changed-february-quits-edge-up-2024-04-02/

______________________________________________________________________

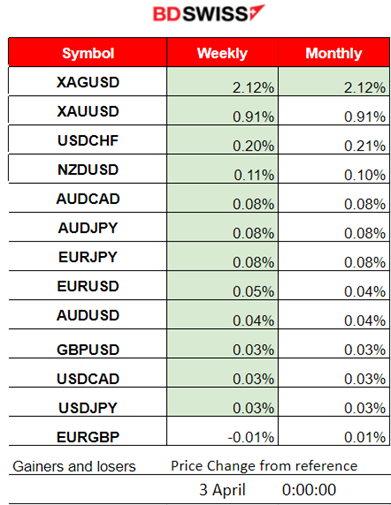

Winners vs Losers

Metals are on the top of the winner’s list for the week. Silver leads with 2.12% gains so far, followed by Gold having 0.91% gains. USDCHF has been on an uptrend since the beginning of the month.

______________________________________________________________________

______________________________________________________________________

News Reports Monitor – Previous Trading Day (02.04.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important announcements, no special scheduled figures to be released.

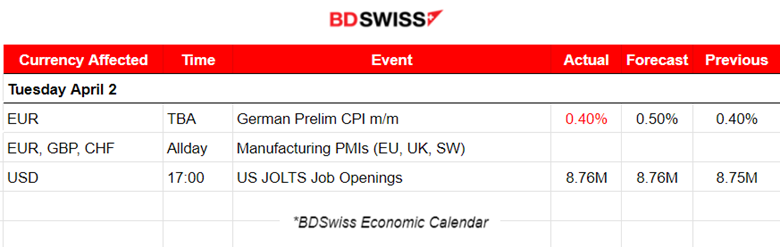

- Morning – Day Session (European and N. American Session)

Manufacturing PMIs:

Eurozone:

Moderate growth of the Spanish manufacturing sector is sustained in March with a PMI reported above 50 points, in expansion. Output rose at its strongest pace in a year. Confidence in the future remained positive despite easing a little since the previous month.

The Italian manufacturing sector showed some signs of positivity in March. The PMI turns to expansion with a figure of 50.4 points. Both new orders and output passed marginally the growth territory. Optimism towards the year-ahead outlook increased, and firms recorded the quickest job growth seen for a year. New orders rose only fractionally, and manufacturers continued to cut stocks and downscaled their purchasing activity.

In France, the manufacturing sector endured another month of contraction in March. We have positive signals for the industry as production fell at the weakest pace since the downturn began nearly two years ago and business sentiment was optimistic. However, demand conditions remained challenging. Despite improvement, the PMI was reported at the contraction territory again at 46.2 points.

The German manufacturing sector ended its first quarter still firmly in contraction, with a devastating PMI of 41.9 points. Weak demand conditions, job losses and a sustained draw-down of pre-production inventories. Business expectations towards future output turned positive though in March.

In the Eurozone manufacturing sector output and new orders declined at the softest rates since early 2023. The data though continued to signal contraction. Business confidence rose to its highest level in nearly a year, but growth expectations remained relatively weak, which weighed further on factory employment.

U.K. PMI:

The PMI figure for the U.K. was reported at 50.3 points, a turn to expansion. The sector showed tentative signs of recovery in March, as output and new orders increased following year-long downturns. Rates of contraction in employment and purchasing activity slowing sharply and business optimism about the year-ahead outlook hitting an 11-month high.

The preliminary monthly CPI figure for Germany showed a 0.4% change, indicating no change in inflation. The annual inflation rate in Germany is expected to be +2.2% in March 2024. That is the lowest figure since April 2021 (+2.0%), and in May 2021 the inflation rate also stood at +2.2%. No major impact on the market for the EUR pairs.

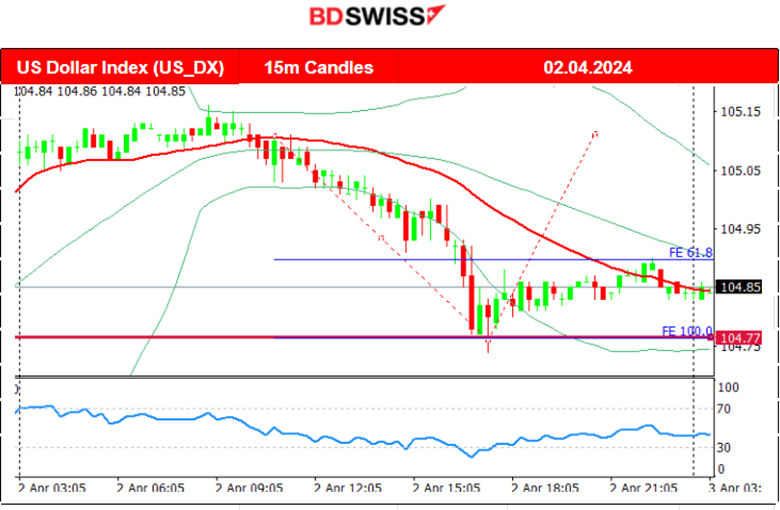

JOLTS: The number of job openings changed a little at 8.8M on the last business day of February. The number and rate of hires slightly changed at 5.8M and 3.7%, respectively. The dollar retraced to the upside from an intraday drop after the news at 17:00.

General Verdict:

__________________________________________________________________

__________________________________________________________________

FOREX MARKETS MONITOR

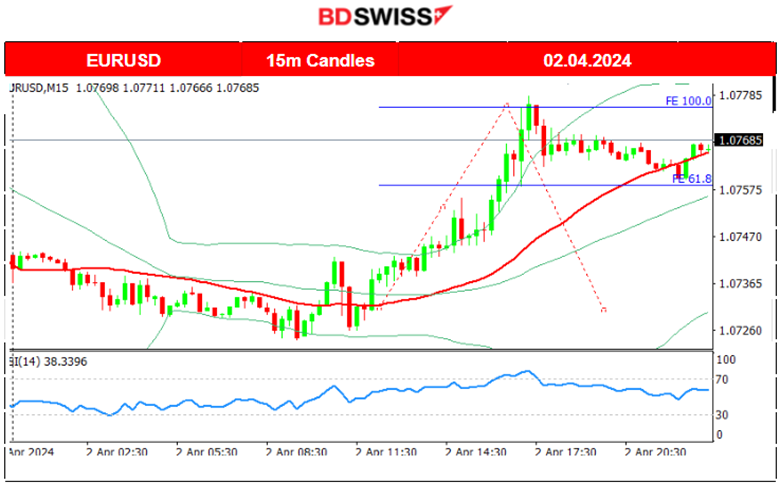

EURUSD (02.04.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair was moving with low volatility close to the nearly sideways 30-period MA until the start of the European session. The PMIs were roughly positive for the EUR. Then, the USD depreciation gave the pair an extra boost to the upside. The dollar corrected with weakening causing the pair to reach the resistance near 1.07785 before retracement took place.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Since the 22nd of March, Bitcoin experienced a good comeback with the price moving upwards crossing the 30-period MA on its way up and showing upward momentum since the fall from the 74K USD peak. The 68K USD level resistance was breached on the 25th of March and the price moved higher even beyond 70K USD. The 30-period MA turned sideways as the price slowed down.

Last week a steady upward movement took place forming a wedge until the 31st of March. On the 1st of April, the price broke the wedge to the downside and dropped heavily back to support near 69K USD. That support was broken twice as Bitcoin eventually on the 2nd of April saw heavy drops. Around the same time as the drawdown, Bitcoin exchange-traded funds (ETFs) posted a net outflow of $86 million, breaking a four-day positive inflow streak, per FarSide data.

Source: https://cointelegraph.com/news/bitcoin-price-flash-crash-leverage-positions-liquidated

On the 3rd of April, we see some retracement, something to expect after a rapid fall in price. It is currently settling at 66,360 USD.

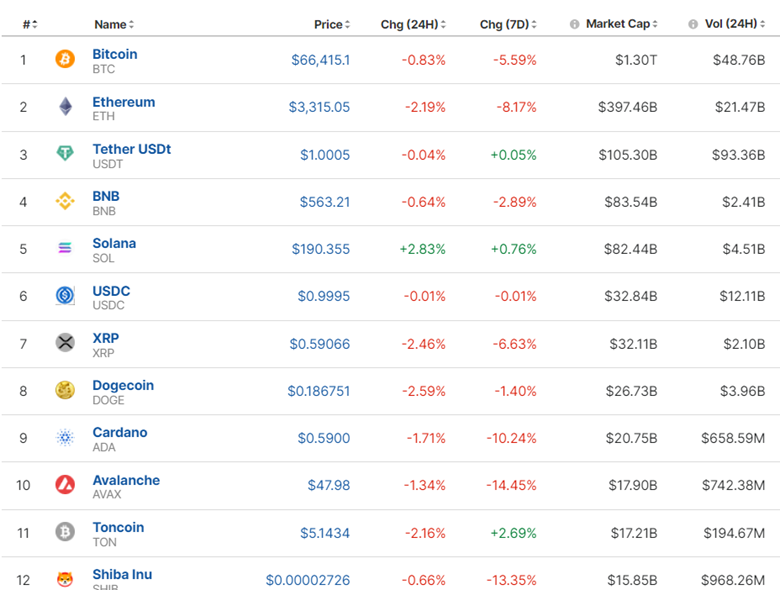

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

The market is currently suffering. All prices retreat and once more we see the positive and strong correlation between all crypto assets as they all experience losses simultaneously.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

S&P500 jumped to near 5,270 USD on the 27th of March. This move broke the channel and it crossed the 30-period MA on its way up. The market was closed on the 29th of March. On the 1st of April, the market opened with a gap upwards. Correction followed with a heavy drop until the support near 5,234 USD. Retracement followed with the price approaching and staying close to the 30-period MA. On the 2nd of April, the index suffered another drop, confirming a downtrend, and it was sharp enough. After finding support near 5,186 USD it retraced near the MA.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 27th of March, the price reversed, crossing the 30-period MA on its way up and settled currently near 81.50 USD/b. On the 28th of March, we have a wedge breakout to the upside that leads the price back to 83 USD/b. The 82 USD/b was an important resistance and upon breakout, it led to the price jump. The market closed on the 29th of March. On the 1st of April, after the news regarding the expansion of the U.S. manufacturing sector Crude oil actually jumped higher and remained on the upside. Today it’s aggressively moving on this uptrend confirming an upside strong momentum.

The latest news shows that production cuts indeed take place. Reuters Survey Shows OPEC Output Reduced in March:

On the 2nd of April Crude oil continued on the uptrend. The RSI currently shows a bearish divergence with those lower highs. However, a halt of an uptrend requires that the price drops below the 30-period MA. This would further support the halt and a future sideways movement, or even the start of a downtrend (H4 retracement to 83 USD).

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 1st of April the price lowered and despite the manufacturing PMI favourable for the USD release that caused the price to drop heavily, Gold could not remain on the downside. An uptrend was formed and kept stable for some time. On the 2nd of April, its price reached 2,288 USD/oz and on the 3rd of April, it retraced to the MA. There is currently an upward wedge, Its breakout to the downside is quite probable, it requires though that the price significantly breaks that wedge and 2,230 USD is the possible next support after the breakout.

______________________________________________________________

______________________________________________________________

News Reports Monitor – Today Trading Day (04 April 2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important announcements, no special scheduled figures to be released.

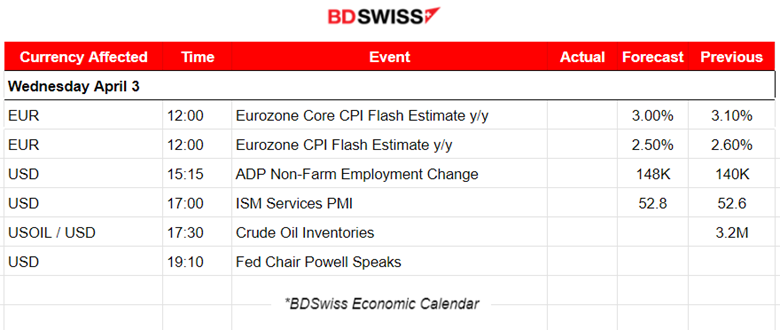

- Morning – Day Session (European and N. American Session)

The Eurozone inflation figures will be interesting, released at 12:00. They are expected to show a decline in CPI changes. These could boost EUR volatility and its depreciation against other currencies.

The ADP Non-Farm Employment change figure is also not expected to change significantly but still, it is a positive one, signalling a hot labour market expectation. The USD might be affected but not with an intraday shock. If so, it will probably be a moderate one.

At 17:00 the same day the release of the ISM Services PMI report could have a good impact with an intraday shock for the USD pairs.

General Verdict:

______________________________________________________________