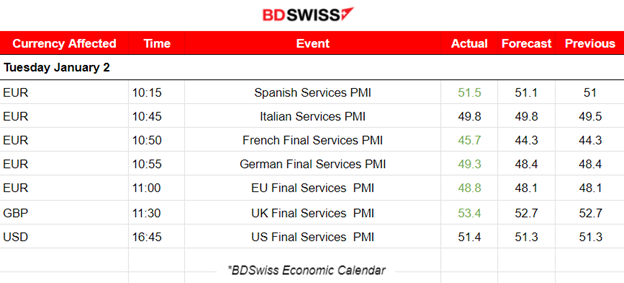

PREVIOUS WEEK’S EVENTS (Week 01-05.01.2024)

Announcements:

Eurozone PMI Releases:

The Eurozone manufacturing sector remained stuck in contraction at the end of 2023, with output continuing to fall and factory job losses extending into a seventh successive month. The EUR was not affected much upon release as the contraction is already priced in.

U.S. Economy

According to the JOLTS report, U.S. job openings fell significantly, further evidence of labour market cooling. This measure of labour demand was down 62K to 8.790 million.

During the FOMC event policymakers appeared increasingly convinced that inflation was coming under control, with diminished “upside risks” and growing concern about the damage that “overly restrictive” monetary policy might do to the economy.

The ADP report showed that more workers than expected were hired in the private sector in December, pointing to persistent strength in the U.S. labour market. Private payrolls increased by 164K jobs in December, the largest monthly increase since August.

NFP: The U.S. reported that firms employed more people than expected in December while wages improved, causing a surprise in the markets and doubt about the rate cut forecasts. The unemployment rate was unchanged at 3.7%.

The probability of an interest rate cut at the March 20 Fed meeting, has dropped significantly. A strong jobs report, the core measure of employment, was well above expectations, showing that despite higher interest rates, the economy continues to do well.

Canada Economy

According to Canada’s Employment data on Friday, the economy added much fewer jobs than expected in December and the jobless rate remained at 5.8%, but permanent employees’ wages increased at the fastest pace in three years.

This is evidence of a strong cooldown in the job market suggesting that the impacts of high interest rates are becoming more widespread across the economy according to analysts.

The Central Bank’s next rate announcement is on Jan. 24, after the release of December inflation data on Jan. 21.

______________________________________________________________________

Sources:

https://www.reuters.com/markets/canada-gains-few-jobs-december-wage-growth-accelerates-2024-01-05/

https://www.reuters.com/markets/us/us-job-openings-fall-moderately-november-2024-01-03/

https://www.reuters.com/markets/us/us-private-payrolls-increase-december-adp-2024-01-04/

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases (Week 02-05.01.2024)

Server Time / Timezone EEST (UTC+02:00)

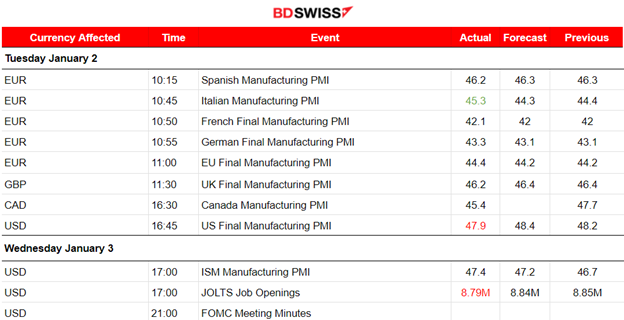

Manufacturing PMI Releases:

Eurozone: The Spanish manufacturing sector remains in contraction territory with falling output and new orders for December. Deterioration for manufacturing in Italy as well with sustained, but softer contractions in output and new orders. The French manufacturing sector ends in 2023 with the strongest deterioration in operating conditions since May 2020. Declines in production, new orders and purchasing activity worsened with a job loss for a seventh straight month. Germany’s manufacturing sector ended in 2023 still firmly in contraction territory. Solid and slightly accelerated decreases in both output and employment.

U.K. PMI: The downturn in UK manufacturing production deepened as the downturn in production volumes accelerated. Both domestic and export work opportunities from clients declined significantly.

U.S. PMI: The worse than the previous figure, now 47.9, suggests serious deterioration of the sector. The U.S. manufacturing performance declines at a sharper pace. Demand conditions weakened and output returned to decline. The sector remains however the strongest relative to other regions.

Canada: The downturn in Canada’s manufacturing sector intensified during December, with accelerated declines in both output and new orders signalled.

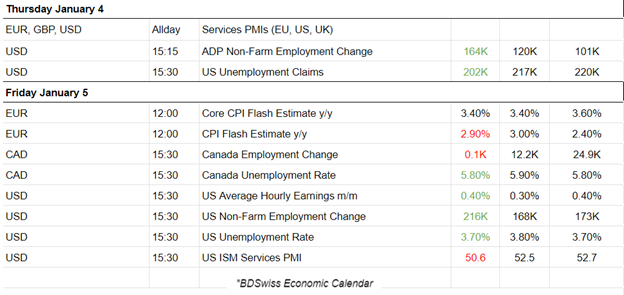

Services PMIs Releases:

Most Services PMIs were in the contraction area.

Eurozone:

The Spanish PMI report showed a figure over 50 indicating expansion. The report suggests that the Spanish services sector growth accelerated in December to a five-month high. Higher new business volumes, additional staff, and higher confidence levels for the future. Other economies in the Eurozone reported figures below 50.

The Italian service sector activity remained in the contraction territory in December, reporting 49.8 points PMI, extending the sequence of decline in activity to five months.

The French PMI was reported at 45.7 points, marking two successive quarters of sustained contraction as demand for services lowered significantly.

The German PMI was reported in the contraction area as well, with 49.3 points recording declines in both activity and employment in December.

In general, the Eurozone economy has been suffering a downturn that continued in December and the reports actually show devastating PMIs for both the manufacturing and the services sector. The services sector figures are closer to the 50 level though and a change in rate policy in the Eurozone might boost business activity in the sector greatly increasing the numbers over 50 in a very short period of time. However, we should not expect interest rate cuts in the Eurozone anytime soon. According to various sources, the ECB could start cutting interest rates in the second quarter of 2024 considering that inflation is near the desirable level.

U.K PMI:

The U.K. faces the fastest increase in service sector activity for six months during December according to the latest PMI report. The figure was released at 53.4 points in the expansion area, an improved figure compared to the previous 52.7.

U.S. PMI:

The U.S. service sector seems to expand as the PMI was reported to be 51.4 points. The sector faced stronger demand conditions as new orders rose at the sharpest rate since June.

On the other hand, the NFP report showed that total nonfarm payroll employment for the U.S. increased by 216K in December, way more than expected, and the unemployment rate was unchanged at 3.7 per cent. The news caused an initial USD sudden appreciation against other currencies. The dollar index jumped momentarily before reversing soon after since the one-sided direction path was not eventually settled as the positive effect faded.

USDCAD barely moved upwards at that time but later as the USD continued with depreciation against the CAD and other currencies, the pair eventually dropped heavily.

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

Dollar Index (US_DX)

The dollar index has been moving steadily to the upside following an uptrend until the 4th of Jan. It eventually found resistance as the NFP report was approaching. On Friday 5th, the U.S. employment news report caused a turning point in the dollar index path. During the news it experienced a sudden jump but soon after it dropped heavily below the 30-period MA to find a strong support before reversing back to the mean. No clear direction for the dollar index as it settled to the mean eventually. The strong data for the U.S. labour market changes the views and forecasts regarding interest rate policy. Will there be a delay? More uncertainty is added causing the dollar to remain stable for now.

EURUSD

The PMI reports last week were reported grim for both sectors in the Eurozone economy while the figure released for the U.S. Economy was better, as usual. The pair obviously was driven mainly by the USD. The EURUSD was moving to the downside instead as the USD was experiencing appreciation. It found strong support close to 1.090 and showed a sideways volatile movement until the end of the week. The NFP report pushed the pair to test the upside on 1.10 but without success. It eventually returned to the 30 period MA and settled around 1.094.

_____________________________________________________________________________________________

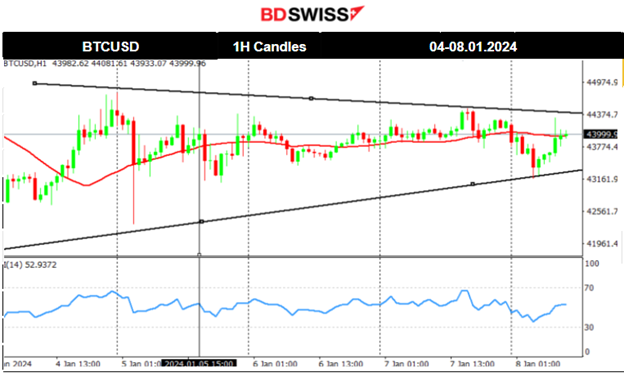

CRYPTO MARKETS MONITOR

BTCUSD

Bitcoin trades around the mean that is currently near the 44K level. It is obvious from the chart that volatility levels dropped significantly and are still dropping forming a triangle. Friday was quite volatile being the NFP day, however, after that event Bitcoin did not experience any significant move and the price just moved sideways around the 30-period MA.

_____________________________________________________________________________________________

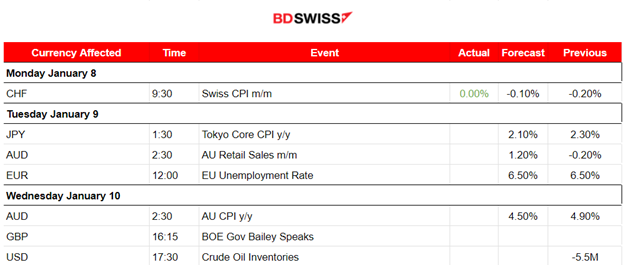

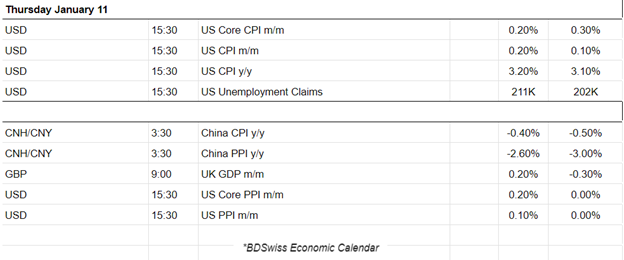

NEXT WEEK’S EVENTS (08 – 22.01.2024)

This week, all eyes are on the U.S. CPI reports as market participants and policymakers are looking forward to seeing if U.S. inflation continues weakening despite the hot labour data presented on Friday.

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

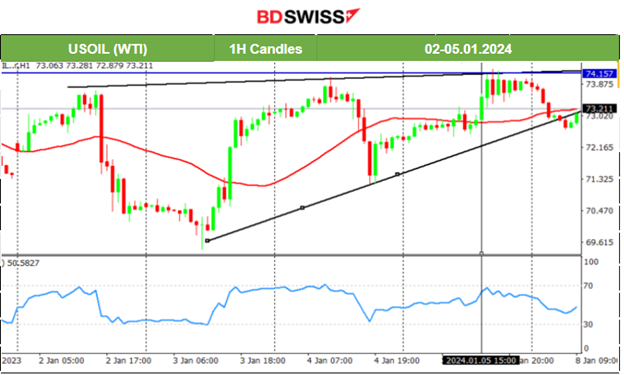

U.S. Crude Oil

Crude Oil moves with high volatility around the 30-period MA and tests the resistance levels near 74 USD/b on its way up. After the NFP report the USD depreciated and Crude moved to the upside testing the 74.2 USD /b without success. It eventually reversed crossing the MA and moving below it to settle around the mean 73 USD/b again. Unless further movement to the downside takes place, breaking the support near 72 USD/b the near path will potentially be sideways. It will be no surprise if Crude tests again the 74 USD/b this week.

Gold (XAUUSD)

Gold’s price formed a triangle before the release of the NFP report on Friday and specific resistance and support levels were set as discussed in our previous analysis. During the news at 15:30, the USD appreciated greatly bringing Gold down rapidly causing it to reach the 2030 USD support before reversing quickly to the mean. The path continued to the upside after the shock since the dollar started to depreciate aggressively reaching the resistance of 2060 UD/oz before reversing for the second time again quickly back to the mean. Currently, Gold is headed downward again testing the support levels below 2030 USD again signalling that it is destined to drop further.

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX)

Price Movement

Clearly, the downtrend was interrupted during the NFP report as the index (and the other U.S. benchmark indices) moved to the upside significantly crossing the 30-period MA on the way up and resulting in a rather sideways path after the volatility levels started to fall. Currently, we witness a triangle formation after the news and the index is signalling that there might be a breakout to the downside. To suggest that the support level near 16250 must break though, we need to give more evidence of a downtrend continuation.

______________________________________________________________