Previous Trading Day’s Events (15 Dec 2023)

We have two consecutive quarters of economic contraction, meeting the technical definition of recession.

“The drop-back in the Eurozone Composite PMI in December provides more evidence that the economy is in recession,” said Andrew Kenningham at Capital Economics.

In Germany the downturn worsened, pointing to a recession in Europe’s biggest economy at the end of the year. Meanwhile, activity declined faster than expected in France as demand for goods and services in the euro zone’s second-biggest economy deteriorated further.

In the U.K., the services sector however saw another pick-up in growth this month, enough to avoid a recession currently.

“The broader economy keeps growing, but industrial production peaked way back in September 2022,” said Christopher Rupkey, chief economist at FWDBONDS in New York. “Manufacturing continues to limp along and is unlikely to provide the fuel for economic growth in the near term.”

The survey from the Institute for Supply Management this month found that manufacturers viewed customer inventories as having increased “toward the upper end of ‘about-right’ territory” in November. The ISM’s manufacturing PMI has remained in contraction territory for 13 straight months, the longest such stretch since the August 2000-January 2002 period.

Source: https://www.reuters.com/markets/us/us-manufacturing-output-rises-november-2023-12-15/

______________________________________________________________________

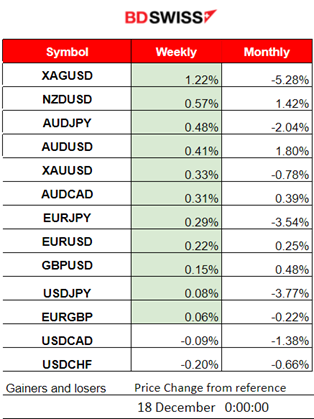

Winners vs Losers

Silver gains reached 1.22% last week. NZDUSD followed with just 0.57% and remains the top performer for the month with 1.42% gains so far.

______________________________________________________________________

______________________________________________________________________

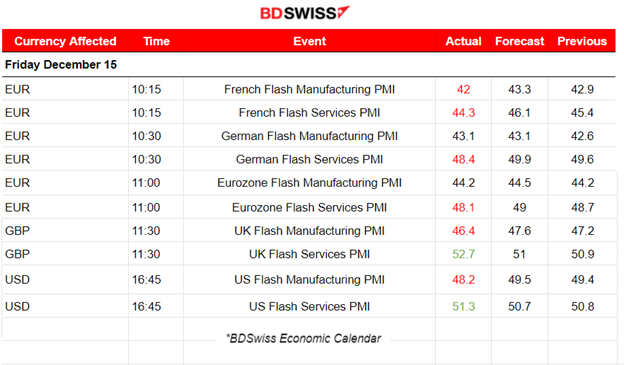

News Reports Monitor – Previous Trading Day (15 Dec 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

Industrial Production measure, a yearly change figure for China, was released at 4:00 showing an increase. Retail sales were also reported higher. The CNH and AUD were slightly appreciated at the time of the release but no major impact was recorded.

- Morning–Day Session (European and N. American Session)

PMI releases were as follows:

Eurozone PMIs

The French business activity fell at the fastest pace for over three years as PMI reports suggest. The Manufacturing figure was reported to be just 42, lower than the expected 43.3. The decrease in output accelerated for the first time since September and was the steepest since November 2020. The period of decline started at the midway point of the year. Services PMI also reported lower than expected 44.3 points versus the expected 46.

Germany reported the expected low figure of 43.1 points for the manufacturing sector and 48.4 points PMI for the services sector, with manufacturers and services firms each recording slightly faster declines in business activity. It ended the year with a further fall in business activity and a rise in output prices.

Eurozone’s PMIs suggest that activity fell at an increased rate in December, closing off a fourth quarter which has seen output fall at its fastest rate for 11 years. Both business sectors reported further steep falls in inflows of new business, which led to a further depletion of backlogs of work. Jobs were cut for a second month. Book orders worsened.

United Kingdom PMI

In the U.K. the private sector output growth edges up to a six-month high, led by a faster recovery in the service economy. The PMI for the manufacturing sector was reported to be in the contraction territory, however, the services sector PMI was reported to be 52.7 points in the expansion territory. The reports showed higher levels of business activity supported by a renewed improvement in order books.

United States PMI

The reported PMI figures for the U.S. are signalling better conditions in general and for the services sector specifically which experienced expansion, with a recorded PMI of 51.3. A slightly stronger business activity close to 2023 as activity rose at the fastest pace for five months in December. The business sector experienced the sharpest increase in new orders since July. Growth was driven by the service sector, as manufacturers registered a further downturn in new orders and a renewed drop in production.

The market reacted with EUR depreciation upon the PMI releases, for the related economies. All figures and reports showed that contraction in business activity is continuing at a dangerous pace. The U.K. PMI’s release caused the GBP to appreciate at that time instead but the effect soon faded. The USD experienced appreciation and eventually gained a lot of ground against other currencies.

According to the Empire State Man. index report, the headline general business conditions index fell twenty-four points to -14.5, a figure showing that business activity declined in New York State significantly. New orders were down, and shipments also declined. Inventories moved lower. Employment declined modestly, and the average workweek edged down.

General Verdict:

____________________________________________________________________

____________________________________________________________________

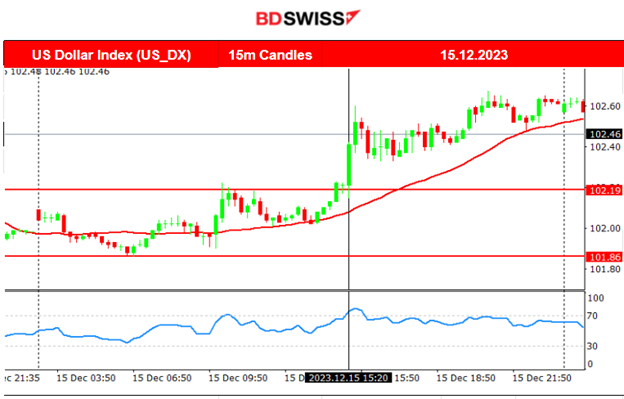

FOREX MARKETS MONITOR

EURUSD (15.12.2023) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The EURUSD declined overall. After the PMI releases starting at 10:15 the EUR started to depreciate greatly against the dollar causing the EURUSD to fall. Upon each release, the pair kept falling further and further, an intraday downward trend that saw no retracement while the USD was gaining strength at the same time.

GBPUSD (15.12.2023) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair experienced high volatility after the start of the European Session and the PMI releases. The PMI figures for the U.K. actually caused an appreciation of the GBP and the pair moved to the upside at the time of the release after 11:00. However, the effect soon faded and the pair reversed to the downside, where it continued with a downtrend, due to the USD continuous appreciation, until the end of the trading day.

___________________________________________________________________

___________________________________________________________________

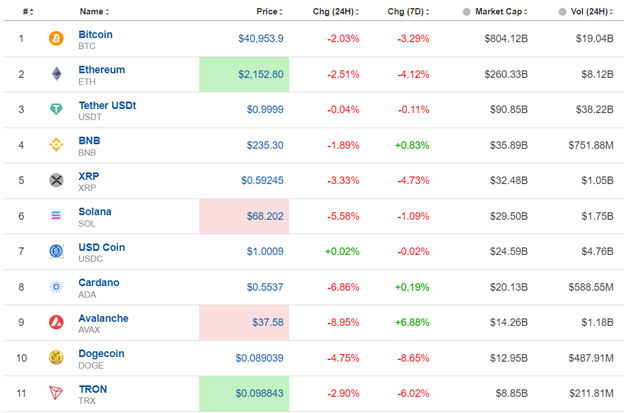

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Bitcoin fell significantly as 41500 was a critical support. We see that eventually due to low volatility, the price formed a triangle that was broken today after the price of bitcoin experienced this huge drop, reaching near 40700. A correction phase is the cause, most likely.

Crypto sorted by Highest Market Cap:

Cryptos saw a decline in the past 24 hours. Not only bitcoin, but we see that the whole market was affected by this “correction”.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4Hour Timeframe Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Risk-on sentiment as market participants are pushing U.S. stocks higher and higher. NAS100 and other indices are clearly on an uptrend. This month has been good for stocks especially since the Fed is discussing rate cuts, thus future lower borrowing costs for businesses. During the FOMC news, their statements caused huge volatility in the market causing the indices to jump. After the retracement that took place on the 14th Dec, the market still is bullish and is reaching the highs again. Volatility levels seem to drop, forming a triangle, with the obvious important resistance level at near 16700 USD.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

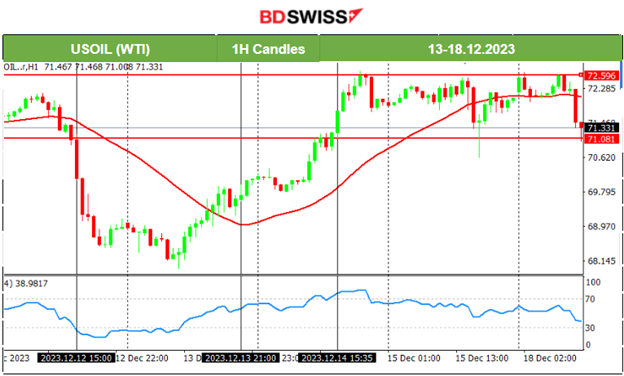

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Crude moved upwards last week after central bank news and statements. The USD also experienced further weakening. Its price eventually reached 72.5 USD/b which served as a critical resistance level. This level was tested many times without a breakout. The path eventually remained sideways, experiencing high volatility and consolidation, however today the price seems to test the low at near 71 USD/b.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

With the FOMC and Fed Rate release the dollar had depreciated greatly enhancing the upward path. Gold jumped until it reached the resistance at 2040 USD/oz and remained settled, around that level. The RSI signalled a bearish divergence and eventually price fell as indicated to the 61.8 Fibo level as depicted on the chart. It remains stable for now near 2020 USD/oz.

______________________________________________________________

______________________________________________________________

News Reports Monitor – Today Trading Day (18 Dec 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

86.4 points was the reported figure for the German Ifo Business Climate report. The headline business climate index for Germany due Monday from the country’s Ifo Economics Institute was expected to improve to 87.8 points from 87.3 last month but eventually no. Grim picture.

General Verdict:

______________________________________________________________