PEP – PepsiCo Q4 Earnings and Stock Analysis

Introduction

PepsiCo Inc.is a beverage and convenient food company that manufactures, markets, distributes, and sells its products, operating through seven segments. It operates beverage and food businesses worldwide: United States and Canada, North America, Latin America, Africa, Middle East and South Asia (AMESA), Asia Pacific, Australia and New Zealand, and China region. Its brands include Lay’s, Doritos, Cheetos, Gatorade, Pepsi-Cola, Mountain Dew, Quaker and SodaStream. Clients enjoy the company’s products in more than 200 countries and territories around the world.

As of January 2024 Pepsico has a market cap of 230.78 Billion USD, the world’s 46th most valuable company by market cap. It is a “public company”, its shares are currently trading as a Nasdaq-listed security.

Q4 Earnings Announcement: The corporation is expected to report 2023 fourth-quarter February 9th 2024, before the market opens. Investors have a great interest in this stock due to its expected high performance in 2024. Stock value could climb 12%, or more. The company’s organic revenue, which excludes acquisitions and divestitures, climbed 8.8% in the 3rd quarter. Consumers are still buying PepsiCo products at a significant rate.

Technical Analysis:

Q3: Late 2-Month Drop in Value

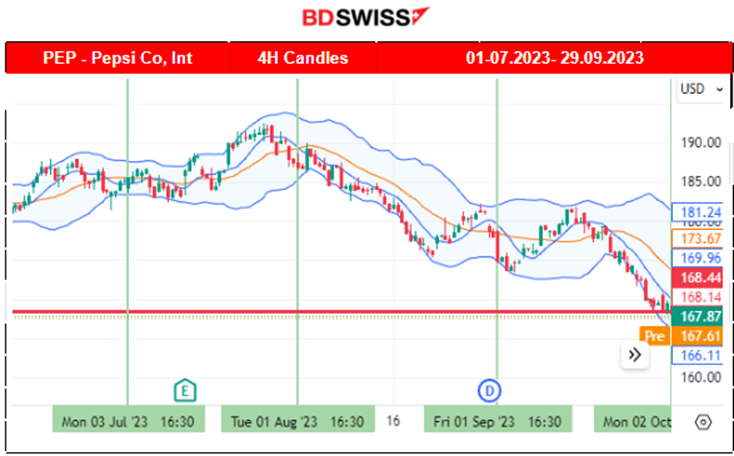

At the beginning of Q3 2023 the PEP stock was climbing moderately, reaching a peak in July close to 192 USD before a long fall in price took place for the next 2 months. At the beginning of August last year, the stock moved steadily lower until it found support that month near 175.5 USD before retracing back to the 20-period MA and beyond. As per the MA (yellow) the path that followed was highly volatile but remained sideways until near the second half of the next month, in September. 173.5 served as a significant support that was broken after the 15th of September, when the price experienced a rapid drop until it closed the 3rd quarter near the 168 USD level.

Q4: Correction with a Stable Sideways Path

The price continued with a further rapid drop as the stock entered the 4th quarter in October. It found support in early October around the 157 USD level and bounced back to the upside with a retracement but remained below the 20-period MA. As volatility levels started to get lower and lower as time passed towards the end of the month, the price jumped higher, crossing the MA and remaining high in consolidation. The price remained in a small range, moving sideways with low volatility for the next 2 months until the end of the 4th quarter with a close price near 170 USD.

Q4: The Stock Market – Trading on NASDAQ

Let’s check the performance of the NAS100 index during the 4th quarter and compare it with the performance of PEP stock. It seems that the NAS100 started to experience strong performance after November. That was a turning point since previously it was experiencing lower and lower levels reaching to the support at 14,050 USD in late October.

The PEP stock was underperforming as well in October and entered the month with a sharp drop from September. Even though both paths experienced an upward movement in November the PEP stock remained stable while the NAS100 index continued with a more aggressive upward path and uptrend after the reversal.

By looking at the charts of other companies in the same industry we see the same resistance to the upside and a sideways path. Key competitor Coca-Cola Co actually outperformed Pepsi Co very significantly and has a more similar path to the NAS100 upward path after November. Both companies continued to raise prices and with every latest release, raising their profit forecasts for 2023.

All benchmark indices are currently showing performance which has hit all-time record highs.

Q3 Earnings:

PepsiCo (PEP) reported revenue was 23.45B USD (Sep, 2023) compared to 22.32B USD the 2nd Quarter (Jun, 2023).

Net income was 3.09B USD compared to 2.75B USD in the 2nd Quarter.

In the 3rd quarter, Revenues and Net income are higher than the previous quarter. During the 3rd quarter of 2023, sources say that Pepsi’s continuous price hikes to mitigate inflation have weakened its product’s demand. The company has also been shrinking portions and making smaller value packs to drive more transactions according to PepsiCo executives. PepsiCo also reported Quaker Foods’ brands gained market share in key categories, such as pancake mix and syrup. The important part is that PepsiCo anticipates organic revenue growth on the high end of 4% to 6% and core constant currency earnings per share growth in the high single digits this year.

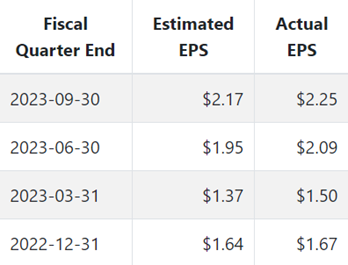

Estimated versus Reported Earnings Figures

In all previous 2023 cases, the actual figure of Earnings Per Share (EPS) was lower than the estimated one.

Source: https://www.alphaquery.com/stock/PEP/earnings-history

The next report for quarterly earnings comes with an average estimated earnings per share of $1.72 for the fiscal quarter ending 2023-12-31 (Q4).

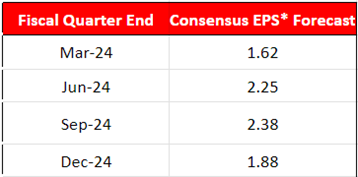

Q4 EPS is lower than the Q3 2023 and it seems that in the start of 2024, the EPS estimate gets even lower. However, as we look ahead past Q1 and into Q2 2024, analysts project that PepsiCo will see rising earnings per share for each quarter: 2.25 USD (Q2) in June and even higher at 2.38 USD (Q3) in September.

Year to Date : Stock Closer Look

When the stock entered the new year, its value jumped for a couple of days but soon reversed significantly to the downside crossing the 20 period MA on its way down. It moved steadily for a while downwards until it found support near 165 USD. We could expect that to happen due to the holiday effect. Its value started to increase significantly in late December as it was getting closer to new year’s festivities and after that event it naturally dropped. The stock remained in consolidation since it found support, 165-168 USD range, but recently saw a breakout to the upside over the 168 USD resistance.

Sources:

https://www.investing.com/equities/pepsico

https://companiesmarketcap.com/pepsico/marketcap/#google_vignette

https://www.nasdaq.com/market-activity/stocks/pep

https://www.cnbc.com/2023/10/10/pepsico-pep-q3-2023-earnings.html

______________________________________________________________