PREVIOUS TRADING DAY EVENTS – 31 March 2023

Announcements:

The Canadian economy is now on track to expand at an annualised rate of 2.8% in the first quarter, assuming March growth comes in flat.

“The Bank of Canada is likely at a crucial juncture and facing a significant dilemma,” Charles St-Arnaud, chief economist at Credit Union Central Alberta Ltd. said in a report to investors. “The central bank may have to choose between fighting inflation and hiking interest rates again or focusing on financial stability and keeping rates on hold.”

Source: https://www150.statcan.gc.ca/n1/daily-quotidien/230228/dq230228b-eng.htm

This personal consumption expenditure price index excluding food and energy increased 0.3% for the month, the Commerce Department reported on Friday. That was below the 0.4% Dow Jones estimate and lower than the 0.5% January increase.

“The inflation trend looks promising for investors. Inflation will likely be below 4% by the end of the year, giving the Federal Reserve some leeway to cut rates by the end of the year if the economy falls into recession,” said Jeffrey Roach, chief economist at LPL Financial.

Source: https://ec.europa.eu/eurostat/documents/2995521/16324747/2-31032023-AP-EN.pdf/e1ba8561-cfa9-6734-3be3-e0ca47d635b6

https://www.cnbc.com/2023/03/31/fed-inflation-gauge-february-2023-.html

Excluding food and energy, the Fed’s preferred inflation gauge — the personal consumption expenditures price index — rose 0.3% in February as said above which was below the median estimate showing inflation down.

The banking sector concerns have brought the indexes down and the recent increases show a big recovery. However, it might be the case that the market is overreacting and that we might see surprising problems in the future from forces that are still secretly connected to the bank failures.

“Extremely narrow rallies are not healthy ones at all, so it is going to be essential for the bulls to see more groups participate in the rally going forward,” Matt Maley, chief market strategist at Miller Tabak + Co., wrote. “If they don’t, it will only be a matter of time before a correction in the big-cap tech names turns this nice rally into an ugly decline.”

Source: https://www.bloomberg.com/news/articles/2023-03-30/stock-market-today-dow-s-p-live-updates#xj4y7vzkg

______________________________________________________________________

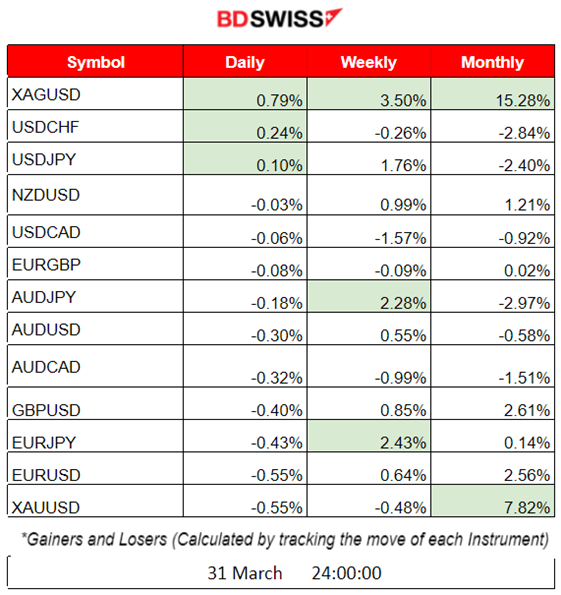

Summary Daily Moves – Winners vs Losers (31 March 2023)

______________________________________________________________________

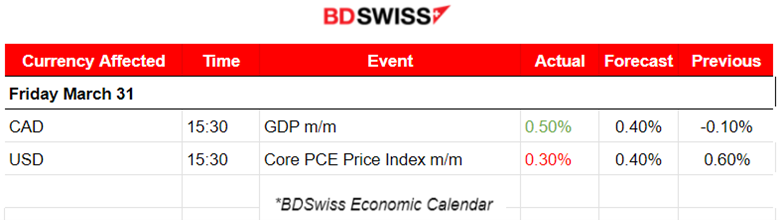

News Reports Monitor – Previous Trading Day (31 March 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No significant figure releases. No intraday shocks are expected during that session.

- Morning – Day Session (European)

The GDP figure for Canada was released at 15:30 and it was more than anticipated which is in favour of the CAD. Since this is a basic and important economic indicator, FX pairs, with CAD as the quote currency, experienced volatility and a steady, downward shock following CAD’s appreciation ending the day lower.

The Core PCE Price index for the U.S. was released at the same time less than expected, having a minor impact on the USD at that time. Most pairs with the USD as quote currency ended the day lower.

General Verdict:

______________________________________________________________________

FOREX MARKETS MONITOR

USDCHF 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

USDCHF experienced a number of reversals the previous week moving around the 30-period MA with no clear long-term trend. Although it was above the MA, while moving from the 28th to the 29th, it experienced an intraday shock that clearly signalled the end of the upward movement above the MA. It then started to move below it. The USD-related GDP and Unemployment Claims figures pushed the pair downwards until the 31st of March when the price started to reverse again moving above the MA. The RSI shows the Bullish Divergence (RSI: Higher Lows, Price: Lower Lows).

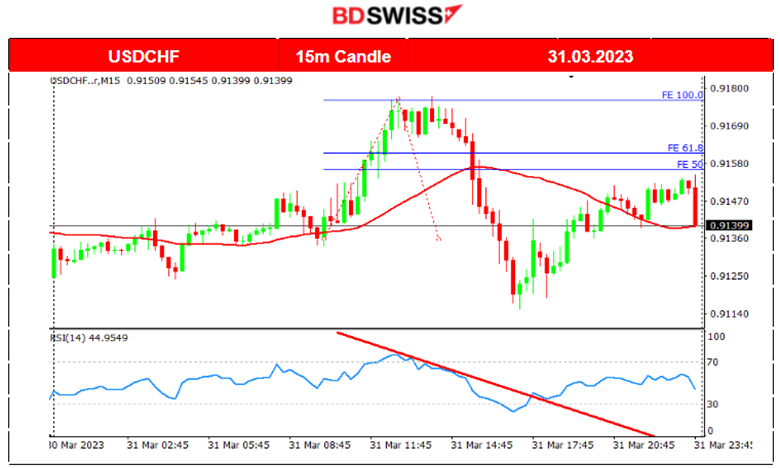

USDCHF (31.03.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair started moving significantly right after the European Markets’ opening as anticipated. A rapid upward movement finding resistance opened the door to a retracement opportunity. The PCE Price Index figure was going to be released and the market was active before that retracing. After the lower-than-expected inflation release, the pair dropped rapidly as the USD was affected greatly by depreciation.

Trading Opportunities

The market moved rapidly upwards and settled at the resistance level as depicted by the 100% Fibonacci level. We caught the retracement after that since it went back, not only 50% of the move and so back to the mean but also experienced a complete price reversal while it was also pushed by the inflation figure release.

Our Technical Analysis is on TradingView:

https://www.tradingview.com/chart/USDCHF/jQM1281U-USDCHF-Quick-Retracement-31-03-2023/

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NASDAQ – NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 28th of March, the index reversed, crossing the 30-period MA and moving upwards. That upward trend, moving above the MA lasted for 3 days straight. This signals the risk-on mood of investors and their faith in the US government to rectify the crisis while there are no expectations of banking-related problems in the future.

NAS100 (NASDAQ – NDX) (31.03.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The US Stock Market has been experiencing unusual volatility with prices going higher and higher. Similar chart as per below for S&P500 and US30. After the NYSE opening, all 3 US indices are experiencing an increase in value.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Overall, Crude’s price has been recently moving upwards. With the recent banking crisis, it was not long ago that the price fell to 67.5 USD/barrel on the 24th of March. Consumers’/depositors’ decisions were greatly affected, shaking the oil demand. This week though, several fundamental factors in the oil market pushed the price even higher. The U.S. government is stating that the banking system is sound and resilient easing depositors and bringing balance again, while disruptions in oil supply push it higher.

USOIL (WTI) (31.03.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude’s price was moving sideways within a small range and during the Asian and European Market sessions volatility kicked in. The price was moving upward overall but during the uptrend, it was experiencing intraday shocks.

Trading Opportunities

Crude experienced a reversal at 12:00 when it was below the 30-period MA and crossed above it at that time moving rapidly and highly upwards. It deviated greatly from the mean and settled at some point signalling the end of the move and creating a retracement opportunity as depicted by the Fibonacci Expansion tool. After retracing back to the mean, another upward shock occurred.

______________________________________________________________

News Reports Monitor – Today Trading Day (03 April 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No significant figure releases. No intraday shocks are expected during that session.

- Morning – Day Session (European)

At 9:30 the Swiss CPI figure is going to be released. It usually creates a small intraday shock depending on how far it is from the expected one. The previous rate was 0.7% and it is expected to fall to 0.4%. In this case, the USDCHF could rise rapidly creating a retracement opportunity after finding resistance.

PMIs releases could cause volatility for all major pairs. As soon as the European Markets open at 10:00, volatility levels should start increasing. No intraday shocks except at 17:00 when the USD pairs might experience an intraday shock due to the Manufacturing PMI release. The release is quite late so capturing a retracement after that might be risky. We should take into account the size of the move and look for retracement signals first.

General Verdict:

______________________________________________________________