Rates as of 04:00 GMT

Market Recap

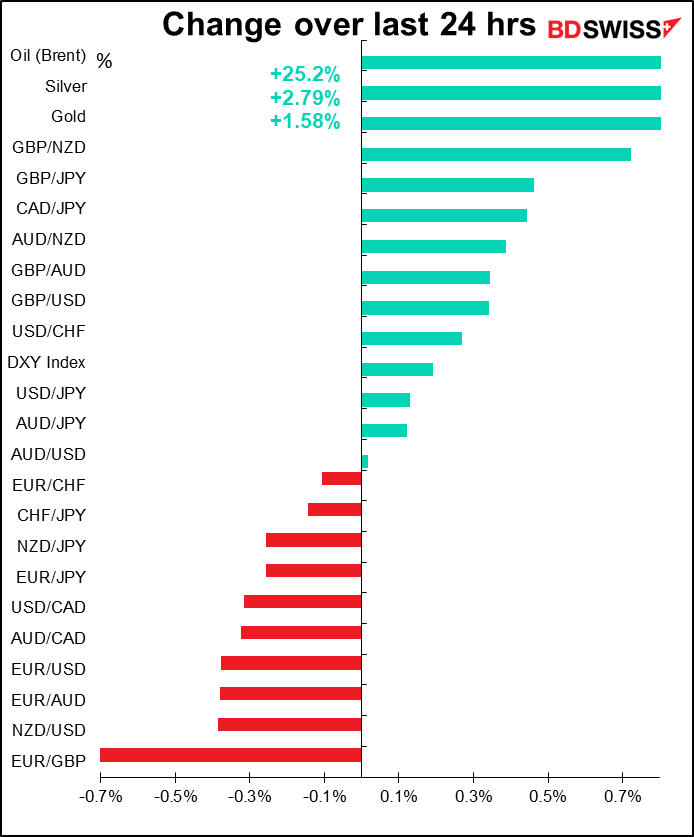

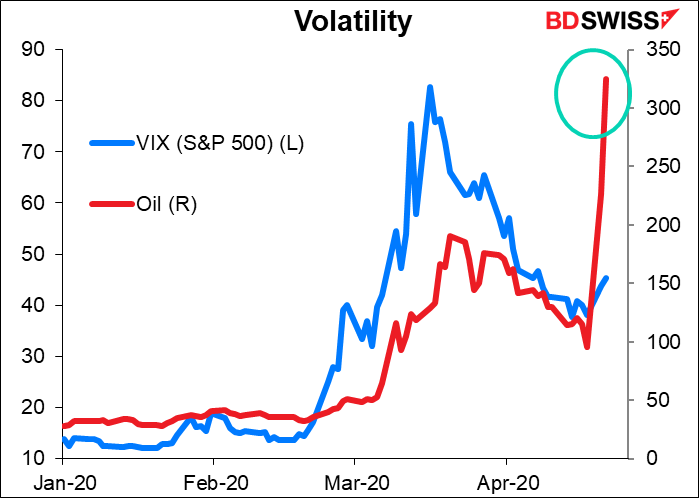

A wild day for oil! It went from $26.50 on Monday to a low of $15.98 yesterday and now has bounced back to $22.69. So down 40%, then up 42%. Crazy!

The volatility is astonishing – about 4x that of the stock market.

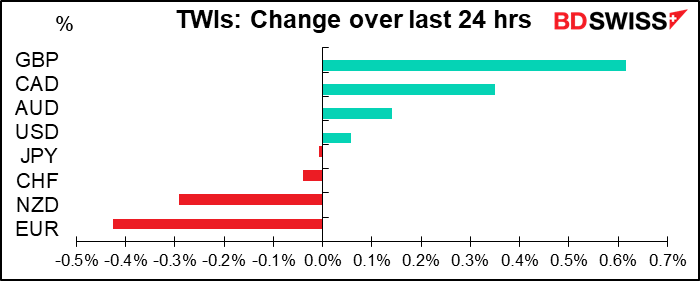

CAD gained along with oil, although NOK didn’t.

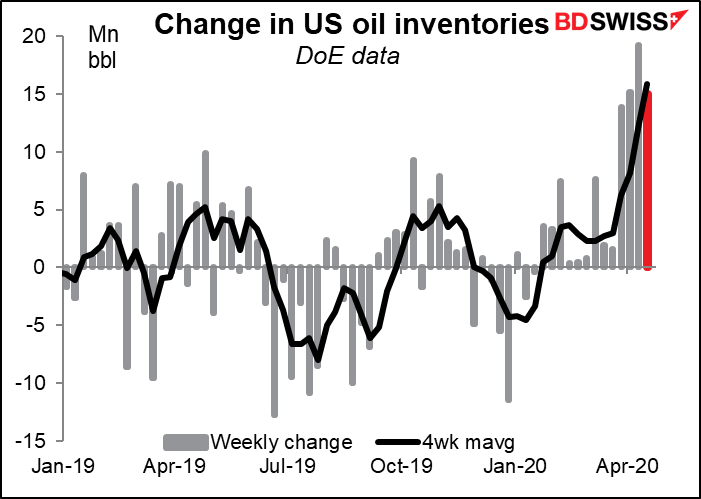

Personally, I don’t think that the rally will last. It was apparently caused by three things: first, the US Dept of Energy figures on oil inventories showed that inventories rose less in the latest week than they did in the week before. Marvelous! Far be it from me to point out that if it hadn’t been for the rise in the week before, the latest week would’ve been the largest rise on record in data going back to 1982. And the four-week moving average is still moving up.

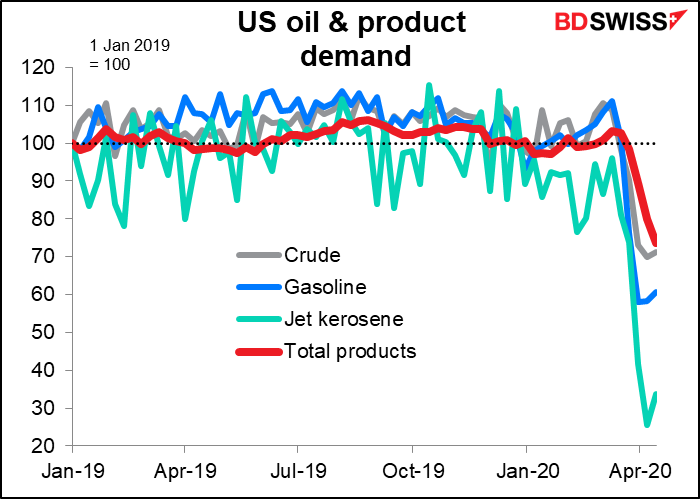

Secondly, there are signs that demand is bottoming out. This is more plausible. According to yesterday’s Dept of Energy figures, demand for motor gasoline and jet kerosene (and crude as well) does seem to have bottomed – not turned up significantly, but at least bottomed – although total product demand was still lower.

Third, and perhaps most importantly, Trump threatened to attack Iranian ships. Now it is entirely possible that the Iranians decide to distract their troubled populace by attacking the US, and it is entirely possible that Trump decides to distract his troubled populace by attacking Iran. However, given the recent history of conflict between the two nations – big on threats, short on fighting – I think it’s highly unlikely that we would see anything significant enough to interfere with shipping.Short of that, I don’t see this having much impact on the supply of oil. I think this was just an excuse to take some big profits on shorts and I expect oil to resume its decline, with the impact that you’d expect on CAD and NOK.

EUR/USD hit a two-week low ahead of today’s European Council meeting. Apparently investors are doubtful whether the countries can agree on a stimulus package. I disagree; I think they’ll agree on what to do, just not on how to fund it. That should boost EUR today, in my humble opinion. See below for details.

In any event, there shouldn’t be any problem finding the money. Spain held its largest-ever 10-year bond syndication yesterday (EUR 15bn) and had a bid-to-cover ratio of around 6.5x, nearly double the previous record. This was similar to Tuesday’s successful sale of EUR 110bn in Italian debt, which also went well. With rates so low and the ECB pledging “whatever it takes,” investors are willing to buy the bonds if they can get a price concession.

The ECB changed its rules to allow them to buy “fallen angels,” bonds that were rated investment grade but were downgraded after the virus hit. The Fed had already done this so it wasn’t a surprise that the ECB followed suit.

Today’s market

The big event today is the European Council (EC) videoconference summit. The main question will be how to finance the proposed European Recovery Fund. Bloomberg reported that the European Commission would propose a EUR 2tn plan that would use the EU’s multi-annual budget, plus a new temporary financing mechanism. However this would involve issuing some joint debt – aka “corona bonds” – which the northern countries resolutely oppose.

I don’t expect a full, detailed agreement today – Standard Operating Procedure for the EU is to kick the can down the road until the road disappears. In this case, the ECB’s debt purchases are enough to contain the market pressure on Italian debt for now, so there’s no need to tackle the politically poisonous question of burden sharing. There’s also some question about grants, but then there’s going to be a debate on the ratio of grants to loans. In any event, watch for whatever details about the European Recovery Fund that do come out, such as the size, structure and speed with which it will be established.

Today is also a big day in the economic indicator world. We get arguably the most important two sets of indicators today.

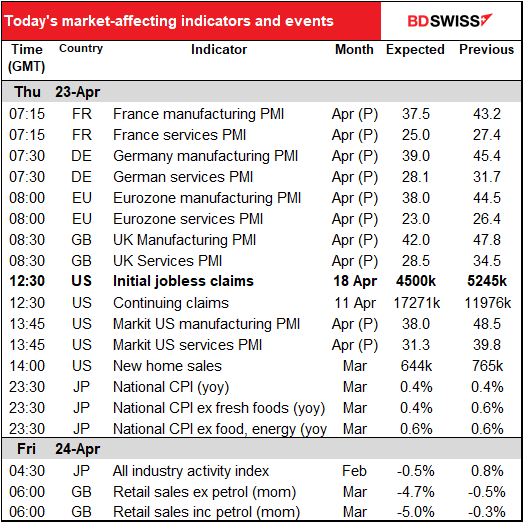

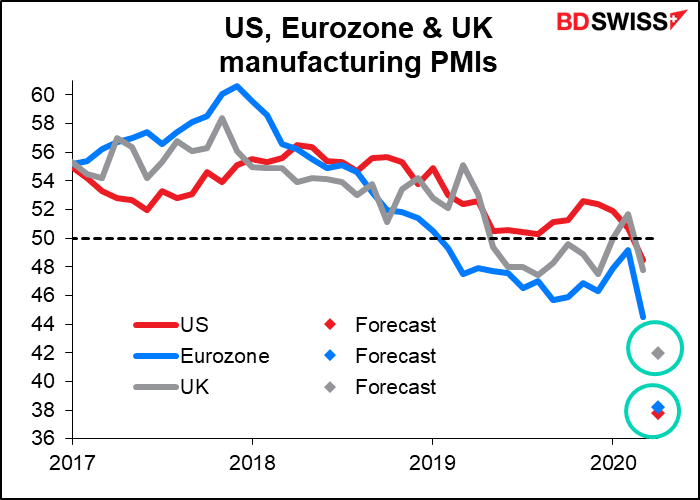

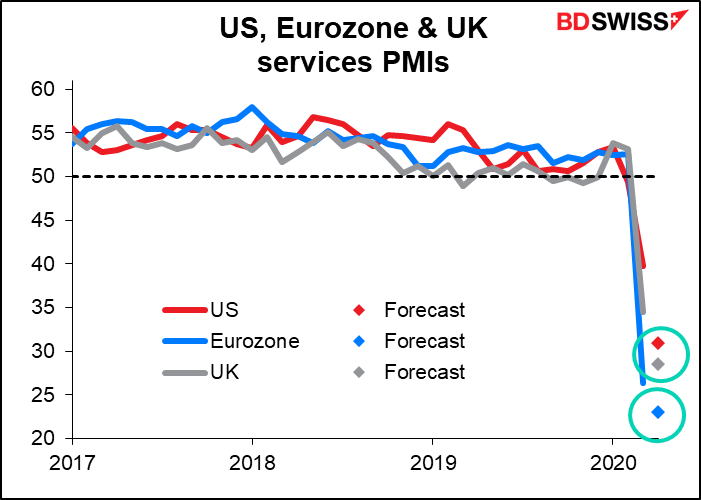

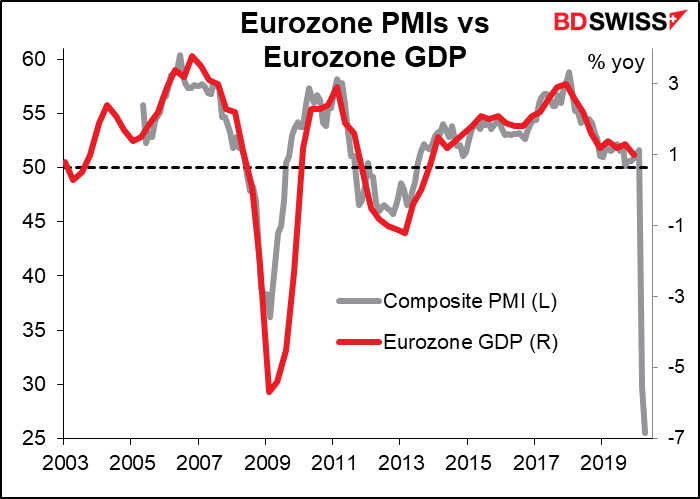

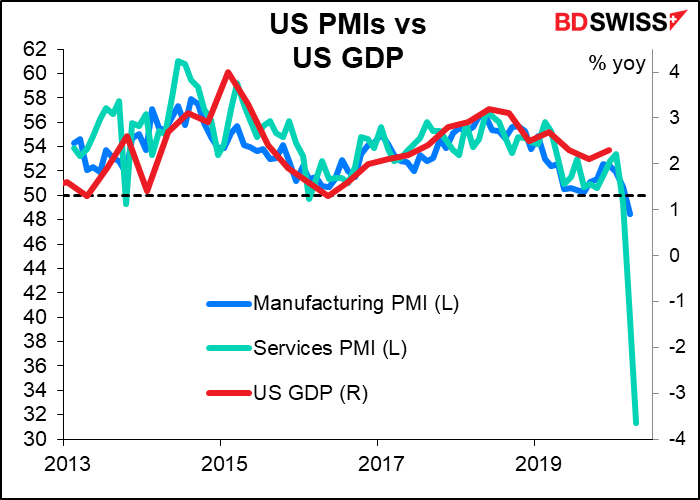

We start off today with the purchasing managers’ indices for the major industrial economies. They’re expected to be lower across the board, which makes sense. In most countries, the lockdowns didn’t start until midway through March; this will be the first indicator to get the full effect. The forecasts are of course nothing but guesses.

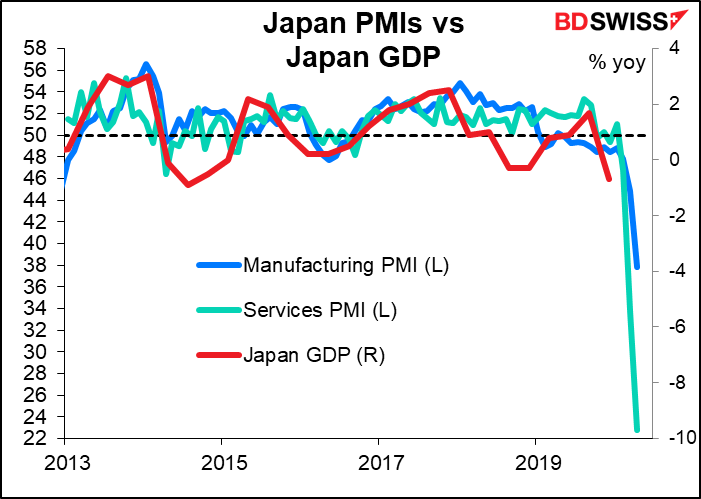

Japan’s PMIs, which came out overnight, were certainly lower. The service-sector PMI, which had already collapsed last month, plunged further to a record low of 22.8 (from 33.8). The manufacturing PMI wasn’t hit as hard – it fell to 43.7 from 44.8. The results would imply a GDP print somewhere around -10% yoy.

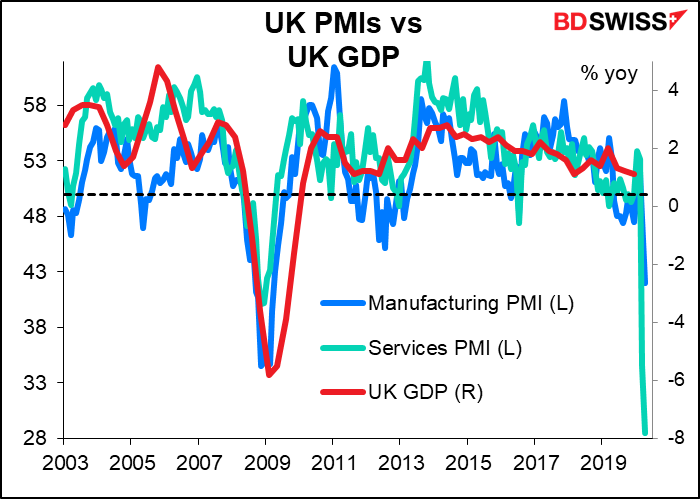

In most cases, the service sector PMI is expected to be worse even than during the Global Financial Crisis of 2008/09. That stands to reason: business was bad then, but at least businesses were still open.

The implications for Q2 GDP are horrendous, like nothing we’ve ever seen before. Remember, in most countries the service sector comprises the bulk of economic activity. Manufacturing is now a much smaller part of the economy than services are.

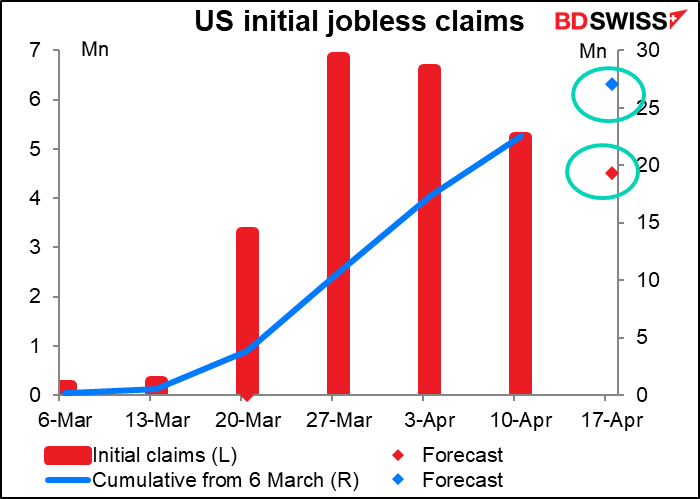

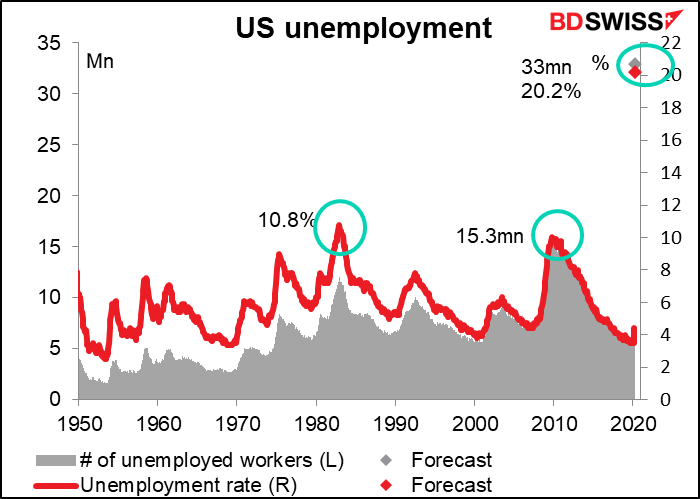

Meanwhile, between the UK and the US PMIs comes the US initial jobless claims, which is now the big indicator of the month, except it’s four times a month. Economists are looking for another horrible number, although less horrible than the one before. In fact it looks like the worst has passed, according to this data, although the cumulative figure keeps climbing.

If today’s forecast is right, the number of people unemployed by the time the April survey week rolls around would be around 33mn according to my calculation, which would be an unemployment rate of 20.2% — second only to the 24.9% peak of the Great Depression. Pretty serious!

Don’t forget to check out Len Keifer’s neat animated graph of the initial jobless claims here.

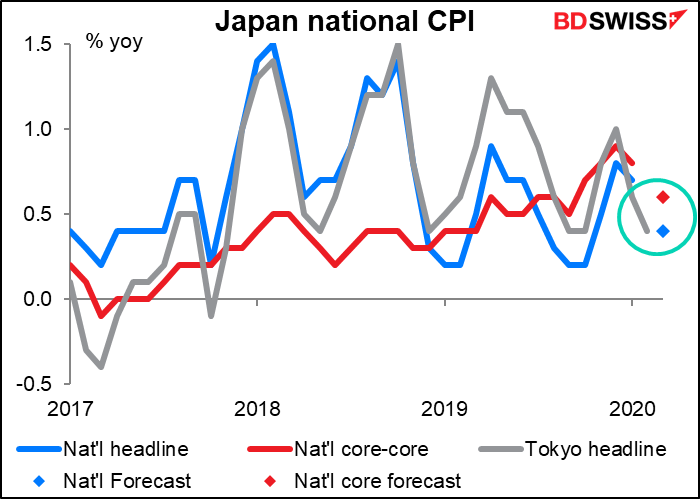

Overnight Japan announces its consumer price index. Same as with the other CPIs: inflation is no longer the big worry for central banks. Anyway Japan hasn’t had any significant inflation since about 1996.

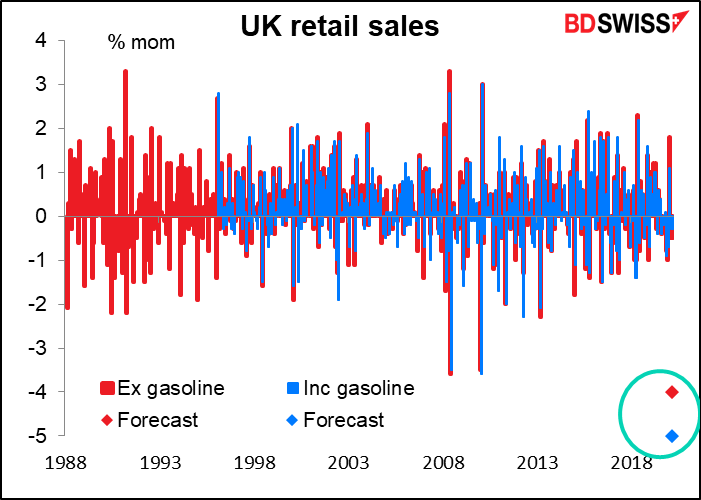

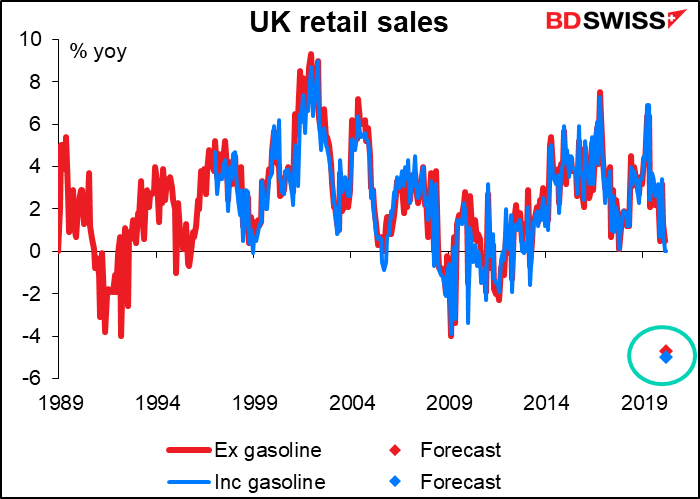

Friday morning real early we get UK retail sales. They’re forecast to be the worst ever, both on a mom and yoy basis. And probably there’s worse to come, too. Many people have no money and even those that do can’t get out of the house to shop, and even if they could the shops are all closed.