Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

Rates as of 05:00 GMT

Market Recap

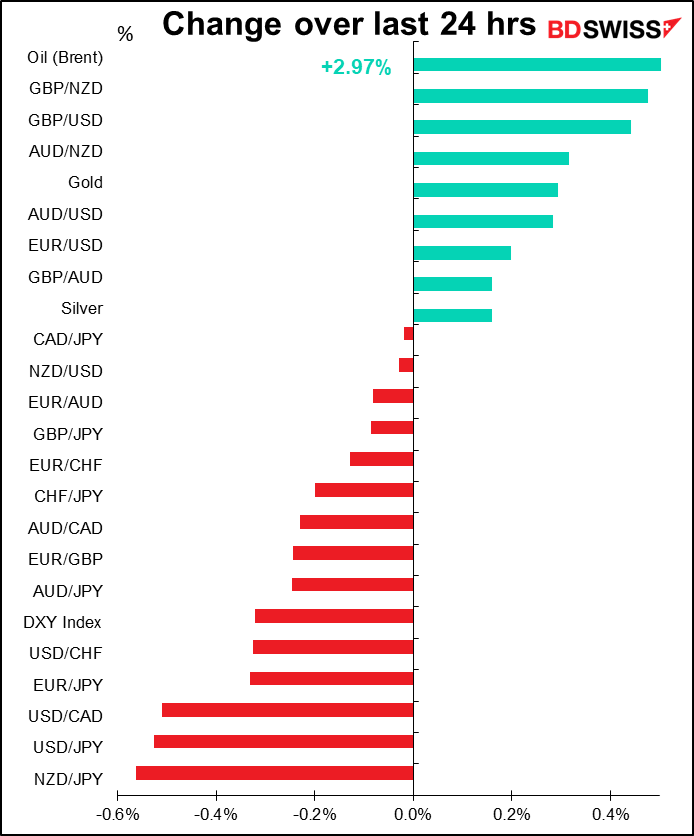

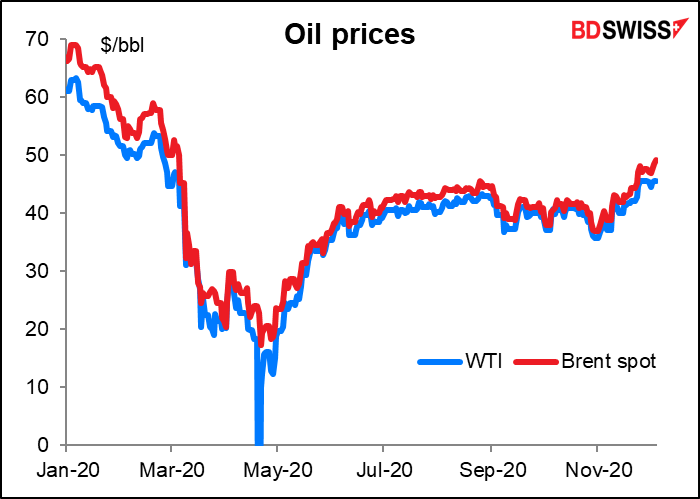

OPEC+ took a lesson from the EU and kicked the (oil) can down the road. The group couldn’t decide whether to increase production by 1.9mn barrels a day (b/d) as scheduled from 1 January or to delay the production hike for three months as had been widely expected before the meeting. So they decided to raise output by 500k b/d in January and then hold meetings every month to decide what to do. Each month they will be able to raise – or, significantly, to lower – production by 500k b/d, depending on the market.

This decision was difficult and took several more days of negotiation than had been expected, as some producers wanted to increase production while others were worried about upsetting the fragile balance in the market. The group therefore seems to be setting itself up for just a string of difficult meetings every month.

But the agreement does have some advantages. First off, the 500k increase in output in January, while more than the zero increase that had been expected going into the meeting, should still keep the oil market in deficit. Secondly, having monthly meetings will allow them to react in real time to developments in an uncertain market, which has its advantages, especially since the agreement includes a mechanism for cutting production as well as raising it.

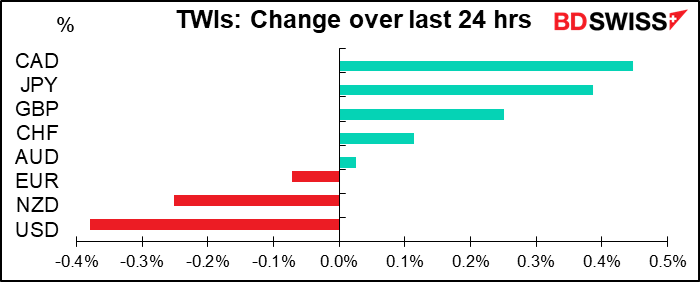

The news was bullish for oil and for CAD. Both Brent and WTI hit their highest level since the pandemic began back in March.

Now with oil perhaps on a firmer tone and the Bank of Canada meeting next week likely to take no new measures, CAD looks poised to gain further, in my humble opinion. But that’s just my view.

Meanwhile, encouraging news about the possibility of some fiscal support for the US economy led to a continued “risk-on” sentiment in the FX market and therefore a weaker dollar. Here’s the latest headline from the Washington Post:

While there isn’t any agreement yet, at least they’re talking and have something to negotiate over. That’s encouraging. But the number of US infections hitting a new record every day and news that Pfizer has cut its 2020 vaccine rollout target in half because of problems in the supply chain hit the stock market and the S&P 500 closed fractionally lower.

Against this background, the strength in JPY mystifies me. Asian stocks are mostly higher this morning, yet JPY is up vs USD and on all the crossrates.

GBP was up on reports that the outline of a Brexit deal could emerge within the next 48 hours, but the latest news is that such hopes are “receding.” I expect GBP to remain volatile indefinitely. It’s conceivable that they don’t come to any agreement before the transition period ends on 1 January and continue negotiating some sort of trade deal even after the UK has crashed out with no deal.

Today’s market

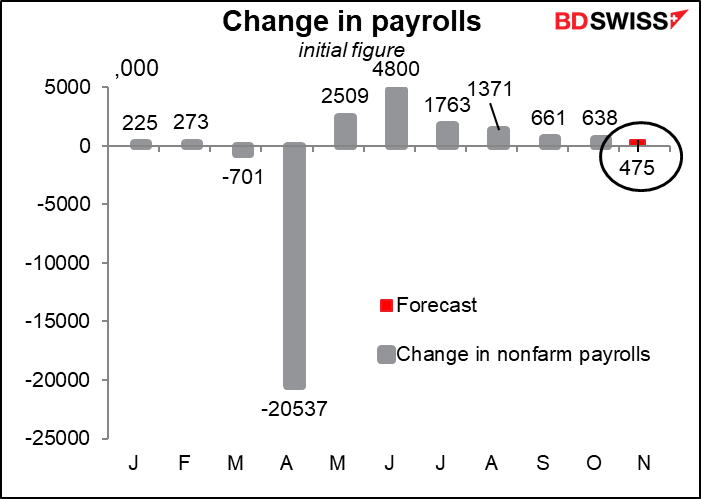

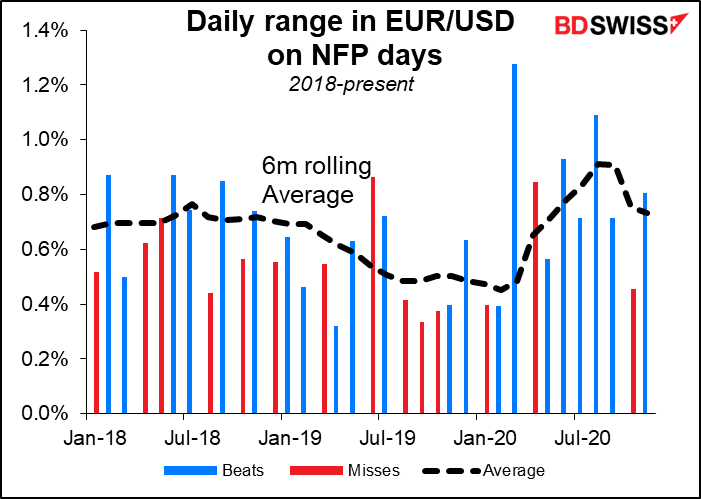

Nonfarm payrolls (NFP) day! Aren’t you excited? I hope so! You might get two minutes of volatility, if you’re lucky.

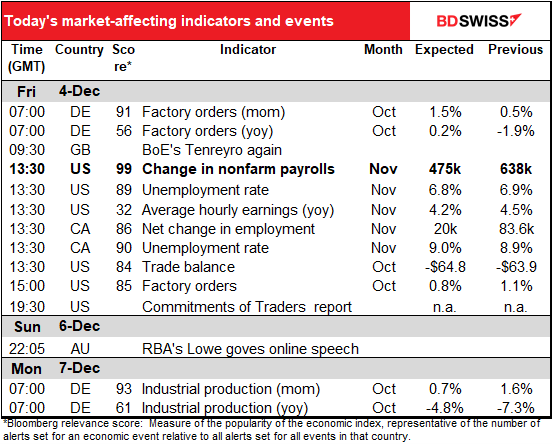

The market has been gradually downgrading its forecasts for the NFP. When I first looked at it last week, economists were estimating +500k. By Tuesday, when I first wrote this comment, they were going for +486k. Now, after Wednesday’s ADP report, which rose by only 307k vs an expected 440k, they’re going for +475k. (One bit of good news on the jobs front: Wednesday’s initial jobless claims fell a greater-than-expected 66k, vs the expected tiny fall of only 3k.) This was the best performance in almost two months.

Recently the NFP haven’t resulted in anything dramatic in terms of trading opportunities. The day’s range isn’t that much different from average regardless of whether the figures beat estimates or miss.

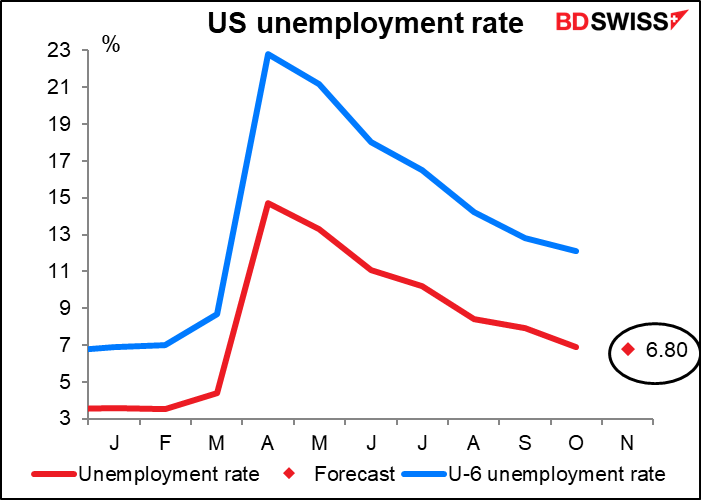

The unemployment rate is only expected to move down a fraction. Even at this extremely high level, it underestimates the real pain in the economy, because the formal definition of “unemployed” doesn’t include people who’d like to work but have given up looking for a job or people who are working only part-time but would like to work full-time. If we include those people back in, we get the U-6 unemployment rate, which at 12.1% is nearly double the official rate of 6.7%. There’s no forecast for this indicator but you might want to keep an eye out for it anyway.

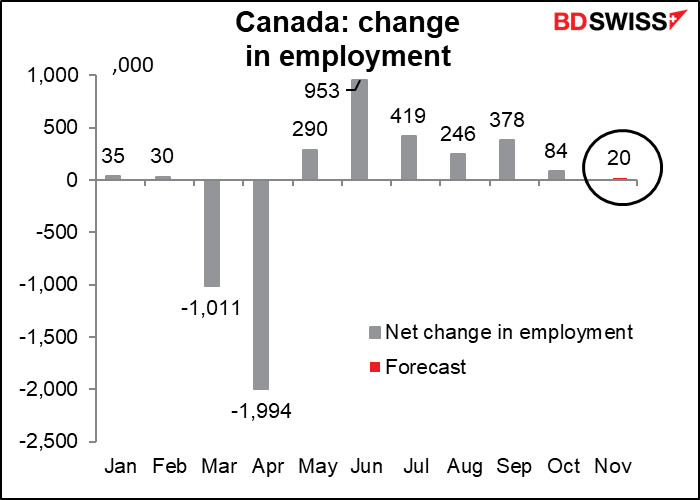

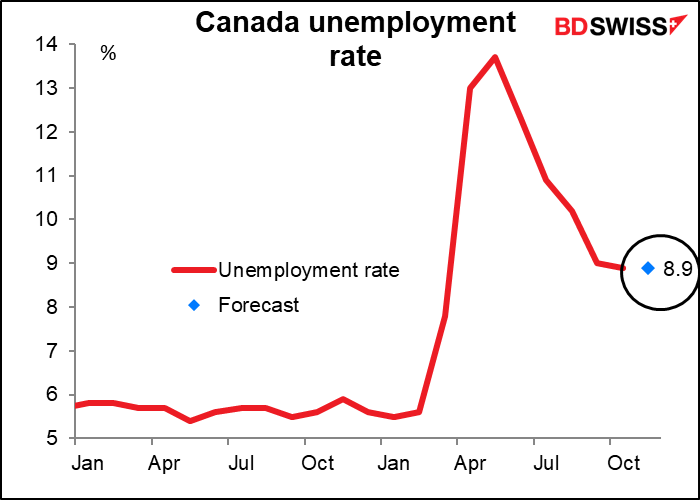

As usual, Canada announces its employment data at the same time. They’re showing the same trend as in the US: the improvement is slowing. This month, employment is expected to be up a mere 20k, which is less than it was even in January and February, when the unemployment rate was 5.5%-5.6%, not 8.9% as it’s expected to be this month.

After that, we have the US trade balance and US factory orders, but I don’t think those are particularly important for USD.

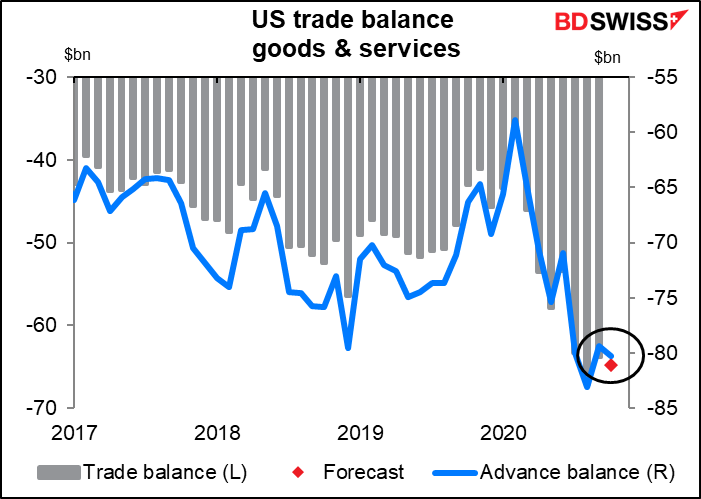

The US trade balance, which used to be politically important for the Trump regime, was quietly dropped many months ago. I haven’t heard any talk in a long time about how he was going to stop all those evil foreigners from winning at America’s expense. So the trade deficit can widen out a bit as expected and honestly, no one will care. The deficit hit a record in August (both for goods alone and for goods & services) and did you hear anything? Was anyone in Washington screaming? Only people who were being forced to wear a mask, as far as I could tell. So today’s figure will probably pass unnoticed, too.

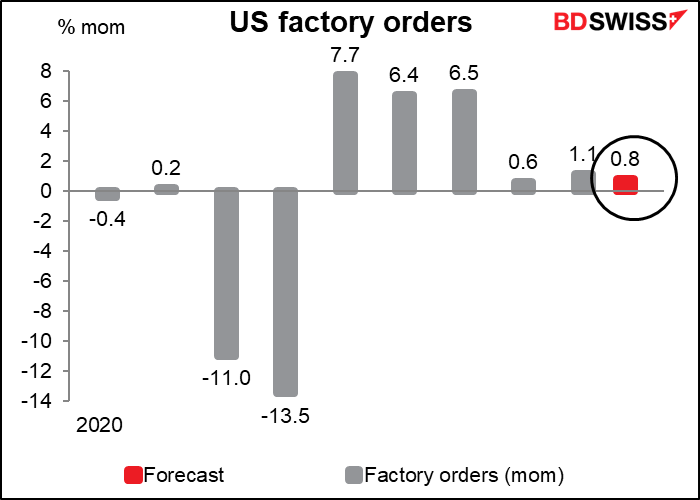

US factory orders have a relatively high Bloomberg relevance score, but they also have a very strong (92%) correlation with the durable goods figure, which was released some time ago, so I don’t think they offer much in the way of a surprise to the market.

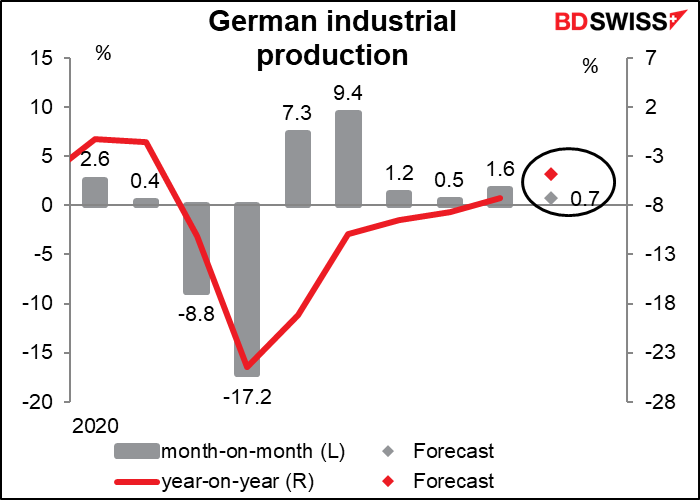

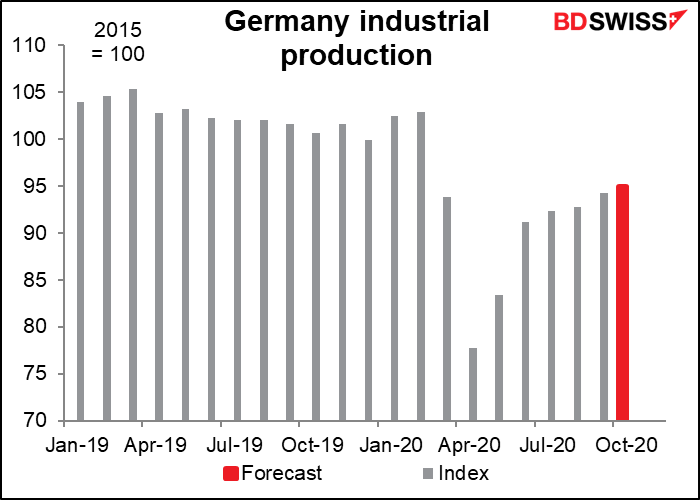

Speaking of factory orders, Monday morning bright and early we get German industrial production, as usual the day after German factory orders. It’s expected to be up only modestly, which would still leave it some 7.5% below pre-pandemic levels. Production seems to be leveling off, which is not a good sign. I’d say this could be negative for the euro.