Previous Trading Day’s Events (07.08.2024)

No relevant data.

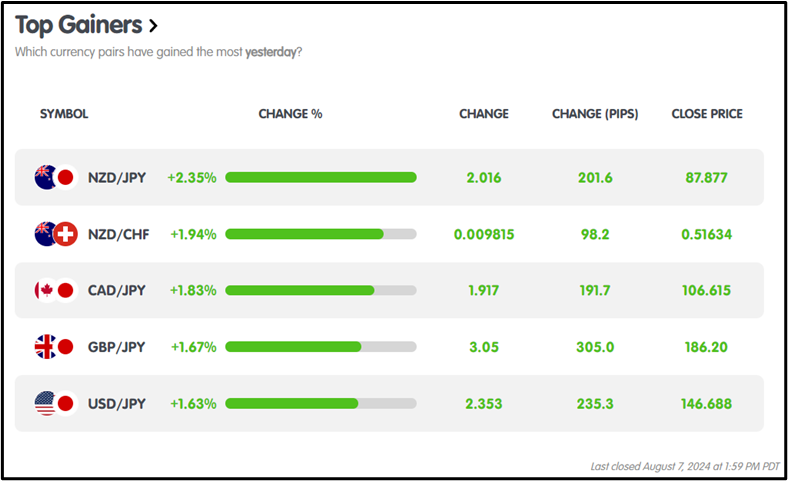

Winners Vs. Losers

On August 7, 2024, NZDJPY led gains with a +2.35% increase, adding 201.6 pips, while EURNZD was the top loser, dropping -0.78% and losing 142.6 pips.

On August 7, 2024, NZDJPY led gains with a +2.35% increase, adding 201.6 pips, while EURNZD was the top loser, dropping -0.78% and losing 142.6 pips.

News Reports Monitor – Previous Trading Day (07.08.2024)

Server Time / Timezone EEST (UTC+03:00)

- Tokyo Session: No relevant data.

- London Session: No relevant data.

- New York Session: No relevant data.

No significant data is to be reported across all trading sessions.

______________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (07.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

EUR/USD showed a bearish trend, opening at 1.09227 and closing slightly lower at 1.09200, with a high of 1.09350 and a low of 1.09040.

CRYPTO MARKETS MONITOR

CRYPTO MARKETS MONITOR

BTCUSD (07.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

BTC/USD displayed a bearish trend, opening at $56,612.82 and closing at $55,124.27, with a high of $57,803.64 and a low of $54,582.99.

STOCKS MARKETS MONITOR

STOCKS MARKETS MONITOR

Walt Disney Company (NYSE: DIS) (07.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

Disney exhibited a bearish trend, opening at $87.07, and closing at $85.94, with a high of $89.27 and a low of $85.76.

EQUITY MARKETS MONITOR

EQUITY MARKETS MONITOR

S&P500 (07.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

The S&P 500 exhibited a bearish trend, opening at $5,223.22 and closing lower at $5,186.93, with a low of $5,186.85 and a high of $5,335.21.

COMMODITIES MARKETS MONITOR

COMMODITIES MARKETS MONITOR

XAUUSD (07.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

XAU/USD showed a bearish trend, opening at $2390.86 and closing at $2382.26, with a low of $2378.09 and a high of $2407.27.

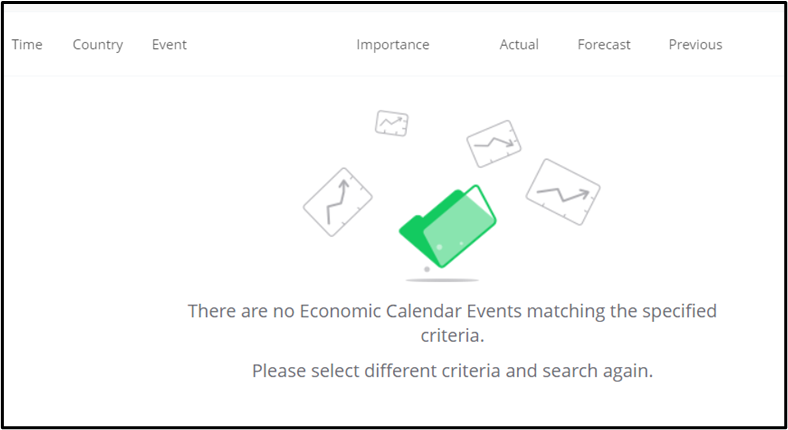

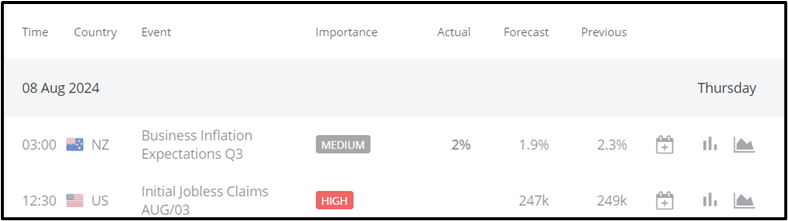

News Reports Monitor – Today Trading Day (08.08.2024)

News Reports Monitor – Today Trading Day (08.08.2024)

- Tokyo Session: New Zealand 2-Year Inflation Expectations fell to 2% in Q3 2024 from 2.30% in Q2 2024.

- London Session: No significant data.

- New York Session: US Initial Jobless Claims increased by 14,000 to 249,000 for the week ending July 27, exceeding the 236,000 market forecast and nearing a yearly high. Today’s forecast is 249K.

New Zealand’s 2-Year Inflation Expectations dropped to 2% from 2.30%. US Initial Jobless Claims rose by 14,000 to 249,000 in the previous release, with a 249K forecast. There is no major data from London.

Sources:

https://marketmilk.babypips.com/

https://km.bdswiss.com/economic-calendar/

https://km.bdswiss.com/economic-calendar/

Metatrader 4 (MT4)