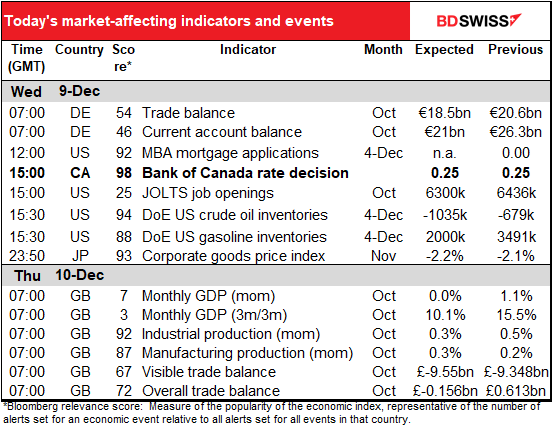

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

Rates as of 05:00 GMT

Market Recap

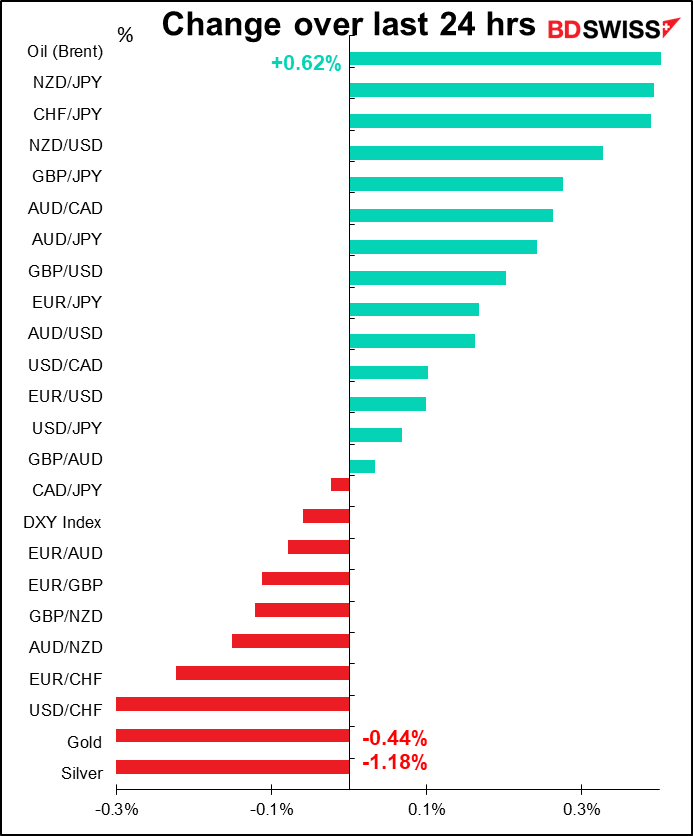

Again, a relatively slow day without any big moves.

I can’t find much explanation for the moves. There doesn’t seem to be anything out there that would’ve pushed up CHF so much – if anything it was generally a “risk-on” day in both the equity and FX markets, as shown by higher commodity currencies and a lower JPY.

The S&P 500 and NASDAQ indices moved further into record-high territory, aided by some progress towards a new fiscal stimulus bill. The White House has proposed a $916bn plan that does not include reviving $300 weekly enhanced unemployment benefits, though it would extend other federal unemployment programs set to expire in the coming weeks. Instead, it would include direct payments of $600 per person, half the amount that the original plan in March included. The Democrats said the cuts to unemployment insurance benefits from a proposed $180bn to $40bn were “unacceptable,” but at least they’re talking, which was more than was going on a few days ago.

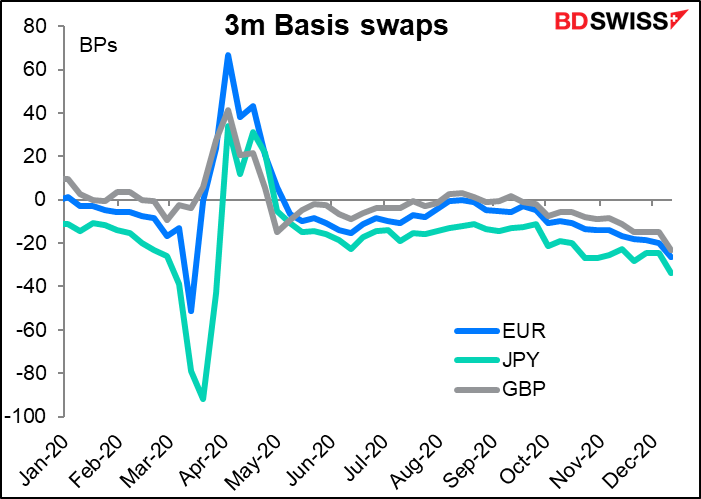

The cross-currency basis swap for EUR/USD and several other crosses are turning increasingly negative, a sign that USD funding needs have increased ahead of the year-end turn. The increasing cost of borrowing USD does not seem to be severe enough to affect the market yet, but it could begin to support the dollar if it increases further. The EUR/USD 3m basis fell to -27bp on Tuesday from around -18bp at the end of November. At this level, the availability of USD is still ample relative to prior year-end-turns (it averaged -17 during the same week of December 2019). It’s nowhere near the peak liquidity crunch in March, when the EUR basis traded at -82 on one day.

GBP rose on a headline that seemed to suggest an agreement had been reached between the UK and EU. In fact, it was just an agreement in principle regarding the Irish border and Britain’s Internal Market Bill and not a sign of overall agreement. On the contrary, EU chief negotiator Barnier told a meeting of the bloc’s ministers that he believed a no-deal scenario was now more likely than an agreement, according to Reuters.

It’s all coming down to tonight: UK PM Johnson will meet European Commission President von der Leyen for dinner in Brussels to try to close the gaps that their negotiators have struggled with for months. It’s rather ironic though. Going into this dinner, Johnson knows whether he’ll accept the EU’s deal or not. Thus there really isn’t any need for the meeting. It’s just theater that will allow him to claim victory, attribute blame, or somehow mask his capitulation.

I’m of two minds, unfortunately. On the one hand, I think Johnson needs a win. Given the problems that the UK economy faces because of the virus and the insufficient planning for Brexit, adding a “no-deal” Brexit on top of that would just be too disastrous. That’s why I think he will give in so long as some face-saving agreement can be cobbled together.

On the other hand, I think he and his colleagues thought all along that since the EU exports more to Britain than Britain does to the EU, that the EU would want a deal more than Britain does. However, as one unnamed EU source said recently, “I’m not sure London has grasped the extent to which a number of member states, even ones normally sympathetic to the UK, are now looking at no deal. There’s quite a bit of momentum to no deal.” To make matters worse, probably the EU hasn’t grasped the extent to which the ideologues in London are comfortable with no-deal, either. Both sides could be walking blindly towards a conclusion that neither really wants.

As one wag on Twitter said, “All these people saying a Brexit deal is a 50:50 chance – they’re going to be proven right, aren’t they?”

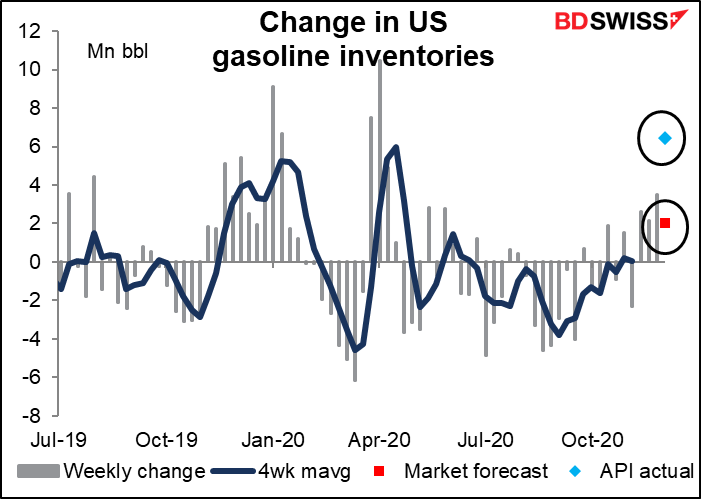

CAD weakened as Canadian bond yields fell ahead of today’s Bank of Canada meeting and oil prices fell on higher-than-expected crude oil and gasoline inventories in the US (see below).

Today’s market

We discussed – and dismissed – the German trade data yesterday. In any event, the results are out already: better than expected.

No forecasts for the weekly US Mortgage Bankers’ Association (MBA) mortgage application data. The figure had been far above normal for many months, but recently it’s started to come back to earth. The housing market seems strong, but this sudden fall in applications may be a sign of weakness in coming months.

I discussed the Bank of Canada meeting in my Weekly Outlook, but since there isn’t much to say I’ll just repeat most of it here. I expect that they’ll simply review how the changes that they made to their operations in October are going and comment on recent developments in the economy. The overnight rate will probably stay at the Effective Lower Bound (ELB) of 0.25% and the quantitative easing (QE) program at a minimum of CAD 4bn a week, with no further changes to the maturity composition of purchases. I would also expect them to repeat their statement from October that they do not anticipate raising the policy rate “until into 2023.” Net net, I anticipate an uneventful meeting with little impact on the market.

The Job Openings and Labor Turnover Survey (JOLTS) report has fallen out of favor, but now that former Fed Chair Janet Yellen is coming back on the scene as US Treasury Secretary, maybe this indicator – one of her favorites – will make a comeback, too. It’s expected to show a small drop in the number of job openings in October, which is a shame because there’s still an awful lot of people looking for jobs.

The number of job openings was higher than the number of unemployed persons for a few happy years there, but now there’s a huge gap. Admittedly though the gap was larger immediately following the Global Financial Crisis in 2008/09, so it has been worse.

What I worry about now is the mismatch between jobs & the unemployed. As the table below shows, from March to September there were four people laid off for every job opening in retail in September and 9.5 people laid off for every job in hotels, restaurants & bars. By comparison, white-collar occupations such as finance and insurance or health care were not so badly affected (although real estate and education were). It’s not going to be possible to retrain all those food service and hotel workers to work in, say, finance and insurance or health care. If a lot of restaurants & bars close permanently, which looks to be the case, then many of these people will struggle to find a job again.

The American Petroleum Institute (API) reported a 1.14mn barrel increase in crude oil inventories yesterday, vs the -1.0mn bbl decline that the market is expecting for today’s Department of Energy figures. Gasoline inventories too rose a larger-than-expected 6.44mn bbl, according to the API, vs the 2.0mn bbl increase that the market was expecting. The API and Dept of Energy crude oil inventory figures often don’t match on a week-to-week basis, but averaged over a month or two they’re pretty much the same.

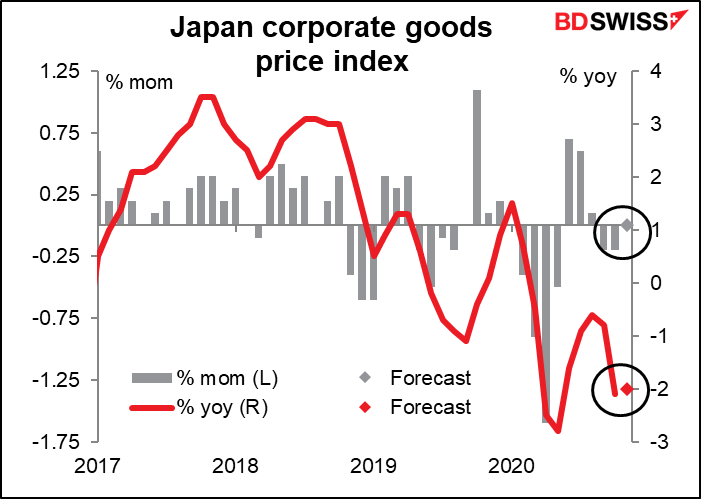

Overnight, Japan releases the corporate goods price index. I include it because it has a high Bloomberg relevance index, but that’s because of its importance for the equity market. I don’t think it’s especially important for FX. It can move the stock market though, because prices for the goods companies buy help to determine corporate profit margins. Movements in the stock market can then influence the FX market, although the chain is rather flimsy by this point.

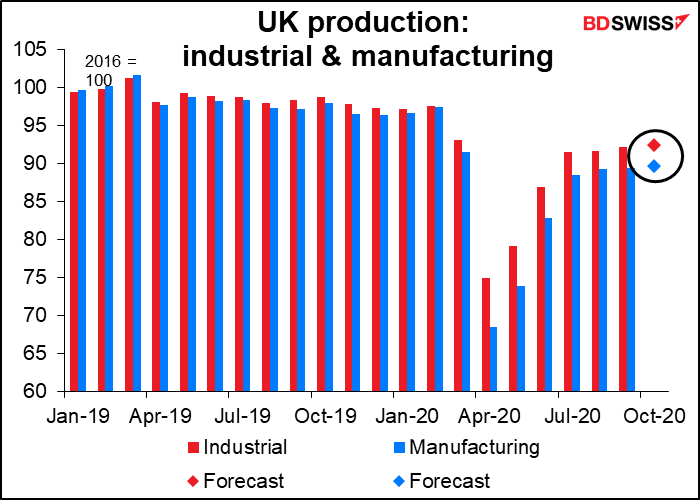

Then early in the European day, almost an hour before sunrise (which will be at 07:55 GMT), Britain announces its basket of short-term economic indicators, including the monthly GDP, industrial & manufacturing production, and the trade balance. They’re all forecast to be negative for the pound.

I think the monthly GDP is the most important, even if it doesn’t rank highest in the Bloomberg relevance score. When I looked at this on Friday for my Weekly Outlook the forecast was for a small decline in GDP, which I thought was reasonable as partial lockdown was reimposed in parts of the country during the month. However that’s since been revised to a small increase. Either way, GDP is likely to decline in November, as the lockdown continued.

I think the figures may cause a temporary flutter in GBP, but they’re only for one month in the past – the Brexit negotiations will affect the country’s economy for months and months ahead. Good or bad news on Brexit would therefore counter bad or good news on GDP.

Industrial & manufacturing production are both expected to be up by 0.3% mom, so it may look like there’s only one dot there, but I guarantee you there are two. It’s going to be really bad if all my graphs are going to look like this for the next several years, until 2020 drops out.

Looking at the expected level of the indices, IP is expected to be 5.2% below the pre-pandemic level while manufacturing alone is forecast to be -7.6%. These are only a slight improvement from the previous month, barely worth mentioning. It looks like industrial & manufacturing output has stagnated. Not a good sign! GBP-negative

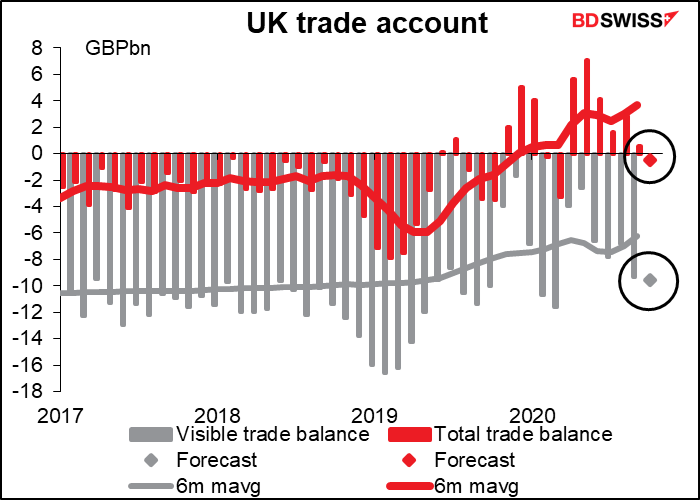

The UK trade account is expected to worsen, too. The visible trade balance is expected to sink deeper into deficit, dragging the total trade balance into deficit as well. That makes three out of three that are likely to be negative for the pound.