PREVIOUS TRADING DAY EVENTS – 17 April 2023

Announcements:

- The Federal Reserve Bank of New York’s general business conditions index jumped over 35 points to 10.8 this month. New York state manufacturing activity unexpectedly expanded in April for the first time in five months.

Economists had expected a reading of negative 15, according to a survey by the Wall Street Journal. Any reading above zero indicates improving conditions. This is the first reading in positive territory in five months.

USD appreciated at the time of the release.

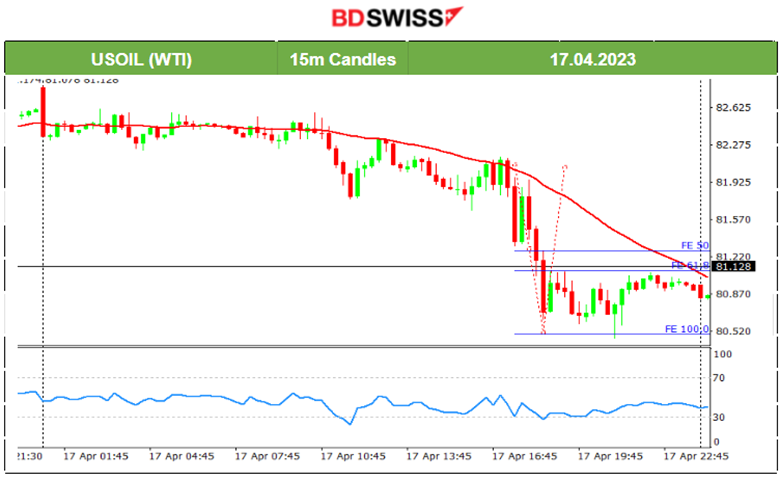

- In March, OPEC+ including Russia announced supply cuts for oil. That caused market turmoil with surging prices. It seems that Russia’s exports are currently increasing as flows from Russian ports rose by 540,000 barrels a day, climbing back above 3 million barrels a day, in the latest four-week period, according to tanker-tracking data compiled by Bloomberg.

Output was indeed cut for a while but the increase in flows last week shows that the size of the output reduction is rather minimal or short-lived.

Crude flows in the week to April 14 rose by 540,000 barrels a day from the previous week to 3.43 million barrels a day. On a four-week average basis, overall seaborne exports increased by 50,000 barrels a day to 3.39 million barrels a day.

The price of Crude has experienced a decline since the 13th of April, from 83.4 USD to 81.08 USD (currently).

______________________________________________________________________

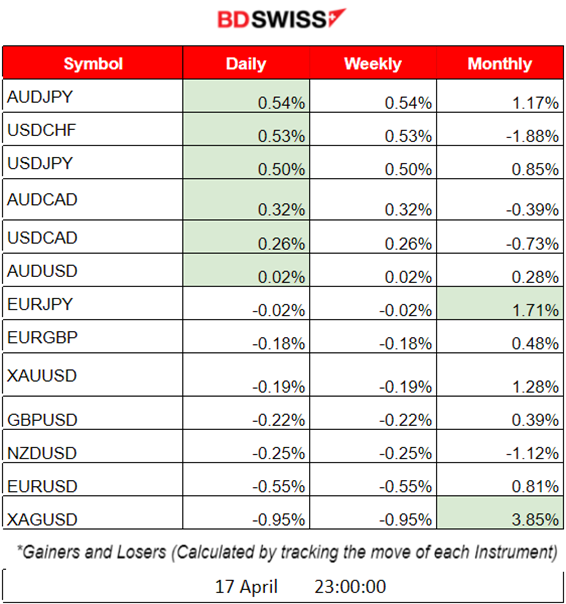

Summary Daily Moves – Winners vs Losers (17 April 2023)

- The USD appreciated due to the New York Fed’s Empire State business conditions index figure release at 15:30. Most winners are USD pairs with USD as base currency. However, AUDJPY is on the top with a 0.54% change for the day.

- This month, Silver and EURJPY are on the top so far with 3.85% and 1.71% respectively.

______________________________________________________________________

News Reports Monitor – Previous Trading Day (17 April 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No significant news announcements and no important scheduled releases.

- Morning – Day Session (European)

At 15:30, it was reported that the New York Fed’s Empire State business conditions index, a gauge of manufacturing activity in the state, jumped 35.4 points in April to 10.8. Any reading above zero indicates improving conditions. This is the first reading in positive territory in five months.

This figure caused a shock at that time for the USD pairs, as it led to USD intraday appreciation. At that time EURUSD dropped, having more than 60 pips deviation from the mean, and later retracement followed.

General Verdict:

- Low market volatility for most majors except the USD pairs.

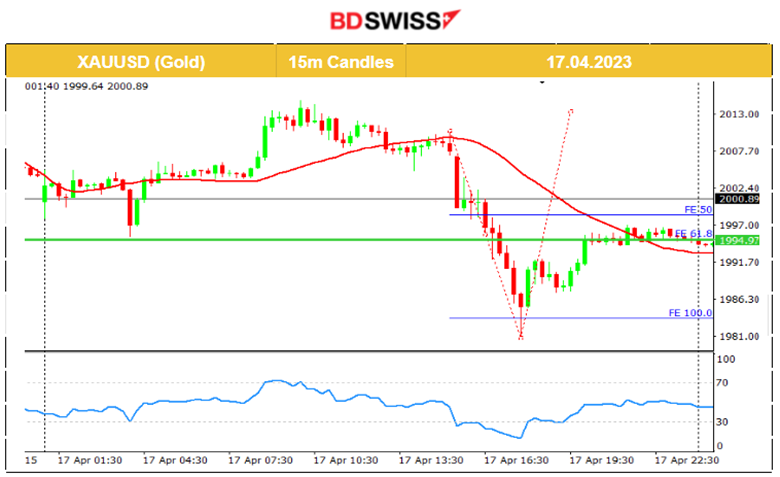

- Oil and Gold dropped while stocks remain stable.

______________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (17.04.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair moved around the mean at the beginning of the trading day but at 15:30 it dropped more than 60 pips due to the figure release of the Empire State business conditions index. The USD appreciated at that time. The pair after finding support retraced back to the 30-period MA.

Trading Opportunities

A retracement took place after the rapid movement downwards due to the released figures. The Fibonacci Expansion tool helps in identifying the level at which the price will at least come back. As per the chart, it is FE 61.8.

____________________________________________________________________

EQUITY MARKETS MONITOR

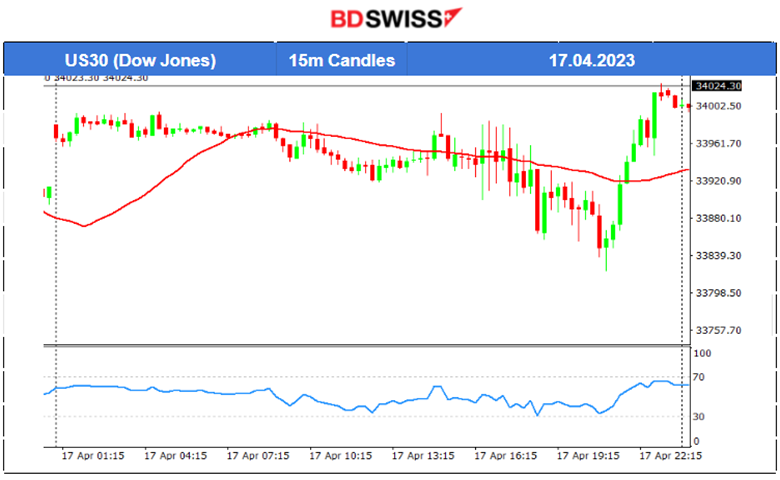

US30 (Dow Jones) (17.04.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The index has experienced high volatility and strong resistance against dropping recently. During the announcements of U.S.-related figures at around 15:30, the index found both strong resistance and support levels moving eventually sideways. At 21:00 it eventually reversed and crossed the 30-period MA moving upwards and ending the trading day higher.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) (17.04.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The price of Crude moved with low volatility during the Asian session as usual and started to get more volatile with the European Markets opening. It was moving below the 30-period MA in general when after 15:30 it showed strong downward movement and eventually found resistance at 80.5 USD. Retracement followed.

Trading Opportunities

The Fibonacci Expansion tool helps in identifying the level at which the price will at least come back. As per the chart, it is FE 61.8.

XAUUSD (Gold) (17.04.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold has no clear direction as it moves around the mean. At first, it was above the 30-period MA and after the European Markets opening it moved below it. After 15:30 it was affected by the U.S.-related figure release that caused USD appreciation leading to a XAUUSD drop. Retracement followed.

______________________________________________________________

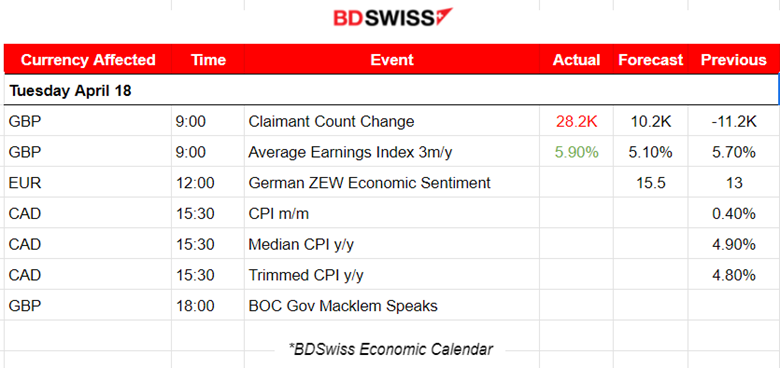

News Reports Monitor – Today Trading Day (18 April 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No significant news announcements and no important scheduled releases.

- Morning – Day Session (European)

The U.K. Claimant Count Change measuring the number of people claiming unemployment-related benefits during the previous month was released at 9:00 along with the average earnings figure and unemployment rate. The latter was reported at 3.8%, causing the GBP to appreciate and a short intraday shock to happen for the GBP pairs.

Inflation-related figures for Canada are released at 15:30 and are probably going to cause intraday shocks to CAD pairs. Retracement opportunities might follow but analysis of the markets will be difficult since the BOC governor will give a speech at 18:00 and which might cause too much uncertainty regarding CAD/pairs direction.

General Verdict:

- Volatility is higher than usual for all FX pairs. GBP has already been affected this morning by job data.

- CAD inflation will have a great impact on related pairs and future decision-making by BOC.

______________________________________________________________