In a July 31, 2024 press release, NVIDIA (NASDAQ: NVDA) announced a Q2 FY25 earnings call for today, August 28 at 2 p.m. PT / 5 p.m. ET / 9 p.m. GMT, live-streamed on investor.nvidia.com. The call includes prepared remarks followed by a Q&A with financial analysts. CFO Colette Kress’s written commentary will be available after the results are released at 1:20 p.m. PT. The webcast replay will be accessible until the Q3 FY25 earnings call.

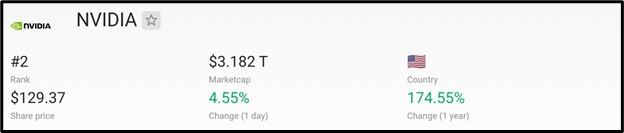

Market Cap

$3.182 trillion marks NVIDIA’s market cap as of August 2024, solidifying its position as the world’s second most valuable company, based on data from companiesmarketcap.com.

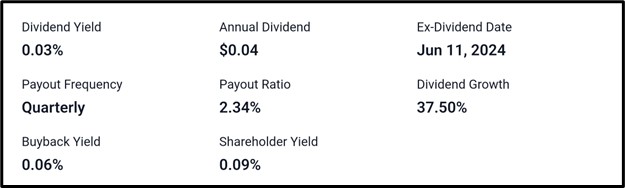

Dividend Information

With a dividend yield of 0.03% and an annual payout of $0.04, the stock boasts a payout ratio of 2.34%, distributed quarterly. Backed by 37.5% dividend growth, and a shareholder yield of 0.09%, the stock demonstrates a steady capital return strategy, with a notable buyback yield of 0.06%. The ex-dividend date was June 11, 2024.

Recent Development At Nvidia

Here are some of the most recent updates from Nvidia :

NVIDIA launches compact language model with cutting-edge precision.

India leverages NVIDIA’s accelerated computing to streamline toll traffic.

NVIDIA debuts an on-device language model to enhance game character interactions.

NVIDIA’s latest research advances weather forecasting and climate simulations.

$60,000 NVIDIA Graduate Fellowships are now open for applications.

Q1 FY25 Earnings Report Recap

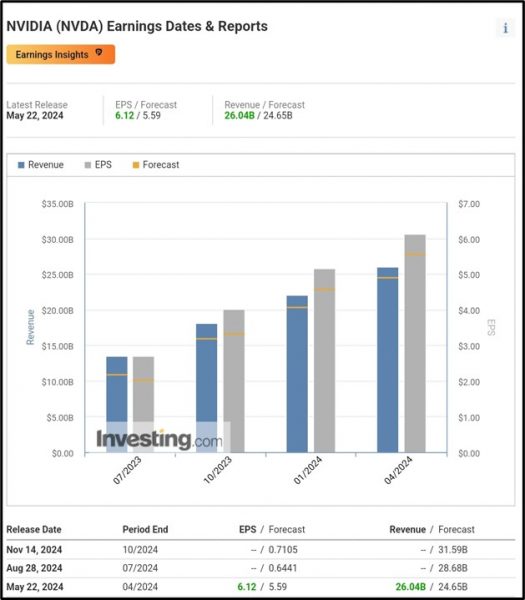

Revenue surged by 262% YoY to $26.04B, showing strong upside momentum across both GAAP and Non-GAAP.

Gross margin expanded by 13.8 percentage points YoY, reflecting a solid boost in profitability to 78.4%.

Operating income skyrocketed by 690% YoY to $16.91B, with Q/Q growth of 24%, underscoring exceptional operational leverage.

Diluted EPS exploded by 629% YoY to $5.98, marking significant earnings acceleration and investor return potential.

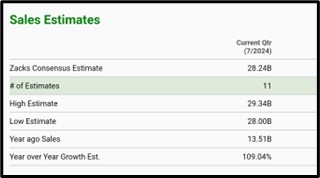

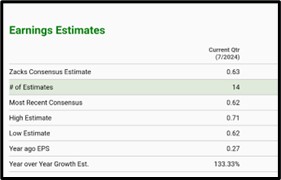

Q2 FY25 Earnings Analyst Forecast

For the current quarter, the Zacks consensus EPS estimate stands at $0.63 with 14 estimates, reflecting a 133.33% YoY growth. In contrast, sales estimates project revenue of $28.24 billion across 11 estimates, marking a 109.04% YoY growth, with a range between $28B and $29.34B.

According to Investing.com, NVIDIA projects its EPS to hit $0.64 and revenue to land at $28.68B

According to TradingView, Nvidia projects an EPS of $0.65 alongside forecasted revenue of $28.72B

According to TradingView, Nvidia projects an EPS of $0.65 alongside forecasted revenue of $28.72B

Technical Analysis

Nvidia shows potential uptrendline rejection at $131.16 on the 1-hour chart.

If rejection holds, target prices could rise to $142.18 and $156.19.

If rejection fails, the price could drop to $122.49 and $115.69.

Apply Risk Management

Conclusion

NVIDIA’s Q1 FY25 results demonstrated exceptional performance with a 262% YoY revenue increase to $26.04B, a 690% rise in operating income, and a 629% jump in diluted EPS. For Q2 FY25, analysts forecast EPS of $0.63-$0.65 and revenue of $28.24B-$28.72B, reflecting continued robust growth. Technical analysis suggests potential price movements with resistance at $131.16, targeting $142.18 and $156.19 if the uptrend holds, or declines to $122.49 and $115.69 if it fails.

Sources :

https://companiesmarketcap.com/nvidia/marketcap/

https://stockanalysis.com/stocks/nvda/dividend/

https://images.app.goo.gl/tBnTdas6MiyJjV8p8

https://blogs.nvidia.com/blog/mistral-nemo-minitron-8b-small-language-model/

https://blogs.nvidia.com/blog/calsoft-metropolis-tollbooths/

https://blogs.nvidia.com/blog/digital-human-technology-mecha-break/

https://blogs.nvidia.com/blog/stormcast-generative-ai-weather-prediction/

https://blogs.nvidia.com/blog/applications-open-graduate-fellowship-awards-2024/

https://www.zacks.com/stock/quote/NVDA/detailed-earning-estimates