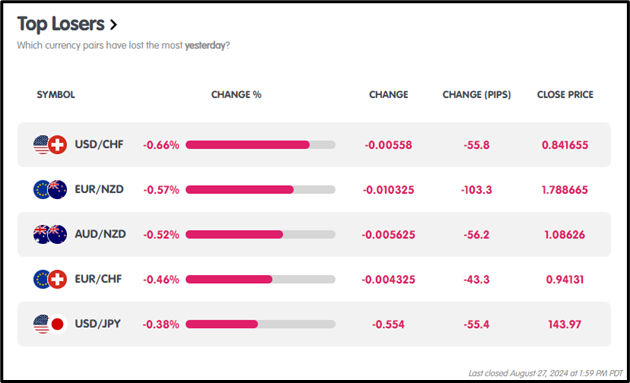

Previous Trading Day’s Events (27.08.2024)

US Consumer Confidence: August composite index at 103.3, surpassing the forecast of 100.9.

US Richmond Fed Manufacturing Index: August index drops to -19 from -17, marking the steepest decline since May 2020.

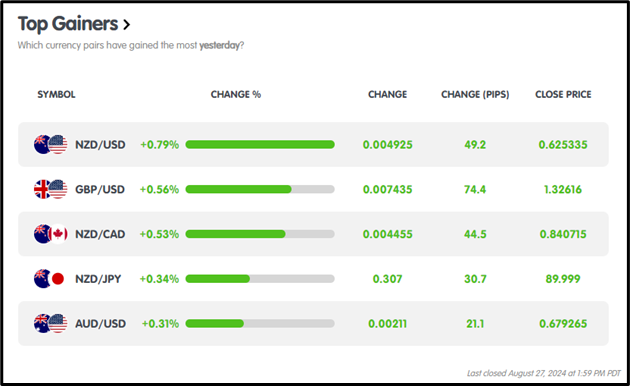

Winners Vs Losers In The Forex Market

On 27 August 2024, NZDUSD led the forex market with a +0.79% rise, gaining 49.2 pips, while USDCHF was the biggest loser, dropping -0.66% with a loss of 55.8 pips.

News Reports Monitor – Previous Trading Day (27.08.2024)

Server Time / Timezone EEST (UTC+03:00)

Tokyo Session: No significant news.

London Session: No significant news.

New York Session:

U.S Consumer Confidence: Bearish USD. 103.3 actual vs. 100.9 forecast;

Richmond Fed Manufacturing Index: USD bearish. -19, the sharpest drop since May 2020;

General Verdict :

FOREX MARKETS MONITOR

EURUSD (27.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

EURUSD displayed a bullish trend, opening at 1.11561 and closing at 1.11838, with a daily high of 1.11901 and a low of 1.11481.

CRYPTO MARKETS MONITOR

CRYPTO MARKETS MONITOR

BTCUSD (27.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

BTCUSD showed a bearish trend, opening at $63,480.18 and closing lower at $61,814.19, with a $63,480.20 high and $61,407.85 low.

STOCKS MARKETS MONITOR

STOCKS MARKETS MONITOR

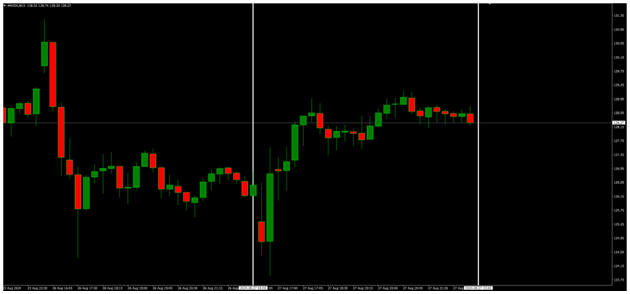

NVIDIA (27.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

Nvidia exhibited a bullish trend, opening at $125.39 and closing at $128.27, with an intraday high of $129.19 and a low of $123.88.

INDICES MARKETS MONITOR

INDICES MARKETS MONITOR

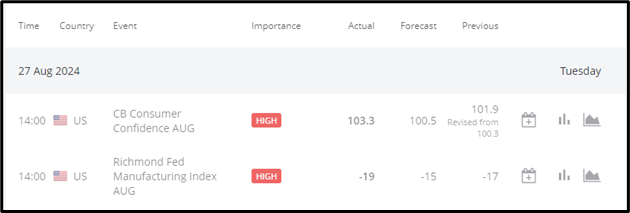

US30 (27.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

US30 showed a bullish trend, opening at 41,245.00 points, closing at 41,309.65 points, with an intraday high of 41,335.28 points and a low of 41,120.48 points.

COMMODITIES MARKETS MONITOR

COMMODITIES MARKETS MONITOR

USOIL (27.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

USOIL traded bearish, opening at $76.691 and closing lower at $75.287, with a daily low of $74.943 and a high of $76.985.

News Reports Monitor – Today Trading Day (28.08.2024)

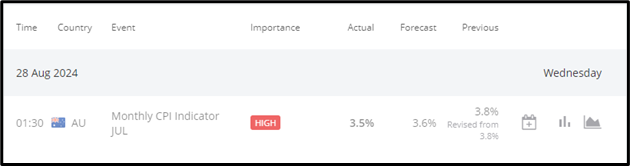

Tokyo Session: Bullish AUD at 1:30 am GMT; CPI at +3.5%, above 3.4% consensus.

London Session: No Significant News

New York Session: No Significant News

Sources :

https://www.conference-board.org/

https://km.bdswiss.com/economic-calendar/

Metatrader 4 ( MT4 )