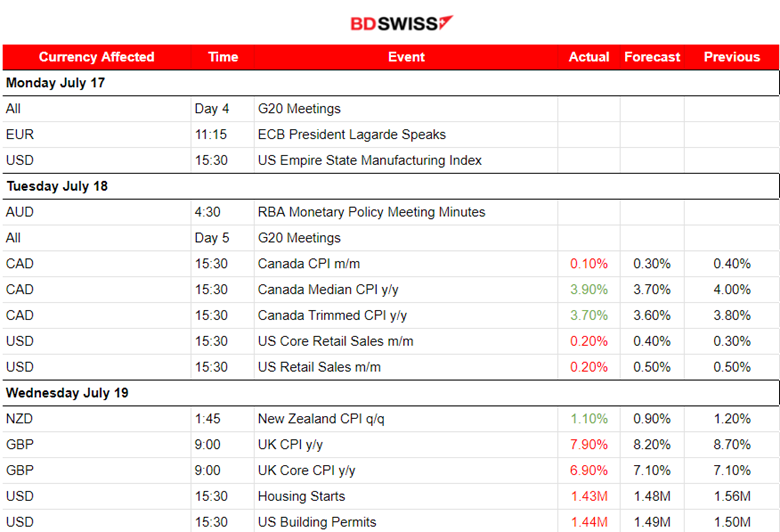

PREVIOUS WEEK’S EVENTS (Week 17-21 July 2023)

Announcements:

U.S. Economy

The measure of New York state factory activity, the Federal Reserve Bank of New York’s general business conditions index decreased 5.5 points to 1.1. This negative reading was higher than expected, at -3.5. The actual was above zero, signalling that the New York manufacturing sector is growing.

The report showed manufacturers added workers after five months of paring payrolls.

The U.S. Retail Sales figures showed a less-than-expected increase in June. The data suggests consumer resilience, though slowing momentum in spending growth. Consumer spending is still signalling that the Fed has more work to do with rates. It remained strong despite frequent and high-interest-rate hikes from the Fed since March 2022. A tight labour market continues to boost wages while consumers’ purchasing power is slowly rising as inflation drops.

U.S. Unemployment Claims were reported less than expected, at 228K, a decrease of 9,000 from the previous week’s unrevised level of 237K. This is the second straight weekly decline in claims reported by the Labour Department. The data suggests that the economy is preventing a recession this year. No recession was recorded so far with not too many people losing their jobs.

The U.S. Central Bank is expected to resume hiking rates next Wednesday, the 26th of July, after skipping an increase in June. The Fed has raised its policy rate by 500 basis points since March 2022.

Australia Economy

Australia’s Employment Data release shows that employment increased significantly, beating expectations for the second month straight in June, while the jobless rate stayed near 50-year lows at 3.5%, adding to the probability of further interest rate hikes. The unemployment rate was recorded at 3.5%, whereas analysts had expected 3.6%.

The Reserve Bank of Australia (RBA) has lifted interest rates by 400 basis points to an 11-year high of 4.1% in just 14 months. However, the Labour Market is still hot, which raises concerns. Incoming RBA Governor Michele Bullock said that the jobless rate would need to rise to about 4.5% in order to have an important impact on inflation.

U.K. Economy

The U.K. Retail Sales are estimated to have risen by 0.7% in June 2023. The reported figures were higher than expected in June despite continued high inflation. Inflation is near 8%, which is the highest of any large economy.

Some analysts think the economy is heading into a recession in the second half of this year.

Canada Economy

Canada’s Retail Sales figures were reported lower than expected in May and the Core Retail Sales figures — which exclude gasoline stations, fuel vendors, motor vehicle and parts dealers — were unchanged in May, suggesting a slowdown in economic growth that would allow the Bank of Canada (BOC) to leave interest rates unchanged.

The data suggests that the economy is slowing, in line with the Bank of Canada’s forecasts, reducing the chance for more future hikes. This month, BOC hiked its policy rate to a 22-year high of 5.0%, its tenth-rate increase since March last year.

The BOC has projected inflation to remain around 3% over the next year before dropping to the central bank’s 2% target by mid-2025.

_____________________________________________________________________________________________

Inflation

New Zealand: New Zealand’s quarterly CPI change grew 1.1%, slightly above the expectations of a 0.90% increase. Expectations shift towards the idea that the Reserve Bank of New Zealand (RBNZ) would hike interest rates further despite signalling a pause earlier this month.

Inflation might have retreated from the 7.2% high since last year but still remains well above the RBNZ’s 1% to 3% target range.

U.K.: The release of the U.K.’s low Inflation figures has shaken the market as they finally suggest that hikes have the desired effect on inflation. Inflation was recorded at 7.9% but still well above the Bank of England’s (BOE) 2% target.

Anticipation of yet further rate hikes from the Bank of England caused the GBP to appreciate recently. This slower CPI change though is not enough to cause a change in policy. The BOE has a long way to go still.

Canada: Canada’s Consumer Price Index (CPI) monthly figure showed an increase of just 0.10%. Overall, it rose 2.8% year-over-year in June. The forecast inflation figure was to drop to 3.0% from 3.4% in May. Stickier and more persistent core measures in inflation are recorded though.

The average of two of the Bank of Canada’s (BoC) core measures of underlying inflation, CPI-median and CPI-trim, came in at 3.8% compared with 3.9% in May.

Last week, the Bank of Canada raised rates to a 22-year high of 5.0%, its tenth-rate increase since last March and expects inflation to remain around 3% over the next year before dropping to the bank’s 2% target by mid-2025.

_____________________________________________________________________________________________

https://www.reuters.com/world/uk/view-uk-inflation-cools-june-pound-drops-2023-07-19/

https://www.reuters.com/world/uk/british-retail-sales-rise-07-june-2023-07-21/

https://www.reuters.com/world/us/us-weekly-jobless-claims-unexpectedly-fall-2023-07-20/

https://www.reuters.com/markets/us/new-york-factory-activity-rebounds-april-ny-fed-2023-04-17/

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases (17-21 July 2023)

____________________________________________________________________________________

FOREX MARKETS MONITOR

DXY (US Dollar Index)

The Dollar significantly strengthened last week. After the labour data release this month, such as the NFP report on July 7th 2023, the market reacted with a depreciation of the Dollar which had a lasting effect. The Dollar started depreciating heavily against other currencies starting from the 7th until the 14th of July. Then, a period of consolidation followed, as per the DXY, until the 19th of July, when the DXY started to climb. The 26th of July is near and the Fed is expected to increase the Fed rate by 25 basis points.

EURUSD

The pair has moved below the 30-period MA and continued the downward movement steadily as the USD gained strength. Obviously driven by the USD, it moved more and more to the downside despite, the fact that the RSI is showing higher lows, signalling a bullish divergence. Rate decisions on the 26th (FED) and the 27th (ECB) will shake the markets in unpredictable ways, especially if there are surprises.

USDCAD

This pair was moving downwards since the 18th of July, even when having the USD as the base currency. That is probably because the Bank of Canada has increased the overnight rate by 25 basis points causing the CAD to appreciate. In addition, on the 18th of July, some important inflation-related data for Canada were reported higher than expected which might have pushed the USDCAD further downwards. On the 20th of July, the pair reversed, crossed the 30-period MA on its way up and remained on the upside. Unemployment claims figures for the U.S. that day were reported lower than expected but still high causing USD appreciation and a jump of the pair. Retail Sales for Canada the next day, 21st July were reported lower than expected, causing also a jump as CAD depreciated.

_____________________________________________________________________________________________

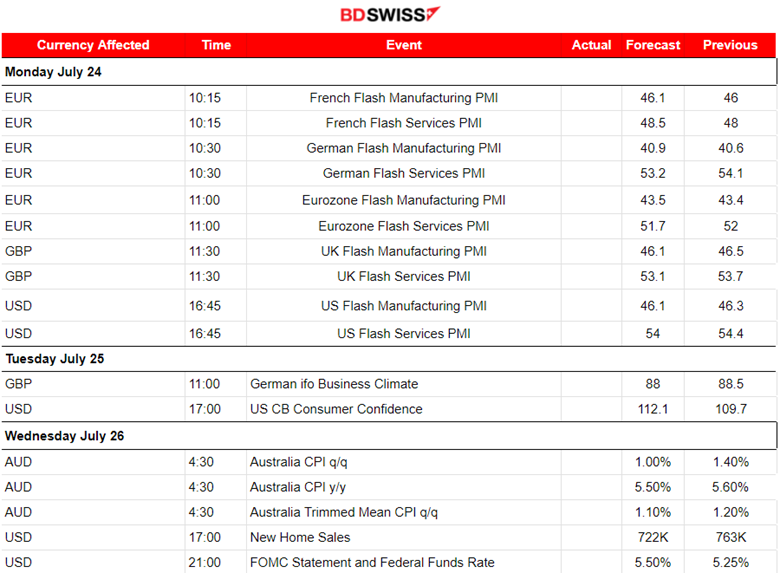

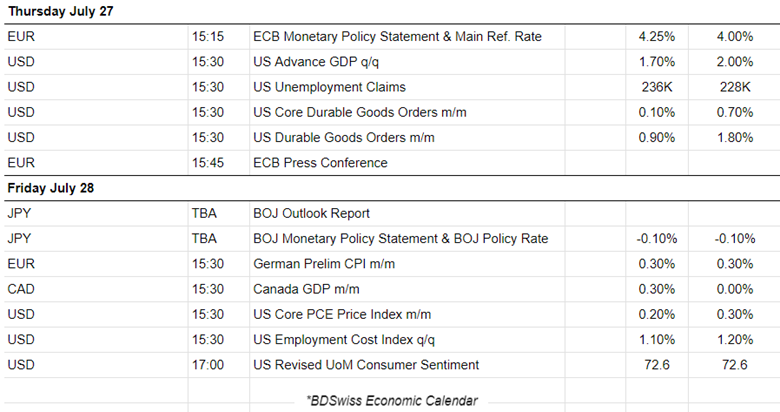

NEXT WEEK’S EVENTS (24-28 July 2023)

Monday starts with PMI releases for both the Manufacturing and Services sectors for major regions.

On Wednesday, the 26th of July, we have many important scheduled releases, such as Australia’s inflation figures, FOMC statement and Federal Funds Rate. The decision for rates from ECB will take place the next day, the 27th of July.

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

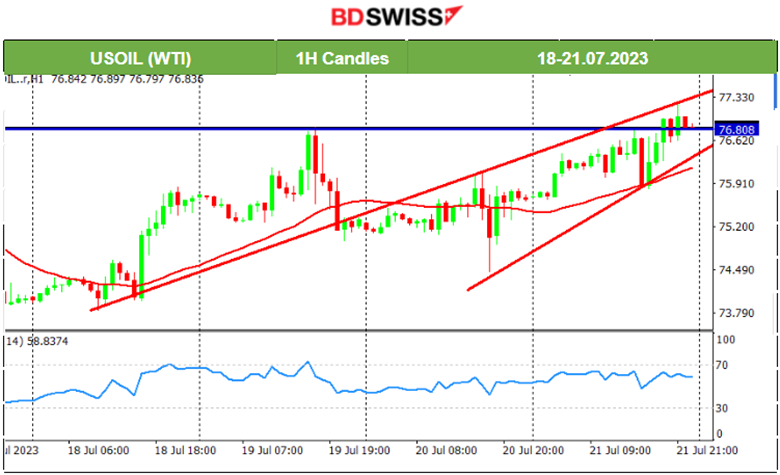

U.S. Crude Oil

We can identify the breakout of the important resistance near 76.80 USD/b. The market has not pushed the price rapidly upwards. Resistance to the upside is apparent. An upward wedge is visible, as Crude continues the upward movement steadily with lower volatility as days pass. It is currently moving above the 30-period MA as it is on a short-term uptrend. Considering the recent path, it is not expected that we will see high deviations from the mean, at least until the Fed’s Rate Decision on Wednesday, 26th of July.

Gold (XAUUSD)

Gold eventually reversed downwards rapidly on the 20th of July, moving out of consolation, breaking the support levels near 1971 USD/oz and crossing the 30-period MA on its way down. The Dollar is currently gaining strength and that is a major driving factor. The downward movement continued while the index was below the MA the next day as well, on the 21st of July, and remained on that path. The RSI shows signs of bullish divergence with higher highs. Will this be enough to safely forecast a reversal to the upside? Let’s see.

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX)

Price Movement

On the 19th, the index moved early upwards but during the N. American Session, it dropped heavily, some time after the NYSE opening. On the 20th of July, the index fell surprisingly fast, especially after the start of the European session. After the reversal, on the 21st of July, the index retraced but it now keeps testing the next support levels. If the important supports near a 15429 USD/oz break, then it is expected that it could dive to 15390 USD at least. The RSI, though, shows a slowdown and signals bullish divergence.

______________________________________________________________