Previous Trading Day’s Events (05 Jan 2024)

“Despite two months of downward revisions in the payroll numbers, this report suggests that with the unemployment rate remaining at 3.7% and hourly wages continuing to surprise to the upside, the economic backdrop is solid and provides a strong cushion for continued consumer spending. The probability of an interest rate cut at the March 20 Fed meeting, which had been over 80% just a couple of weeks ago, has dropped precipitously to below 60% following this morning’s payroll print.” Quincy Krosby, Chief Global Strategist for LPL Financial, Charlotte, North Carolina.

“It’s a very favourable jobs report. Non-farm private payrolls, the core measure of employment, was well above expectations, and there was a downward revision to the prior period, but it’s still a very strong number for the month of December. It shows that despite higher interest rates, the economy continues to percolate along, and it’s a very favourable environment for businesses. It should help the jobs picture more when the Fed does reduce rates.” Tim Ghriskey, Senior Portfolio Strategist, Ingalls & Snyder, New York.

“The topline payrolls number was higher than expectations, but the real problem is wage growth coming in hotter than expected. The drop in participation could explain why the unemployment rate was unchanged. There might be some seasonal factors attached to this, but it’s a game changer in the debate over the Fed, in the sense that the hope of them lowering rates in the first quarter is likely to fade and the market may now begin to price (rate cuts) at a later date. What does it mean for the economy? Well, there’s a bit of an acceleration here, so that points to the possibility of a soft landing.” Peter Cardillo, Chief Market Economist, Spartan Capital Securities, New York.

“The main story here is we are seeing some cool down in the job market,” said Doug Porter, Chief Economist at BMO Capital Markets. “The one disturbing aspect for the (central) bank is that average hourly wages took a big step up in the month.”

“The stagnation in employment, which followed sluggish GDP growth last year, suggests that the impacts of high-interest rates are becoming more widespread across the economy,” said Royce Mendes, Head of Macro Strategy at Desjardins Group.

“With wage numbers like this, the Bank of Canada will remain concerned about the inflation risk being still slanted to the upside,” said Derek Holt, Vice President of Capital Markets Economics at Scotiabank. “Markets are still aggressive in pricing cuts as soon as the March or April meetings.”

The central bank’s next rate announcement is on Jan. 24, after the release of December inflation data on Jan. 21.

Source: https://www.reuters.com/markets/canada-gains-few-jobs-december-wage-growth-accelerates-2024-01-05/

______________________________________________________________________

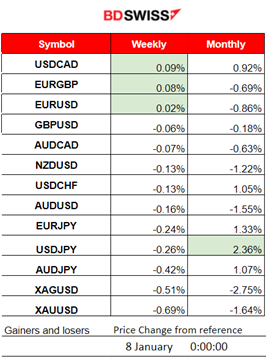

Winners vs Losers

The USDJPY remains on the top for the month’s winner’s list as the USD strengthened significantly and the JPY depreciated against other currencies after the earthquake on January 1st, while the BOJ is still keeping interest rates at rock-bottom levels.

______________________________________________________________________

______________________________________________________________________

News Reports Monitor – Previous Trading Day (04 Jan 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

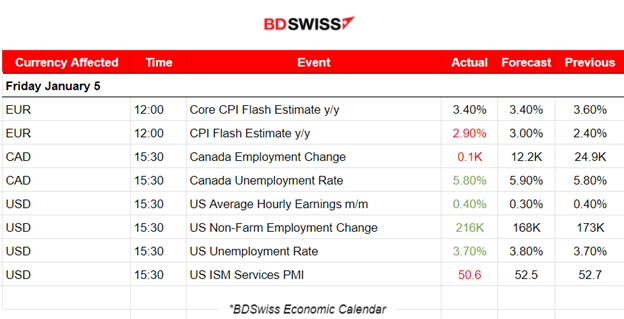

- Morning–Day Session (European and N. American Session)

The Flash Estimate Figures for the CPI changes in the Eurozone seem to be reported as expected. The non-core figure was reported lower than expected, 2.9% vs 3% forecast, however, it was higher than the previous figure. The reaction in the market was moderate with the EUR not affected significantly from the report release.

At 15:30 the USD and CAD pairs were greatly affected, experiencing an intraday shock that caused volatile market conditions and up-down effects. Reports for both economies surprised the markets as the figures regarding employment change were released way different than expected. Canada’s employment change was just 0.1K versus the expected 12.2K while the jobless rate was released surprisingly lower than expected, unchanged at 5.8%. This mixed data caused an initial CAD strengthening causing CAD pairs such as EURCAD to fall at that time, near 25 pips before reversing soon after.

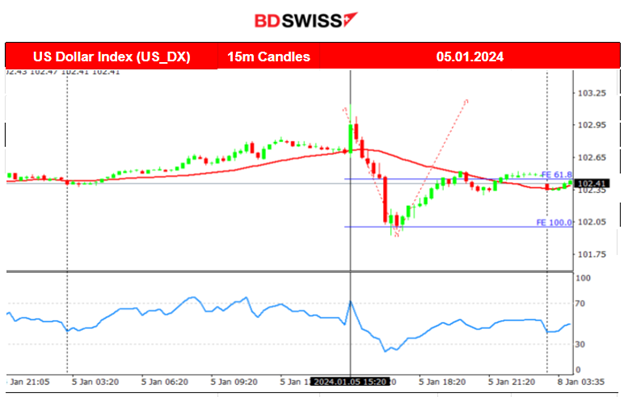

On the other hand, the NFP report showed that total nonfarm payroll employment for the U.S. increased by 216K in December, way more than expected, and the unemployment rate was unchanged at 3.7 per cent. The data so far were obviously showing an economy diving in contraction and the Fed looking for data to support the view of interest rate policy change. More employment than expected was actually reported e though, along with a lower-than-expected jobless rate surprising everyone and causing an initial U.S. dollar sudden appreciation against other currencies. The dollar index Jumped momentarily before reversing soon after since the one-sided direction path was not eventually settled as the positive effect faded.

The U.S. ISM Services PMI figure confirmed the further expansion of economic activity in the Services sector as the figure barely passed the 50 threshold level. However, the figure is significantly worse than the previous PMI report. What’s the next figure is an interesting question. Moving to deterioration?

General Verdict:

____________________________________________________________________

____________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (04.01.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair experienced an early path to the downside, but steady, that was driven mainly by USD appreciation. The news releases at 15:30 caused the USD to experience an initial strong appreciation, an intraday shock, causing the EURUSD to drop rapidly but soon reverse, thus causing the shadow as depicted on the chart. After the release the pair moved further to the upside when the market decided to act in a way that the dollar depreciated significantly, driving the pair upwards and to test the resistance at near 1.10. The resistance proved strong and the retracement back to the 30-period MA followed eventually.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Bitcoin trades around the mean that is currently near the 44K level. It is obvious from the chart that volatility levels dropped significantly and are still dropping forming a triangle. Friday was quite volatile being the NFP day, however, after that event the Bitcoin did not experience any significant move and the price just moved sideways around the 30-period MA.

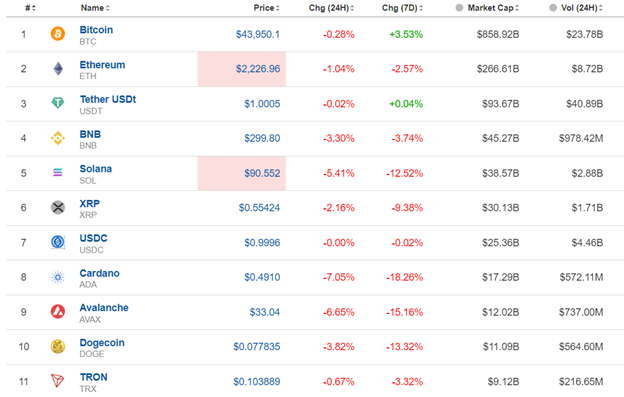

Crypto sorted by Highest Market Cap:

All Cryptos suffered lower prices in the last 24 hours since volatility levels dropped and the markets corrected from the volatile moves of last week.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4Hour Timeframe Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Clearly, the downtrend was interrupted during the NFP report as the index (and the other U.S. benchmark indices) moved to the upside significantly crossing the 30-period MA on the way up and resulting in a rather sideways path after the volatility levels started to fall. Currently, we witness a triangle formation formed after the news and the index is signalling that there might be a breakout to the downside. To suggest that the support level near 16250 must break though, we need to give more evidence of a downtrend continuation.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

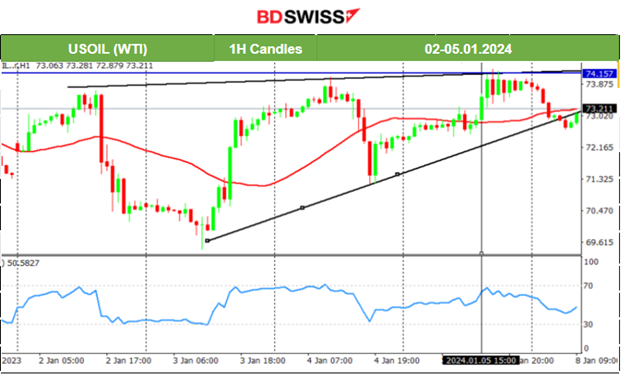

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Crude Oil moves with high volatility around the 30-period MA and tests the resistance levels near 74 USD/b on its way up. After the NFP report the USD depreciated and Crude moved to the upside testing the 74.2 USD /b without success. It eventually reversed crossing the MA and moving below it to settle around the mean 73 USD/b again. Unless further movement to the downside takes place, breaking the support near 72 USD/b the near path will potentially be sideways. It will not be a surprise if during this week, Crude tests again the 74 USD/b.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Gold’s price formed a triangle before the release of the NFP report on Friday and specific resistance and support levels were set as discussed in our previous analysis. During the news at 15:30, the USD appreciated greatly bringing Gold down rapidly causing it to reach the 2030 USD support before reversing quickly to the mean. The path continued to the upside after the shock since the dollar started to depreciate aggressively reaching the resistance of 2060 UD/oz before reversing for the second time again quickly back to the mean. Currently Gold is headed downward again testing the support levels below 2030 USD again signalling that it is destined to drop further.

______________________________________________________________

______________________________________________________________

News Reports Monitor – Today Trading Day (08 Jan 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

The Swiss Consumer Price Index (CPI) remained unchanged in December 2023 compared with the previous month. Inflation was +1.7% compared with the same month of the previous year. The average annual inflation reached +2.1% in 2023. CHF appreciated greatly against other currencies. EURCHF dropped near 20 pips at the time and reversed soon after.

General Verdict:

______________________________________________________________