PREVIOUS TRADING DAY EVENTS – 01 September 2023

The data suggests Labour markets are “normalising” and actually raise the expectations that the Fed’s next move would be a cut in interest rates in the first half of 2024 according to Andrew Hunter, Deputy Chief U.S. Economist at Capital Markets. The CME Fedwatch now has a 93% chance of a “no change” decision by the FOMC at the September meeting and 64% of no changes at all by year-end.

Stock markets closed flat on Friday. The benchmark S&P 500 gained 8 points to 4515, having been higher in early trades. Gold rallied over $1950 but could not hold this key level and closed at $1940. As the Dollar gained, USOil continued its strong week, breaching and breaking the important $85.00 level.

Sources: https://www.reuters.com/markets/europe/global-markets-view-europe-2023-09-0/

https://www.ft.com/content/e8cceac7-8848-4624-be75-27d02fa5d8a4

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

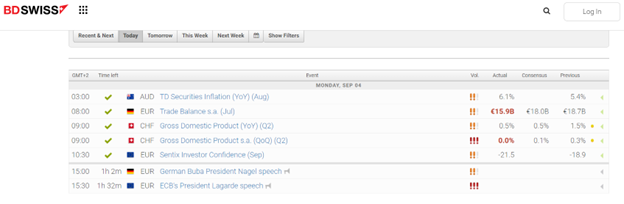

Today 04 September – Asian and European markets have been subdued with no North American session today, as both the U.S. & Canada have been closed for Labor Day. A speech by ECB President Lagarde may impact EUR pairs, the EURUSD currently rotates at 1.0800 and GBPJPY is the most volatile having gained 0.47% today. (see below).

___________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (04.09.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The EURUSD closed the week below the key 1.0800 level, at 1.0773, so far today the pair has recovered the 1.0800 handle but the higher time frame Daily and H4 charts remain bearish. The daily 21-EMA sits at 1.0878 and the H4 at 1.0828 and represents today’s key resistance zone. Support could be found at 1.0800-1.0790 zone, 1.0785 and then Friday’s low at 1.0770.

Today’s Biggest Mover – GBPJPY

The GBPJPY has rallied 0.47% today breaching 184.00, the Daily 21-EMA and is testing the next major resistance at 185.00. The H1 and H4 21-EMA are co-located at the 184.50 zone. The 50.0 Fibonacci Retrace level from Friday’s low is 184.25 and the key 61.8 Fibonacci is at 184.10.

___________________________________________________________________