Previous Trading Day’s Events (13.05.2024)

______________________________________________________________________

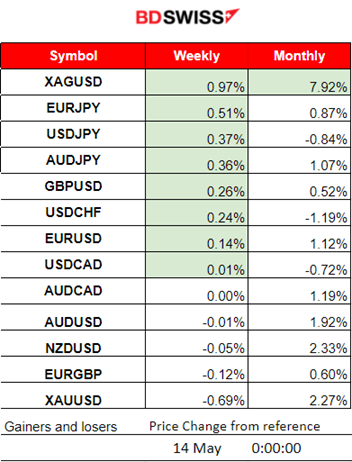

Winners vs Losers

Silver is on the top of the winners’ list with 0.98% gains. It leads this month as well with 7.92% gains. JPY pairs (JPY as quote) are following since JPY weakens further and quite significantly raising the chances of another intervention.

______________________________________________________________________

______________________________________________________________________

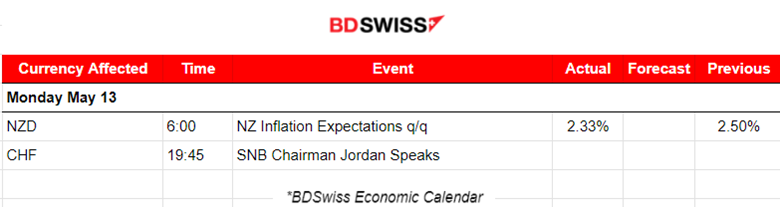

News Reports Monitor – Previous Trading Day (13.05.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

At 6:00 the New Zealand expectations for one-year-ahead annual inflation decreased 49 basis points from 3.22% to 2.73%. Two-year ahead inflation expectations decreased from 2.50% to 2.33%. This fall in inflation expectations caused the NZD to depreciate. The NZDUSD dropped near 14 pips upon release before eventually retracing to the intraday mean.

- Morning – Day Session (European and N. American Session)

No important news announcements, no special scheduled releases.

General Verdict:

__________________________________________________________________

__________________________________________________________________

FOREX MARKETS MONITOR

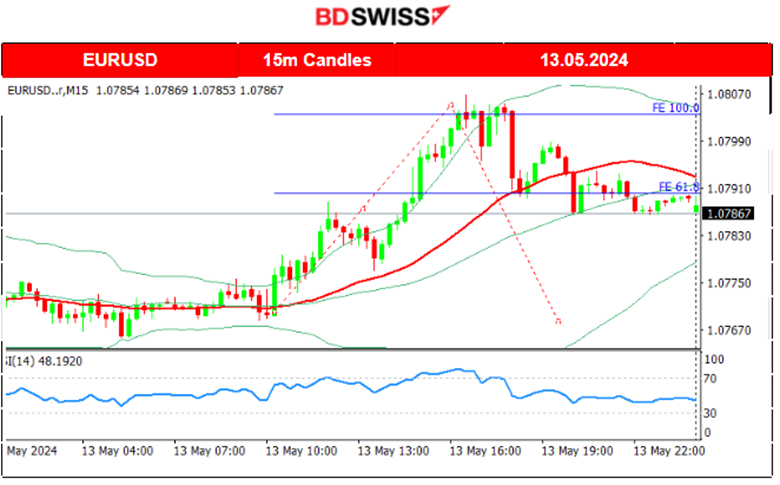

EURUSD (13.05.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Since there was an absence of significant special releases, volatility was not high. However, there was a significant intraday deviation from the MA since the start of the European session, dollar weakening, causing the pair to move upwards and reach the resistance at near 1.08070. After that strong resistance, the pair retraced eventually to the 30-period MA and continued sideways with low volatility until the end of the trading day.

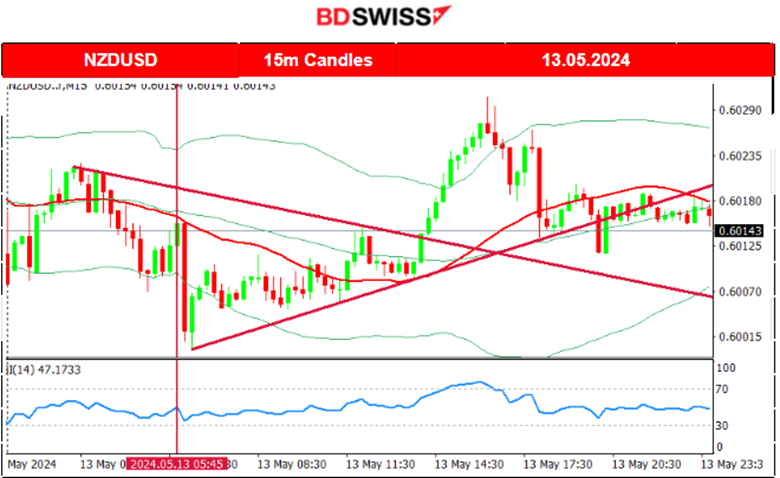

NZDUSD (13.05.2024) 15m Chart Summary

NZDUSD (13.05.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Overall, the NZDUSD pair moved sideways but with moderate volatility. Early during the Asian session, it deviated from the 30-period MA to the downside upon the release of the inflation expectations data at 6:00. NZDUSD dropped near 14 pips upon release before eventually retracing to the intraday mean. After breaking the intraday triangle formation, as depicted on the chart, it moved to the upside finding resistance at near 0.60290 before eventually retracing to the MA and closing near flat for the trading day.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC+03:00)

Price Movement

A clear downward channel for Bitcoin and possible triangle formation has been broken on the 9th causing the price to jump to around 63K. On the 10th of May, Bitcoin saw a huge drop after the news release at 17:00 causing the sudden U.S. dollar strengthening and the trigger of a risk-off mood. After that event, the price continued with an upward steady movement within a channel as depicted on the chart. That channel formation was broken on the 13th of May with Bitcoin jumping, correcting fully from the drop on the 10th of May. After the price reached the resistance at near 63,285 it retraced to the 30-period MA and the 61.8 Fibo level.

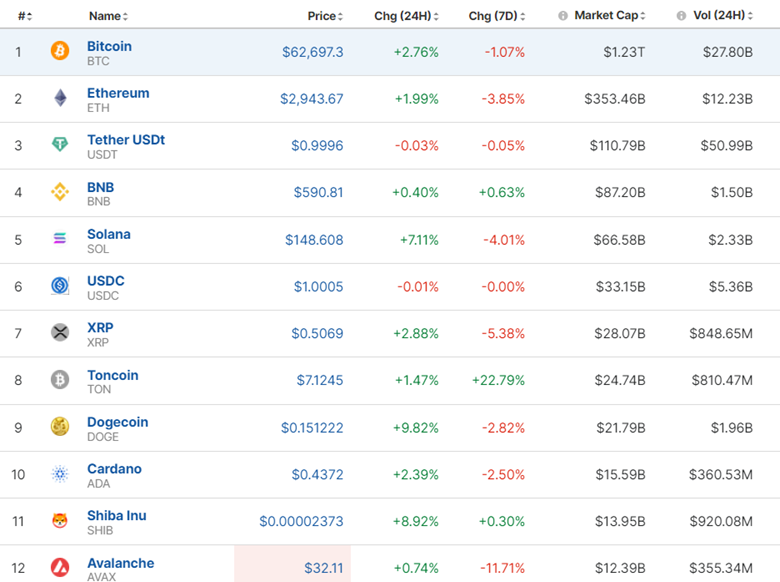

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

Cryptos lost ground after the news release on the 10th of May that showed the fall in U.S. consumer sentiment and a rise in inflation expectations. Yesterday the market bounced back, correcting from that drop and eliminating some of the 7 days’ losses.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

A triangle formation is apparent when moving into the 9th of May. That triangle formation broke as the price moved to the upside after the U.S. Unemployment claims figure release, causing indices to experience a jump. On the 10th of May, the index dropped upon release of the U.S. news for Consumer sentiment and inflation expectations. That news release caused dollar appreciation at that time and the index to fall around 20 dollars. It eventually reversed to the upside steadily after touching the 30-period MA and the 61.8 Fibo level.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

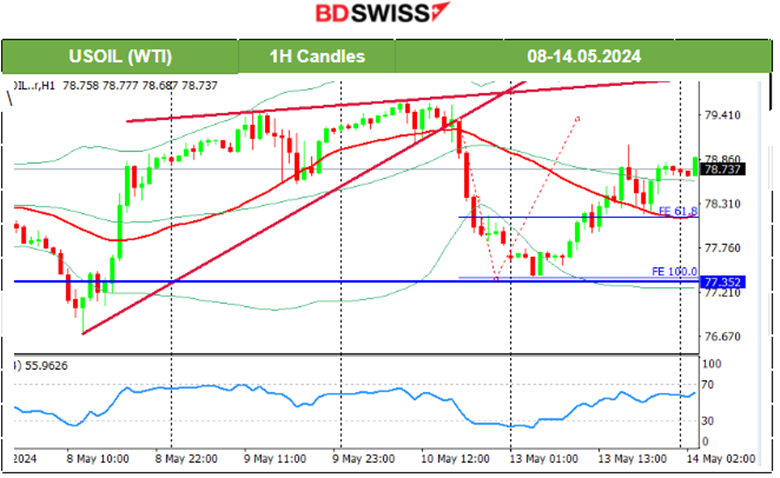

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The price dropped heavily on the 10th of May after the U.S. Unemployment claims news at 17:00, a near 2-dollar drop to 77.37 before retracement started to take place. An upward movement took place as expected and mentioned in our previous analysis. The price retraced to the 30-period MA and went even beyond, crossing it on the way up and reaching the resistance at near 79 USD/b.

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

A consolidation phase broke on the 9th of May after the U.S. unemployment claims figure release. Gold’s price jumped after USD depreciation took place and broke the consolidation, reaching the resistance of 2,330 USD/oz as predicted in our previous analysis. Later that resistance broke as well causing the price to jump further to the upside. The price reached a peak at 2,378 USD/oz, on Friday 10th of May, before retracing to the 61.8 Fibo level at near 2,350 USD/oz. On the 13th of May, the price crossed the 30-period MA on its way down signalling the end of the uptrend or even a change in trend. The price moved downwards and the support near 2,332 USD/oz was reached before the retracement took place back to the MA, close to 2,345 USD/oz.

______________________________________________________________

______________________________________________________________

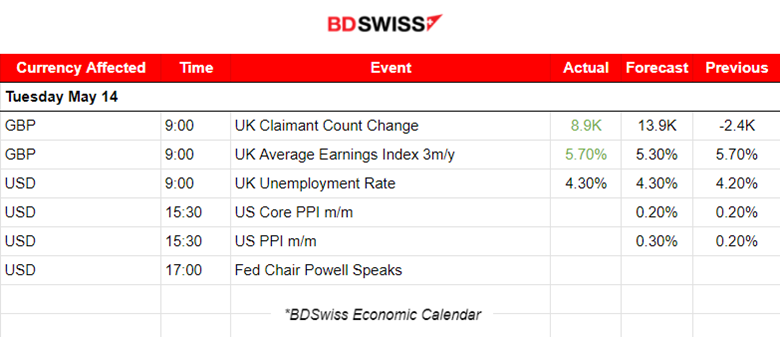

News Reports Monitor – Today Trading Day (14 April 2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning – Day Session (European and N. American Session)

At 9:00 the U.K. Claimant Count (number of people claiming unemployment-related benefits) change was reported at just 8.9K, lower than the expected 13.9K. Average earnings growth remained steady at 5.7% and the monthly unemployment rate increased to 4.30% as expected. Payrolled employees in the U.K. fell by 5K (0.0%) between February and March 2024. The data suggest cooling which is what the BOE wants to see and be more confident that the next inflation figure release has the potential to fall further towards the target. The market reacted with a low-level intraday shock and no one-sided direction for GBP pairs.

U.S. PPI figures released the same day are probably going to cause an intraday shock, affecting USD pairs. It could be moderate since the market could instead wait for the CPI figures to react heavily. However, a monthly PPI figure surprise to the downside could cause a huge impact.

General Verdict:

______________________________________________________________