Previous Trading Day’s Events (13 Feb 2024)

“The lingering concern for the Bank of England will be that the labour market has not cooled sufficiently to achieve a sustainable return to the 2% inflation target,” Finney said.

The BoE is worried that pay might continue to rise too quickly for inflation to fall to its 2% target.

Source: https://www.reuters.com/world/uk/uk-regular-wages-grow-62-3-months-december-2024-02-13/

All three major U.S. stock indexes fell more than 1% each, and the Dow Jones industrial average posted its biggest daily percentage drop in almost 11 months. The yield on the benchmark U.S. 10-year Treasury note rose 14 basis points to 4.31% after reaching 4.314%, its highest level since Dec. 1.

“Markets are taking it pretty hard because it puts a nail in the coffin of early (March) Fed rate cuts,” said Carol Schleif, chief investment officer at BMO Family Office in Minneapolis, Minnesota. “It’s evidence of a still-sturdy economy. There’s still inflation to be wrung out of the system.”

After the data, expectations rose that the Fed will likely not cut rates until its June 11-12 policy meeting.

Gold prices fell below the key $2,000 per ounce level to a two-month low following the CPI data. Spot gold was down 1.3% at $1,993.29 an ounce, its lowest since Dec. 13th.

Source:

https://www.reuters.com/markets/global-markets-wrapup-1-2024-02-13/

______________________________________________________________________

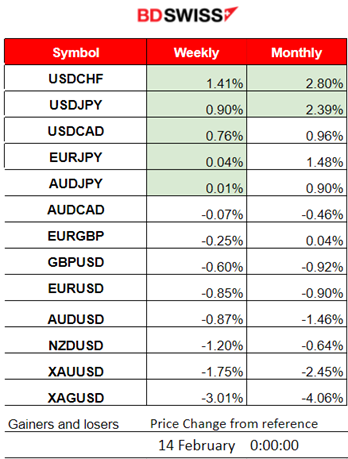

Winners vs Losers

USD pairs (with USD as base) climbed to the top after the U.S. inflation report release. Currently, USDCHF is on the top of the winner’s list with 1.41% gains and with the top 2.80% performance for the month so far.

______________________________________________________________________

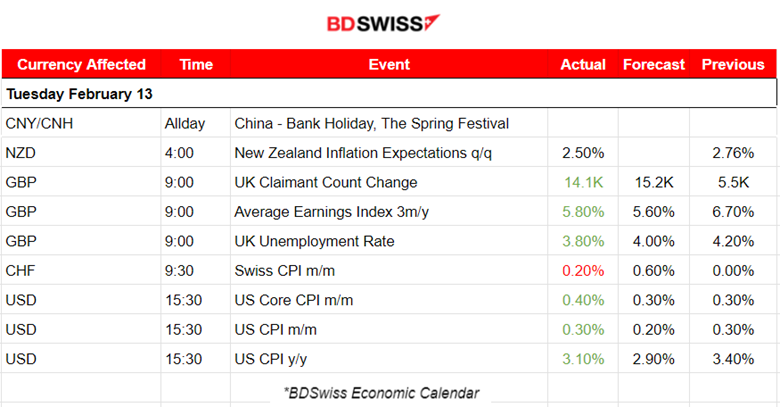

News Reports Monitor – Previous Trading Day (13 Feb 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

In New Zealand, the annual CPI inflation for the December 2023 quarter was measured at 4.7%, a decline from last quarter’s 5.6% annual inflation. Respondents’ expectations for CPI inflation have declined across short, medium, and long terms. The two-year-ahead, five-year-ahead and ten-year-ahead annual inflation expectations decreased from last quarter’s mean estimates and remained within the 1- 3% inflation target band. At the time of the release, the NZD started to depreciate significantly. NZDUSD dropped to near 30 pips during that time and retracement followed.

- Morning – Day Session (European and N. American Session)

At 9:00, several figure releases took place for the United Kingdom. The early estimate of payrolled employees for January 2024 increased by 48,000 (0.2%) during the month and increased by 413,000 (1.4%) during the year. Wages & bonuses were reported stronger than expected, (5.8%) but cooler than last month (6.7%). The unemployment rate was reported down (3.8%) and claims also reported better, CC change at 14.1K. The market reacted with an initial GBP appreciation. The GBPUSD jumped near 20 pips at that time but it soon reversed after finding resistance.

The Swiss consumer price index (CPI) increased by 0.2% in January 2024 compared with the previous month.

During the CPI data / Inflation report for the U.S. at 15:30 on the 13th Feb, the USD strengthened greatly causing the markets to shake. The higher than expected inflation figure raised concerns of higher interest rates and, thus higher borrowing costs in the near future. The Fed made it clear that cuts will take place only if there is strong data supporting that inflation will eventually drop to the target level of 2%. The report yesterday triggered the expectations that a delay might eventually take place causing stocks prices to fall heavily and the dollar to strengthen. USDJPY climbed to near 160 pips since the report release.

General Verdict:

____________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (13.02.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair was moving sideways with low volatility but that changed at the start of the European session. The pair started to move to the upside significantly before the important U.S. inflation news. The inflation figure was reported higher than expected at 3.1%. The dollar appreciated heavily, affecting the EURUSD with a sharp drop near 90 pips. No retracement to the 61.8 Fibo took place indicating a strong momentum to the downside that might continue unless important resistance breaks.

___________________________________________________________________

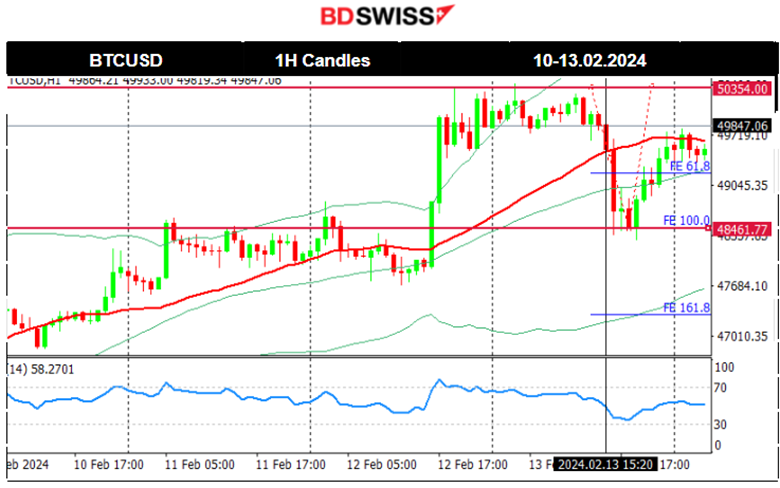

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 7th Feb, Bitcoin moved to the upside aggressively. The momentum is quite strong as it seems to break all the Fibo levels, 100 and 161.8 without any significant retracement. Its price continued to the upside aggressively breaking further resistance and eventually reaching the strong resistance at near 48,900 USD, levels last seen during the SEC news regarding the approval of Bitcoin ETFs. Despite the bearish RSI signals, Bitcoin surged on the 12th Feb breaking the 49,000 USD resistance, reaching the resistance near the 50,000 USD. On the 13th Feb, the U.S. inflation figure released at 15:30 caused Bitcoin to fall until it found support near 48,300 USD. It soon reversed showing resilience and moved to the upside and back to the 30-period MA.

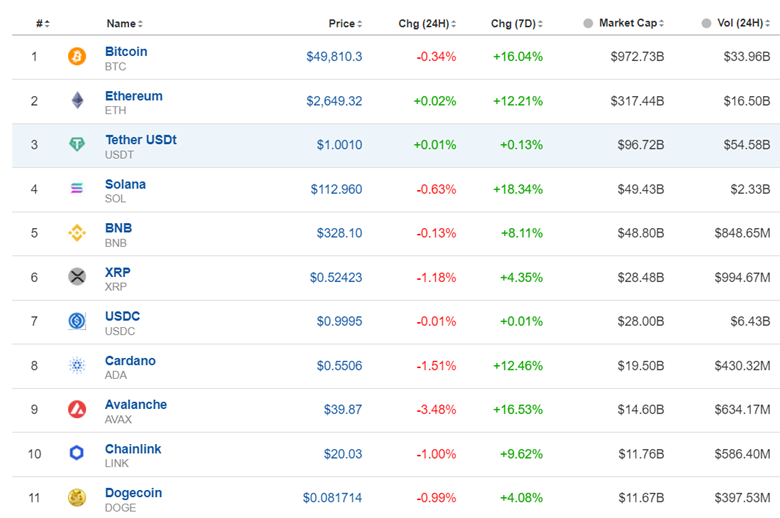

Crypto sorted by Highest Market Cap:

The market holds the gains generated last week and performs well despite strong USD appreciation, after the U.S. inflation report released yesterday.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

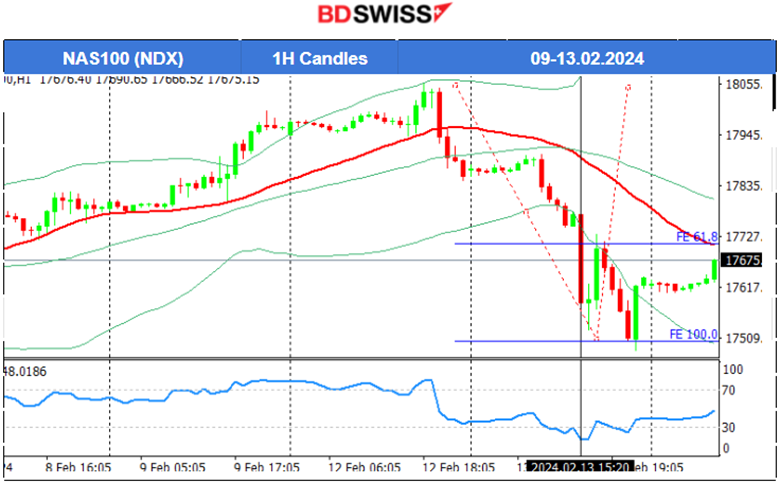

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 8th Feb, the index did not experience strong volatility closing the trading day almost flat, however, on the 9th Feb, it moved to the upside aggressively reaching the area near the 18,000 level. After 20:00, on the 12th Feb, the market started the downfall amid the important inflation news, risk-off mood. The index went all the way down as the market anticipated that the inflation figure was going to be reported higher than expected. It actually had. That is why after the release the index (and the other benchmark U.S. indices) plummeted. It eventually found support at nearly 17500 USD before retracing back to the 30 period MA.

______________________________________________________________________

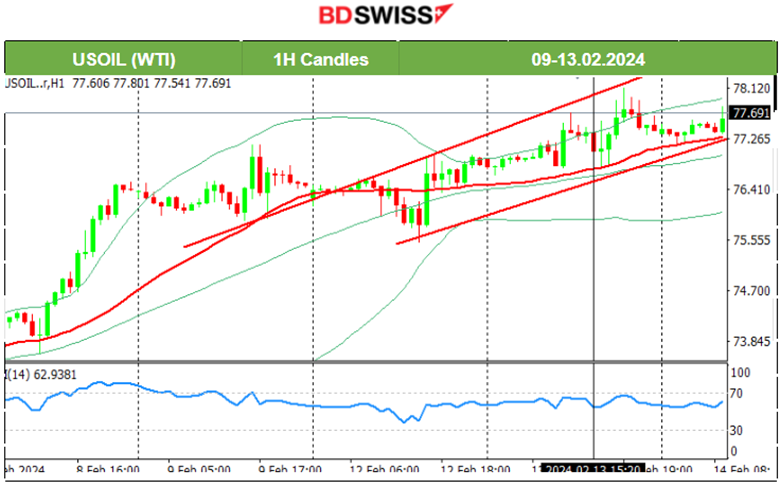

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 12th Feb Crude oil continued with the upward path. Despite the surprising inflation figure reported on the13th Feb, Crude’s price did not experience major volatility but rather kept moving upwards within the channel as depicted on the chart. The RSI does not show any indication of a turning point to the downside yet.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 8th Feb, Gold broke the upward channel moving to the downside and reaching the support 2020 USD/oz after the USD experienced strong early appreciation. It closed the trading day almost flat since the USD lost strength significantly causing Gold’s price to reverse fully. On the 9th Feb, it experienced another drop testing again that support at near 2020 USD/oz. After an unsuccessful breakout, it eventually retraced to the Fibo 61.8 level. On the 12th Feb Gold dropped further. On the 13th Feb, it finally experienced a rapid upward movement before the U.S. inflation report. After 15:30, the more than expected inflation figure caused USD heavy appreciation and a sharp drop for Gold, passing the support at 2000 USD/oz, moving further downwards until the next support near 1990 USD/oz. The momentum is quite strong yet and the downfall continues currently. The level of 1975 USD/oz could be the next support.

______________________________________________________________

News Reports Monitor – Today Trading Day (14 Feb 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important announcements, no special scheduled figure releases.

- Morning–Day Session (European and N. American Session)

At 9:00, annual inflation for the U.K. was reported at 4%, thus no change. On a monthly basis, CPI fell by 0.6% in January 2024, the same rate as in January 2023. The market reacted heavily to the news with GBP depreciation. The dollar appreciated at 9:00 as well against other currencies. The GBPUSD dropped near 40 pips at that time.

General Verdict:

- High volatility post-inflation report for the U.S. EUR, GBP and USD are moving. The dollar continues with further strength.

- Gold is going down as the USD strengthens further.

- Crude oil is actually climbing but not with great momentum.

- U.S. indices saw a reversal today, correcting from yesterday’s sharp drop.

______________________________________________________________