PREVIOUS TRADING DAY EVENTS – 05 September 2023

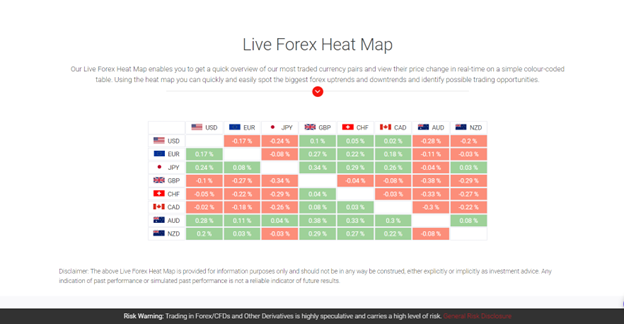

Yesterday’s data saw the RBA leave rates unchanged and the AUDUSD decline over 1.5%, Chinese Caixin Services PMI miss expectations, declining to 51.8 from 54.2 and a raft of weak Service PMI data across Europe weigh on the EUR (EURUSD lost -0.81%).

Stock markets closed mixed on Tuesday, the benchmark S&P 500 lost 18.94 points (-0.42%) to 4496, the Dow slipped -0.52% and the Nasdaq was flat at 14,021. Gold also slipped to close at $1925 having rejected the $1950 handle last week. Even as the Dollar gained, USOil continued its strong run breaching $87.50, as UKOil broke the psychological $90.00 level for the first time since November 2022.

Sources:

https://www.reuters.com/markets/global-markets-wrapup-1-2023-09-06/

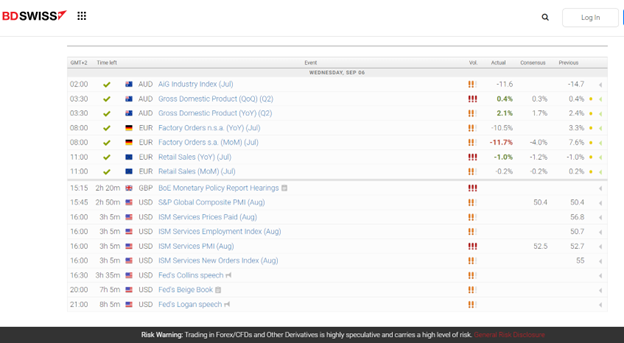

Today, 06 September – Asian and European markets have been subdued following the weak handover from Wall Street, with FX pairs trading in narrow ranges following yesterday’s significant moves. Australian GDP slipped but was better than expected, German factory orders were woeful at -11.7%, declining from +7.6% last time, and Eurozone Retail Sales declined -0.2% M/M from +0.2% last month, with the Y/Y figure declining a whole -1.0%. Still to come are the BOC Rate Announcement, US ISM Services PMI, the Fed’s Beige Book along with speeches from the Fed’s Collins and Logan.

___________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (06.09.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The EURUSD remains under pressure after yesterday’s sell-off which hit a new 63-day low at 1.0705. The daily 21-EMA now sits at 1.0850 from 1.0878 on Monday, and the H4 at 1.0774, and represents today’s key resistance zone if 1.0765 is breached. Support could materialise today at the 21-EMA H1 area, around 1.0735 below here sits the Tuesday low and only 5 pips lower the psychological 1.0700.

Today’s Biggest Mover – GBPJPY

GBPJPY is today’s biggest mover. Having rallied 0.47% yesterday, today it is -0.34% lower and backtesting the key 185.00 and H4 21-EMA, but still above the daily 21-EMA at 184.35. The H1 21-EMA sits at 185.20. The low yesterday, which was rejected firmly, was just above 184.00 at 184.06. A breach and break of 185.00 today, could find support at 184.95, 184.70 and 184.50.

___________________________________________________________________