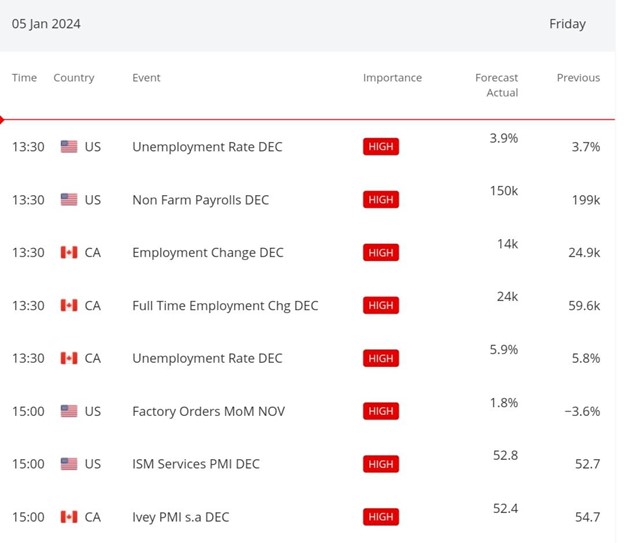

Today, on the 5th of January 2024, the eagerly anticipated Non-farm Payroll (NFP) report for December 2023, is set to be released, a crucial event highlighted on the BDSwiss economic calendar ( https://global.bdswiss.com/economic-calendar/ ). This economic indicator, which measures the change in the number of employed people during the previous month, excluding the farming industry, plays a significant role in shaping market sentiments. The forecast for this report is 150K, a notable decrease from the previous release, which stood at 199K. Traders and investors are closely watching the actual figure, set to be revealed at 13:30 GMT. If the actual report exceeds the forecast, it is generally considered positive for the USD currency.

Shifting our focus to the technical analysis aspect, let’s examine the GBPUSD currency pair in the 4-hour timeframe. The price of GBPUSD has been confined within a range, with 1.28269 acting as the resistance level and 1.26113 as the support. The impending NFP report release introduces a crucial element to this analysis. Should the actual report surpass the forecast, indicating strength in the USD, there is a higher likelihood of the support level being breached. This potential breakdown could pave the way for a downtrend, favouring sellers in the GBPUSD market. Conversely, if the actual report falls short of the forecast, signalling weakness in the USD, there is an increased probability of the resistance level being broken. Such a scenario could mark the beginning of an uptrend, creating opportunities for buyers in the GBPUSD market.

The combination of fundamental analysis, with a focus on the NFP report, and technical analysis, considering the established support and resistance levels, is crucial for traders navigating today’s market movements, especially those dealing with USD pairs.

As we delve deep into the complexities of market analysis, it would be insightful to learn about your perspective on GBPUSD today. How does your analysis align with the potential impact of the NFP report, and what strategies are you considering in response to these market dynamics?