PREVIOUS WEEK’S EVENTS (Week 19-23 June 2023)

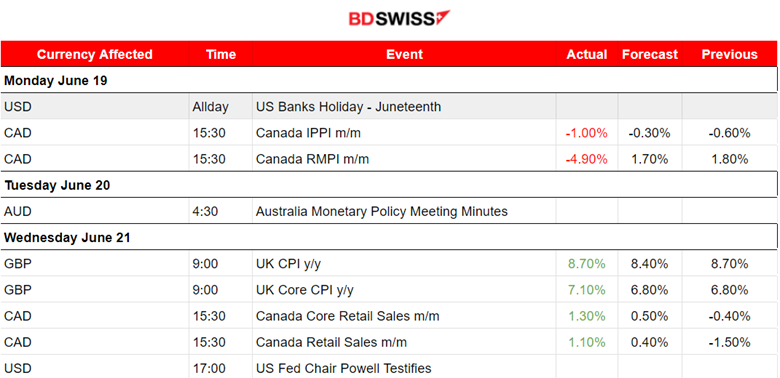

Announcements:

U.S. Economy

Last week, Fed Chairman Jerome Powell testified about the Semi-Annual Monetary Policy Report before the House Financial Services Committee, in Washington DC, causing the Dollar to weaken significantly on the 21st of June. It was highlighted that inflation has moderated somewhat since the middle of last year and fell significantly to 4.4%, however, Powell made it clear that he and his team are strongly committed to bringing inflation back down to the 2% goal.

Expectations of further rate increases remain and will be appropriate by the end of the year. Market participants expect hikes to resume at the Fed’s July meeting. The effects of policy tightening on demand are apparent but the full effect on inflation might take more time.

The advance figure for seasonally adjusted initial claims was reported at 264K, unchanged from the previous week’s revised level. The numbers are still high.

Looking at the PMI reports, U.S. business activity fell to a three-month low in June. The Flash PMI data showed a drop in manufacturing activity while the services sector grew but with ease for the first time this year.

Overall, the Federal Reserve’s aggressive interest rate increases over the past year didn’t have such a negative impact on growth as feared. The U.S. economy has continued expanding in the April-through-June period, although it is increasingly reliant on the vast services sector for overall growth in GDP.

The Fed projected that rates could rise by perhaps half a percentage point more by year-end from the current policy-rate range of 5.00% to 5.25%.

Eurozone Economy

Flash Figures for both the Manufacturing and Services sectors were released showing U.K. and European PMIs plunged with U.S. PMI (preliminary for June) expected to decline for both sectors.

Eurozone business growth fell for the month as a manufacturing recession deepened. Germany, the biggest economy, outperformed on services while France was a big drag with a services PMI of 48. Manufacturing activity has been in decline since July and the downturn deepened. The Euro area economy will probably continue to contract in the second half of the year.

The ECB rate hikes are increasingly slowing down the economy. Considering the recent data, the upcoming recession is probably inevitable. The jobless rate is low and nominal wage growth is at its highest in decades. Most policymakers, though, fear inflation more than a recession. The ECB stated that it will hike again in July.

U.K. Economy

Britain’s PMI for both sectors also fell more than expected. The preliminary, or Flash PMI data, showed that Britain’s Services sector grew at its slowest pace in three months while the Manufacturing sector contracted by the most in six months.

The S&P Global’s Composite Purchasing Managers’ Index (PMI) preliminary reading showed that in May it was hit by the weakest growth in new orders since January as factories suffered.

The BoE is expected to continue raising the borrowing costs as it tries to tackle inflation which held at 8.7% in May. Hikes, though, will add further to the likelihood of a recession later in the year.

Australia Economy

Minutes of the June 4 policy meeting were released showing that members were puzzled about the data and suggesting that a possible pause should take place.

The Reserve Bank of Australia (RBA) board initially considered leaving rates unchanged since consumer spending was slowing. However, it took the decision for a hike during the last meeting in June since inflation risks were feared.

Jobs data released for May were strong. Data taken into account involved rising electricity prices, high rents, stubborn services inflation and a rebound in national house prices. Headline inflation is high at 7.0% while unemployment is down near 50-year lows of 3.6%. In addition, there is low productivity and rising wages.

The risk that inflation would not return to the RBA’s 2-3% target prevailed, eventually leading to a hike.

_____________________________________________________________________________________________

Inflation

U.K.: All eyes were on the U.K.’s inflation data that were released last week during the start of the European session. Annual inflation was reported unchanged, at 8.7% while Core inflation was reported higher at 7.1% more than expected.

A huge surprise for policymakers. Despite hikes, inflation refuses to fall. The BOE raised interest rates from 4.5% to 5%, an aggressive move that caused a shock for GBP pairs creating confusion about hike expectations.

_____________________________________________________________________________________________

Interest Rates

Switzerland: The Swiss National Bank raised its policy interest rate by 25 basis points, to 1.75% as expected and signalled that more tightening was likely to come. This brings the total amount of rate hikes in this cycle to 250 basis points in one year.

It is clear that world central banks are not done yet with their monetary tightening campaigns to bring price rises under control. Although the U.S. Federal Reserve left interest rates unchanged last week, it signalled further hikes by the end of the year.

The decision was made amid fears of rising inflationary pressures. A tighter monetary policy is necessary to bring inflation sustainably below 2%.

U.K.: The Bank of England surprised the markets with an interest rate increase by 50 basis points as a response to “significant” news suggesting Britain’s persistently high inflation would be difficult to bring down.

The U.K.’s economy is not weak and doing better than expected but inflation is extremely high and persistent, justifying BOE actions for an aggressive hike.

Sources:

https://www.reuters.com/markets/europe/euro-zone-business-growth-stalls-june-flash-pmi-2023-06-23/

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases (19-23 June 2023)

_____________________________________________________________________________________________

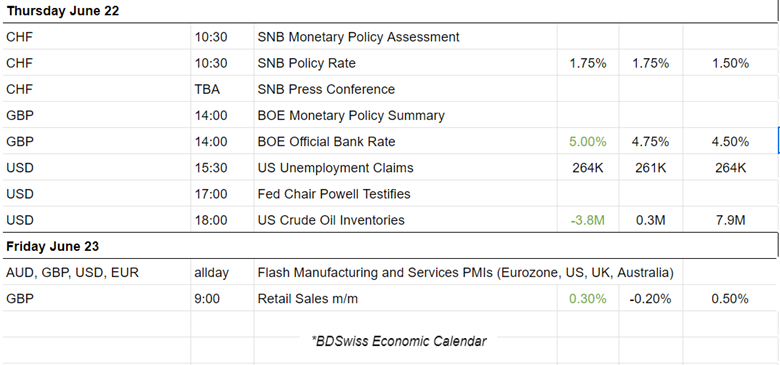

Summary Total Moves – Winners vs Losers (Week 19-23 June 2023)

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

EURUSD

EURUSD started to climb on the 21st of June since the Dollar lost ground from Fed’s Powell speech and comments. It eventually found resistance on the 22nd and retraced back to the mean. On the 23rd of June, the PMI data releases caused the EURUSD to drop significantly, finding support at 1.08440 before retracing back to the mean.

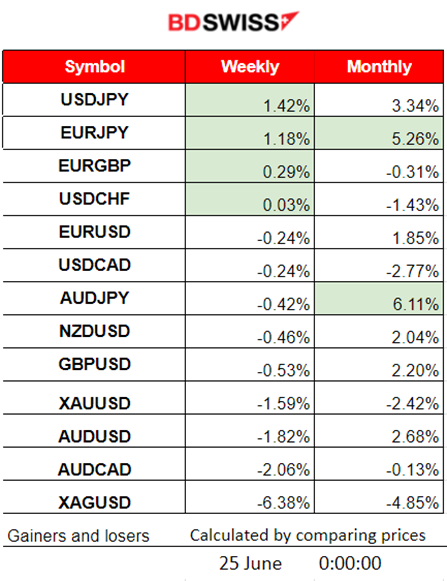

EURGBP

EURGBP was steadily moving upwards. Inflation is dangerously high and stubborn for both regions, Eurozone and U.K. On the 22nd, the BoE decided to increase rates, surprisingly increasing OBR by 50 basis points since inflation data on the 21st were disappointing and raised fears that inflation is not going down. The market reacted with a shock but the pair has not moved in one direction. It eventually settled to the mean and moved sideways. On the 23rd, the pair dropped significantly after the release of the devastating PMI data for the Eurozone.

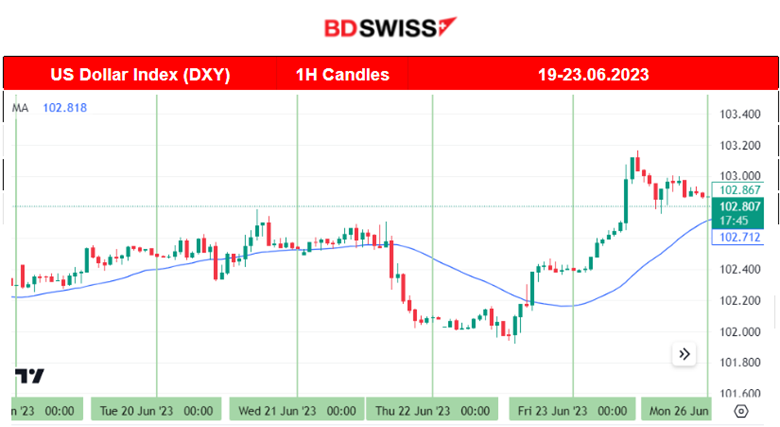

DXY (US Dollar Index)

The DXY has been moving sideways the previous week the 21st when it eventually experienced a drop moving below the 30-period MA. The drop is attributed to Fed’s Powell who gave a speech that day and some comments regarding policy had a negative impact on the Dollar. On the 22nd, DXY found resistance before eventually reversing, crossing the MA and eventually continuing its path upwards with the Dollar keep on strengthening until the end of the week.

_____________________________________________________________________________________________

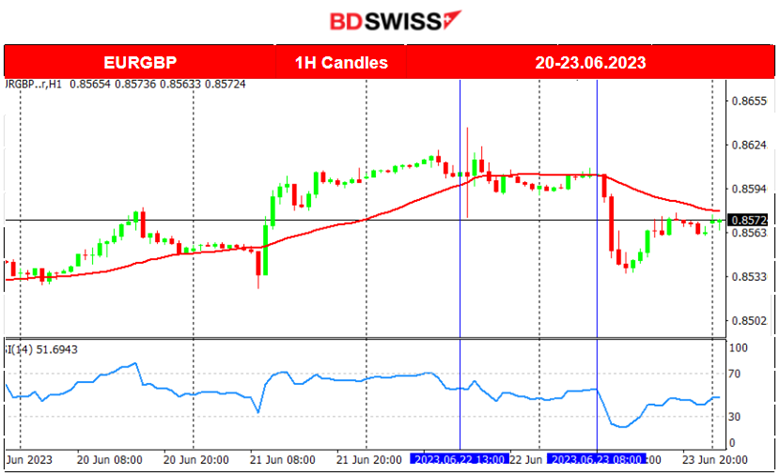

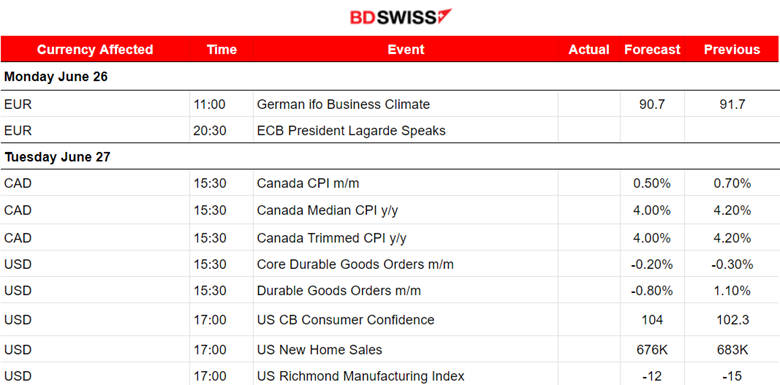

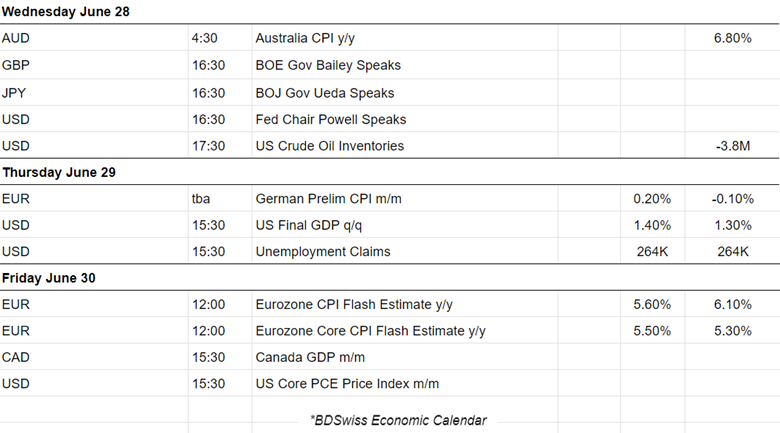

NEXT WEEK’S EVENTS (26 – 30 June 2023)

Important CPI data releases this week for Australia, Canada and the Eurozone.

We also have GDP figures for Canada and the U.S.

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

U.S. Crude Oil

Crude moved significantly lower on the 22nd, deviating highly from the mean and moving downwards. It experienced high volatility but the RSI suggests that the price is slowing down as it shows higher lows while the price shows lower lows. This bullish divergence is signalling a sideways path close to the mean but with the usual high volatility to govern the path.

Gold (XAUUSD)

The Gold price has reversed after moving downwards for several days, breaking important support levels on the way. On Friday, it moved higher crossing the 30-period MA after finding important support near 1910 USD/oz and on the way up it found resistance near 1940 USD/oz before retracing back to the mean. What drove the Gold price upwards on Friday? Possibly the disappointing PMI news for all regions. Business activity was significantly reduced as PMI data suggest and risk-off mood is again leading investment decisions. The Gold price has put a stop to the downward trend for now and will possibly move sideways with high volatility.

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX)

Price Movement

This week, the index was following a short-term downward trend since it retraced from the recently long upward movement. The market is steadily trying to resist any falls, experiencing high volatility. After the reversal on the 22nd of June, which caused the index to move rapidly higher and over the 30-period MA, the index has significantly retraced back to the mean and beyond, testing again the significant support levels near 14805 USD. However, a sideways path is expected, and breaking that support level will signal a volatile downward path again.

______________________________________________________________