MCD – McDonald’s Corporation: Q4 Earnings and Stock Analysis

Introduction

McDonald’s, the famous corporation, operates a fast food chain, offering various food products such as burgers, fries, ice cream, soft drinks and other alcoholic beverages. The corporation franchises and operates McDonald’s restaurants both in the United States and internationally.

It employs around 100K people and it is currently listed in the NYSE with a last recorded market capitalization of around 216.45B USD having a rank between the top 40-50 companies by market cap worldwide.

Currently 3739 Institutions are holding shares, that is 70.61% of its shares.

Q4 Earnings Announcement: The corporation is ready for the announcement of the fourth-quarter earnings that are going to be released on the 5th February 2024. Investors are waiting with strong anticipation to see the performance of this giant as the value of its stock in the 4th quarter increased by nearly 13.42%.

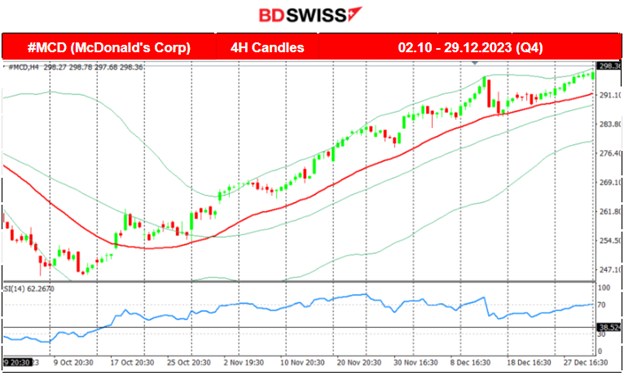

Technical Analysis:

Q3: A Late Drop

The beginning of Q3 was quite stable for MCD stock but that changed after July. At the beginning of August the stock moved lower levels below 291 USD and breaking an even more important support zone at 285 USD level that pushed the price to settle lower for a while. However, volatility levels started to pick up in late August with the stock trying to test those highs, which later served as resistance, without success and the stock finally followed a sharp downward path that accelerated during September, to close the 3rd quarter.

Q4: A Strong Steady Performance

It is clear from the chart that the stock’s price found support in early October around the 245.73 USD level and after testing that twice it finally rebounded to the upside. After the retracement back to the 30-period MA, the path was quite steady and to the upside, with the price climbing while being above the MA. A clear uptrend. This led to the price reaching the highest for the quarter near 297 USD.

Q4: The Wider Stock Market

By looking at the performance of the 500 companies listed in the exchange we can get an idea what was happening to the whole market during the 4th quarter and compare the performance of the MCD stock with the overall stock market performance during that time. While the MCD stock was underperforming in early October, the market was also on a downward trend confirmed by the price being under the 30-period MA during that time. It only reversed to upside, crossing the MA on its way up only when it was near November.

MCD stock (Q4 Chart) also shows a reversal to the upside which actually happened earlier. However it coincides with the market movement to the upside and its steady upward path later on until the end of the quarter and the year.. This of course shows that the company is strong in recovering and adapting to new market conditions but it is also greatly affected by the factors that have a strong impact on the other companies the index is tracking. All benchmark indices are currently showing performance which has hit all-time record highs.

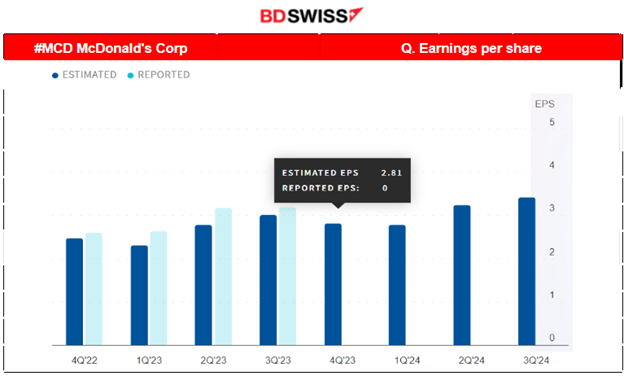

Q3 Earnings:

McDonald’s Corporation reported revenue was 6,692.2M USD (Sep 30, 2023) compared to 6497.5M USD the 2nd Quarter (Jun 30, 2023).

Net income was 2317.1M USD compared to 2310.4M USD in the 2nd Quarter.

In the 3rd quarter, Revenues and Net income are higher than the previous quarter. During the 3rd quarter of 2023, sources say that MCD reported accelerated digital engagement across the markets resulting in more frequent visits and incremental sales on the back of tailored loyalty messages. In addition, it invested in a strong lineup of mobile app offers and content offerings. During the 3rd quarter of 2023, MCD’s digital app boosted fan engagement and loyalty.

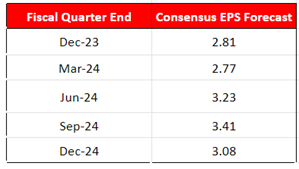

In all previous 2023 cases, the estimated figure was lower than the actual figure. Now according to https://www.nasdaq.com/ analysts expect earnings of 2.81 USD per share for Q4 2023, lower than the reported figure for Q3. In Q3 the estimated figure was 2.77 USD/s lower than the actual reported 3.17 USD/s figure.

Chart Source: https://www.nasdaq.com/market-activity/stocks/mcd/earnings

As we look ahead past Q4 and into 2024, analysts project that MCD will have a very good year with rising earnings per share each quarter. 2.77 USD (Q1) in March, 3.23 USD (Q2) in June and even higher at 3.41 USD (Q3) in September.

McDonald’s strategy is its commitment to deliver consistent, high-quality food and a memorable dining experience. Its service is connected with fast and convenient, and is generating iconic menu items like the Big Mac, Chicken McNuggets and more. Importantly, it focuses on affordability and value. No matter where you are in the world, a McDonald’s restaurant guarantees a familiar experience with all the others.

The estimates are strong because McDonald’s has implemented a strong marketing strategy attracting and retaining a diverse customer base that is likely to continue being implemented in the future.

Month Jan: Stock Closer Look

Currently the U.S. stock market is showing good performance as stated previously. January 2024 has been a good month for McDonald’s Corp so far overall but it has experienced its downs as well. Early in the month its stock price fell heavily reaching 287 USD before reversing to the upside slowly and with high volatility. Only after the 17th January the price jumped higher passing the important resistance at near 295.5 USD reaching even near 302 USD, a 52-week high stock price. Retracement followed back to the 61.8 Fibo level. Will 297 USD remain strong support? Let’s see.

Sources:

https://www.nasdaq.com/market-activity/stocks/mcd/earnings

https://www.investing.com/equities/mcdonalds-financial-summary

https://finance.yahoo.com/news/heres-why-investors-retain-mcdonalds-124100606.html

______________________________________________________________