In this Analysis, we will delve into the Daily(D) timeframe to gain a comprehensive view of the current state of XAUUSD, USOIL, GBPUSD and EURUSD. Additionally, we will briefly touch on a fundamental factor influencing its price.

GBPUSD TECHNICAL ANALYSIS: JANUARY 10TH, 2024

GBP/USD can’t seem to make a decision on which direction to go, like a rollercoaster!

PRICE ACTION:

Scenario 1 (Short): Consider short positions below 1.26082, targeting 1.25113.

Scenario 2 (Long): For the optimists, consider long positions above 1.27911, with targets at 1.28703, 1.29918

Quick Fundamental:

The currency pair soared past 1.2750 on Tuesday, only to slip and slide down the charts, ending the day with a frown. Wednesday’s European session kicked off with the pair still nursing its bruises under 1.2700. But wait, there’s more drama ahead! Bank of England’s very own Andrew Bailey steps into the spotlight later today. He’s set to face a grilling about the rollercoaster ride of interest rate hikes and their thrilling impact on financial stability. Buckle up, folks, it’s going to be an eventful day!

GBPUSD DAILY CHART:

XAUUSD TECHNICAL ANALYSIS: JANUARY 10TH, 2024

PRICE ACTION:

Scenario 1 (Short): Consider short positions below 2009.933, targeting 1976.497.

Scenario 2 (Long): For the optimists, consider long positions above 2051.273, with target at 2086.582

Quick Fundamental:

Gold, in a stunning twist, soared past the $2,040 mark, only to do an about-face and finish the day right back where it started as if nothing happened. Currently, XAU/USD is playing a game of red light and green light under a sneaky bearish shadow, hovering just a tad over $2,020 as Wednesday morning swings into action. Stay tuned to see what this shiny enigma does next!

XAUUSD DAILY CHART:

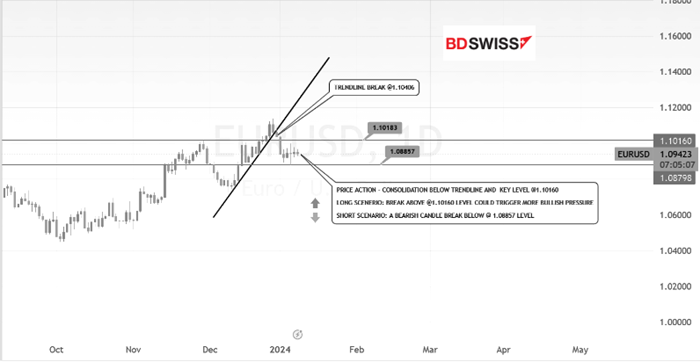

EURUSD TECHNICAL ANALYSIS: JANUARY 10TH, 2024

PRICE ACTION:

Scenario 1 (Short): Consider short positions below 1.08857, targeting 1.07481.

Scenario 2 (Long): For the optimists, consider long positions above 1.10160, with target at 1.11348

Quick Fundamental:

EURUSD took a playful dip on Tuesday, showing a bit of indecision after its Monday meanderings. It’s like the currency pair is playing hide and seek, currently peeking out from just under the 1.0950 mark. Adding a twist to the plot, the European Central Bank’s very own Vice-President, Luis de Guindos, is gearing up to grab the mic during Wednesday’s European trading session. Will his words be the magic spell that changes the game for EURUSD? Stay tuned!

EURUSD DAILY CHART:

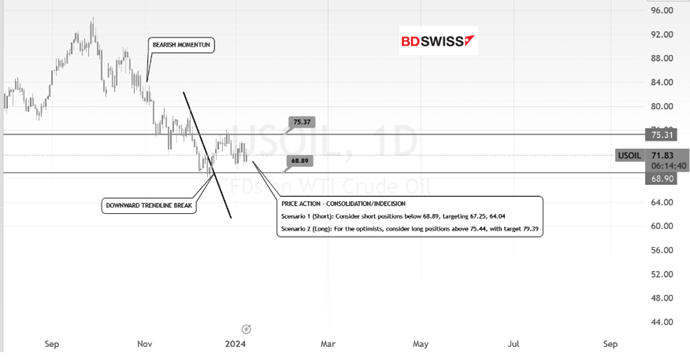

USOIL(WTI) TECHNICAL ANALYSIS: JANUARY 10TH, 2024

PRICE ACTION:

Scenario 1 (Short): Consider short positions below 68.89, targeting 67.25, 64.04.

Scenario 2 (Long): For the optimists, consider long positions above 75.44, with target at 79.39

Quick Fundamental:

WTI oil prices are on a thrilling rise, hitting $72.50 per barrel amid enthusiasm in the Asian markets. This surge is fueled by two major plot twists: the U.S. reporting a much larger than expected drop in crude oil stocks, and heightened tensions in the Red Sea due to an attack by Iran-backed Houthi militants. Adding to the excitement, the American Petroleum Institute revealed a substantial decrease in oil stocks, surpassing expectations. Meanwhile, the US Energy Information Administration forecasts record U.S. crude oil production in the coming years, though it hints at a potential slowdown in growth. It’s an oil saga filled with surprises and suspense”

USOIL DAILY CHART:

Source : forexfactory.com | babypips.com | fxstreet.com