PREVIOUS TRADING DAY EVENTS – 03 July 2023

“Normally, these figures would have allowed the SNB to halt its monetary tightening,” said Charlotte de Montpellier, an economist at ING. “However, at the latest press conference, the SNB was quite clear and does not seem to want to take account of inflation that is temporarily below 2%. As a result, and given that the other central banks are still in the process of raising their rates, I believe that the SNB will raise its rate one last time in September.”

Annual core inflation was 1.8%, down from 1.9% in May.

As per the PMIs report yesterday, Germany’s manufacturing sector contracted fast as output and new orders moved to lower levels. The HCOB final Purchasing Managers’ Index (PMI) for manufacturing fell to 40.6 from 43.2 in May, marking the 5th consecutive monthly drop.

“Conditions in the manufacturing sector have undoubtedly worsened, but this is not a crash,” said Cyrus de la Rubia, chief economist at Hamburg Commercial Bank AG.

“Overall, the PMI data for manufacturing show that a recession in this sector, which was still expanding in the first quarter according to GDP statistics, has become much more likely,” de la Rubia said.

Source:

“Producers are being hit by weak domestic and export market conditions with clients showing a greater reluctance to commit to spending due to market uncertainty, increased competition and elevated costs,” Rob Dobson, a director at S&P Global Market Intelligence, said.

“Although some respite is being offered in the short term by reduced pressures on supply chains and costs, these remain a symptom of the current weakness of demand faced by the sector and are therefore unlikely to play a role in boosting production moving forward,” Dobson said.

A final PMI reading for the much larger services sector is due on Wednesday.

The ISM survey is consistent with an economy that is in recession contradicting the data such as nonfarm payrolls, first-time applications for unemployment benefits and housing starts that show strong market activity

“This provides further reason to suspect that a recession is on the horizon,” said Andrew Hunter, deputy chief U.S. economist at Capital Economics. “The ISM survey adds to the evidence that core goods prices will start falling again soon.”

Source: https://www.reuters.com/markets/us/us-manufacturing-extends-slump-june-ism-survey-2023-07-03/

______________________________________________________________________

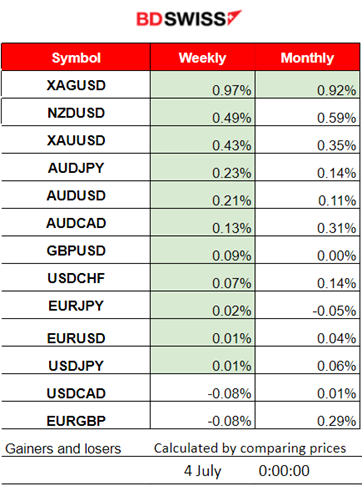

Summary Daily Moves – Winners vs Losers (03 July 2023)

Silver (XAGUSD) has been gaining ground this month and reached the top of the week’s and monthly lists.

______________________________________________________________________

News Reports Monitor – Previous Trading Day (03 July 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning – Day Session (European)

The Swiss Inflation related data at 9:30 showed that inflation is getting significantly lower. This is the monthly figure showing that consumer prices increased by 0.1% in June, less than the expected 0.20% increase. The market reaction to this figure caused intraday CHF depreciation against other major currencies. Retracements followed for pairs.

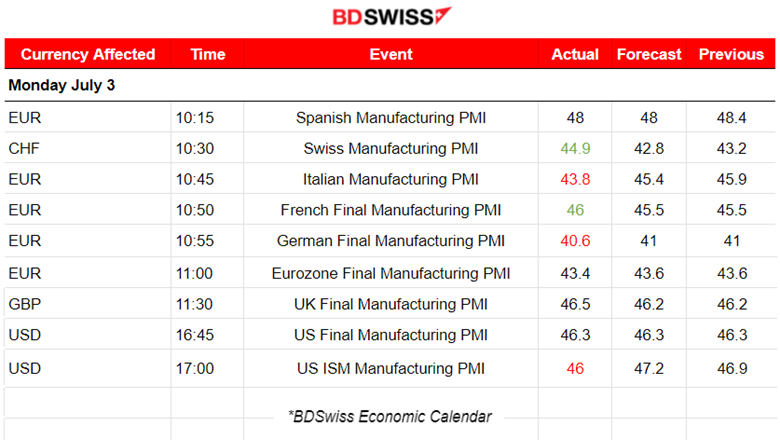

PMI data releases for the Eurozone, U.K. and the U.S. were as per below:

Eurozone: The manufacturing sector was already in a contraction area but it looks like it worsened in June. The eurozone PMI fell to 43.4 in June, less than expected. Germany had the same fate with a worsened PMI since it fell to 40.6, down from the consensus of 41.0 points. Spain, Italy and France also reported readings below 50, all remaining in the contraction area.

U.K.: The UK manufacturing sector remains in contraction territory, with declining levels of output, new orders and employment. The PMI fell to a six-month low of 46.5 in June, down from 47.1 in May.

U.S.: Economic activity in the manufacturing sector contracted in June for the eighth consecutive month. The U.S. ISM Manufacturing PMI was released at 17:00, reported at 46 points, lower than the expected 47.2 points, remaining well in the contraction area. The market reacted with a small shock at the time of the release affecting USD pairs.

General Verdict:

______________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (03.07.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Due to the early appreciation of the USD, the pair moved downwards rapidly until it found significant support at 1.08725 before reversing. The reverse happened at the start of the European session when the PMIs started to get released and volatility reached higher levels. EURUSD reversed to higher levels steadily and the U.S. ISM PMI had an impact at 17:00 pushing it with a shock to reach the resistance near 1.09335 before retracing back to the mean.

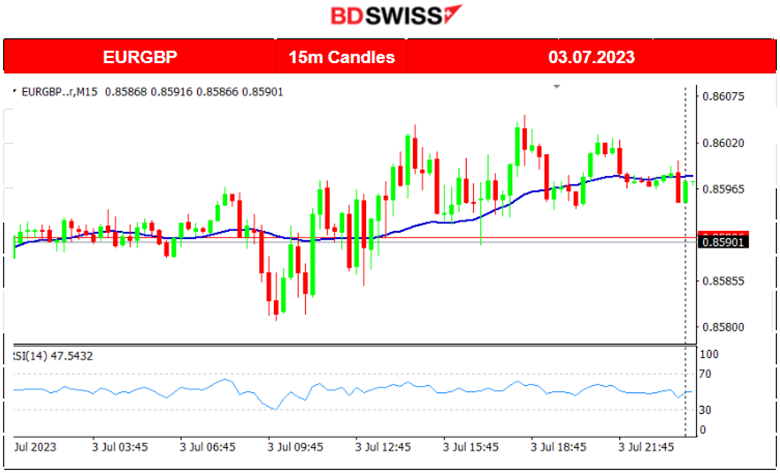

EURGBP (03.07.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The EUR and the GBP were not affected greatly by the PMIs as no shocks were observed. The USD instead moved a lot and reacted significantly to the figures yesterday, as per the DXY chart. EURGBP moved with relatively low volatility sideways around the 30-period moving average.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 30th of June, the index broke significant resistance levels and moved upwards reaching near 15230. Retracement back to the mean did not happen. Then it moved even further to 15250, where more resistance was found, and it eventually settled at 15200. 15250 remains a significant resistance level while 15170 acts as a significant support. Breakouts of these levels cause strong one-direction and rapid movement. On the downside, the breakout will serve as a confirmation of a retracement back to the 61.8 Fibo level.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude has been forming a bearish divergence which seems now that is finally completed. It seems that its price was moving within a channel, following an upward trend and this channel broke on the 3rd of July, on the downside. It is possible that Crude will move sideways for now until more levels are broken and volatility increases. That would probably happen at the end of this week as NFP figures are approaching.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The dollar had experienced depreciation during the European sessions the last couple of days pushing Gold upwards. Gold started to move significantly upwards after the 30th of June showing higher highs while the RSI had flat highs. This shows that the upward steady movement is slowing down. NFP ahead. Employment data for the U.S. will have a strong impact on the USD and thus XAUUSD.

______________________________________________________________

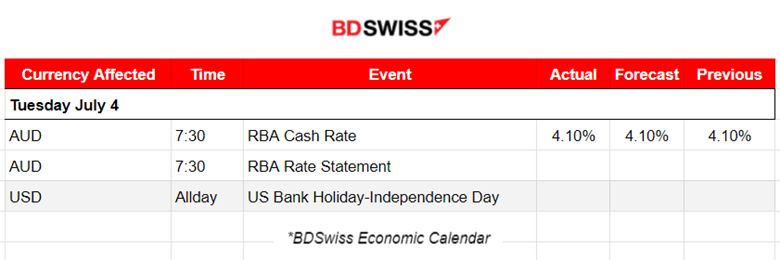

News Reports Monitor – Today Trading Day (04 July 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

The RBA left the Cash rate unchanged at 4.10%. The Australian dollar weakened, 0.25% to 0.6652 against the U.S. dollar. Retracement followed quite soon after the release, more than full.

- Morning – Day Session (European)

No major news, no significant scheduled releases.

General Verdict:

______________________________________________________________