“The Malaysian government is committed to the search, and the search must go on,” Malaysian Transport Minister Anthony Loke said on Sunday.

The Malaysian government, committed to the search for the missing Boeing 777 carrying 239 people from Kuala Lumpur to Beijing on March 8, 2014, reiterated its determination. Malaysian Transport Minister Anthony Loke emphasized this on Sunday during an event marking the anniversary of the disappearance.

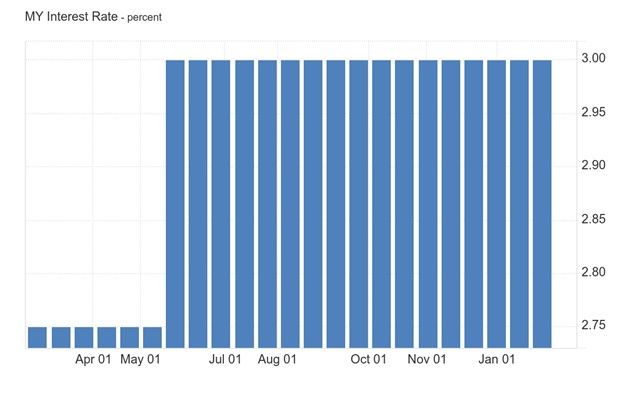

In the economic realm, the central bank of Malaysia maintained its overnight policy rate at 3% for the fourth consecutive meeting in January 2024. Today, the new Malaysia interest rate will be announced, shaping the nation’s financial landscape.

The decision of the Central Bank of Malaysia to keep the policy rate unchanged aligns with market expectations, indicating that the current monetary policy stance is consistent with the assessment of inflation and growth prospects. Inflation rates for both headline and core indicators in 2023 met expectations, averaging at 2.5% and 3%, respectively. Looking ahead to 2024, while inflationary pressures are anticipated to remain moderate, they could be influenced by changes in domestic policies, global commodity prices, and financial market dynamics, particularly regarding subsidies and price controls. Despite the fourth-quarter GDP estimate showing growth at 3.4% in advance, the overall growth for 2023 stayed within projected ranges. Nevertheless, the growth forecast remains vulnerable to external factors such as weaker-than-expected demand from overseas and significant contractions in commodity markets.

If the outcome remains unchanged, with the policy rate staying at 3%, it could potentially lead to stability in the Malaysian Ringgit.This decision indicates that the central bank believes the current economic conditions do not warrant a change in interest rates. Consequently, investors may perceive the Malaysian economy as steady and predictable, which could bolster confidence in the country’s currency. However, if economic conditions deteriorate significantly or if inflationary pressures escalate unexpectedly, the central bank may need to reassess its stance on monetary policy, which could potentially impact the currency’s value.

From a technical analysis perspective, observing the Daily chart of USDMYR, the exchange rate has been consolidating within a range, encountering resistance at 4.7978 and support at 4.7149, with the current exchange rate hovering around 4.7065. If the upcoming interest rate figure supports a continuation of the exchange rate below the current support level, there is a high probability that prices will further decline, signifying the strengthening of MYR. However, if the support level holds and rejects the breakout, causing the exchange rate to revert back within the range, then there is a high likelihood of the exchange rate retracing towards the resistance level.

Sources :

Central Bank of Malaysia https://www.bnm.gov.my/