On Aug. 13, 2024, Lowe’s Companies, Inc. (NYSE: LOW) announced its Q2 2024 Earnings Conference Call set for 9 a.m. ET (13:00 GMT) today, Aug. 20. The webcast will be accessible via the Quarterly Earnings section on Lowe’s Investor Relations website, ir.lowes.com, with supplemental materials available 15 minutes prior.

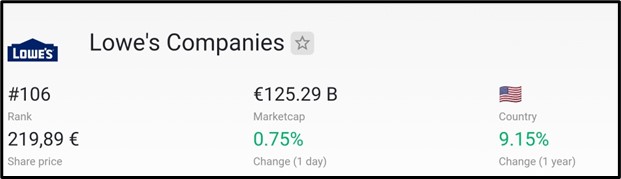

Market Cap

€125.29 Billion marks Lowe’s Companies’ market cap as of August 2024, positioning it as the 106th most valuable company globally, according to companiesmarketcap.com.

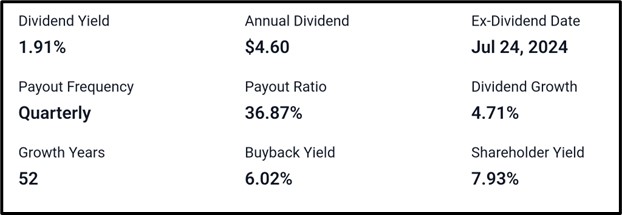

Dividend Information

With a dividend yield of 1.91%, an annual dividend of $4.60, and a payout ratio of 36.87%, Lowe’s offers quarterly payouts and has a solid 52-year growth streak. The ex-dividend date was July 24, 2024. It has seen a dividend growth of 4.71%, a buyback yield of 6.02%, and a shareholder yield of 7.93%.

Recent Development At Lowe’s

Here are some of the latest developments at Lowe’s :

Lowe’s teams mobilize support for rural areas impacted by Tropical Storm Debby.

Lowe’s rebrands and expands its Retail Media Network with enhanced omnichannel ad solutions.

Lowe’s and CM Tucker Lumber forge sustainable partnerships, driving environmental leadership

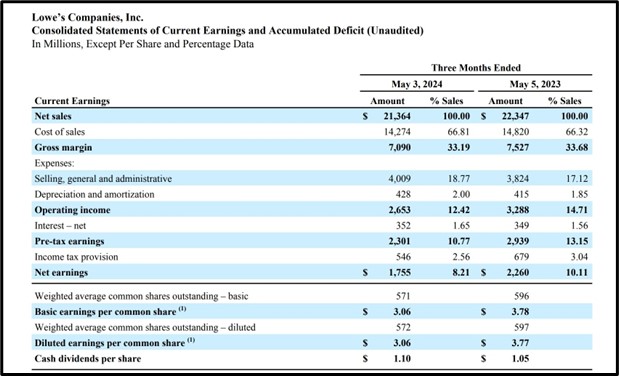

Q1 Earnings Report Recap

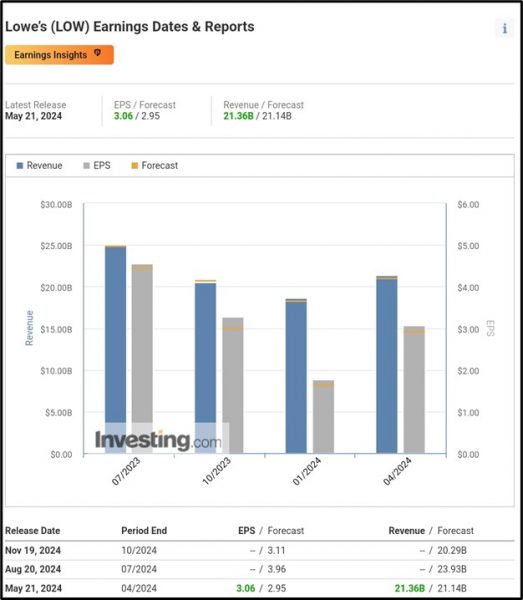

Q1 Net sales: $21.36 billion, with a gross margin of 33.19%

Operating income: $2.65 billion, representing 12.42% of sales

Pre-tax earnings: $2.30 billion, 10.77% of sales

Net earnings: $1.76 billion, 8.21% of sales

Basic EPS: $3.07, Diluted EPS: $3.06

Cash dividends per share: $1.10

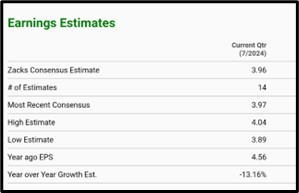

Q2 Earnings Report Analyst Forecast

For the current quarter ending in July 2024, Zacks reports a consensus sales estimate of $23.91 billion, with projections ranging from a low of $23.75 billion to a high of $24.04 billion, reflecting a year-over-year decline of 4.20%. On the earnings side, the consensus estimate is $3.96 per share, with estimates spanning from $3.89 to $4.04, marking a 13.16% decrease from the same quarter last year, where earnings were $4.56 per share.

According to Investing.com, Lowe’s projects an EPS of $3.96 and anticipates revenue to hit $23.93 billion.

According to Tradingview.com, Lowe’s projects an EPS of $3.96 and anticipates revenue to hit $23.93 billion.

Technical Analysis

Lowe’s (NYSE: LOW) potential upside breakout at $247.19 on 1hr chart.

Target levels: $256.93 and $269.31 if breakout holds.

Downside risk: $239.54 and $233.53 if breakout fails.

Apply Risk Management

Conclusion

Lowe’s Companies Inc. (NYSE: LOW) anticipates Q2 2024 sales of $23.91 billion, down 4.20% year-over-year, with EPS forecasted at $3.96, a 13.16% decline from last year’s $4.56. Despite a market cap of €125.29 billion and a strong dividend history, Q1 results showed $21.36 billion in net sales with a 33.19% gross margin. Future performance hinges on key technical levels, with potential upside targets of $256.93 and $269.31, but downside risks to $239.54 and $233.53 if breakouts fail.

Sources:

https://corporate.lowes.com/investors

https://corporate.lowes.com/sites/lowes-corp/files/2024-08/q2-2024-earnings-release.pdf

https://companiesmarketcap.com/eur/lowes-companies/marketcap/

https://stockanalysis.com/stocks/low/dividend/

https://corporate.lowes.com/sites/lowes-corp/files/2024-05/q1-2024-financial-statements.pdf

https://www.zacks.com/stock/quote/LOW/detailed-earning-estimates

https://www.investing.com/equities/lowes-companies-earnings