PREVIOUS TRADING DAY EVENTS – 26 April 2023

Announcements:

Even though it is quite high, core inflation remains far above the RBA’s target band of 2-3%. The Reserve Bank of Australia (e streak.RBA) resumed raising rates at its May 2 meeting, having paused in April after a 10-hike.

“Headline inflation has peaked, and weaker tradables inflation will contribute to slower inflation over the rest of 2023,” said Sean Langcake, head of macroeconomic forecasting for BIS Oxford Economics.

“But we think there is enough momentum in core and services inflation to warrant tighter policy settings, and maintain our expectation for another rate hike in May.”

“The economy isn’t going off the rails yet,” said Christopher Rupkey, chief economist at FWDBNDS in New York.

“Equipment spending was likely a bit weaker in the first quarter,” said Shannon Seery, an economist at Wells Fargo in New York. “Conditions for new capital investment continue to grow less favourable. We anticipate a further tightening in banks’ lending standards to take hold.”

“We don’t believe this marks a change in trade’s cooling trajectory, with imports facing weaker consumer demand and tighter lending standards for businesses, while demand for exports will slow due to the continued strength of the dollar and declining economic activity abroad,” said Matthew Martin, a U.S. economist at Oxford Economics.

Source: https://www.reuters.com/markets/us/us-core-capital-goods-orders-shipments-drop-march-2023-04-26/

______________________________________________________________________

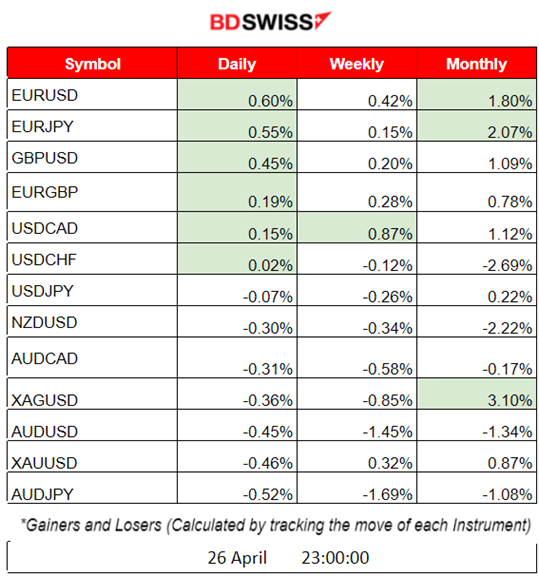

Summary Daily Moves – Winners vs Losers (26 April 2023)

______________________________________________________________________

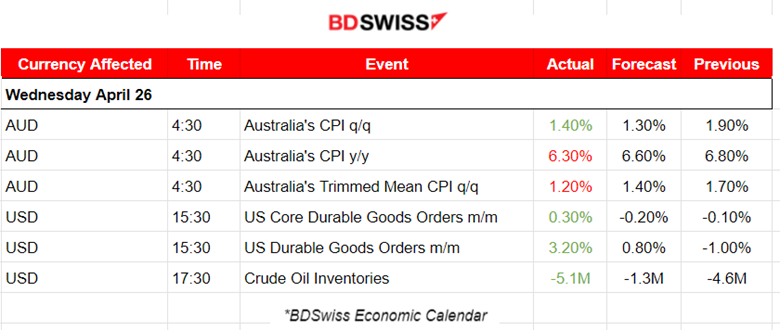

News Reports Monitor – Previous Trading Day (26 April 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

At 4:30, Australia’s CPI figures were released. Since they are inflation-related data, there was an impact on the AUD causing intraday shocks. Major AUD pairs with AUD as base currency dropped more than 20 pips before the full retracement which was quite rapid.

- Morning – Day Session (European)

After the release of the Durable Goods figures at 15:30, USD experienced a short shock downwards before retracing back.

At 17:30, the change in Crude Oil inventories reported a big negative figure explaining the fall in prices recently. Since then, the USD moved higher with appreciation for the rest of the trading day.

General Verdict:

______________________________________________________________________

FOREX MARKETS MONITOR

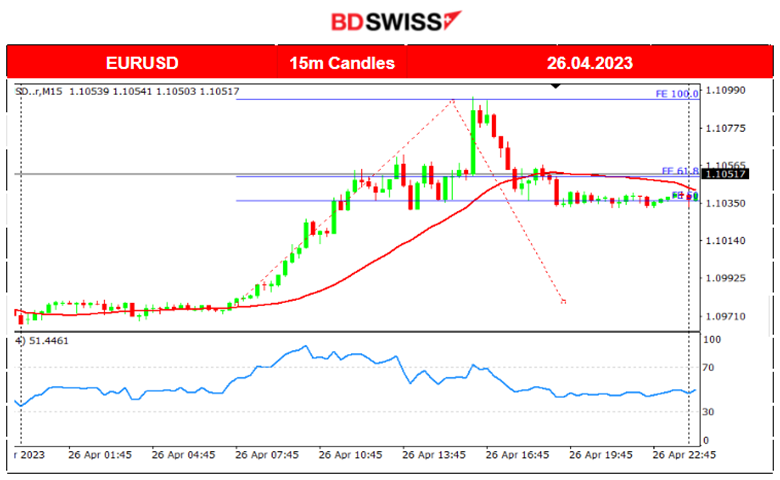

EURUSD (26.04.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

EURUSD moved higher since the morning hours (Asian Session) and the news at 15:30 caused it to move further upwards as USD depreciated. The retracement came later.

____________________________________________________________________

EQUITY MARKETS MONITOR

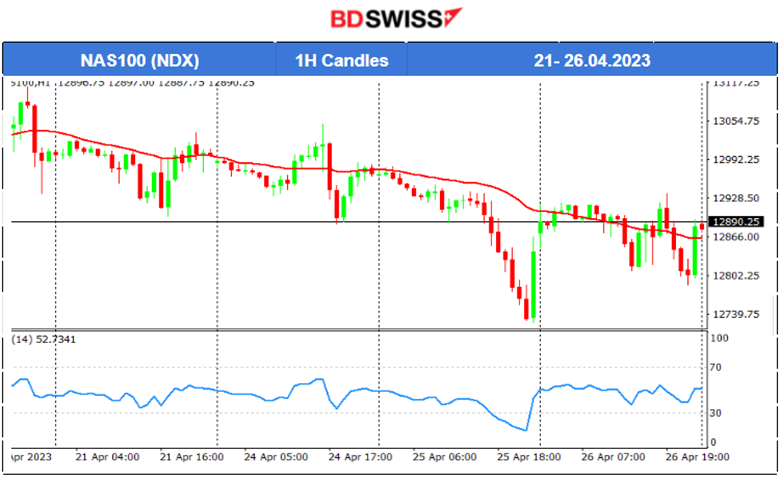

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 25th of April, the index moved significantly downwards, breaking important support levels and indicating the end of the sideways channel. A significant retracement happened the next day, putting the index back on track but on the downward path as it moves around the 30-period MA.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

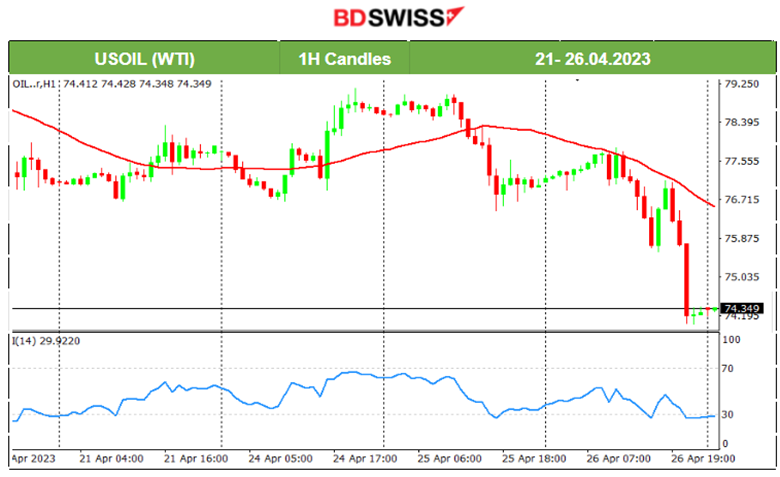

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude was repeatedly testing the support levels near 76.5 USD for some time when yesterday, it eventually managed to break them. The release of the high negative change in U.S. Crude oil inventories might have had an impact as its price experienced a drop all the way to 74 USD/barrel.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold is moving relatively sideways with high volatility heading more towards the upside where it finds resistance. Since the 24th of April, it is moving around the 30-period MA and is testing the resistance near the 2000-2007 USD level.

Trading Opportunities

Bearish Divergence: The RSI has indicated lower highs while the price formed higher highs, signalling that the price would drop yesterday.

______________________________________________________________

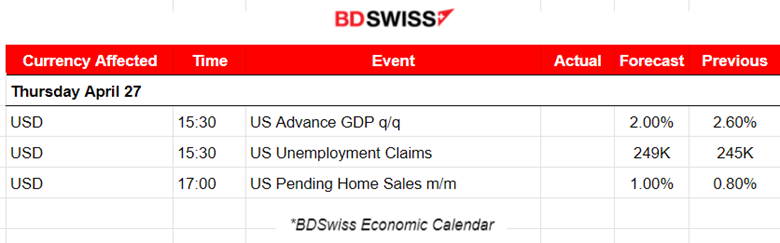

News Reports Monitor – Today Trading Day (27 April 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements or significant scheduled releases.

- Morning – Day Session (European)

At 15:30, high volatility is expected with the release of the U.S. Advance GDP and Unemployment Claims.

At 17:00, USD pairs might also experience some abnormal volatility with the release of the Pending Home Sales figures.

General Verdict:

______________________________________________________________