Rates as of 04:00 GMT

Market Recap

Japan was on holiday overnight for “Respect for the Aged Day”– and no, I didn’t get a call from my daughter who’s studying in Japan right now. I wonder if I should be pleased that she doesn’t think I’m aged yet or upset that she didn’t think to call. Japan’s markets will be closed tomorrow too, for Vernal Equinox Day. Now the days will start getting shorter and shorter…

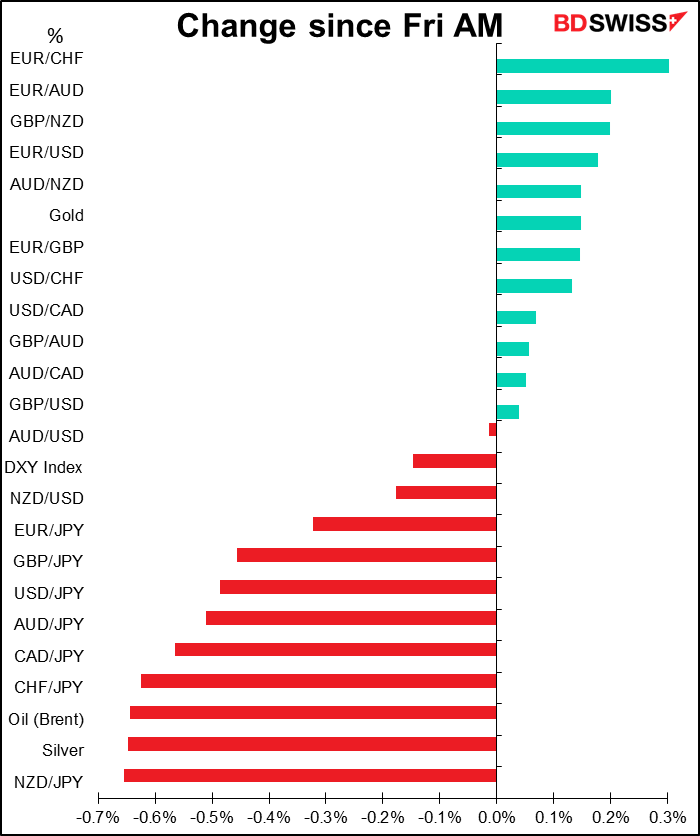

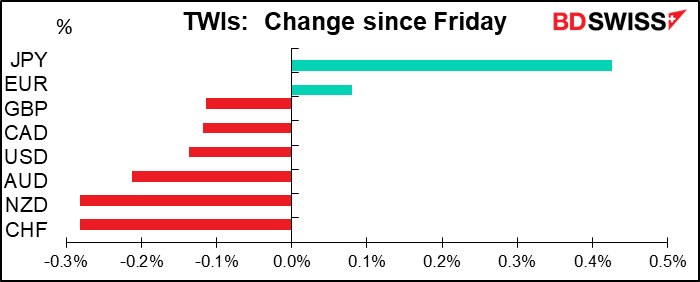

With Wall Street lower Friday and most Asian markets lower this morning, we’ve got a typical “risk-off” move in the FX market with one big exception. JPY is leading the way up and NZD and AUD are lower, except for a glaring anomaly: CHF is the #1 loser. EUR/CHF showed the biggest percentage gain among the currency pairs that we follow (see graph at bottom).

No doubt part of that rise was attributable to general EUR strength. EUR gained vs most other currencies, JPY being the main exception.

As I mentioned last week, the moves in JPY tend to come during European and New York trading, not Tokyo time. Since Tokyo was out today and will be out tomorrow, that leaves plenty of opportunities for people to push USD/JPY lower.

The weaker CHF may also have been caused in part by the “risk-off” tone in AUD/JPY. CLS, a major FX trading & settlement firm, reported unusually high volumes in AUD/JPY on Friday. At 01:00 GMT, which would be Tokyo trading time – presumably Tokyo traders positioning themselves ahead of the long weekend. This may have spilled over into other JPY crosses as well.

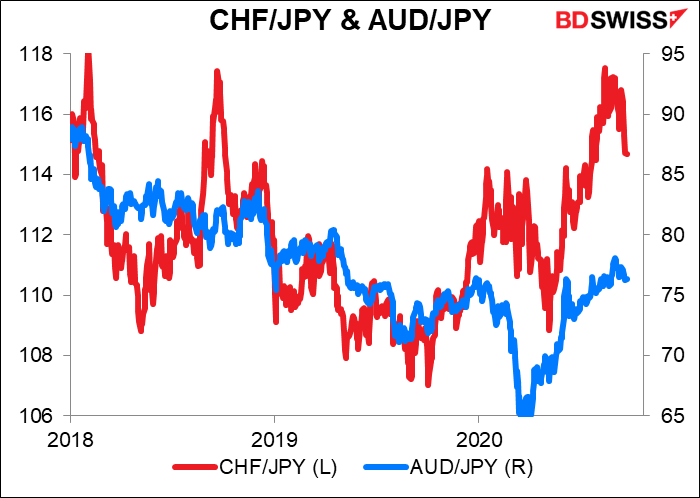

Over the longer term, CHF/JPY does seem to be sensitive to risk – that is, when AUD/JPY moves higher (lower), CHF/JPY also moves higher (lower). This suggests that JPY is the more “risk-sensitive” of the two safe-haven currencies.

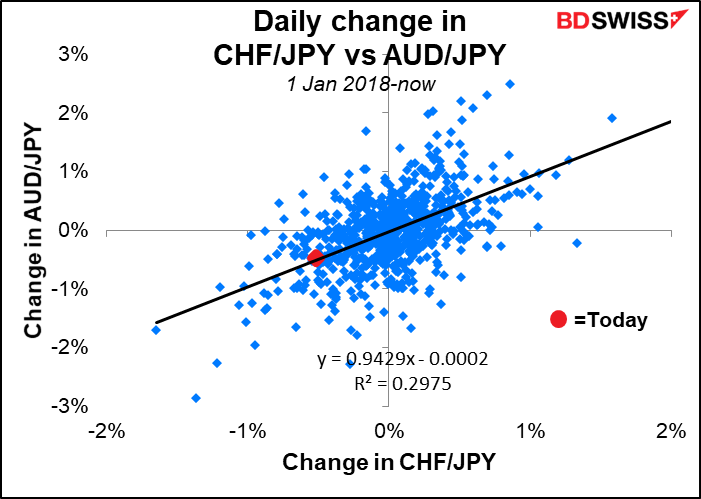

However on a day-to-day basis there isn’t much of a correlation in changes. Today’s move was exactly in line with what one might expect – it lies right on the line showing the average move.

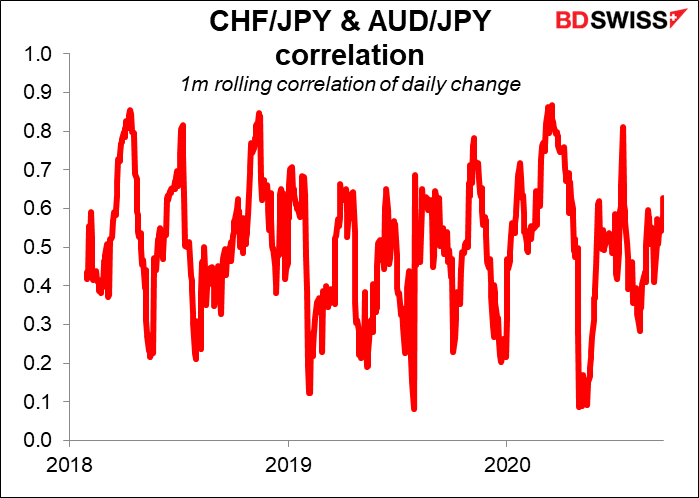

The relationship between the two pairs is quite variable. The correlation can swing between 0.9 (= almost one-for-one) to 0.1 (almost nothing).

One thing that I don’t think is moving CHF: positioning ahead of this week’s Swiss National Bank (SNB) meeting. The SNB has the lowest interest rates in recorded history and is steadily intervening in the FX market. There’s not much more that they can do. They’re likely to repeat their usual comments once again and make no change in their stance.

In any event, I’m eagerly awaiting the start of “verbal intervention” by Japanese authorities once they get back in the office on Wednesday. I’ve discussed elsewhere how the Ministry of Finance gets excited whenever USD/JPY gets to ¥105. It’s below that now, so we can soon expect to hear how officials are “watching the market closely,” which is the Japanese equivalent of the ECB’s “vigilant.” Whether it works or not is another matter. With the pickup in foreign bond yields for Japanese investors getting less and less, capital flows out of Japan may fall even further. Meanwhile, with Warren Buffet buying Japanese stocks and a new administration coming in with a focus on economic and regulatory reform, foreign purchases of Japanese stocks may pick up. The result could be a stronger yen regardless of risk sentiment.

Commitments of Traders Report

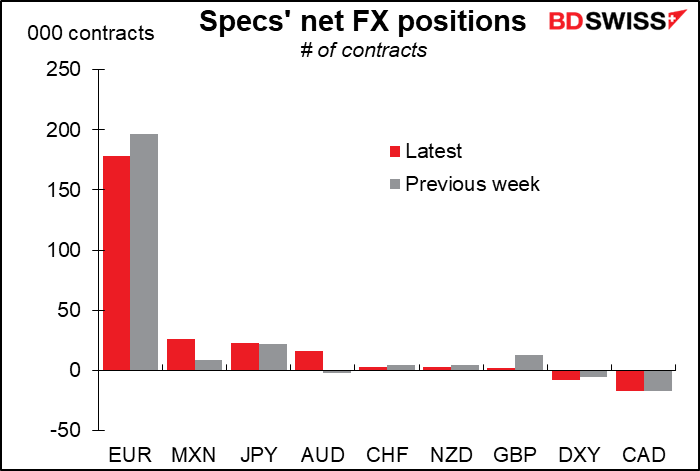

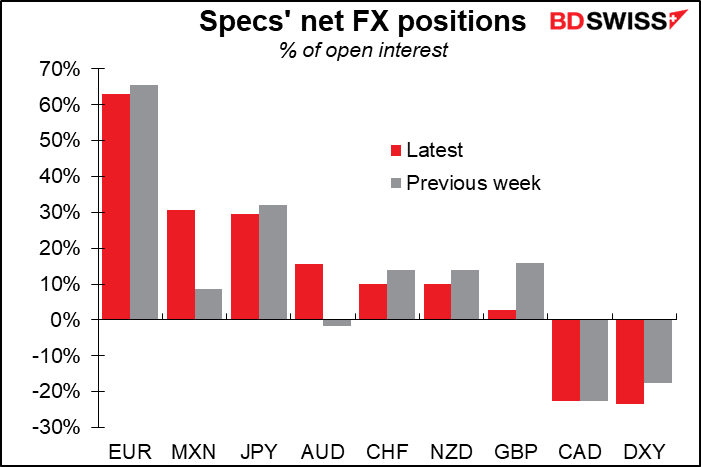

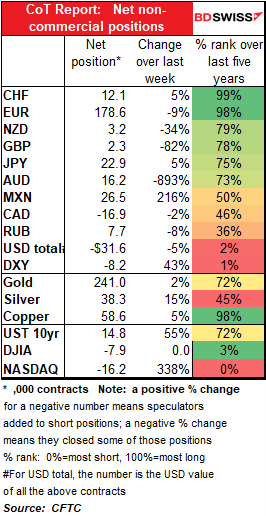

Speculators continued to cut their long-EUR positions, but they still dwarf any other positions that they have in the market nowadays.

The increase in long MXN is interesting – I wonder if this is the start of a pro-Biden move.

Speculators flipped from short AUD to long AUD.

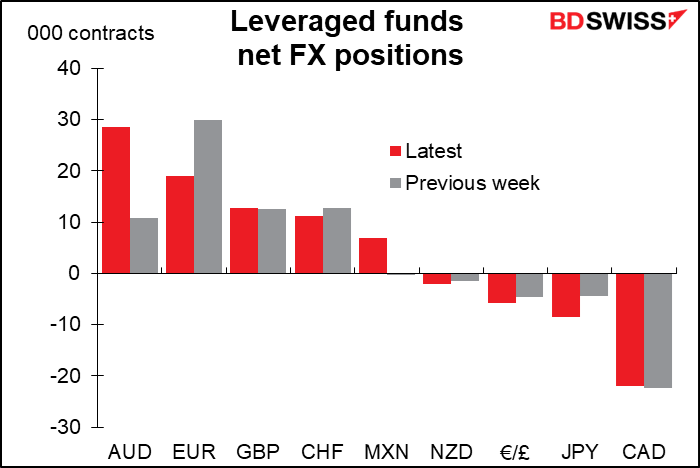

Much of the shift in AUD must have been hedge funds – long-AUD is now the largest position of hedge funds, exceeding their long EUR. Yet CAD remains their largest net short. Perhaps this is a bet that China recovers faster than the US?

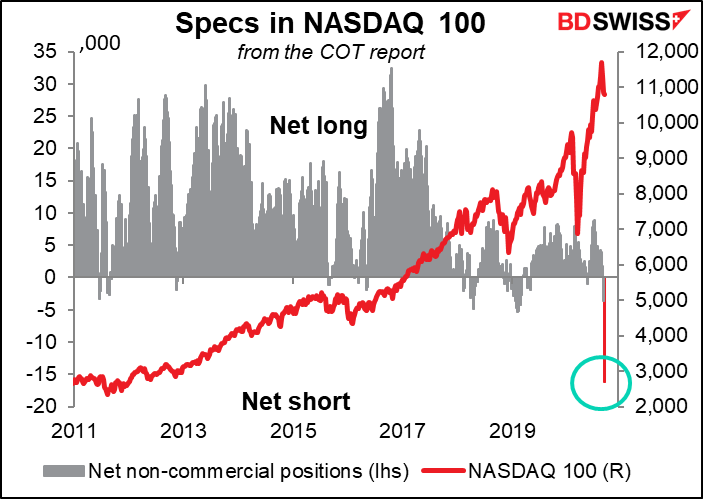

Note the record-short position in the NASDAQ 100 futures – the largest short since we have data (starting June 2010). This was really sudden, a drop from -3,700 contracts to -16,200. This was not hedge funds, which actually reduced their shorts this week, or asset managers such as pension funds or portfolio managers. It’s also not retail. It all came from the “other reportables” category, which includes corporate treasurers, central banks, smaller banks, credit unions and other miscellaneous buy-side participants.

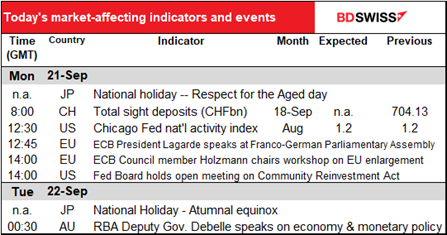

Today’s market

Not much on the schedule for today!

ECB President Lagarde will speak at an online meeting of the Franco-German Parliamentary Assembly. I doubt if she’ll say anything market-moving, but you never know. ECB GOvering Council Member Holzmann’s appearance at a workshop on “W5 years of EU Northern Enlargement” and the Fed Board openg meeting to discuss advance rlemanking on the Community Reinvestment Act are probably even less market-affecting.

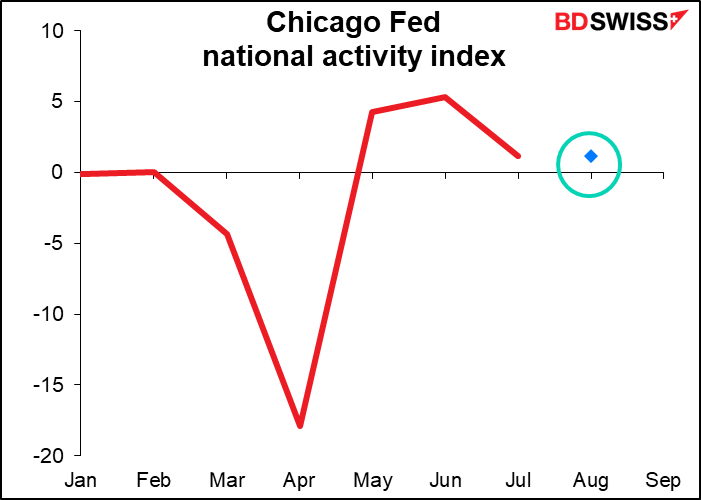

When the US starts up, we get the Chicago Fed National Activity Index (CFNAI). It’s different from the other regional Fed indices. It’s designed to gauge overall economic activity and related inflationary pressure on a national basis, not regional. A positive index reading corresponds to growth above trend and a negative index reading corresponds to growth below trend. As the 85 components have all been previously announced, the indicator isn’t one of the more closely watched among those issued by the various regional Feds. Moreover it’s difficult to interpret any one number, because the figures are so volatile. This month is expected to be little changed from the previous month, but at least it’s expected to be still showing above-trend growth – nice to know after such a huge collapse back in April.