Rates as of 05:00 GMT

Rates as of 05:00 GMT

Market Recap

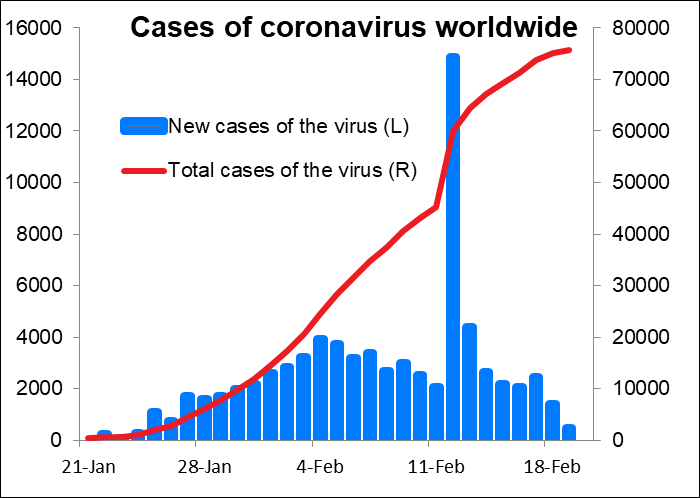

Given the overwhelming impact of the COVID-19 virus on the markets nowadays, we usually have either straight “risk on” or “risk off” days, depending not on the economic news but rather on the medical news. The medical news today is pretty good: the number of new cases of the virus continues to fall, at least according to the official numbers (see graph). But the impact on the markets this morning isn’t so straightforward. We’re not seeing a straight “risk on” or “risk off” mood, but rather a more nuanced approach to the markets. That may in fact be the real “risk on” mood, because instead of just reacting to risk in general, the FX market at least seems to be weighing the actual risk to each country.

Some of the discrepency may be because of confusion about the virus news. There were also reports of a big increase in cases in South Korea – they more than doubled in one day as there was a surge of infections tied to a religious group.

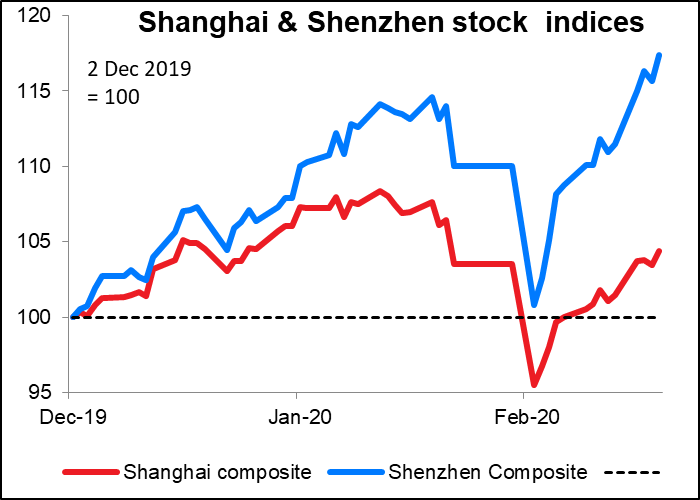

US stocks closed slightly higher yesterday, with the S&P 500 renewing a record high. But Asian stocks are mixed this morning, although China is up. In fact both the Shanghai and Shenzhen stock indices are above where they were before the Lunar New Year break, which is kind of odd to me given that many cities in China are still under lockdown.

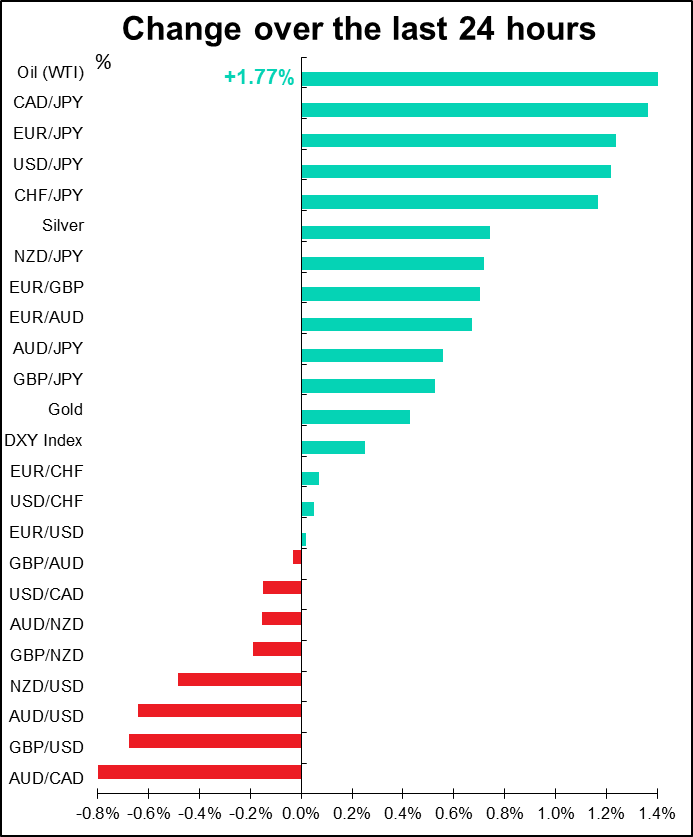

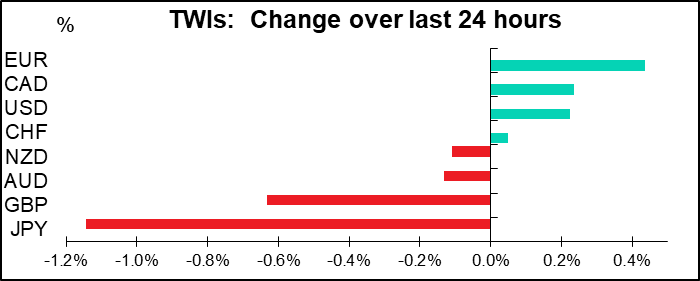

In this context, JPY was the main loser. That could be because of the “risk on” atmosphere, but in that case, we’d expect CHF to be lower as well. It was a bit lower, but not significantly (USD/CHF was up +0.05% and EUR/CHF up +0.07%, vs +1.22% for USD/JPY.) That makes me think that the yen may be falling because people are worried about the impact of the virus on the already weak Japanese economy. Japan is one of the countries most highly leveraged to China and would therefore be hurt most by continued weakness in China. If JPY weakens on “risk on” (as usual) and then weakens on “risk off” too (because of specific China fears), it’s basically a one-way ticket for JPY.

The yen weakness was particularly noticeable because Japan’s trade figures were better than expected – in particular, exports were down only 2.6% yoy vs expectations of a 7.0% fall. This suggests the economy was probably doing better than people had thought before the virus hit (although machinery orders fell more than expected – but they’re incredibly volatile and impossible to forecast, actually.)

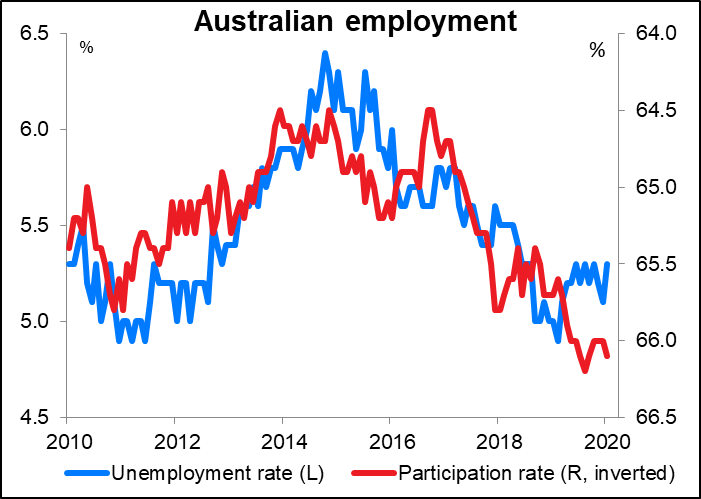

Furthermore, if JPY were down today because of “risk on,” then AUD would usually be up, and it isn’t. That’s probably because FX traders don’t understand economics that well but instead just have knee-jerk reactions to the headlines that come out, in this case the Australian employment data. The Australian unemployment rate was expected to rise to 5.2% from 5.1%, but instead rose to 5.3%. Horrors! But people failed to notice – or maybe they don’t care – or maybe they don’t understand – that the participation rate, which was expected to stay at 66.0%, rose to 66.1%. Coupled with the fact that the change in employment was a bit higher than expected — +13.5k vs +10.0k expected – it actually shows a strong labor market. The reason the unemployment rate rose was not because of more people being unemployed, but rather because more people are looking for work – a sign of optimism.

Note that AUD/USD has started to recover. I’d expect to see it gain back a lot of the losses today.

Also gold and silver were up too, a sign of “risk off,” but the biggest gainer of the day was oil, despite another rise in US crude inventories (according to the API), a sign of “risk on.” So mixed signals across the board.

GBP initially spiked after UK inflation data came in stronger than expected, with both headline and core inflation surprising to the upside. But that wasn’t enough to sustain the gains in the face of more Brexit fears — EU Trade Commissioner Hogan came out in support of Britain’s position that a Canada-style agreement with the EU was possible, but at the same time said that “even with a deal there is going to be a massive change in terms of logistics, in terms of how we trade with each other, how we travel.” I remain structurally bearish on GBP.

Today’s market

The day starts with yet another British indicator: UK retail sales. On a mom basis sales are expected to show a decent rise – the first rise in five months and the largest since June — but that won’t be enough to push the yoy rate of growth higher. The Bank of England has noted that “surveys of business activity” have picked up, but said that they want to see “follow through to the hard data on domestic activity…” That’s what this indicator is. It remains to be seen whether an increase along the lines of what’s forecast will be good enough to allay their fears. The next UK retail sales figure won’t be available for the Monetary Policy Committee during its discussion, so this is it. I think it will at least show that the economy is moving in the right direction and there’s no urgent need to cut rates. In that respect it may be positive for the pound.

The Confederation of British Industry (CBI) industrial trends survey is a second- or even third-tier indicator that people usually don’t pay much attention to, except last month there was an enormous surge in business optimism that presaged the higher-than-expected manufacturing purchasing managers’ index (PMI). This month there are no forecasts for the optimism index – no one wants to stick their neck out that far, I guess. In any event it’s expected to show a small rise in orders and a small decline in prices – not much change. We’ll see if it continues to serve as a precursor to the PMI, much like the ADP report is (erroneously) viewed as an indicator of where the nonfarm payrolls might be. GBP neutral

The minutes of the ECB’s latest meeting (23 January) will attract some interest to see what if any discussion there was about the coronavirus (too early, perhaps) and whether there was any support for a further reduction in rates or other easing measures. My guess is that it was too early for both. The disasterous December industrial production figures hadn’t been released yet. The general market view after that meeting was that policy would be on hold for the rest of the year while they carry out their Strategic Review. I don’t think we’ll get any major indication in the minutes that that assumption was incorrect. I think the upcoming 12 March meeting could be more tempestuous, with below-expectations growth meeting an unanticipated source of uncertainty and downward pressure on growth and inflation.

The Philadelphia Fed business outlook index is expected to fall a lot, but that’s probably just mean reversion after its large 14.6-point gain in the previous month. Tuesday’s Empire State manufacturing index, by comparison, was up a lot this month (to 12.9 from 4.8; 5.0 expected). A modest fall, like that expected, would still keep the Philly Fed index squarely in expansionary territory, in contrast to…well, almost everywhere else. USD positive

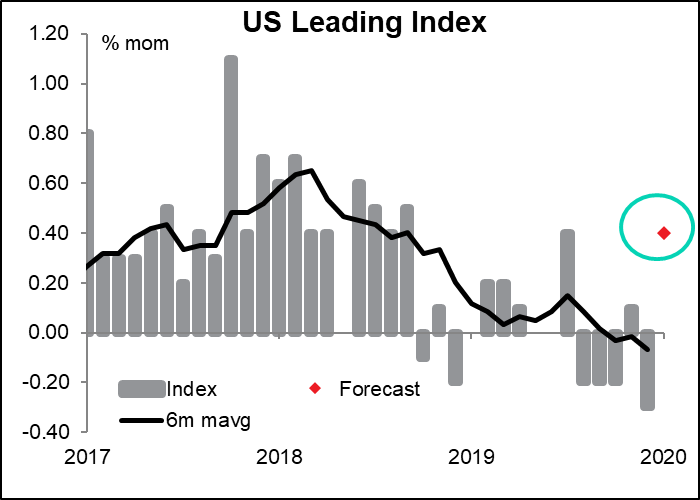

The US leading index should see a decent rebound based on the recent fall in jobless claims and the further inexorable rise in equity prices. In that respect it could be modestly dollar bullish in that it projects the US economy continuing to grow nicely, in contrast to the Eurozone economy, which appears to be tanking. However, it’s debatable how accurate this leading index is going to lead when an alien force like the coronavirus suddenly intervenes to upset the usual correlation between the past and the future.

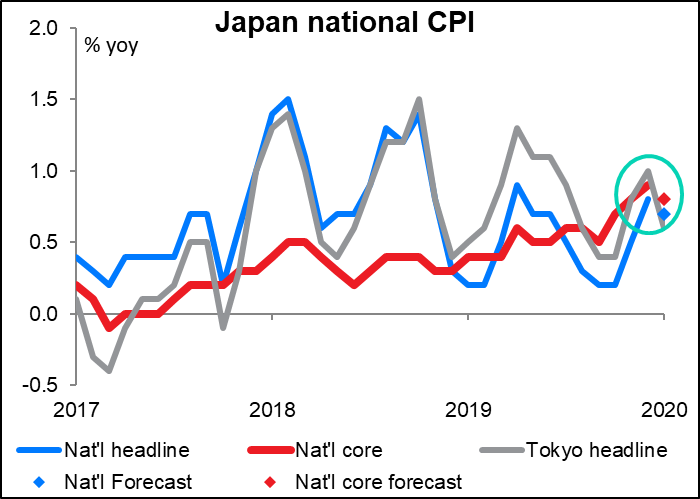

Overnight, Japan will release its nationwide CPI data. Inflation is expected to be slightly lower, but who cares? Not only is the national CPI an anticlimax two weeks after the Tokyo CPI comes out, but in the larger scale, Japan hasn’t hit its inflation target in over 25 years, give or take a few months when a hike in the consumption tax temporarily pushed prices up. In fact, the main reason to watch the inflation data is to make sure that inflation isn’t decelerating again. The statement after every Bank of Japan meeting pledges that “the Bank will not hesitate to take additional easing measures if there is a greater possibility that the momentum toward achieving the price stability target will be lost.” Putting aside the question of whether there really is any such “momentum” (most unbiased observers would say no, not at all), if indeed it looks like deflation is returning, then they might be forced to put their money where their collective mouths are and “take additional easing measures,” whatever those might be.

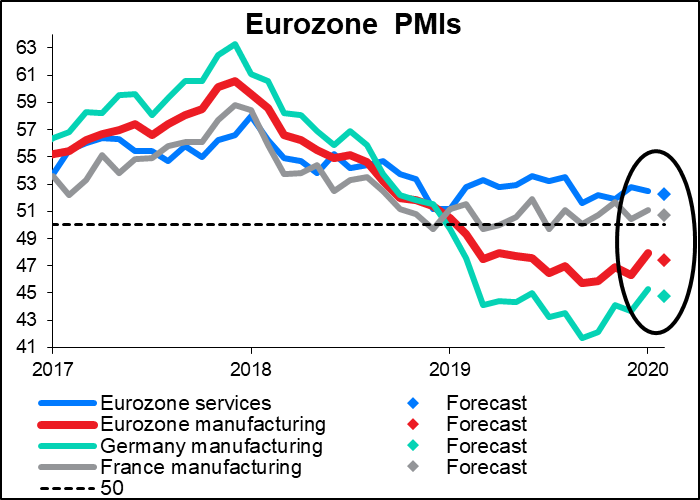

Finally, early Friday we start getting the preliminary purchasing managers’ indices (PMIs) for the major industrial economies. The Japanese PMIs attract little if any interest and no one bothers forecasting them. My guess is that it’s because the industrial production figures already come with a forecast of the next month’s data and so Japan already has this kind of information.

As for the EU PMIs, everything but the French services PMI is expected to be lower, including both EU-wide manufacturing and services (and therefore of course composite, too.) Not a collapse by any means, but more of a relapse. I expect this will confirm the growing sentiment that the Eurozone economy is not going to recover any time soon and the ECB may have to take more steps to deal with the problem, which would be EUR negative.