PREVIOUS TRADING DAY EVENTS –30 Oct 2023

______________________________________________________________________

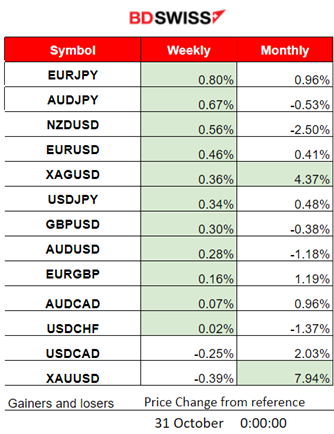

Winners and Losers

News Reports Monitor – Previous Trading Day (30 Oct 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important announcements. No special scheduled figure releases.

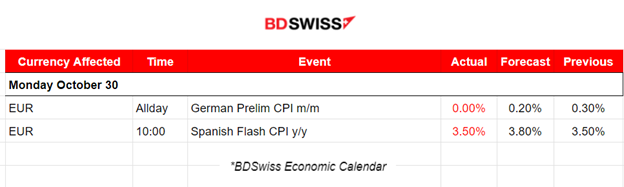

- Morning–Day Session (European and N. American Session)

EUR-related news caused little impact. These were the inflation-related figure releases and German and Spanish CPI data that seemed important. The German Preliminary monthly CPI figure was reported lower confirming the desired effect of elevated interest rates. The same applies to the Spanish Flash yearly CPI figure that was reported lower than expected and unchanged. The EUR eventually won against the dollar after a short period of depreciation mainly because the USD was weakening continuously against other currencies for the rest of the whole trading day.

General Verdict:

____________________________________________________________________

____________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (30.10.2023) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair was moving sideways with low volatility and climbed as soon as the European session started and the news kicked in. The pair moved steadily to the upside at a relatively quick pace. After finding strong resistance at near 1.06255 it retraced back to the 30-period MA and touched its mean at the 61.8 Fibo level.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Bitcoin remains in consolidation and with low volatility levels, having 35000 USD as an important resistance level. Fundamentals remain the key factors that push the price to deviate significantly from the mean. Important resistance remains at the 35200 USD level. It is currently testing support levels that, if broken, could push the price downwards towards the support near 33350 USD.

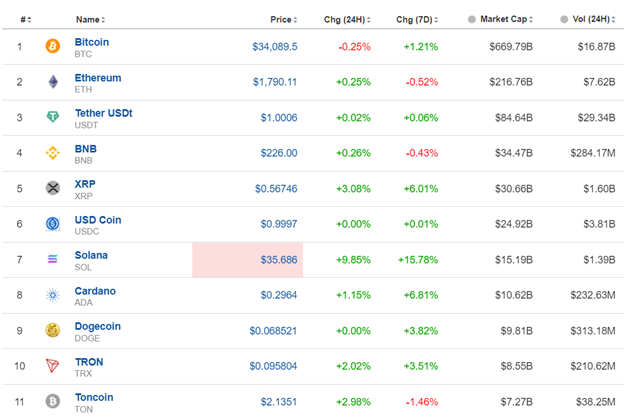

Crypto sorted by Highest Market Cap:

Volatility levels are lower and the markets for Crypto are not moving much. In the last 24 hours, we see some gains for Crypto, except for Bitcoin. In general, not much is happening at the moment in regard to shocks or big moves.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

All benchmark U.S. indices are fighting for the upside. The trend downwards seems to have paused. Reversal to the upside did not happen yet but technically the data show that it might actually take place. Currently, we see an upward wedge that seems to have been broken to the downside. However, this could be a false breakout. Additionally, the fundamentals might hold stock prices up creating some further support. On the daily chart it is clear that further upside movement and more resistance breaks will enhance the view for an upside movement, part of a retracement to the 30-period MA.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

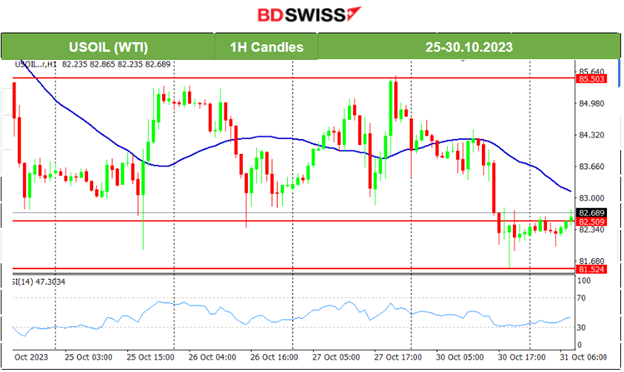

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Crude eventually broke the consolidation yesterday going towards the downside. It broke the 82.5 USD/b and reached 81.5 USD/b before retracing back. However, retracement is not fully complete technically. We could see more movement to the upside in the short-term, intraday.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Gold jumped over the 2000 USD/oz reaching the resistance near 2009 USD/oz before it retraced to the mean after the market opening. The risk-off mood is still on as war is ongoing. Gold performance is over 8% for this month so far. It is currently moving with low volatility and close to the 2000 USD level, testing the triangle formation upper band. Breakout to the upside could push Gold’s price upwards rapidly reaching 2009 again.

______________________________________________________________

______________________________________________________________

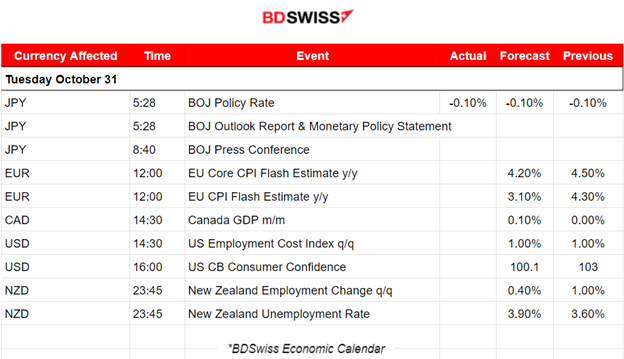

News Reports Monitor – Today Trading Day (31 Oct 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

The Bank of Japan (BOJ) maintained its -0.1% target for short-term interest rates, as expected, and that for the 10-year government bond yield around 0% set under its yield curve control (YCC). The JPY was boosted yesterday by a report that the Bank of Japan (BOJ) could further tweak a key bond yield policy tool when announcing the monetary policy decision. Today the JPY is losing heavily against the dollar as the BOJ failed to appease some investors who had expected a bigger move toward ending years of massive monetary stimulus.

- Morning–Day Session (European and N. American Session)

Core CPI and CPI Flash Estimates figure releases are expected to cause increased volatility levels affecting the EUR.

CAD pairs might experience some small intraday shock at the time of the monthly GDP figure release. The figure is expected to be reported higher.

The employment cost index and CB consumer confidence report could shake the USD pairs. The USD in general is expected to be affected today with high volatility as important news approaches and expectations form.

Late at 23:45, the New Zealand Labour data might cause moderate shock affecting the NZD pairs at the time of the release. It will be a late release but the data are important for policymakers, thus increasing the probability of a shock happening upon release.

General Verdict:

______________________________________________________________