PREVIOUS TRADING DAY EVENTS – 28 April 2023

Announcements:

BOJ also announced a plan to review its past monetary policy move. The new 71-year-old governor who took office this month, Kazuo Ueda, has room to make future changes but it seems that he is in no rush to do so. In a news conference, the new chief said the broad-based review wouldn’t be tied to near-term policy shifts and stressed the need to wait for more evidence to conclude inflation would sustainably achieve the BOJ’s 2% target.

“While trend inflation is gradually heightening, it will take some time to achieve our inflation target,” Ueda said after the BOJ’s widely-expected decision to make no changes to its yield curve control (YCC) policy.

“The risk of missing our price target with premature monetary tightening is bigger than the risk of experiencing inflation exceeding 2% due to a delayed tightening. The cost of waiting for trend inflation to heighten is low,” he said.

“The fact that the BOJ left a reference to further easing as needed confirmed its stance to continue monetary easing,” said Naomi Muguruma, senior market economist at Mitsubishi UFJ Morgan Stanley Securities.

Data this week suggest that inflation is accelerating for France and Spain, alongside modest expansion for the euro region’s 20-nation economy in the first three months of the year.

“What happened to euro-area inflation in April could be pivotal to the ECB’s May policy decision — a big upward surprise on core inflation would put the decision over whether to hike by 25 or 50 basis points on a knife edge.”

Bank of Canada paused hikes, however further tightening is a possibility due to the job data showing a strong labour market, and sticky high prices.

“Until there are clearer signs that slowing growth is also helping to ease core inflation, the Bank of Canada will continue to lean towards raising interest rates, even if a hike is not ultimately needed,” Andrew Grantham, an economist with Canadian Imperial Bank of Commerce, said in a report to investors.

“The shaky March data will reinforce the Bank of Canada’s decision to hold rates steady at its last policy announcement,” Royce Mendes, head of macro strategy at Desjardins Securities, said in a report to investors. “That said, it’s not yet enough to move central bankers to completely close the door to future rate increases.”

______________________________________________________________________

Summary Daily Moves – Winners vs Losers (28 April 2023)

______________________________________________________________________

News Reports Monitor – Previous Trading Day (28 April 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

At 2:30, the Tokyo Core CPI figure was released, a change of 3.5%, more than expected but did not have much impact.

The Monetary Policy Statement was released at 7:00 and that caused high depreciation of the JPY. USDJPY moved upwards rapidly, more than 100 pips.

BOJ Policy Rate remained unchanged at -0.10%.

- Morning – Day Session (European)

At 15:30, Canada’s GDP was reported as less than expected. CAD experienced short depreciation. The U.S. Core PCE Price Index and U.S. Employment Cost figures did not have much impact on USD.

Consumer sentiment rose 2.4% in April to 63.5, as expected, according to final results from the University of Michigan Survey of Consumers at 17:00. USD depreciated after the release until about 19:00.

General Verdict:

______________________________________________________________________

FOREX MARKETS MONITOR

USDJPY 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

USDJPY was moving relatively sideways the last few days. Major scheduled releases for the USD had been causing intraday shocks followed by retracements back to the 30-period MA. Deviations were max near 50-60 pips from the MA. On the 28th April the BOJ news caused the pair to move rapidly upwards, over 260 pips. That’s huge. No retracement has taken place yet.

____________________________________________________________________

EQUITY MARKETS MONITOR

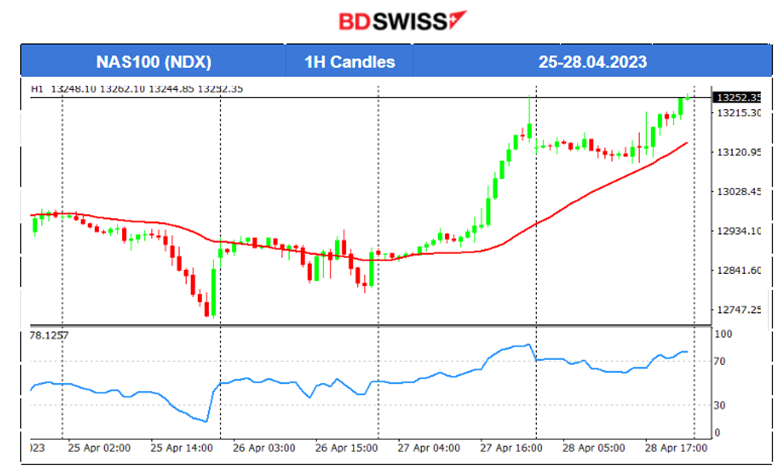

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

While the index showed a clear downward trend, it rose unexpectedly on the 27th April moving above the 30-period MA and gaining momentum. Current fears of a new recession do seem to have an impact. Recent Labor data for the U.S. show a strong labour market still. The upward movement continued on the 28th of April, signalling that this might be the start of a new upward trend.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude was testing the support near 73.96 USD/barrel. A further downward movement was less probable to happen and this idea was supported by the recent U.S. inventory figures showing fewer and fewer barrels in inventories. On the 28th April, its price started to move upwards. No retracement yet back to the mean, something expected after a price reversal.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold is moving around the 30-period MA for days testing the resistance levels near the 2000 USD level and around the mean near the 1990 level.

______________________________________________________________

News Reports Monitor – Today Trading Day (01 May 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No significant news announcements, no important scheduled releases.

- Morning – Day Session (European)

Due to Bank Holidays and the fact that it is Monday, we do not expect to have major movements.

At 17:00, we have the release of the ISM Manufacturing PMI figure. The manufacturing business activity for the U.S. is indicated to be in contraction, in contradiction to the services sector which shows expansion and an overall business growth. If the index is more than forecast, the impact will be great on the USD. There will be an intraday shock nevertheless for the USD pairs, however, it is not expected to be huge.

General Verdict:

______________________________________________________________