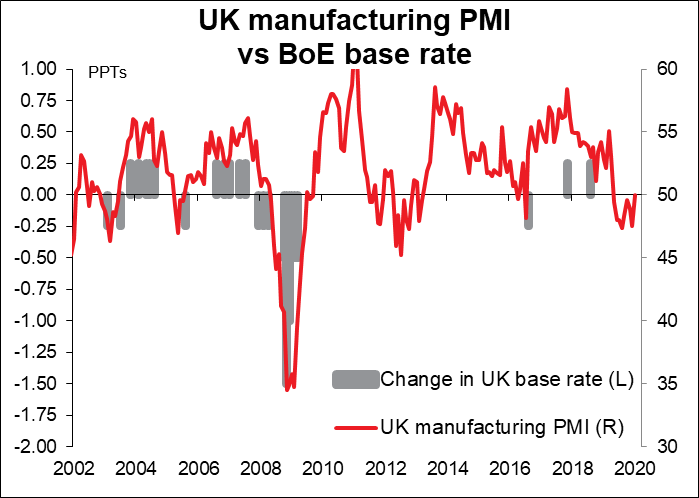

Rates as of 05:00 GMT

Rates as of 05:00 GMT

Market Recap

Fascinating market move today: JPY and AUD trade-weighted indices are down by the same percentage. It isn’t so rare that the two move in the same direction – it’s happened 35% of the time over the last two years, meaning the market’s not always risk on vs risk off. But what are we to make of it today?

AUD is clearly suffering from a “risk off” mood today. US stocks were down and this morning almost every market in Asia is down (except, bizarrely, Shanghai and Shenzhen!) I don’t know if this was specifically the trigger, but investors were shocked by news that China’s passenger car sales slumped 92% yoy in the first half of February according to the Passenger Car Association. This was the biggest drop on record.

So why is JPY, a well-known “safe haven” currency, down too when CHF, the other safe haven, is up? I think the reason is clear: people are worried about the risk of recession in Japan. That’s outweighing “risk off” support for the yen. In other words, people have finally realized that the real risk here is to Japan.

This graph gives a rough guide to each country’s exposure to China through its exports.

The graph below shows that since February, JPY has not been trading like a “safe haven” currency, but rather has traded in line with the other countries affected by the China slump. (Note that AUD and NZD have been turned around from the way they’re usually quoted.) It’s also curious that KRW, which in theory should be the hardest-hit, has actually weakened the least. But I’m not an emerging market specialist and I have no idea why this is – maybe it’s because of exchange controls in the country.

See today’s “Weekly Outlook” for a more detailed discussion of why I think JPY is likely to weaken whether the China slump gets better or worse.

Yesterday’s minutes of the recent ECB meeting were noticeable for factoring in developments that actually took place after the meeting was over. That’s because ECB members have several chances to edit the draft of the minutes before they’re published and sometimes factor in developments that have happened since the meeting. In this case, the tone of the press conference immediately after the meeting was rather optimistic, but in the minutes they seem to have added some notes of caution. It looks like the Governing Council is trying to lay the groundwork for a grimmer reality at its next meeting on 23 March. I think that meeting could result in another split among the Council members between the doves who want more stimulus and the hawks who think they’ve gone too far already, another reason why I see EUR weakening further.

It was noticeable that GBP was slightly weaker vs both USD and EUR despite much stronger-than-expected retail sales for January (including petrol, +0.9% mom vs +0.7% expected, previous -0.5%). This was the largest gain since last March. This indicates continued Brexit fears.

Today’s market

The day starts with the Eurozone purchasing managers’ indices (PMIs). I went through these yesterday. The bottom line is almost all are expected to decline, except for French services.

Considering what a global outlier Germany and the Eurozone are already (this is January’s data), a further decline is really disappointing. It calls into question the market’s assumption that a recovery will begin in Q1. EUR negative

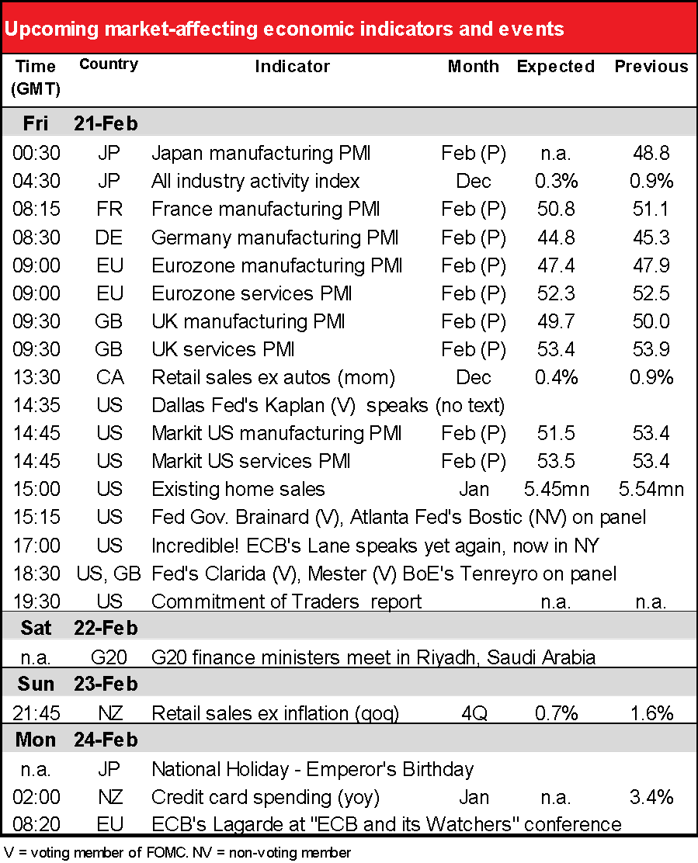

The UK PMIs are also expected to be lower, but not by that much. The manufacturing PMI is forecast to just dip below the “boom or bust” line of 50.

However, this is probably not weak enough to call for a rate cut from the Bank of England. I therefore expect these small declines to be neutral for GBP.

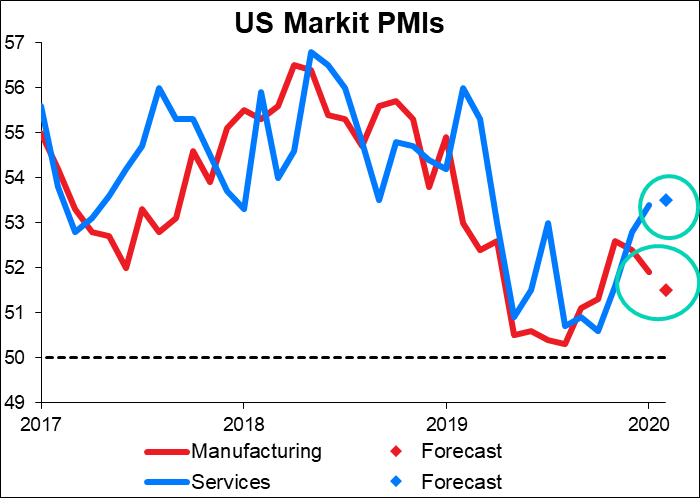

The US PMIs are also forecast to decline, and in fact the market looks for a fairly large fall in the US manufacturing PMI. However the US figures are still going to be higher than those anywhere else. They’ll still show expansion, just maybe not as much expansion as manufacturers had expected last month. The fact that the US economy continues to expand is likely to be positive for the dollar.

Canada’s retail sales are forecast to show a second consecutive rise after four months of decline. The Bank of Canada worried at its January meeting that “during the past year Canadians have been saving a larger share of their incomes, which could signal increased consumer caution. This could dampen consumer spending…” Nonetheless they projected “a pickup in household spending…” in the coming months. Today’s figures may reassure them on Point #1 and corroborate their view on Point #2. That would be positive for CAD.

US existing home sales are forecast to be down a bit, while next week’s new home sales are forecast to be up a bit. But really, they’re both forecast to be pretty stable within the recent range. This is yet another sign of the firm US housing market, which has benefited from falling interest rates. A continued stong housing market is likely to be positive for the dollar.

Finally, over the weekend the G20 finance ministers will meet in Riyadh, Saudi Arabia. They’ll no doubt discuss what to do about the COVID-19 virus and whether to embark on more fiscal expansion. They will no doubt agree that the disease is terrible and that they should do their utmost to support their economies at this time. However, I would like to say that I can’t remember a single concrete action that came about from a G20 meeting, although there may well have been some committees formed that took action I didn’t hear about on subjects such as tax avoidance or terrorism or such.

The only thing of interest I can see is if there’s some pushback against the US for its recent enthusiasm for labelling countries as “currency manipulators.” In March 2018 the finance ministers included the following statement on FX in their communique. Let’s see what if anything they say this time:

Flexible exchange rates, where feasible, can serve as a shock absorber. We recognise that excessive volatility or disorderly movements in exchange rates can have adverse implications for economic and financial stability. We will refrain from competitive devaluations, and will not target our exchange rates for competitive purposes.