JPMorgan Chase & Co. (NYSE: JPM) announced in a June 11, 2024 press release that it will host a conference call to review Q2 2024 financial results on Friday, July 12, 2024, at 8:30 a.m. (EDT), with results released around 7:00 a.m. (EDT). The live audio webcast and presentation slides will be accessible on www.jpmorganchase.com under Investor Relations, Events & Presentations.

JPMorgan Chase & Co. (NYSE: JPM) announced in a June 11, 2024 press release that it will host a conference call to review Q2 2024 financial results on Friday, July 12, 2024, at 8:30 a.m. (EDT), with results released around 7:00 a.m. (EDT). The live audio webcast and presentation slides will be accessible on www.jpmorganchase.com under Investor Relations, Events & Presentations.

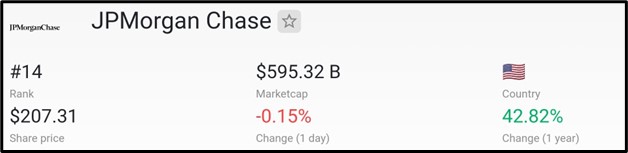

According to www.companiesmarketcap.com data, as of July 2024, JPMorgan Chase, with a market cap of $595.32 billion, ranks as the world’s 14th most valuable company.

According to www.companiesmarketcap.com data, as of July 2024, JPMorgan Chase, with a market cap of $595.32 billion, ranks as the world’s 14th most valuable company.

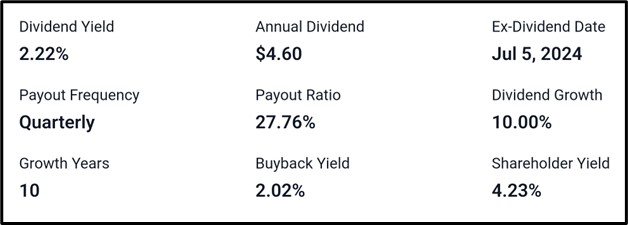

Dividend Information

As of July 5, 2024, the ex-dividend date, the company boasts a 2.22% dividend yield and an annual dividend of $4.60, growing at 10% annually over 10 years. The payout ratio stands at 27.76%, with quarterly payouts. Additionally, the buyback yield is 2.02%, contributing to a shareholder yield of 4.23%.

Recent Development At JP Morgan

Here are the latest updates from JPMorgan:

– J.P. Morgan launches an enhanced data normalization solution for institutional investors.

– JPMorgan Chase opens a new office in Glasgow.

– J.P. Morgan and Sephora extend Tap to Pay on iPhone to Canada.

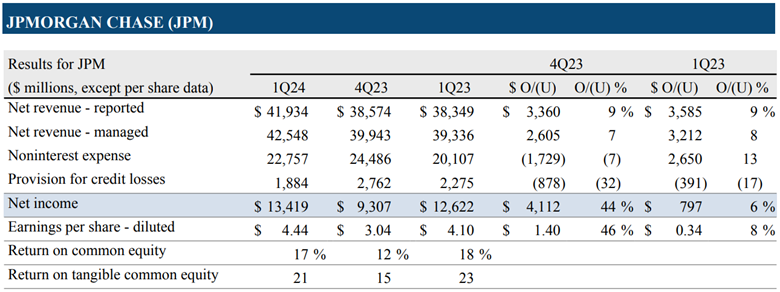

Recap of Q1 Earnings Report Release  Net income reached $13.4 billion, a 6% increase, or 1% when excluding First Republic ( First Republic now a part of JPMorgan Chase ). Net revenue grew to $42.5 billion, up 8%, or 4% without First Republic. Net interest income (NII) rose to $23.2 billion, an 11% increase, or 5% excluding First Republic. NII excluding Markets stood at $23.0 billion, up 10%, or 4% without First Republic, driven by balance sheet mix, higher rates, and increased revolving balances in Card Services, though offset by deposit margin compression and lower CCB (Consumer & Community Banking) deposit balances.

Net income reached $13.4 billion, a 6% increase, or 1% when excluding First Republic ( First Republic now a part of JPMorgan Chase ). Net revenue grew to $42.5 billion, up 8%, or 4% without First Republic. Net interest income (NII) rose to $23.2 billion, an 11% increase, or 5% excluding First Republic. NII excluding Markets stood at $23.0 billion, up 10%, or 4% without First Republic, driven by balance sheet mix, higher rates, and increased revolving balances in Card Services, though offset by deposit margin compression and lower CCB (Consumer & Community Banking) deposit balances.

Noninterest revenue was $19.3 billion, increasing 5%, or 3% excluding First Republic, with higher asset management and Investment Banking fees, partly offset by lower CIB ( Corporate & Investment Bank ) Markets non-interest revenue. The previous year’s quarter saw higher net investment securities losses in Corporate, balanced by net investment valuation gains in AWM ( Asset and Wealth Management ).

Noninterest expense rose to $22.8 billion, up 13%, or 9% without First Republic, driven by higher compensation, more employees, and a $725 million FDIC ( Federal Deposit Insurance Corporation ) special assessment. The provision for credit losses was $1.9 billion, including net charge-offs of $2.0 billion and a net reserve release of $72 million, comprising a $142 million net release in Wholesale and a $44 million net build in Consumer. Net charge-offs of $2.0 billion increased by $819 million, mainly due to Card Services. Last year’s provision was $2.3 billion, with $1.1 billion in net charge-offs and a $1.1 billion net reserve build.

First Republic contributed $668 million in net income, with $1.3 billion in net interest income, $315 million in non-interest revenue, $806 million in noninterest expense, and a $31 million net benefit to the provision for credit losses.

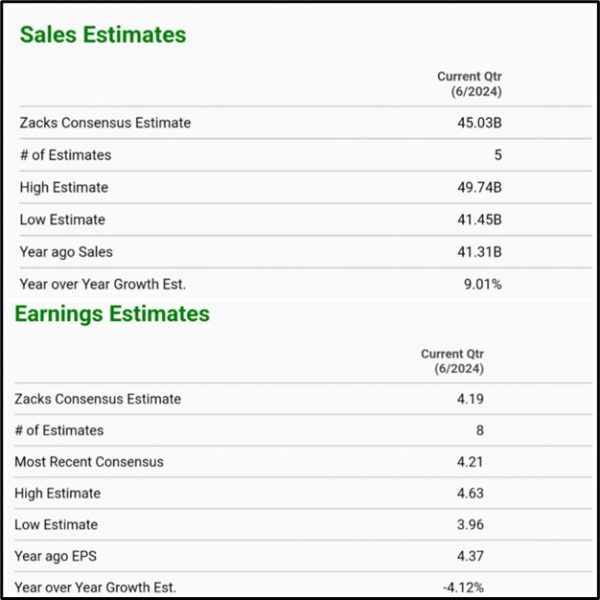

Q2 Earnings Report Analyst Forecast

The Zacks Consensus Estimate for sales is $45.03B, with 5 estimates contributing, ranging between a high of $49.74B and a low of $41.45B. This represents a 9.01% year-over-year growth compared to last year’s $41.31B in sales. Earnings estimates for the same quarter show a Zacks Consensus of $4.19 per share from 8 estimates, with a range of $4.63 at the high end to $3.96 at the low end. Last year’s EPS was $4.37, reflecting a year-over-year decline of 4.12%.

Investing.com projects JPMorgan Chase & Co (NYSE: JPM) to achieve an EPS of $4.14 and revenue of $41.72 billion.

According to Tradingview.com, JPMorgan Chase & Co. (NYSE: JPM) is expected to report an EPS of $5.88 and revenue of $42.23 billion.

Technical Analysis Q2 Forecast

Technical Setup: JPMorgan Chase & Co’s chart on Tradingview shows a potential breakout above resistance at $210.60 on a 4-hour ascending triangle pattern.

Upside Potential: If the breakout sustains, there is a significant probability for the price to advance towards $231.16. Further breach of $231.16 could lead to an extended move towards $257.30.

Downside Risk: Conversely, if the breakout fails, there is a high likelihood of a decline towards $194.43. A breakdown below $194.43 could potentially push the price down to $181.74.

Apply Risk Management

Conclusion

In conclusion, JPMorgan Chase & Co. has demonstrated robust performance, with Q1 2024 showing growth in net income and revenue despite challenges. The upcoming Q2 earnings forecast suggests continued resilience, with analysts estimating potential growth in both sales and earnings. Technical indicators point towards a promising breakout scenario, highlighting further potential for upward movement in stock price. With ongoing strategic expansions and innovations, JPMorgan Chase remains well-positioned for future growth and shareholder value enhancement.

Sources:

https://www.jpmorganchase.com/ir/news/2024/jpmc-to-host-second-quarter-2024-earnings-call

https://companiesmarketcap.com/jp-morgan-chase/marketcap/

https://stockanalysis.com/stocks/jpm/dividend/

https://images.app.goo.gl/k8Tcap4n7JXbHgRMA

https://www.jpmorgan.com/technology/news/jpmorgan-chase-opens-new-glasgow-office

https://www.jpmorgan.com/about-us/corporate-news/2024/tap-to-pay-on-iphone-canada-expansion

https://www.jpmorganchase.com/ir/quarterly-earnings

https://www.zacks.com/stock/quote/JPM/detailed-earning-estimates

https://www.investing.com/equities/jp-morgan-chase-financial-summary