Jerome Powell, the chairman of the Federal Reserve, recently delivered a testimony in Congress addressing various economic factors that are currently shaping the economic landscape. Among the key points discussed were interest rates, inflation, and the market reactions to these factors.

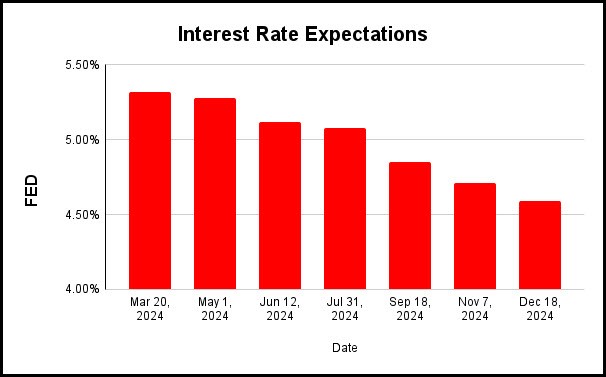

One notable highlight from Powell’s testimony was the mention of the possibility of interest rate cuts in response to economic data showing signs of inflation. Powell emphasized the challenge of striking a balance between fostering economic growth, job creation, and ensuring that prices remain affordable for consumers. Below image represents the Interest Rate Expectations.

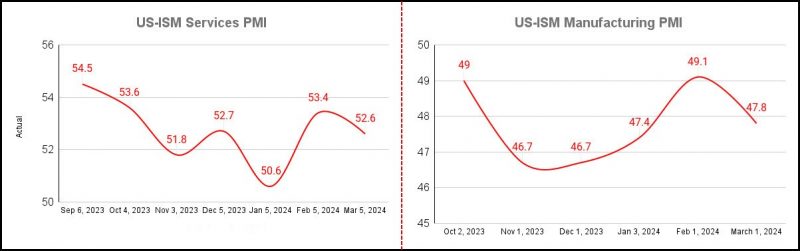

The market reaction to Powell’s statements was mixed. Initially, the dollar index fell in response to his comments. Powell also pushed back on questions about rate cuts, stressing the importance of evidence indicating that inflation is moving towards the Fed’s 2% target before considering any adjustments.Below are the inflation figures.

Economic Data Trends and Financial Market Insights

Recent economic data in the US has shown weaknesses in sectors such as manufacturing, services, and consumer sentiment. These factors, coupled with stagnating inflation, have contributed to a surge in gold prices, reaching all-time highs.

Concerns have been raised regarding potential stagflation, where economic growth deteriorates while inflation remains a persistent issue. Meanwhile, some US banks, including New York Community Bank, have faced challenges and required an emergency funding programme ( a programme that started a year ago and ends by March 11th) to address financial strains.

Concerns have been raised regarding potential stagflation, where economic growth deteriorates while inflation remains a persistent issue. Meanwhile, some US banks, including New York Community Bank, have faced challenges and required an emergency funding programme ( a programme that started a year ago and ends by March 11th) to address financial strains.

In a contrasting move, the Bank of Canada decided to maintain its interest rate at 5% to combat inflation that slowed down more than expected in January. This decision led to a strengthening of the Canadian dollar following the Bank of Canada’s hawkish-sounding statements amidst economic weaknesses in the US.

Market Reactions and Analysis

The recent testimony by Fed Chair Powell provided some clarity on the Fed’s stance on interest rates and inflation but left lingering questions about the future trajectory of the economy.

The Q&A session shed light on key points such as the number of potential rate cuts this year, confidence in inflation progress towards targets, and the overall robustness of the economy and labor market.

In conclusion, Powell’s testimony and subsequent market reactions highlight the delicate balance that policymakers are navigating between supporting economic growth, managing inflation, and ensuring financial stability.