PREVIOUS WEEK’S EVENTS (05.08.2024 – 09.08.2024)

US Economy:

ISM Services PMI rose to 51.4 in July, surpassing expectations of 51.

Initial Jobless Claims fell to 230K, beating the forecast of 240K.

Australia Economy:

RBA maintained the cash rate at 4.35% in August, aligning with market predictions.

New Zealand Economy:

The unemployment rate increased to 4.6% for June.

2-year inflation expectations decreased to 2.03% in Q3.

Canada Economy:

The unemployment rate held steady at 6.4% in July, below the expected 6.5%.

______________________________________________________________________________________

Currency Markets Impact – Past Releases (05.08.2024 – 09.08.2024)

US Economy:

ISM Services PMI: 51.4 (July), beat 51 forecast, bullish USD. Release: 14:00 GMT, 5 Aug 2024.

Initial Jobless Claims: 230K, vs 240K forecast, bullish USD. Release: 15:30 GMT, 8 Aug 2024.

Australia Economy:

RBA Cash Rate: 4.35% (Aug), as forecast, bearish AUD. Release: 07:30 GMT, 6 Aug 2024.

New Zealand Economy:

Unemployment Rate: 4.6% (June), bullish NZD. Release: 22:45 GMT, 6 Aug 2024.

2-Year Inflation Expectations: 2.03% (Q3), bearish NZD. Release: 03:00 GMT, 8 Aug 2024.

Canada Economy:

Unemployment Rate: 6.4% (July), below 6.5% forecast, bullish CAD. Release: 15:30 GMT, 9 Aug 2024.

____________________________________________________________________________

FOREX MARKETS MONITOR

EURUSD

Price Movement:

Last week, EUR/USD exhibited a bearish trend, opening at 1.09202 and closing slightly lower at 1.09144, with a high of 1.10091 and a low of 1.08804.

This week, a breakout above the downtrend line has been identified on the 1-hour chart at 1.09193. If the breakout sustains, we could see the exchange rate rally towards 1.09382 and 1.09532. However, if the breakout fails, the pair may decline towards 1.08947 and 1.08638.

____________________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD

Price Movement:

Last week, BTCUSD exhibited a bullish trend, opening at $58,123.62 and closing at $58,781.80, with a high of $62,730.85 and a low of $49,128.56. Currently, the 1-hour chart shows an uptrend line rejection around $58,318.70. If this rejection holds, BTCUSD could potentially rally to $60,825.64 and $64,014.62. Conversely, if the rejection fails, a decline to $56,346.33 and $54,797.92 is likely.

____________________________________________________________________________

COMMODITIES MARKETS MONITOR

U.S. Crude Oil

Price Movement:

Last week, USOIL maintained a bullish trend, opening at $74.32 and closing at $77.08, with a high of $77.10 and a low of $71.69. Currently, an uptrend line rejection at $76.45 suggests potential upside movement towards $79.42 and $81.53. However, if the rejection fails, the price could decline towards $75.43 and $74.71.

____________________________________________________________________________

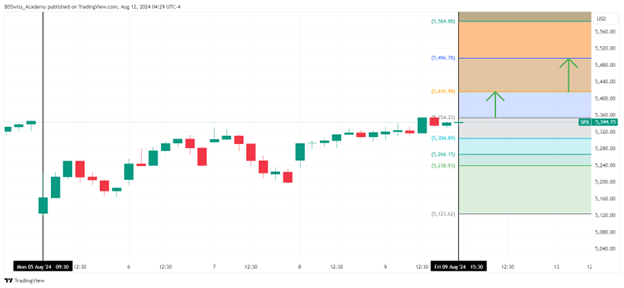

EQUITY MARKETS MONITOR

S&P500 (SPX500)

Price Movement:

Last week, the S&P 500 maintained a bullish trajectory, opening at $5151.09 and closing at $5344.15, with a high of $5358.68 and a low of $5121.10. Currently, a potential resistance breakout to the upside is identified on the 1-hour chart at $5354.25. If this breakout holds, the price could rally towards $5416.98 and $5496.78. Conversely, if the breakout fails, a pullback towards $5304.89 and $5266.15 is likely.

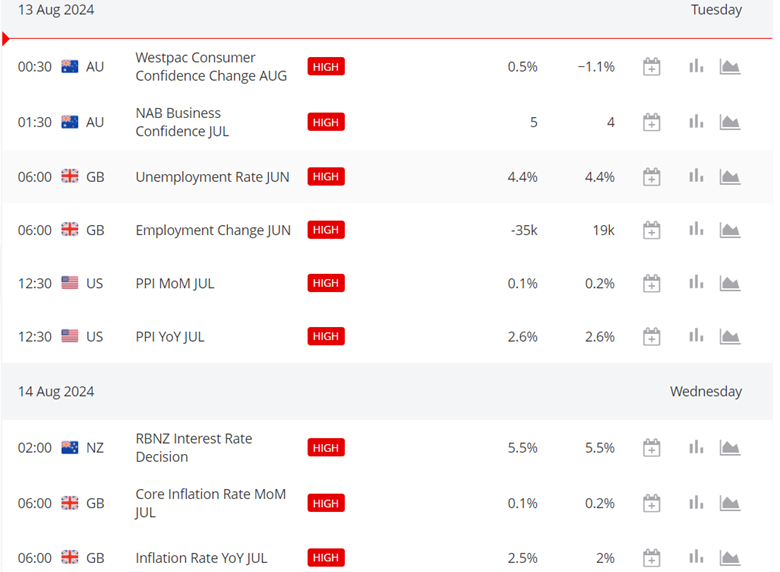

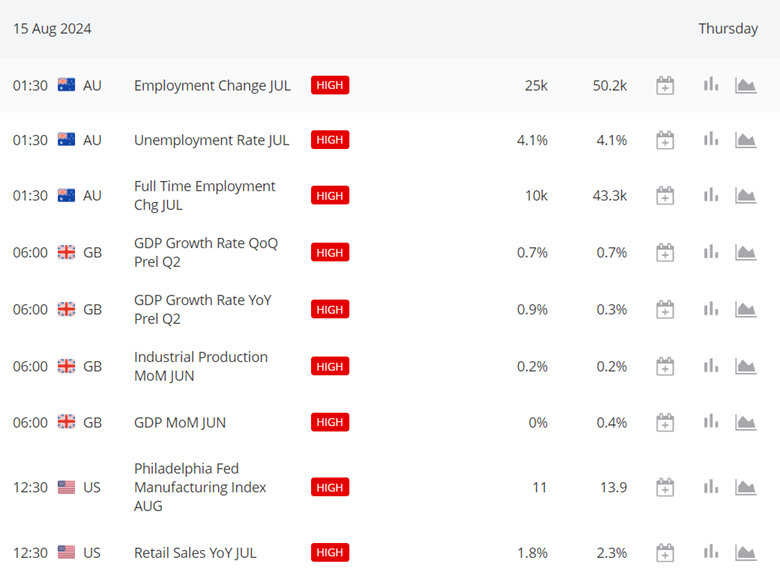

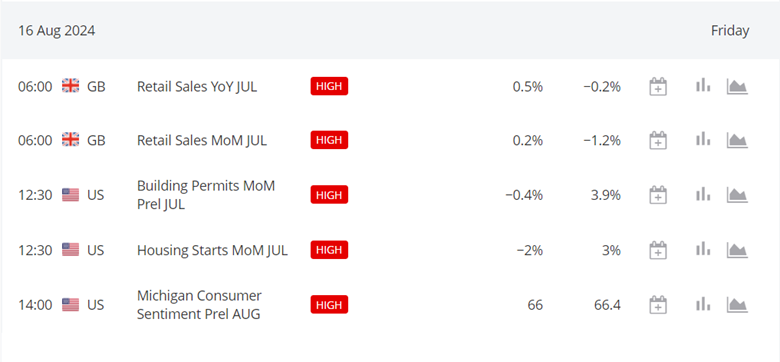

THIS WEEK’S EVENTS

(12.08.2024 – 16.08.2024)

Coming up:

Australia Economy:

For Australia, a Wage Price Index (forecasted at 0.9%) and Employment Change (forecasted at 20.4K) are key indicators. Lower-than-expected figures could weaken the AUD, especially with the Unemployment Rate expected at 4.1%.

United Kingdom Economy:

In the UK, the focus is on the Claimant Count Change (forecasted at 14.5K), CPI y/y (forecasted at 2.3%), and GDP m/m (forecasted at 0.1%). Lower-than-forecasted figures could pressure the GBP.

US Economy:

In the US, Core PPI, Core CPI m/m, and Retail Sales m/m are all forecasted at 0.2%, with Unemployment Claims forecasted at 235K. If actuals fall short, it could lead to USD depreciation.

New Zealand Economy:

For New Zealand, the Official Cash Rate is forecasted at 5.50%. A lower actual rate could weaken the NZD, affecting the overall monetary policy sentiment.

Sources :